BOARDROOM ALPHA FOR INVESTOR RELATIONS TEAMS

Monitor How Investors See You. Benchmark to Peers. Track Investor & Activist Activity.

Corporate Governance, Performance & Board Tracking

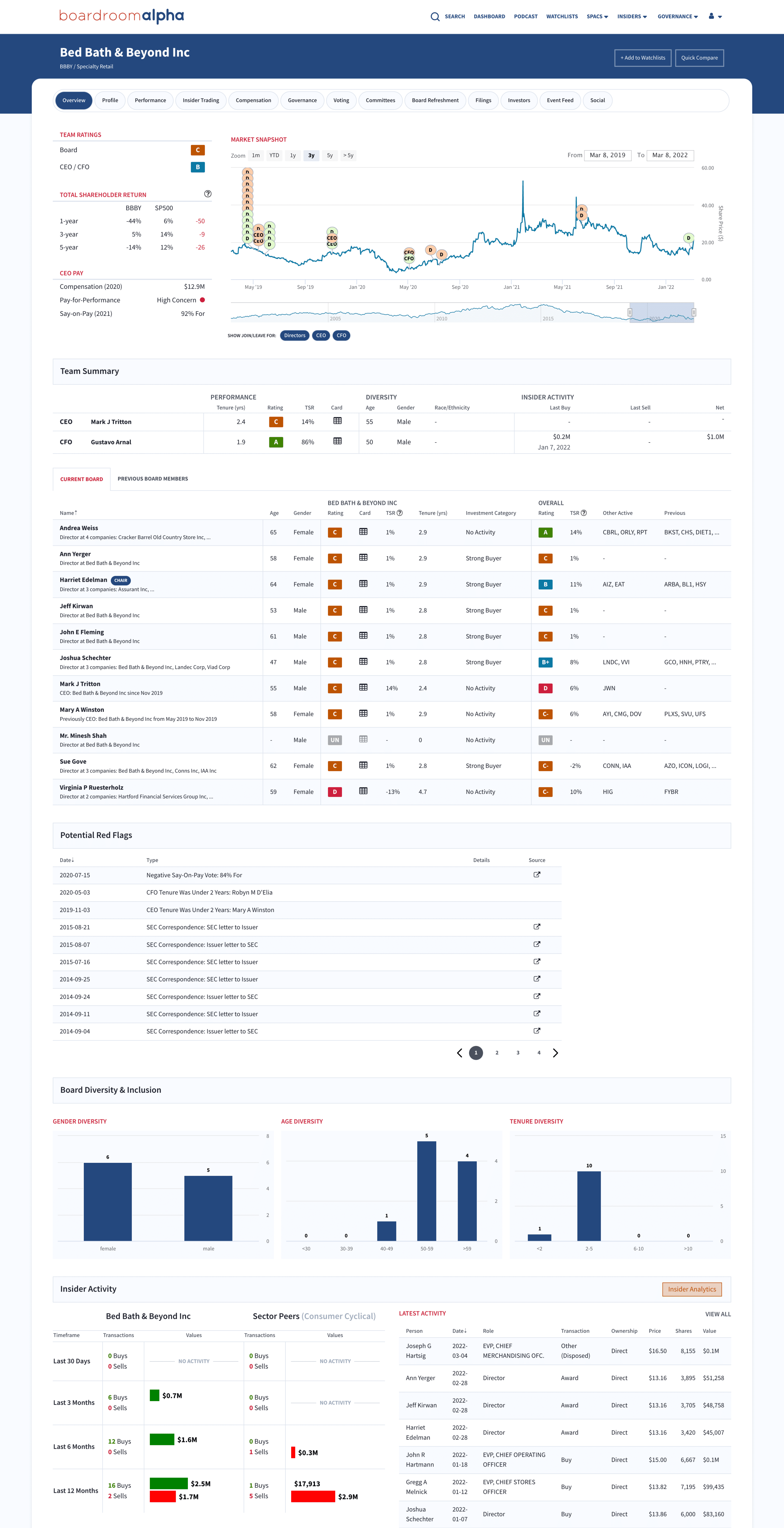

Easily track your company’s performance relative to peers across key ESG metrics like shareholder return, diversity (age, gender, race/ethnicity, tenure).

