IPO & SPAC PLATFORM

Analytics, Database, Research

Comprehensive research and analytics on every SPAC, person, sponsor, and underwriter.

Full SPAC tracking from pre-IPO to beyond deSPAC with supporting performance analytics.

Complete SPAC database updated in real-time and available via API.

Trusted daily by top investors, banks, SPAC sponsors, SPACs and more.

IPO & SPAC Research Platform

Everything you need to understand, track, and analyze the IPO and SPAC markets.

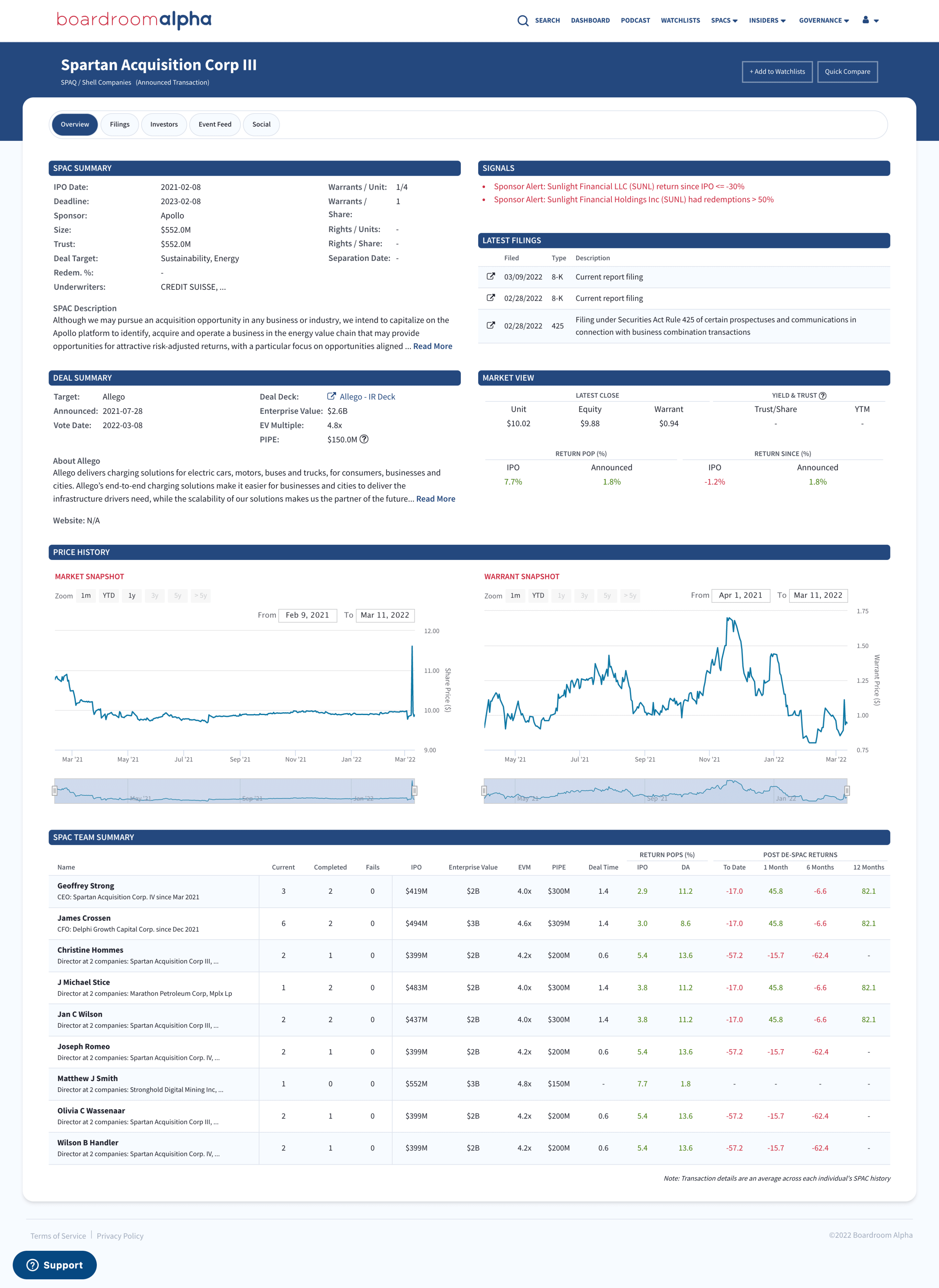

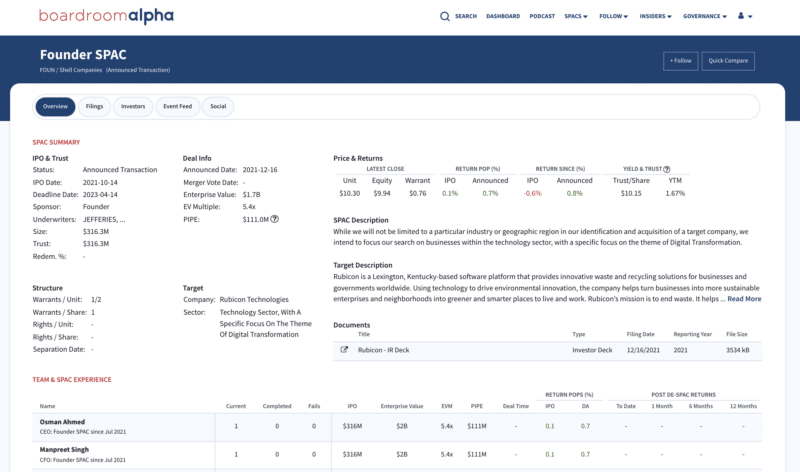

SPAC Profiles & Tracking

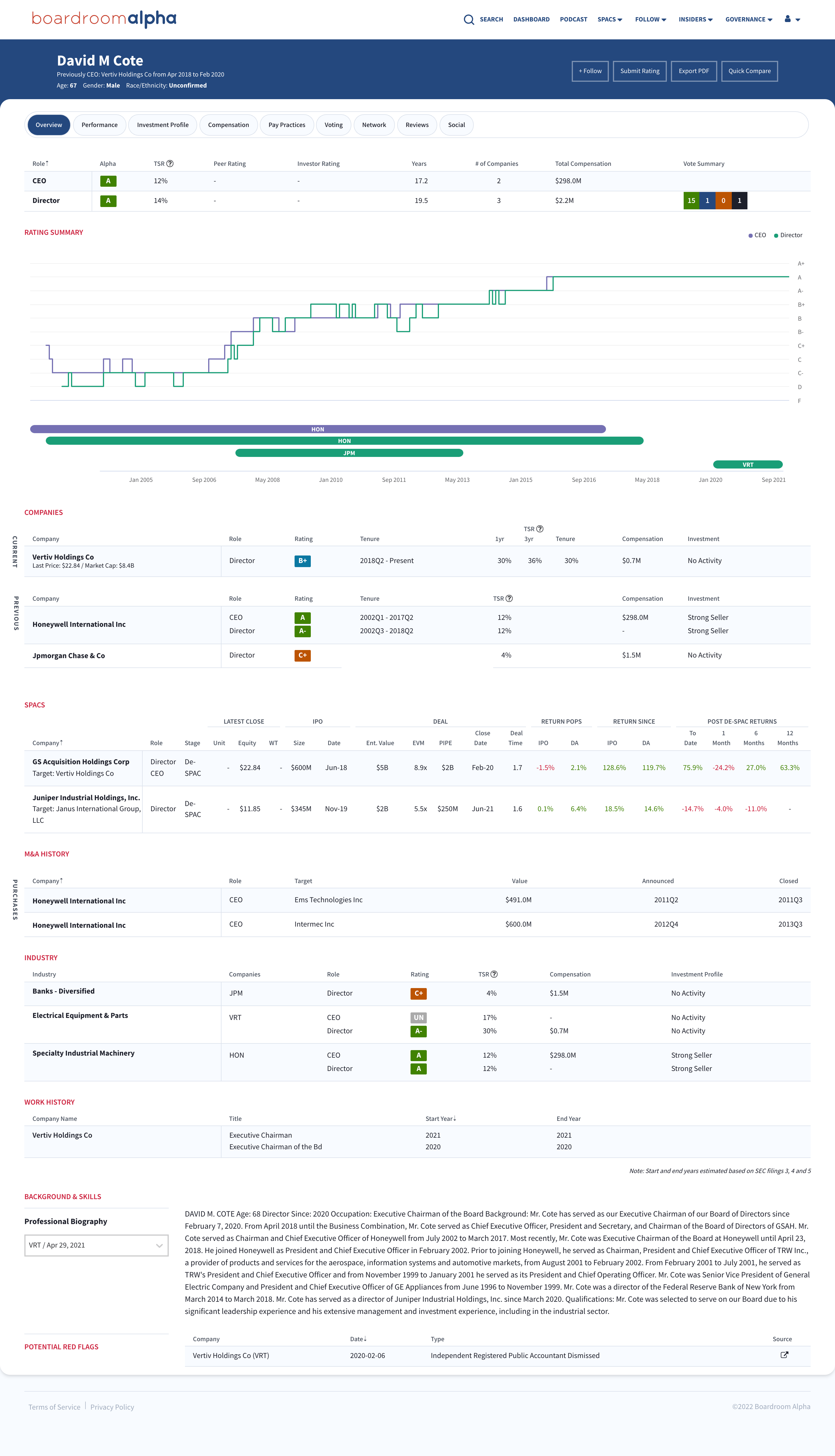

- Full detail, SPAC track record, and public company track record for every director, CEO, and CFO

