Getaround Founder & CEO Sam Zaid joins the podcast.

Sam Zaid is a technology entrepreneur with an engineering background and a 15 year history in startups. He founded Getaround, a peer to peer carsharing company, about 10 years ago to solve the problem of underutilized cars.

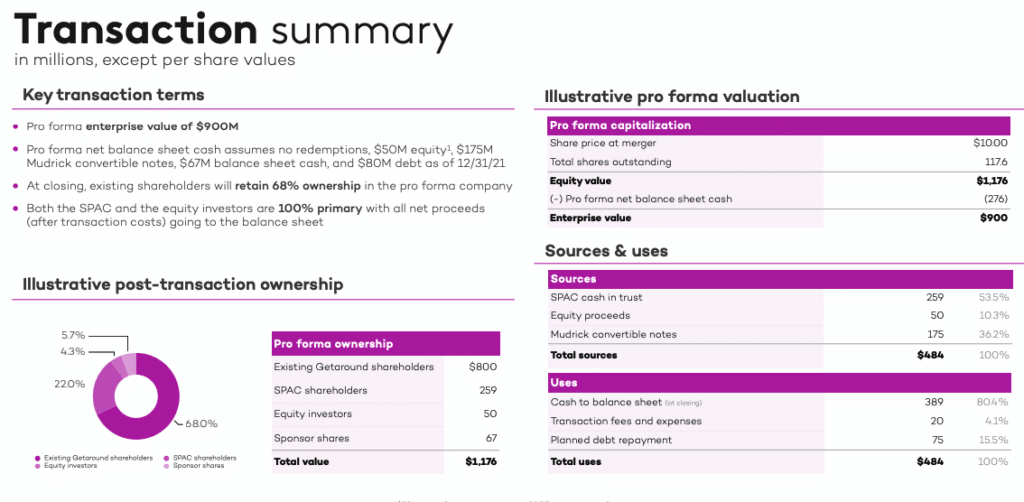

Sam joins the podcast to discuss the macro trends in car ownership & usage (news flash: less ownership), why the ease of carsharing makes sense, and why they have decided to join the public markets via a merger with InterPrivate II Acquisition Corp. (IPVA). No definitive update on timing of the merger, but look out for this one to close end of this quarter or early in 2023 (latest S-4 on file here).

See the full investor presentation here.

- Notably, Getaround has secured $175M in committed capital via convertible notes from Mudrick Capital

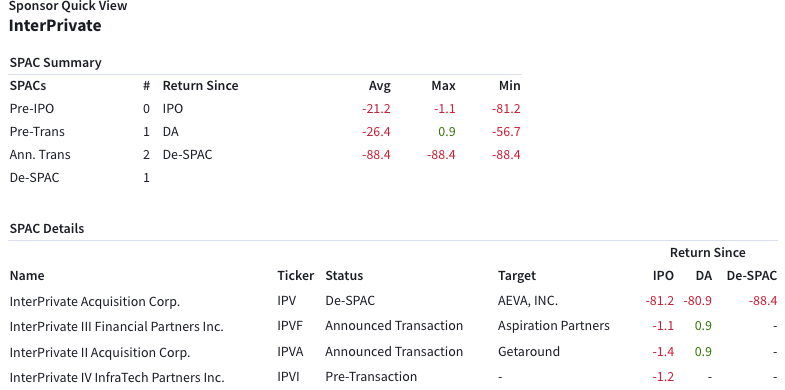

InterPrivate II is sponsored by PE company InterPrivate, and this is their second SPAC. They have 2 others outstanding, 1 with a target and one seeking.

