Yes, SPAC IPOs are still pricing (slowly). Trouble is, last year’s bubble valuations are making deals tougher to execute as committed financing dries up. Expect more cancellations.

————————————————-

Free Investor Resources from Boardroom Alpha

————————–————————–

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

Yes, SPAC IPOs are still happening, even if the pace is down to a trickle. 6 IPOs so far this month, down from 20 in February and 109 last March.

SPAC IPOs down to a trickle

But as we’ve seen in recent weeks, even SPACs with DAs aren’t out of the woods yet. Without committed financing, we are starting to see many SPAC deals priced at aggressive 2021 valuations fall through the cracks. Expect to see more sweeteners and especially deal cancellations as we navigate volatile markets for the foreseeable future.

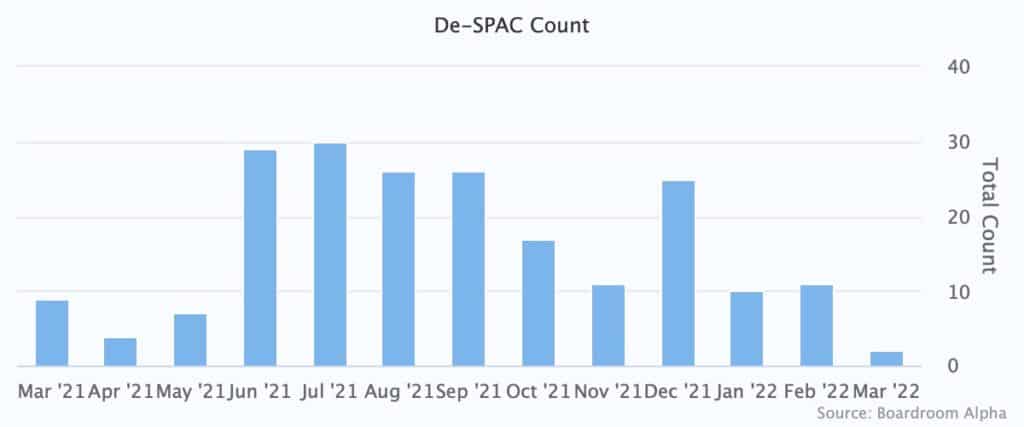

So far in March, we’ve seen 2 deSPACs make it out of the gate, down from 9 last year.

Not surprisingly, market volatility is closing the exits

NUBI prices $110M IPO

Nubia Brand International (NUBI) priced a $110M IPO: 1/2W, $10.20 trust. Targeting wireless telecom. Patrick Orlando of Digital World Acquisition Corp. (DWAC) is a “special advisor” to the board. The SPAC will be led by CEO Jaymes Winters, and CFO Vlad Prantsevich.

EF Hutton, division of Benchmark Investments, LLC, is acting as the sole book running manager for the offering.

FMAC sweetens terms for shareholders ahead of Starry Merger

FirstMark Horizon (FMAC) reminds investors that its sweetened the deal for its proposed merger with Starry. The company is allocating an additional 1M shares to non-redeeming stockholders. 2.4M shares out of 41.4M public shares have agreed not to redeem in exchange for bonus shares.

RCFLU/Gett terminate deal

Rosecliff Acquisition Corp. (RCFLU) terminated its merger agreement with Gett as a result of “recent market volatility.” Gett, a corporate ground transportation management (GTM) technology platform, says it exit the Russian market permanently. The company expects to enter 2023 as a “fast-growing and profitable company that will be ready to go public when markets return to a more actionable state.” Rosecliff will keep looking for a deal. A prospectus wasn’t even filed for this one.

Biggest SPAC Movers

Biggest SPAC Gainers

4.44% ~ $ 9.40 | BTNB – Bridgetown 2 Holdings Limited (Announced)

2.45% ~ $ 11.71 | CFVI – CF Acquisition Corp. VI (Announced)

1.54% ~ $ 71.37 | DWAC – Digital World Acquisition Corp. (Announced)

.91% ~ $ 9.95 | DNAA – Social Capital Suvretta Holdings Corp. I (Announced)

.89% ~ $ 10.21 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

.62% ~ $ 9.80 | RVAC – Riverview Acquisition Corp. (Pre-Deal)

.61% ~ $ 9.88 | LCW – Learn CW Investment Corp (Pre-Deal)

.61% ~ $ 9.91 | PORT – Southport Acquisition Corporation (Pre-Deal)

.51% ~ $ 9.80 | PRPC – CC Neuberger Principal Holdings III (Pre-Deal)

.51% ~ $ 9.89 | VGII – Virgin Group Acquisition Corp. II (Announced)

.51% ~ $ 9.95 | SVNA – 7 Acquisition Corp (Pre-Deal)

.50% ~ $ 9.96 | VCXB – 10X Capital Venture Acquisition Corp. III (Pre-Deal)

.46% ~ $ 9.78 | LDHA – LDH Growth Corp I (Pre-Deal)

.45% ~ $ 10.02 | GACQ – Global Consumer Acquisition Corp. (Announced)

.41% ~ $ 9.76 | VAQC – Vector Acquisition Corporation II (Pre-Deal)