Monitor your peers for changes executive and director changes, insider buying/selling, announcements, the latest SEC filings, and more. Receive daily and real-time alerts to keep you ahead of the latest changes.

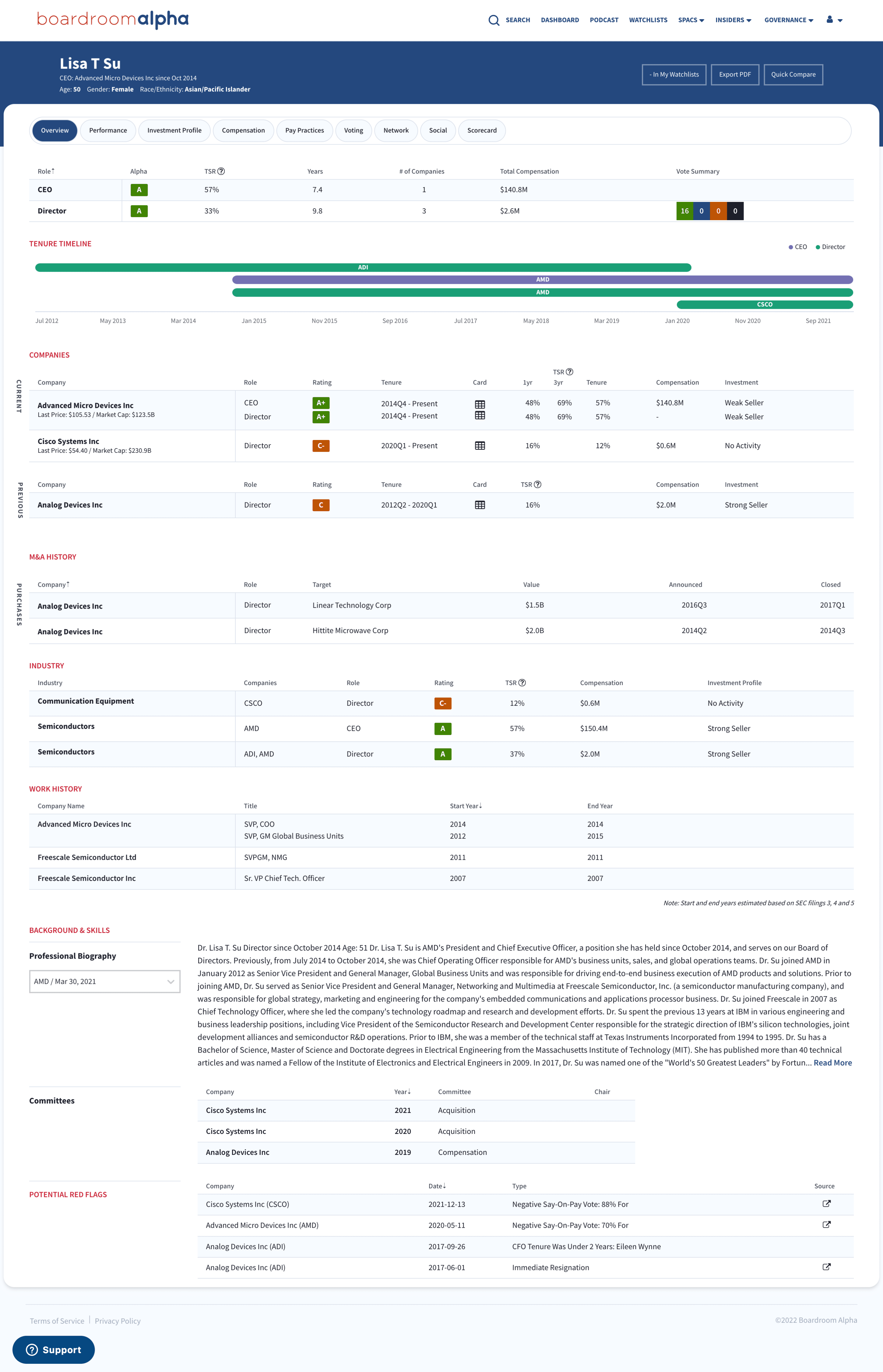

Comprehensive CEO, CFO and Director Scorecards highlight how investors see your team

See an independent, quantitatively driven assessment of each person on your company’s board and in the C-Suite’s track record. Know which team members are at risk from the outside.

