Corporate Governance Research and Resources

Governance FAQs

FAQ: What are Activist Cooperation Agreements?

FAQ on Activist Cooperation Agreements. What they are, why they matter, and examples. Also, links to additional resources on cooperation agreements.

Director Overboarding

Director overboarding continues to be a key factor that shareholders — and those who advise them — look at when evaluating nominees at the annual shareholder vote. This brief overview of “director overboarding” will look at what it is, why it matters, and how it is evaluated.

Say-on-Pay Voting: What You Need to Know

Learn what shareholder Say-on-Pay votes are, when they occur, why they are important, where to find them, recent trends, and more.

Universal Proxy Cards – What You Need to Know

Understand what the SEC’s new Universal Proxy Card rules are, what their impact may be, and find additional resources to learn more.

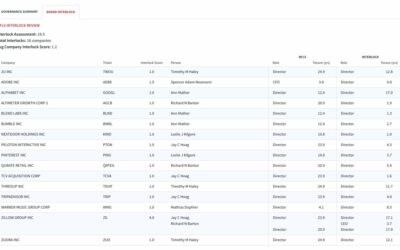

FAQ: Interlocking Directorates

Understand what interlocking directorates are, when they are legal, why they are a risk, and how to analyze them.