.41% ~ $ 9.78 | TWNI – Tailwind International Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.82 | MON – Monument Circle Acquisition Corp (Pre-Deal)

.41% ~ $ 9.88 | SPAQ – Spartan Acquisition Corp. III (Announced)

.40% ~ $ 9.94 | OCA – Omnichannel Acquisition Corp (Pre-Deal)

.40% ~ $ 9.97 | APN – Apeiron Capital Investment Corp. (Pre-Deal)

Biggest SPAC Losers

-20.02% ~ $ 7.95 | FMAC – FirstMark Horizon Acquisition Corp (Announced)

-1.92% ~ $ 9.71 | CPAA – Conyers Park III Acquisition Corp. (Pre-Deal)

-1.15% ~ $ 9.44 | MOTV – Motive Capital Corp (Announced)

-1.11% ~ $ 9.73 | TCOA – Trajectory Alpha Acquisition Corp. (Pre-Deal)

-.82% ~ $ 10.89 | GGPI – Gores Guggenheim, Inc (Announced)

-.60% ~ $ 9.89 | MCAF – Mountain Crest Acquisition Corp. IV (Pre-Deal)

-.53% ~ $ 9.84 | DAOO – Crypto 1 Acquisition Corp (Pre-Deal)

-.52% ~ $ 9.65 | APMI – AxonPrime Infrastructure Acquisition Corp (Pre-Deal)

-.51% ~ $ 9.76 | RCLF – Rosecliff Acquisition Corp I (Pre-Deal)

-.51% ~ $ 9.80 | INAQ – Insight Acquisition Corp. (Pre-Deal)

-.50% ~ $ 9.87 | ACAB – Atlantic Coastal Acquisition Corp. II (Pre-Deal)

-.50% ~ $ 9.92 | MNTN – Everest Consolidator Acquisition Corp (Pre-Deal)

-.50% ~ $ 10.00 | DTRT – DTRT Health Acquisition Corp. (Pre-Deal)

-.44% ~ $ 10.14 | ADOC – Edoc Acquisition Corp (Announced)

-.40% ~ $ 9.87 | BNIX – Bannix Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.87 | ARTE – Artemis Strategic Investment Corporation (Pre-Deal)

-.40% ~ $ 10.07 | HUGS – USHG Acquisition Corp. (Announced)

-.31% ~ $ 9.70 | JUGG – Jaws Juggernaut Acquisition Corporation (Pre-Deal)

-.31% ~ $ 9.78 | NHIC – NewHold Investment Corp. II (Pre-Deal)

-.31% ~ $ 9.80 | MCAG – Mountain Crest Acquisition Corp. V (Pre-Deal)

Know Who Drives Return Podcast

Boardroom Alpha’s team talks to the public company and SPAC leaders that are driving return for shareholders, delivering on ESG promises, and more.

See all the episodes here and make sure to subscribe using your favorite podcast app so you don’t miss a single episode.

Recent podcasts

- Update on Activism and Universal Proxy with Michael R. Levin

- AON’s Aria Glasgow on Managing ESG and Human Capital Risk

- Korn Ferry’s Anthony Goodman on the Importance of Board Evaluations

- Podcast: Getaround CEO Sam Zaid on Carsharing and Going Public

- What to Know about Universal Proxy with Bruce Goldfarb of Okapi Partners

- Podcast: Li-Cycle’s (LICY) Ajay Kochhar on Lithium Ion Battery Recycling and EVs

The Daily SPAC

Boardroom Alpha publishes daily SPAC market analysis at theStreet.com. Sign up for the newsletter and get it in your inbox daily. Get the Newsletter: Sign-up now!

- Daily SPAC Update – June 30, 2025Welsbach Technology Metals Deal and Extension Vote Pass. Breeze Extends. Eureka Acquisition Extension Vote. Blackhawk Vote Adjourned Again.

- Daily SPAC Update – June 27, 2025Two More SPAC IPOs, but June Fails to Match May’s Surge. Iron Horse Extends and Gets Deal Approved. Winvest + Xtribe Deal Vote.

- Daily SPAC Update – June 26, 2025Blue Gold Debuts Post-SPAC. EGH Separate Trading. Breeze and Welsbach Extension Votes. Inception Growth Postpones and Updates Trust.

- Daily SPAC Update – June 25, 2025Two SPAC IPOs: Lightwave and Oxley Bridge. Evergreen + Forekast Deal Terminated. Columbus Circle/Pompliano Publish Investor Deck.

- Daily SPAC Update – June 24, 2025Bitcoin’s Pompliano Strikes SPAC Merger. SLAM and. Altenergy Both in Deal Termination Disputes. JVSA + DoubleDragon Deal Vote.

- Daily SPAC Update – June 23, 2025ShoulderUp DeSPACs to Dot Ai. Black Hawk Extension Votte. Colombier II Deal Vote Set.

SPAC Monthly Market Reviews

- SPAC Market Review – April 2023

- SPAC Market Review – March 2023

- SPAC Market Review – February 2023

- SPAC Market Review – January 2023

- SPAC Market Review – December 2022

- SPAC Market Review – November 2022