Identify top talent for succession planning and board refreshment from almost 200,000 US public company directors, CEOs, and CFOs. Know who has a track record of driving return and quickly understand performance track records using Boardroom Alpha’s proprietary ratings, M&A activity, insider/buying and selling, relationships, and more.

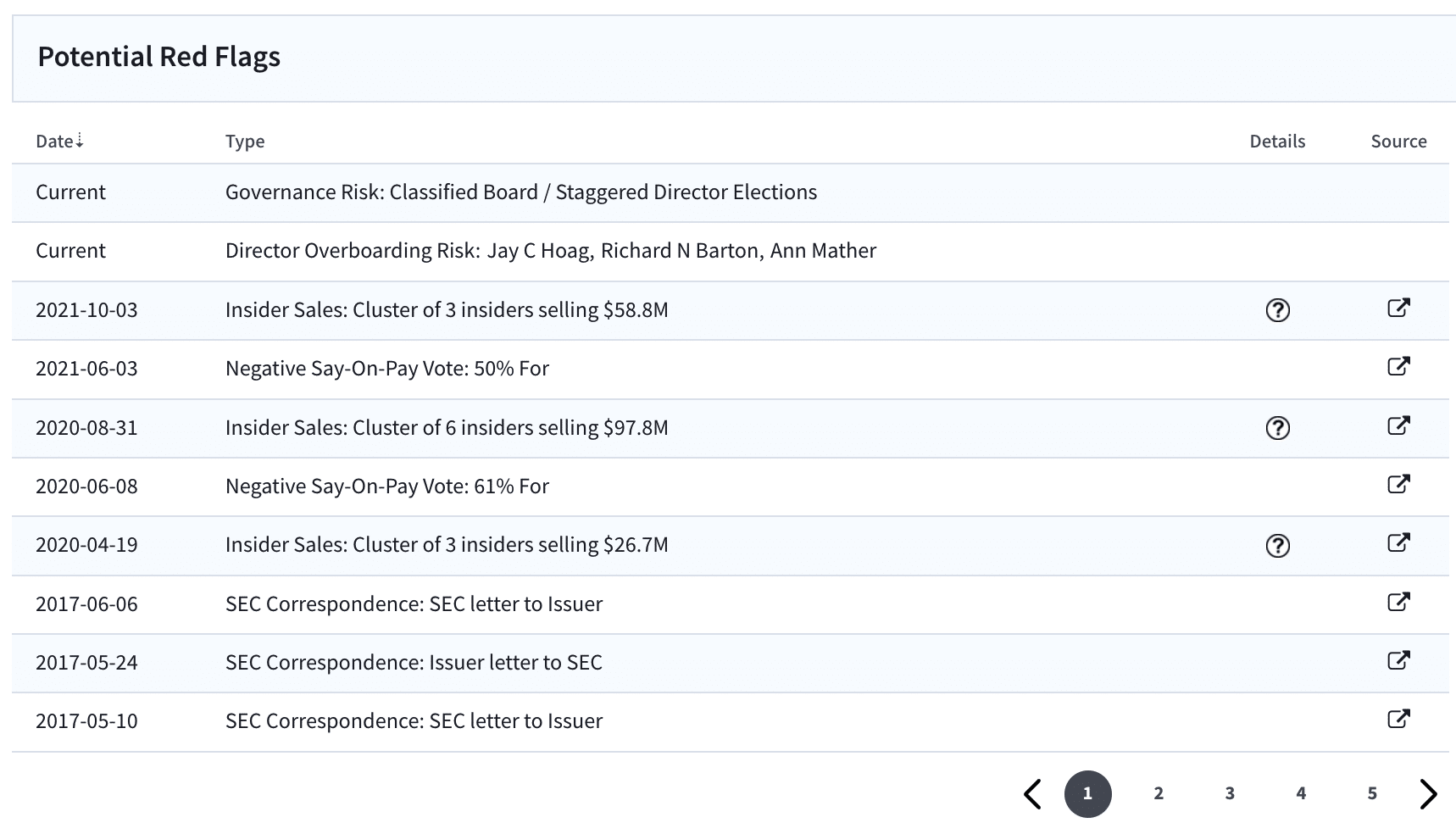

Corporate Governance Red Flags for Companies and People

Monitor for the potential governance red flags that investors, proxy advisors, and others are watching for.