Topics Discussed

- Intro and background on Sam

- Too many cars, and the founding of Getaround

- Customer base, powerhosts, and the gig economy

- Asset-light business model, marketplace model

- Proprietary technology stack, Getaround Connect

- Partnerships: Uber, Kayak, and OEMs

- Going public, SPAC market and IPOs, UoP

- Competitive landscape and ESG considerations

About Sam Zaid

Mr. Zaid is a co-founder and the Chief Executive Officer of Getaround, a role in which he has served since January 2022 and from 2010 until December 2020. Between December 2020 and December 2021 Mr. Zaid served as Executive Chairman of Getaround. Before Getaround, Mr. Zaid founded and served as Chief Executive Officer of 360pi, a price intelligence platform for online retailers that was acquired by MarketTrack in 2017. Mr. Zaid also founded and served as Chief Executive Officer of Apption, an enterprise software consultancy specializing in big data analytics and Artificial Intelligence that he founded in 2004. Mr. Zaid has been named an E&Y Entrepreneur of the Year, a Microsoft Code Award winner, and was a Google Scholarship recipient. Mr. Zaid studied Engineering Physics at Queen’s University in Canada, graduating with First-class honors, and Artificial Intelligence & Robotics through the Singularity University Graduate Studies Program.

Getaround Podcast Transcript

David Drapkin (Boardroom Alpha)

Welcome back to Know Who Drives Return. I’m your host, David Drapkin. Today, it’s my pleasure to be joined by Sam Zaid. Sam is the founder and CEO of peer to peer car sharing company Getaround. Getaround, as many of you may know is in the process of entering the public markets via SPAC transaction with Interprivate II Acquisition Corp, excited to talk to Sam about car sharing his SPAC transaction, his background and everything under the under the roof. So Sam, first of all, thanks for thanks for joining today. Really, really excited to talk to you.

Sam Zaid (CEO, Getaround)

Thanks for having me. I’m excited to be here.

David Drapkin (Boardroom Alpha)

Awesome. So before we get into Getaround specifically, you have an interesting background. So how about a bit of a introduction to you where you come from maybe a little bit about your history?

Sam Zaid (CEO, Getaround)

Yeah, sure. Happy, happy to talk about that. So yeah, look, I mean, my background, I’ve you know, been a technology entrepreneur for most of my career, I had a short stint as a as a photonics engineer for a time back in back in the day, and it was great. It was great fun. But long time ago now I have a background in in engineering physics, and I’ve been doing startups. I don’t want to say almost 20 years, but let’s say 15 years, something like that. And yeah, roundabout, it started getting around just over, you know, 10 years ago. And have really been working on that ever since. And you’re happy to talk a little bit more about about our the mission problem there if that makes sense.

David Drapkin (Boardroom Alpha)

Yeah. So what what led to the founding of Getaround? What was what was the big idea?

Sam Zaid (CEO, Getaround)

Yeah, no, I mean, that’s, that’s what motivates that motivates us every day. And yeah, we started as I mentioned, just over 10 years ago, really, because we have a world problem right at the time, we call that problem, car overpopulation. Because simply just have too many cars. And we don’t use them that are used, you know, 5% or less every single day. So something like 1.2 million 1.2 billion cars globally, we waste 30 billion car hours daily. And car ownerships not cheap, you know, costs about 27% of average household income for the average American household, and actually is becoming cars has become increasingly expensive direction around 11% More expensive than just a year ago. And of course, you know, now with remote work, hybrid work, people are commuting a lot less so than the business case for car ownership, and certainly for multi car households, dinner a lot more pressure. You know, we started getting around back in launch back in 2011. We just felt strongly that people would share cars more, and you wouldn’t necessarily keep them for your reserved them for exclusive use. If, like many things before it technology just made that easier. And for for us what that meant was like really creating a digital a fully digital experience where you can book a car instantly be gone in 60 seconds. And that meant developing technology, IoT technology that could go in the car. So you didn’t have to meet anybody to get a physical key, your phone really becomes your car key. And then really leveraging the power of the internet and data connectivity to automate and streamline streamline that experience so you’re not doing like no need to return a car, traditional car rental. And people are like logging fuel and mileage and doing all these things manually. Like don’t get rid of that, do it through technology, and really streamline that experience. So you can create that sort of that that wow moment in the eyes of the customer. And so that’s what we set out to build. I mean, today we are a digital marketplace, we develop that patented technology, which powers our marketplace. got millions of users sharing 10s of 1000s of cars across countries in North, North America and Europe.

