The SPAC market continues its slow, painful regression back towards SPAC normalcy (i.e. pre-SPAC mania). The challenges remain the same as SPACs continue to liquidate, redemptions remain at (no longer?) shockingly high levels, some try to extend, and few try to come to market. With a bevy of SPACs set to liquidate – over 50 have deadlines in March 2023 – over the next few months perhaps a thinner market can bring some normalcy back, though there is little to support any enthusiasm in the vehicle at this point.

Below, is a run down of the SPAC market activity for February 2023 — including an increasing pace and amount of deSPAC bankruptcies.

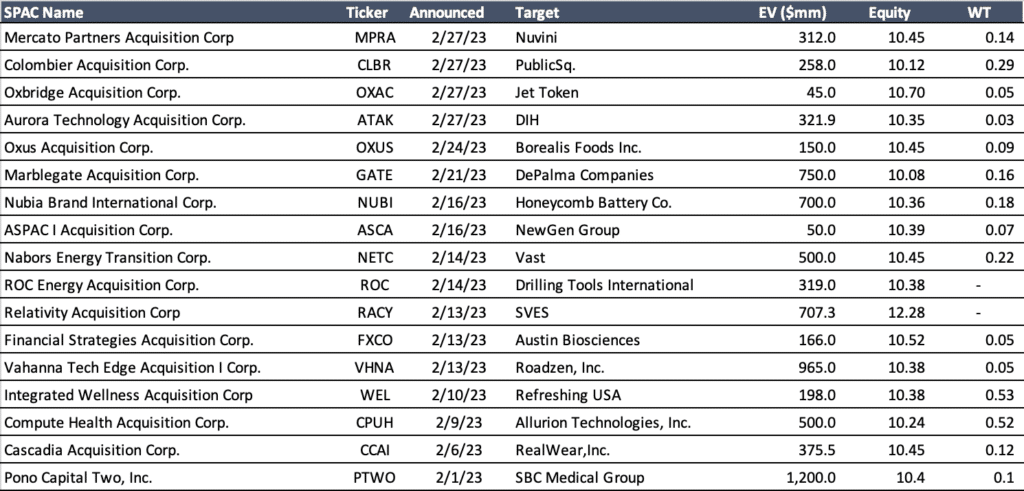

SPAC Mergers

Despite the ongoing negativity in the sector, sponsors are still incentivized to get to business combination agreements, thus merger activity continues despite a dried up SPAC financing market. Another 17 DAs were announced in February, in line with recent activity. However just one deal, Pono’s combination with SBC Medical, is valued at > $1B.

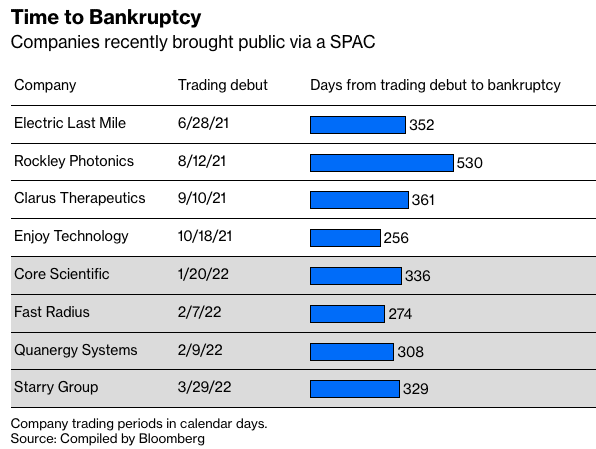

DeSPAC Bankruptcies

We spoke about this in last month’s review, and the activity is only heating up. Our friends at Bloomberg provided a nice overview recently of the quick bankruptcy trend facing DeSPACs on the heels of Starry Group (STRY) becoming the latest DeSPAC to file so soon after its trading debut.

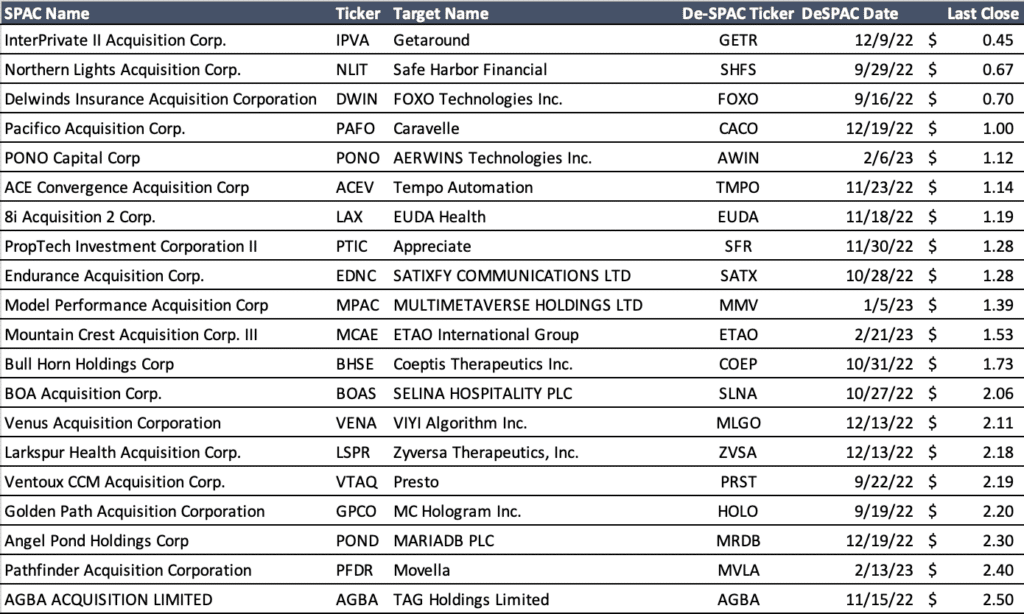

No doubt DeSPACs are reeling. Who could be next to potentially file for bankruptcy? Take a look at the last trading prices for DeSPACs in the last 6 months alone. There are 20 SPACs that are trading at $2.50 or less, and just six DeSPACs in the last 6mos are trading above the original SPAC offer price of $10. We wouldn’t be surprised to see more cheap M&A or companies that won’t be able to survive without additional capital.