Governance risk factor coverage includes: terminations, immediate resignations, high CEO/CFO turnover, investigations from SEC and other groups, class action activity, accounting firm dismissals, SEC filing and technical violations, and more.

Corporate Governance Database

Boardroom Alpha’s comprehensive governance provides insight into the governance of all US publicly traded companies and the executives and directors behind them. Use our robust RESTful API, take data feeds, or integrate directly into Excel.

Governance Data

- Executive Compensation data

- Director Compensation data

- Say-on-Pay voting

- Insider buying and selling (all Form 3, 4, 5) data

- Fund voting (from N-PX Filings)

- Board indendence

- Director overboarding

Governance Analytics

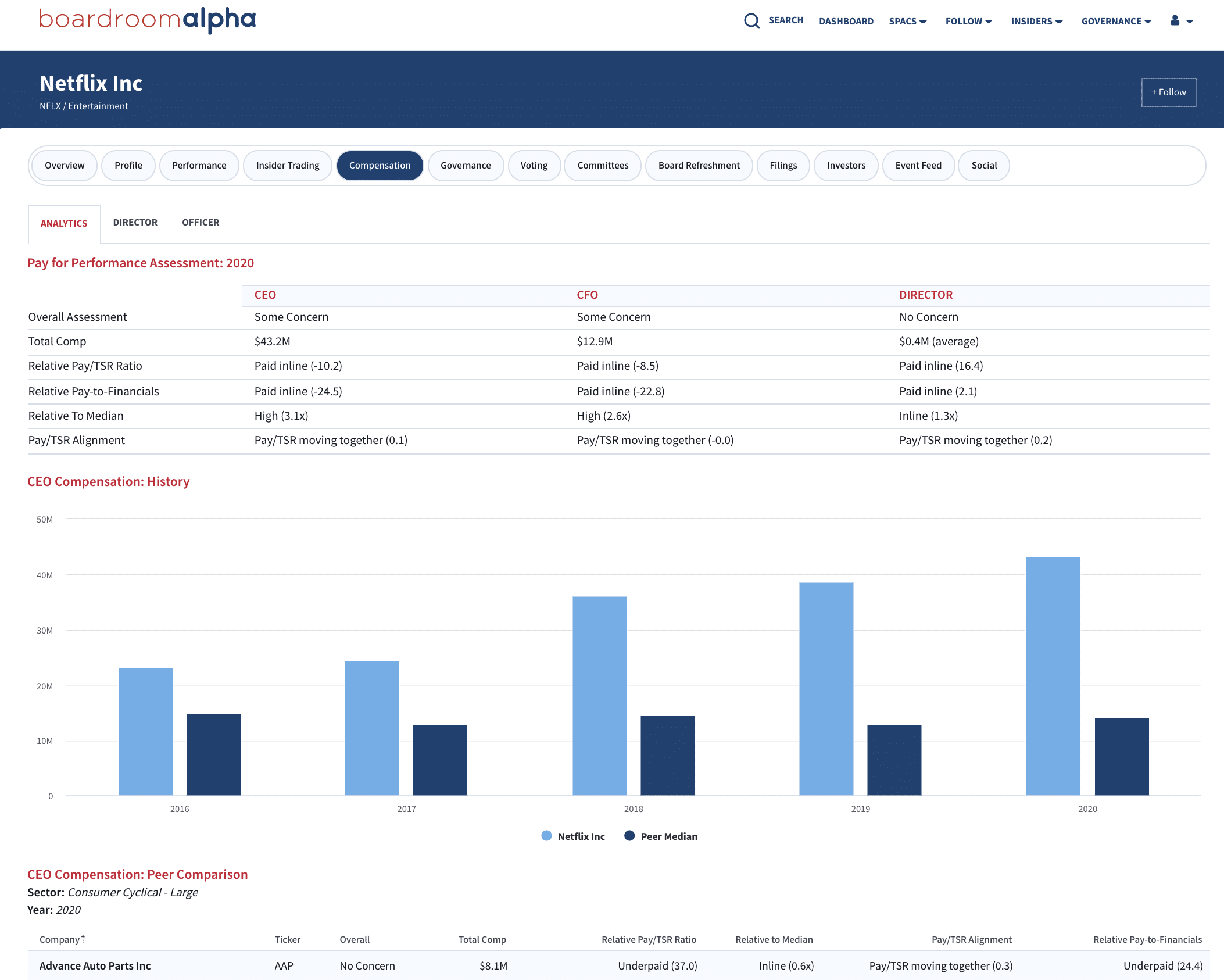

- Pay-for-performance

- Board interlock analysis

- Board performance analytics (TSR, ratings, and more)