David Drapkin (Boardroom Alpha)

I think I read in your in your materials that something like cars are parked for 95% of the time of their life. And so are you finding that the uptake from from users from from your from your users to to rent other cars, you know, has been you know, appetite for them? It’s a way for them to make more money right for, you know, basically leasing an unused asset.

Sam Zaid (CEO, Getaround)

Yeah, absolutely. I mean, most people are not using their cars that much and using them less today than probably pre pandemic. So, you know, I that’s 5% That was like, a pre pandemic is that I don’t know what the status post pandemic is less. You know, but it’s already so small that like, you know, you can’t get much more than 5% so that’s exactly right. I mean, you know, if your car can make money for you get your car for free. It just takes that you know, typically just second biggest expense load off of the the expense ledger every month. And, you know, it just gives you that much more, you know, just gives you more freedom as somebody who lives without a car, you don’t need to own one you can use someone else’s. And of course, if you do own a car, it’s not something that’s burdening you every month in terms of all the expenses and costs.

David Drapkin (Boardroom Alpha)

It’s interesting how you brought up COVID. Obviously, you said you were founded 10 years ago. So that was even pre COVID. But it seems, as were many businesses may have taken a hit, you know, in the physical world, it feels like something like Getaround makes more sense. It was maybe COVID could have been even a little bit of a tailwind. As you mentioned, with the work from home in a hybrid environment with people commuting less. Have you found that to be not COVID as a positive, but have you found at least some positive tailwinds from the change in people’s behaviors? Post the pandemic?

Sam Zaid (CEO, Getaround)

Yeah, no. I mean, it’s so COVID COVID itself, especially the early part was extremely tough, because obviously away from people moving around to NOC but, you know, in terms of in terms of, yeah, like, as a, as you’re pointing out the secular long term trends. I mean, you know, definitely, most people own cars, because they were commuting five days a week. And so certainly, there’s a now, a lot of people who don’t feel the need to own a car or own as many cars and households can get away with that. So that’s one shift. Certainly people are more, you know, we’ve just seen the general behavior shift in terms of how people use cars, how frequently used cars, how long they booked them for. And, and, you know, and of course, traveling by plane, as you know, was and continues to get more arduous. And so you can make it easy, if you’re getting a car as easy as tapping, you know, a couple taps on an app on your phone that, you know, that starts to become a very attractive alternative for for, obviously, not for cross country trips, but for for more local and nearby trips.

David Drapkin (Boardroom Alpha)

Right. Right. So I want to get into the hosts a little bit. So you have, so you have a host you they have one car, they rent that car out, but I was reading it seems to get these so called Power hosts, which you know, that maybe they have a fleet of cars, you know, 1015 and maybe run a side hustle or or maybe it’s their full time business. Can you talk about the difference between maybe the single host versus the power host? And, you know, which is more, you know, a bigger customer base for you guys.

Sam Zaid (CEO, Getaround)

Yeah, yeah. So on the supply side? Yeah, look, the majority of our, if you count the number of unique hosts, it’s dominated by individual consumers, right, they’re their consumers going to share one or two cars, the sharing part time offset in cost of ownership, making some extra money. You know, the model works really well for that use case. And what we’ve found over the past few years is then you have power posts, who are really entrepreneurs. And now they’re a smaller cohort in terms of the individual’s privacy, they provide more cars, so they actually make up the majority of vehicles. And they’re really entrepreneurs. And, you know, people tend to think of powerhouse maybe as these like, big, you know, big corporate companies and things they’re not, they’re really, they’re really sole proprietors, solopreneurs, or micro businesses micro printer. So, it’s sort of that same DNA you find on you can find in E commerce, like a lot of micro brands and things like that. And so on average, they share about 12 cars. But for us, it’s really exciting segments a growing segment. Although it’s a very different segment than your traditional car rental business. Because you know, the digital nature of our tech and our product needs, you know, it’s more about them owning the asset and making it available and keeping it service than trying to run all of the front office customer service, sort of like lot operations that you typically find in a more logistics heavy car rental business. A lot of that’s automated away through through the technology.