Lowest Trading SPACs from DeSPACs in the Last 6 Months

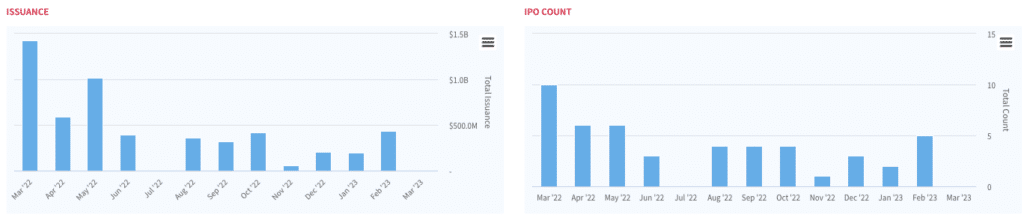

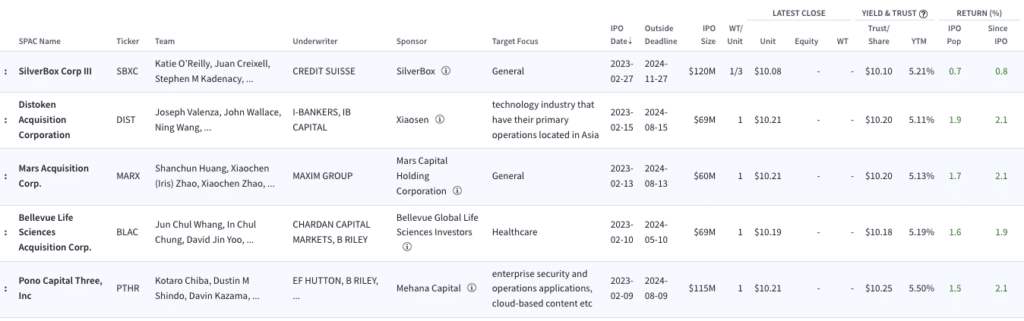

SPAC IPOs See Uptick

The SPAC IPO market is (somewhat open) and February was the most active month of new issuance since May ’22. Overall 5 deals priced for a total of $433M. Size, however, remains on the smaller end with just two of the 5 deals pricing over $100M. SilverBox Corp III and Pono Capital Three were the two largest at $120M and $115M, respectively, and also represent the third in their respective line of SPACs from the sponsors.

February 2023 SPAC IPOs

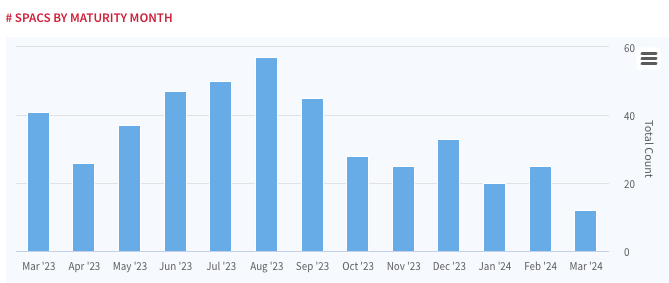

The Great SPAC Maturity Wall

At long last we have finally hit March 2023, the month where SPACs go to die. While numerous SPACs have kicked the can down the road via extension, liquidated early, or found merger targets – we are still left with 50+ SPACs that are set to expire this month. That is WELL below the ~150 that we were staring at last year. All the SPAC extension activity as resulted in a much more evenly distributed maturity schedule, but one that is likely to wreak liquidation havoc this summer as ~150 SPACs will be set to come due from June-August.

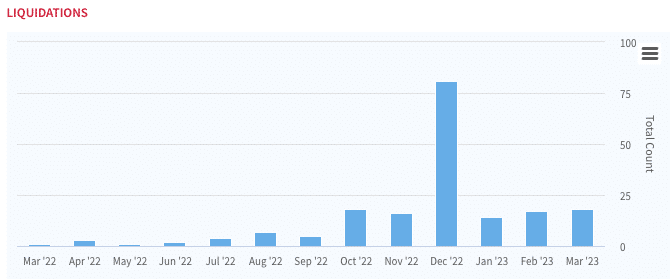

SPAC Liquidations, once a a surprise event, are now humming along at a steady pace. Following the insane jump in December 2022 due to the early liqudation craze spurred by the excise tax, SPACs are now liquidating at a much calmer cadence. 17 liquidated in February while another 18 have already indicated that they will liquidate in March.

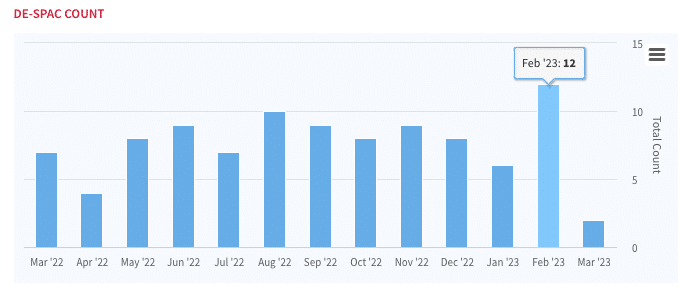

DeSPAC’ing

DeSPACs ticked up in Feb, with 12 closings finally getting across the finish line. The story remains largely the same at the SEC – a backlog and long review times continue to push merger timelines longer and longer.