- CEO performance analytics (TSR, ratings, and more)

- Diversity analytics

- Insider buying/selling analysis

Benchmark Executive Compensation and Pay-for-Performance

Quickly see how your executive compensation compares to your peers and stay ahead of investor, activist, and proxy advisory firm pressures.

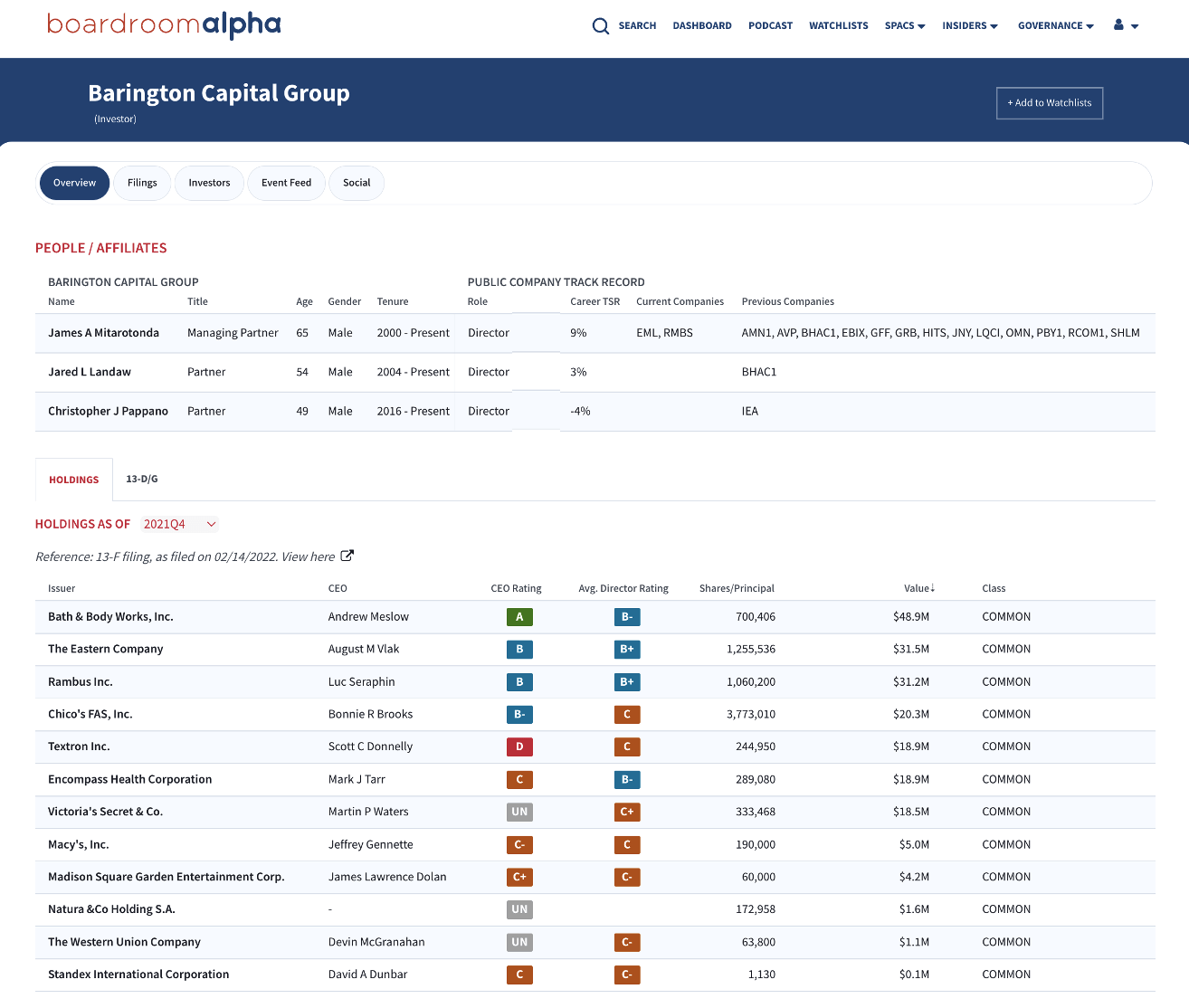

Track Activist Activity

Quickly research the latest activist activity with Activist profiles, activists who typically sit on boards, and activist holdings.