David Drapkin (Boardroom Alpha)

Do you think you mentioned rising leased vehicle costs currently, do you think that is, you know, a bit of a headwind for that business in the near term?

Sam Zaid (CEO, Getaround)

Um, you know, we haven’t we haven’t found that. Certainly, if you start looking at the extremities and people who are who are trying to buy a lot of cars, that’s challenging. But, again, most of these are, are, are smaller operations, they’re 12 cars average. So they’re still very much like people who are doing this, you know, you know, either on the side or, you know, alongside other things, and they’re pretty scrappy, and they can find, you know, you can still find deals on 12345 cars, it’s just harder to go like if you’re an enterprise or Avis to go buy like 300,000 cars and not you know, he has really hit with some of the the supply demand dynamics in the market right now. But, you know, what we find is our hosts tend to be pretty scrappy, and a lot of them either have cars or they have friends who have cars. And so there’s the ways that they can get access to that supply.

David Drapkin (Boardroom Alpha)

Right? That makes sense. And now a word from our sponsor boardroom Alpha boardroom. Alpha delivers Moneyball for public company officers and directors so you know who drives return. Evaluate the full track records for every CEO, CFO and director with exclusive ratings, tracking of insider buying and selling executive compensation, SPAC and m&a, history, relationships, and more. Also evaluate companies from a performance focus governance perspective, that includes board and executive team ratings, diversity, compensation, analytics, board risks, and more. institutional investors use boardroom alpha for idea generation, and validation of Long’s and shorts. Everyone from executive recruiters to proxy advisors and others rely on the data to keep up to date on all people activity, and easily searched for top talent. Learn more at www dot boardroom alpha.com. So let’s talk about the business model a little bit acid light, so you’re not owning the cars, you know, you’re running the tech. What does what does the business model look like? How does Getaround make money?

Sam Zaid (CEO, Getaround)

Yeah, so we’re a marketplace model. So it’s very much like in Airbnb. So, you know, we manage the payments and the booking and the payments themselves consistent the actual reservation price, which is what really cost to get the car in that that split, where we take 40% and 60% goes to the actual host, we of course, provide all the the customer service, the insurance, the technology around that, that’s our cost. And then on top of that, there’s a small booking fee that’s charged to the guests themselves, that something really caught coverage for the different dynamics of a particular trip and the risk associated with it. And that’s something that was unique to us. And so you end up with a net to gross profile, it’s somewhere between 45 to 50%. To the company, with the balance going to have the host supplying the vehicles.

David Drapkin (Boardroom Alpha)

And then your technology, you mentioned that the technology is really the bread and butter of the Getaround service to Getaround connect. So you use your phone to unlock the door, everything is seamless. How do you? You know, presumably I’d say about a car 10 years ago, it’s not you know, connected? How do you get every car, you know, onto the network, so to speak.

Sam Zaid (CEO, Getaround)

Yeah, yeah. So you’re right. I mean, for us that that’s the sort of secret sauce, so to speak, that we’ve been we’ve been making since we started. And it’s really what makes gettering unique visa vie the competition is that digital experience that’s really powered by that patented software and hardware technology, which we call our Getaround. Connect cloud platform. And let me just say what that means. And then how we do it, how we get cars done. So what does it mean? It means like cars are fully connected. So they’re, they’re always communicating digitally with our cloud system. So you get a lot more real time information about the car, you know, otherwise, someone’s renting your car, and you’re like, I don’t know where it is, I don’t know what they’re doing with it. I know nothing, right. And so there’s a lot more real time information, which allows you to actually streamline the experience that really powers our what we call our God in 60 seconds experience. So you can book a car walk or walk up to it open to Getaround that type of button, unlock and drive, right. And that’s meant to make it you know, as easy as having the fob in your pocket, instead of pulling out the 5g plug in to Getaround. As you mentioned, we have to equip cars with the IoT technology. So that provides for remote lock unlock, you get real time GPS location, real time sensor data. So readouts like engine lights, fuel mileage, stuff like that, which obviously makes it a lot easier to manage managing a car or a set of cars. And the way we do that is also asset light is through a third party network of installers that we you know, we build up across the country in the markets where we operate, they do online certification and in virtual training, and then basically, they become a certified installer of ours. So that tends to be mostly you know, individual car electronic shops, and you know, that’s most of what that industry is, but then we also have larger partners like Car Toys and Best Buy geek squad that also are the same but obviously bit more professionalized in that regard, of course scale. And, you know, the big thing there obviously, is once you have this technology as the person sharing the car, you no longer have to meet, you know the guests or the renter to give them a key. You don’t have to coordinate the pickup and return at the car. You don’t have to be physically there so you can be at work. You’re currently making money for you. And you can manage things remotely from your laptop or phone.

