GOVERNANCE DATABASE & API

CORPORATE RED FLAGS

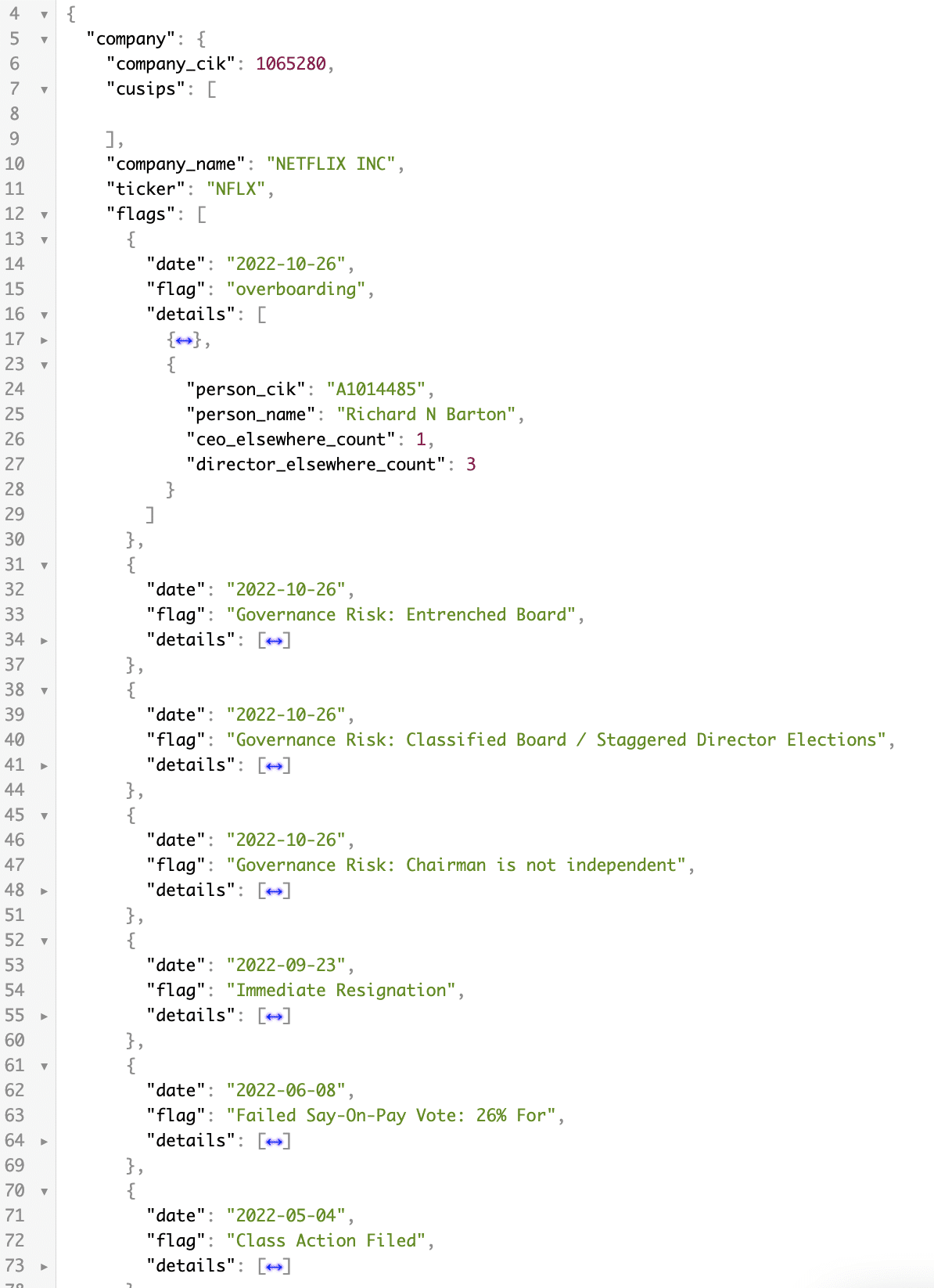

ACCELERATE DILIGENCE AND SURFACE HIDDEN RISKS ACROSS PERFORMANCE, GOVERNANCE AND INSIDER TRADING POTENTIAL RED FLAGS

CORPORATE RED FLAGS DATABASE & API

Boardroom Alpha’s corporate red flags database covers every US public company and identifies those performance, governance and insider trading red flags that might otherwise be hidden.

Company Identifiers

- CIK assigned by the SEC to the reporting company

- Ticker of the reporting company

- Company name

- CUSIPs for the reporting company (for licensed CUSIP customers)

Corporate Red Flags Include

Note: the corporate red flags database expands continually, contact us for the full listing.

- Entrenched boards

- Staggered boards

- Boards lacking public company experience

- Proxy fights / contested proxies

- Overboarding of directors / officers

- No lead independent director

- Non-independent Chairman

- Share pledging

- Multi-class shares

- SEC enforcements

- Class action filings

- Listing rule violations

- Shareholder return underperformance

- All-time & 52-week stock lows

- Bankruptcies

- Bankruptcy history for directors / officers

- Immediate resignations

- Involuntary leave

- Short CEO / CFO tenures

- Say-on-Pay failures & negative votes

- Pay-for-Performance concerns

- SEC correspondence (w/ annotations for notable risks/issues)

- SEC investigations

- Accountant dismissals

- Accountant resignations

- “Going Concern” risks

- Internal Control weakness

- Settlement agreements

- Form 144 and 10b5-1 filings/announcements

Data & APIs

Boardroom Alpha's comprehensive governance and SPAC databases provide insight into the governance of all US publicly traded companies and the executives and directors behind them. Use our robust RESTful API, take data feeds, or integrate directly into Excel.

Governance

Data

- Executive Compensation data

- Director Compensation data

- Say-on-Pay voting

- Board Composition & Diversity

- Insider buying and selling (all Form 3, 4, 5) data

- Fund voting (from N-PX Filings)

- Board Independence

- Director Overboarding

Governance

Analytics

- Pay-for-performance

- Board interlock analytics

- Board performance analytics (TSR, ratings, and more)

- CEO performance analytics (TSR, ratings, and more)

- Diversity analytics

- Insider buying/selling analysis

SPAC Database

(Special Purpose Acquisition Companies)

Power your internal SPAC models and research systems with Boardroom Alpha’s comprehensive SPAC Database.

Includes all key data points including: IPO date, vote date, size, redemptions, team members, performance analytics, deal metrics and more.

Easily integrate using the RESTful database API.