Watch for 13-D filings as activist take or change positions in your or peer companies.

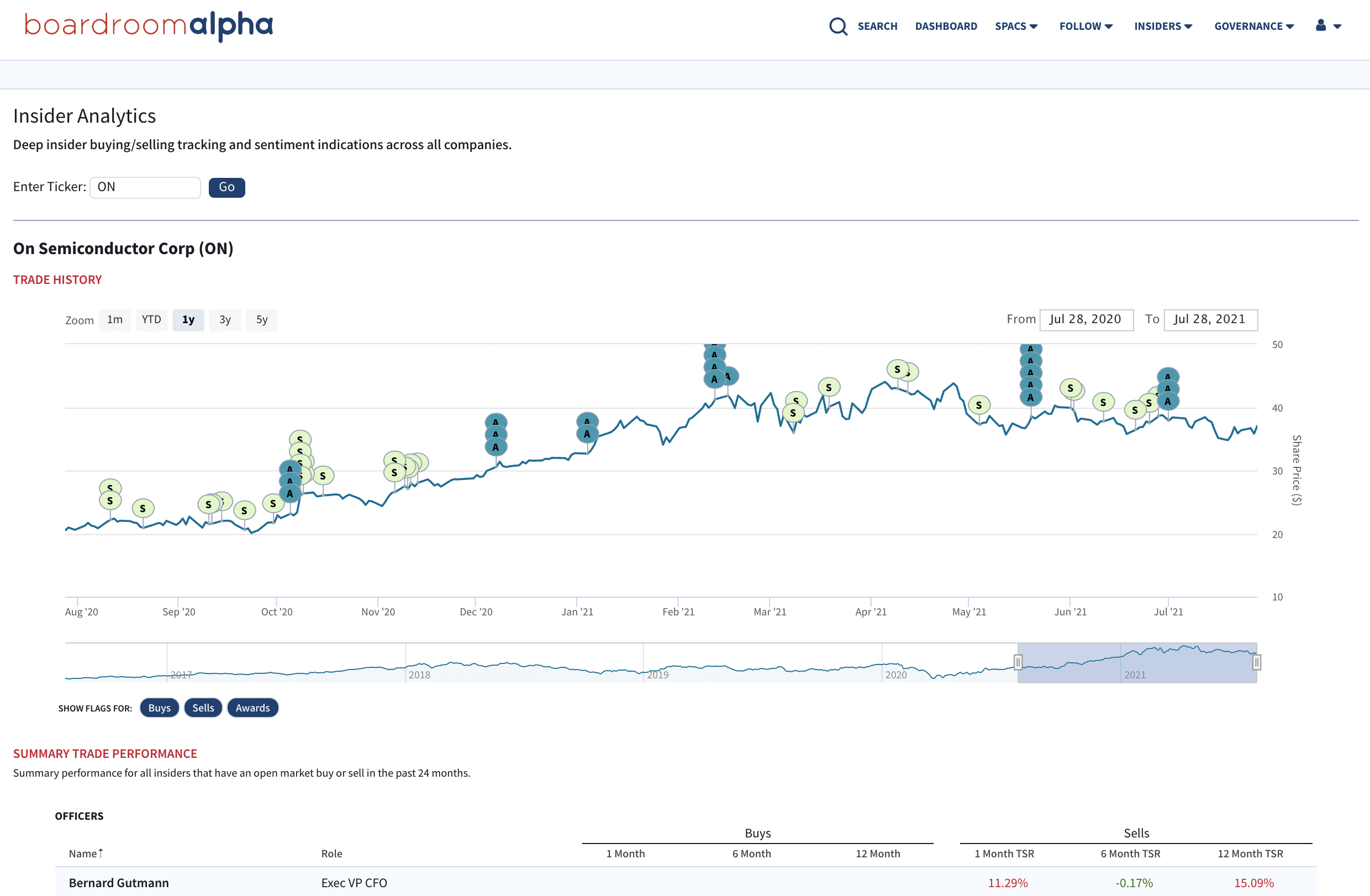

Monitor Insider Buying, Selling, and Awards

Track your team’s and peers’ insider buying, selling and awards to watch for potential governance red flags. See potential issues before outsiders do.