David Drapkin (Boardroom Alpha)

Who deals with like repairs and cleaning, and all those little nuisances?

Sam Zaid (CEO, Getaround)

Yeah, yeah. So those are those are still. Yeah. I mean, we automate, we’re automating progressively more and more, we haven’t automated everything yet. So, you know, mine, you still got to clean your car and search your car, but you have to do it every time. And so like, you know, that stuff, you can obviously schedule, it is something we’re working on in terms of building ecosystem partnerships, so that, you know, we can help, you know, help identify and integrate partners that allow you to then also do yes, remotely, because the fundamental advantage you have, obviously, with the technology in your car is, you know where it is, and you can get access to it remotely. And so, you know, if you have someone who’s you’ve contracted with the Queen’s cars, they can still do that without you having to be physically there, or giving them the car here, whatever. So. So, you know, a lot of our hosts do that themselves, that obviously, we’d like to make that more streamlined and try to leverage, you know, some some volume buying power there to make it better for them. Right, right.

David Drapkin (Boardroom Alpha)

I want to see if you could touch on, you have some high high profile partnerships with the like, likes of Uber, I believe you just announced them with kayak the other day, and you have some OEMs in the pipeline. How have you thought about, you know, those partnerships? And what are those bring to the table?

Sam Zaid (CEO, Getaround)

Yeah, you know, it’s interesting, because, you know, in our business is really a direct to consumer business, and that we, you know, we attract both the host and the guests directly. But then partner, you know, because of the technology platform, there’s a lot of interesting opportunities to to work with partners and help partners deliver that same magic experience to their customers. So Uber is very interesting, you know, we have an integration where a driver can dynamically link their Uber Getaround accounts, they can instantly book a car on Getaround, from a subset of hosts who enabled it support drive with Uber, and then everything is magically synchronized. So then they see, you know, their Getaround trip inside their Uber driver app. From there, they can start driving and earning immediately. So that’s really transformative, right? You essentially, you can become an Uber driver in a matter of minutes without owning your car, right? That’s not normal. And typically, you want to rent a car some other way. It’s much more manual and lengthy process, just getting the car and getting certified and all that stuff. So that’s really interesting. We, you know, we’ve seen a lot of growth in that this year. So we’re excited for next year. And kydex new is actually part of our push to expand our value proposition outside of urban dwellers into the hands of travelers or people who can use Getaround at a destination. And it’s something we’ve actually had life in Europe for some time, and more recently, now, we’ve just announced it in the US. And we’ve been rolling out more and more inventory in cities, and we’re happy with the progress there. You know, mediums are important partners, I think you mentioned those also, you know, we’ve been working with many of them. For a number of years now. There’s actually a whole myriad of ways you can collaborate. But really, the current focus is getting natively integrated into the new wave of connected cars and EVs. So like just when you buy a television, you come to the Netflix app, you get a car, it’s Getaround ready already integrated to Getaround apps, you don’t need any additional technology hardware or anything in your car.

David Drapkin (Boardroom Alpha)

That would make it certainly more seamless.

Sam Zaid (CEO, Getaround)

So, ya know, exactly. I mean, that is our goal, make it increasingly more and more seamless. So that, you know, this is something you can rely on, maybe you know, it’s gonna work in easy way, and provide you an alternative to car ownership and car rental.