See how your team’s activity compares to your peers to make sure you’re not sending unintended signals to the market.

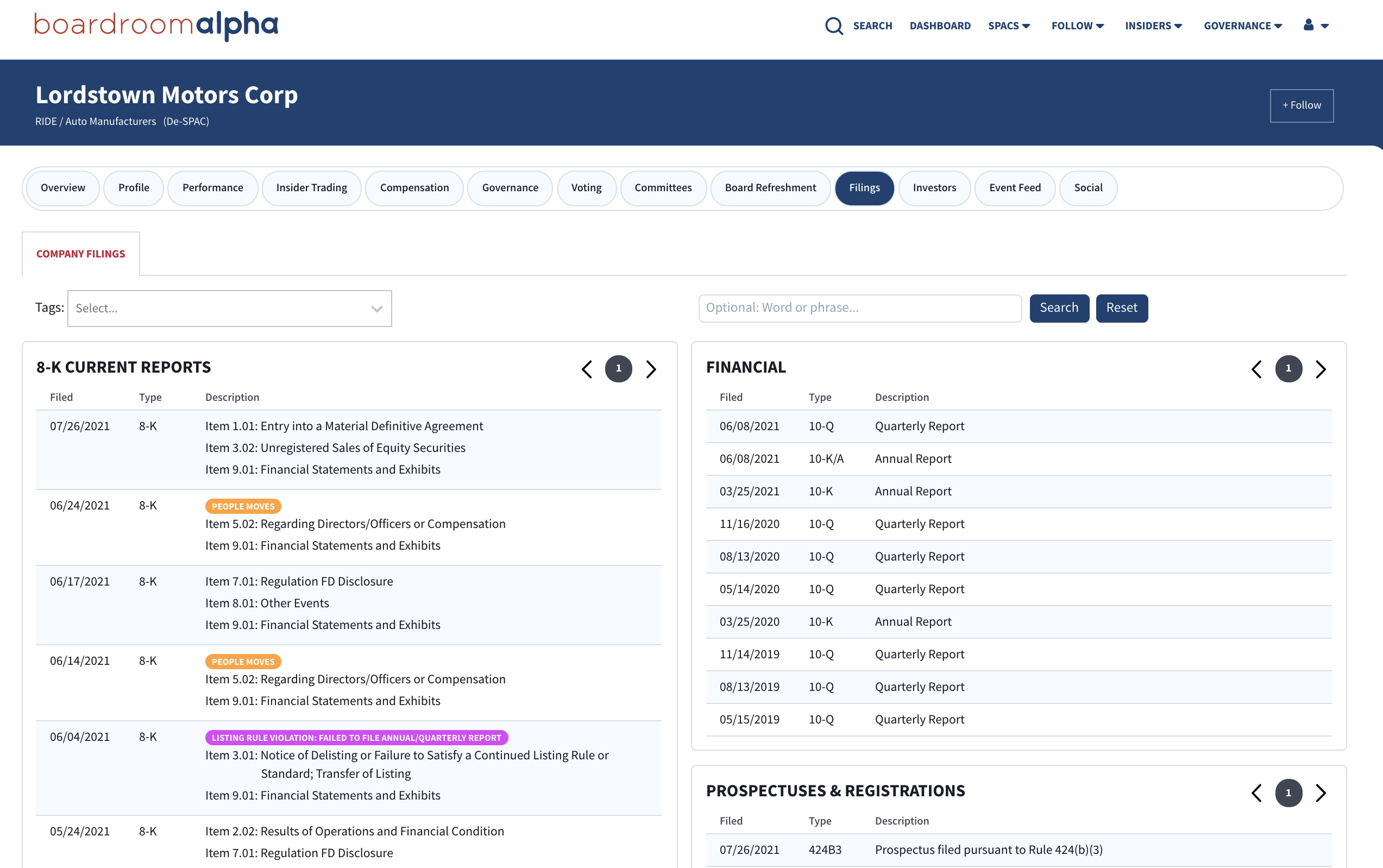

Intelligent SEC Filings Search & Tagging

Quickly search all SEC filings for a single company or across all companies. Leverage Boardroom Alpha’s machine learning classifications to quickly narrow your search to the most relevant filings.

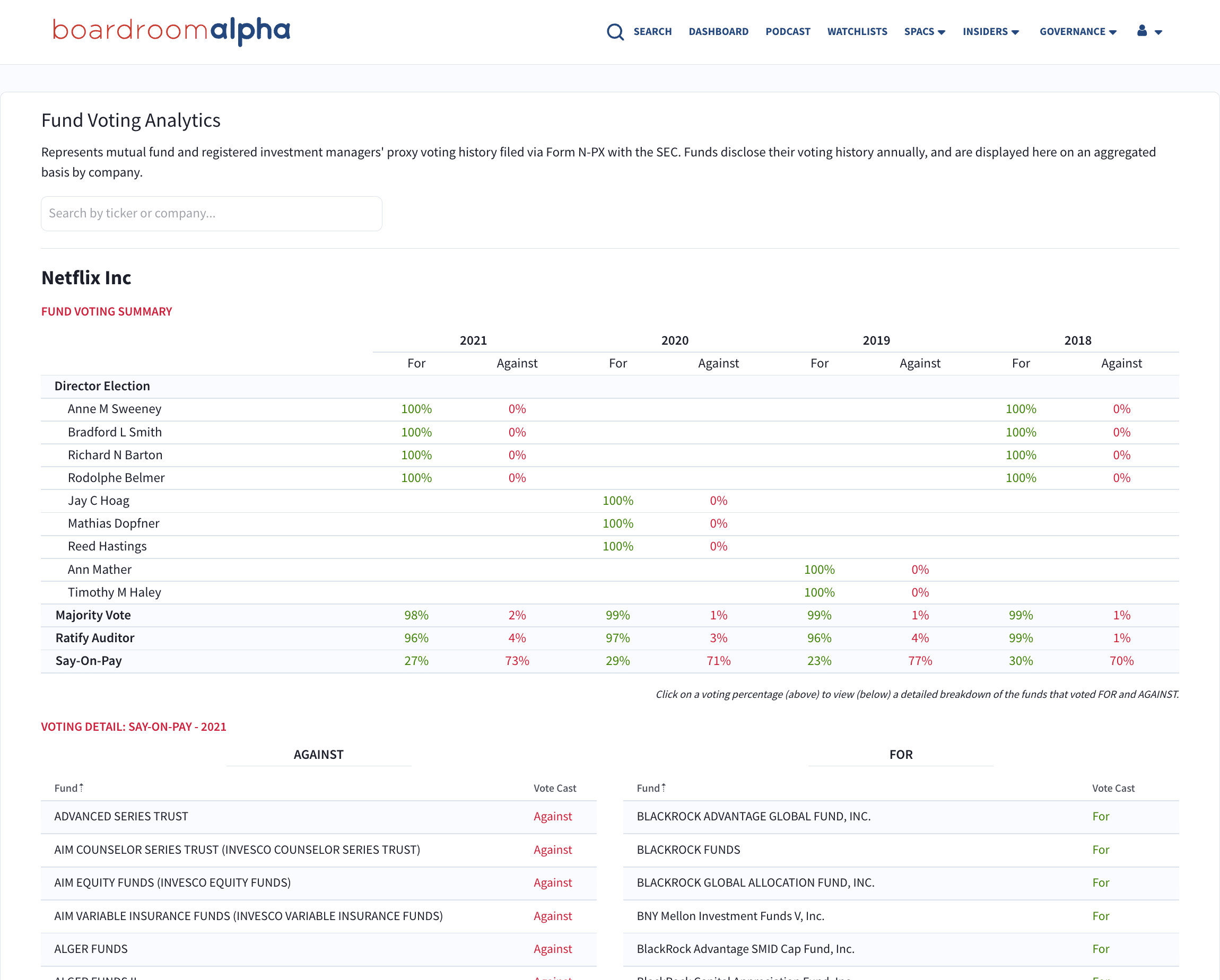

Evaluate and Track Fund Voting on Key Company & Shareholder Initiatives

See how every fund votes across proposals and companies at annual shareholder meetings. Drill down to see which funds supported, or tried to vote down, initiatives.