David Drapkin (Boardroom Alpha)

Right. So Getaround as a company entering entering capital markets. So obviously, you said 10 years old, you know, why, why today? What what what brings what is the impetus for for wanting to go public today? You know, no secret that right now, you know, not only IPOs, but obviously stock markets little challenge. You know, so what, what’s the decision making behind, you know, going public in 2022?

Sam Zaid (CEO, Getaround)

Yeah, so your question, I mean, you know, why not the, you know, counter trend? The No, no, no, no, I get it. I mean, it’s a tough time in the markets. Without a doubt, equity, equity markets are clearly challenged right now. But, you know, the first thing is, we’re not really playing for right now. Right? You know, we feel this transaction is more about giving us what we need to just focus on execute on our plans. To be honest, we’ve been operating and preparing to go public for I don’t even know, probably over 18 months at this point. And so, earlier this year, we saw a great opportunity to partner with Dana private team, to really go public, which we just felt gives us a unique opportunity, especially in a challenging market to just double down on a number of growth and strategic opportunities, some of which we just talked about, you know, that we have right in front of us. And I’d say that unlike you know, probably cohort of more Recent spec deals, you know, we have 175 million of committed capital that comes with the closing transaction. So when we looked at it holistically, you know, for us it was about how do we continue to execute on our plans? What are the what’s the mechanism to do that we’ve been preparing to be public, it’s just solid, like, you know, it satisfies all of our criteria. I’ll be agree, you know, I agree, it’s obviously a challenging time in equity or capital markets in general,

David Drapkin (Boardroom Alpha)

I think it’s a, it’s an important point to highlight that 175 million of capital, because, as I avid followers of the stock market, on our side, you know, as you mentioned, many of the companies going public today no committed capital, you know, thy had the trust, but that goes away. So it’s really just like a capital markets transaction. So you know, thanks. Thanks for bringing that up any specific use of proceeds for that, for that capital that you’re going to be adding?

Sam Zaid (CEO, Getaround)

Yeah, I mean, I guess the use of funds is broadly just what we talked about. So it’s investments in growth and innovation. So really, predominantly, for us, it’s about growing, how are we growing or growing by really, not so much, by adding tons of new geographies or markets, it’s really more about densifying, the markets we’re in that’s like 80% of it, you know, giving, giving more cars, more choices for the consumer, building that liquidity in the marketplace. And then, and then really about the innovation side, you know, there’s also growth that comes from that from, from the continued product innovation, which is something we’re really excited about, because this is, you know, this is still very much an early space, it’s very Greenfield. And so, you know, on top of the technology we’ve already built, there are just a number of ways to really leverage that in terms of just building an increasingly friction free user experience, or new ways to monetize, you know, the customer or the data. So we’re just, you know, we just felt like really, that’s, that’s just a huge opportunity area of m&a. It’s just providing consumers with more and more options, so they can instantly rent, unlock and drive by together.

David Drapkin (Boardroom Alpha)

And you mentioned Europe, so you’re already International? What, what geography? How many? How many? Or how many countries? Are you in? Or geography stat didn’t give us?

Sam Zaid (CEO, Getaround)

Yeah, we’re in. We’re seven countries in Europe. So, you know, the ones you’d expect? Sort of like Central Western Europe, France, UK, Spain, Germany, Netherlands, Norway, etc. Cool.

David Drapkin (Boardroom Alpha)

And so you did mention early days, at least in the in this arena, it’s early days, doesn’t seem to be a ton of direct competition. You have churros Zipcar that are sort of in the in the realm and then your traditional rental car. Companies, how do you think about, you know, the competition in in this space?

Sam Zaid (CEO, Getaround)

Yeah, look, I think there’s increasing more attention paid to the space because, you know, so it’s naturally becoming more, a little bit more competitive over time. I think that’s just validating the space overall, which I mentioned. Yeah, it’s like, it still needs them. It’s sort of like internet 20 years ago, people are now just waking up to it. And I think there’s two things that differentiate this one, you know, being an asset like marketplace really differentiates us from the more traditional models, and Zipcars, we don’t own the asset. And because we don’t own the asset, then the cars themselves are much more distributed, given the nature of our marketplace. So it means we offer like more choice of cars, more variety, more locations where you can get a car. And so that, you know, the asset light model really provides that value to the consumer. Or, as we’ve talked about our real unique differentiators the technology, which then powers our digital experience. So like summarizing that up, it’s really like as a consumer, you can book unlock, and drive, you do that from the Getaround app. So you can book a car you want and 60 seconds walk to unlock from your phone drive. That’s pretty straightforward. You don’t have to wait like most marketplaces for the host to prove your booking. There’s no need to meet people in person to get a key, you’re not filling out paperwork or waiting at a rental counter, like you would in a more traditional car rental model. So that’s really the core differentiator with Getaround versus all the competition on the demand side. And then for a host supplying the car. The main benefit is you can operate remotely, you don’t have to be physically with your car or near to rent it out, or you know, be available. You can rent a car in the middle of night while you’re sleeping. Right. And so your car makes more money for you when you’re you’re away. For example, when you’re at work, and then the technology really takes a lot of those manual steps out of the experience, including having to meet people arrange pickups on weekends. So the net of it is as a host you earn more with less effort and you don’t have to invest in staff for front office ops.

David Drapkin (Boardroom Alpha)

So you won’t have that Seinfeld episode where they take the reservation, but they can’t hold the reservation?

Sam Zaid (CEO, Getaround)

Right? Right. Taking and holding is the same collapsed into one instant thing. And digital.

David Drapkin (Boardroom Alpha)

To wrap up, I noticed you tie yourself as a ESG friendly company. Can you talk a little bit about how and what you’re bringing to on the ESG side of the world?

Sam Zaid (CEO, Getaround)

Yeah, no, totally, it is something that’s been, you know, our mission for a long time before ESG was a buzzword. And, you know, so first, we’ve pledged to have only EVs on the marketplace by 2040. And then beginning 2030 will stop accepting high scars. So, so that was their first like, objective, we’ve gone public with which we happen to be California to the punch on that one, too. So we’re, we’re proud of ourselves. And, and then we’re also working on a number of things really, to make it easier for people to purchase and finance EDS, to share and Getaround. Obviously, our objective is to have more people driving like tailpipe emission free. And then the other part that people don’t always get about car sharing, it’s sort of the fascinating part, when you look at the data is that households that actually moved to becoming car free, actually reduced their overall driving, and consequently, obviously, their carbon footprint. That numbers about 34 to 41%. When you look at the data studied by the sustainability and Transportation Center at UC Berkeley, it’s ultimately moving household from ownership to sharing the more we can do that and continue to do that it means overall, less driving, less congestion, lower emissions. So our goal is a company beyond just ease in terms of hitting the ESG impact is really just moving more people to live car free or car and shifting people away from ownership to access that just has such a massive environmental impact and benefit. Roughly alcohol on Albritton. You know, we modeled this a number of ways using the data from all these research papers, but it’s roughly means like a million cars shared on Getaround, eliminates about 100 billion pounds of carbon each year. So that’s, you know, we were not quite a million cars yet, but we’re working on it.

David Drapkin (Boardroom Alpha)

It’s great. It’s good to hear. It’s funny, because I forget, since I’ve moved to the city, I forget I’ve forgotten about car ownership. So it’s, it’s been fun to learn about Getaround. Very interesting, looking forward to you know, following the story and good luck on the deal, the near future and we falling and thanks. Thanks again for taking the time today. Really appreciate it, Sam.

Sam Zaid (CEO, Getaround)

Thank you, Dave. It’s great. Good questions, enjoyed the chat and I look forward to it, I don’t want to listen to myself, but hearing this anyway, when it comes out.

David Drapkin (Boardroom Alpha)

Oh, last question I have to ask right now it’s probably at the mercy of the SEC. But any any sense of timing I know S4 are on file, any sense of time and when we think the transaction may close?

Sam Zaid (CEO, Getaround)

Yeah, I mean, nothing. I mean, let me say we’re working hard at it, but your guest is probably as good as mine.

David Drapkin (Boardroom Alpha)

Awesome. I love it. Thanks again, Sam. Appreciate it.