- Unit / Warrant structure

- SPAC target focus

- Latest prices and returns

- Investors holding each SPAC

- Real-time SEC filing feed and full-text search

- Potential Red Flags

- Press releases

- Underwriters

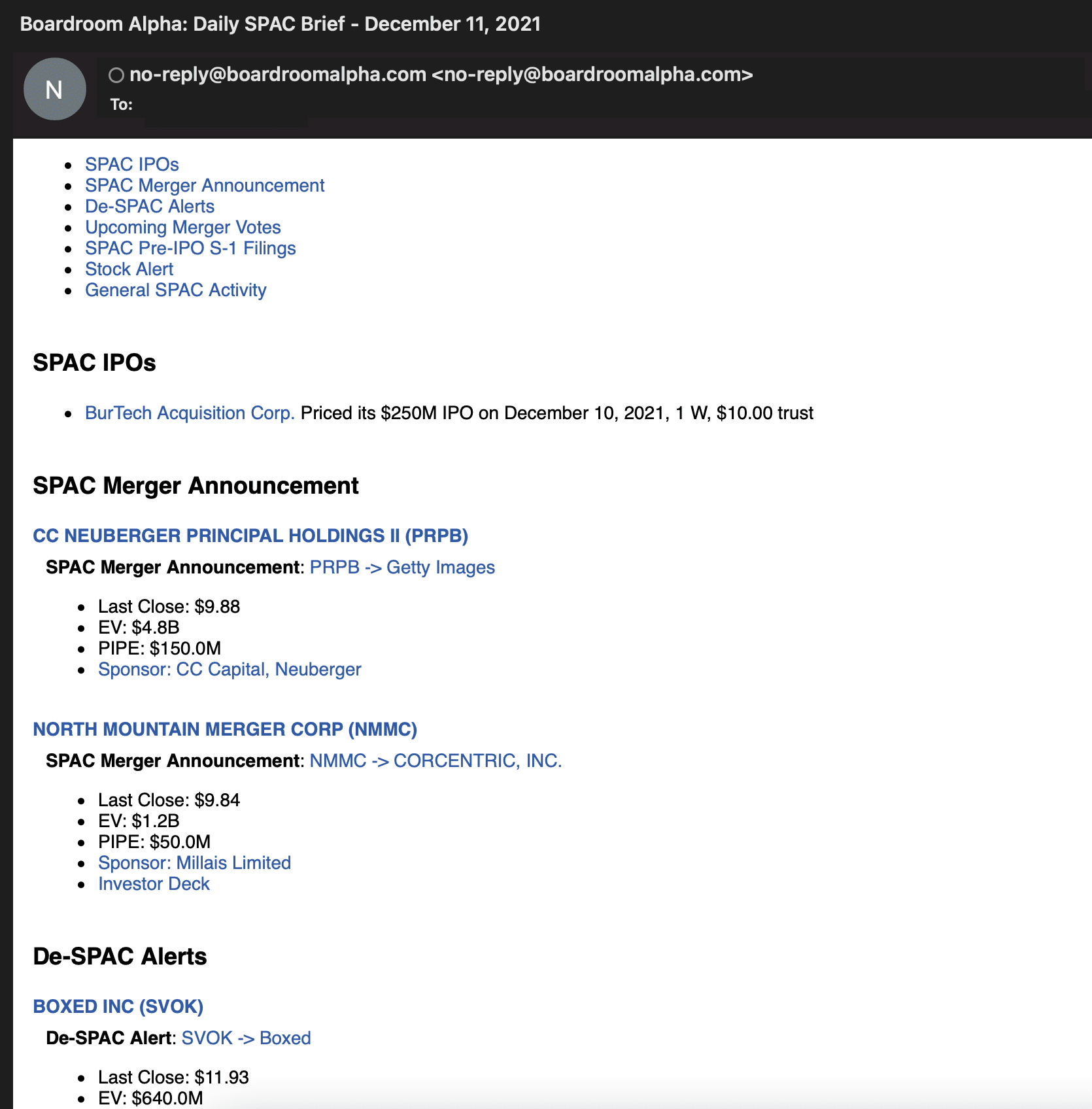

Alerts, Daily Briefs, and News

- Morning brief on latest SPAC activity (filings, IPOs, deals, and more)

- Deal announcement alerts

- All press releases

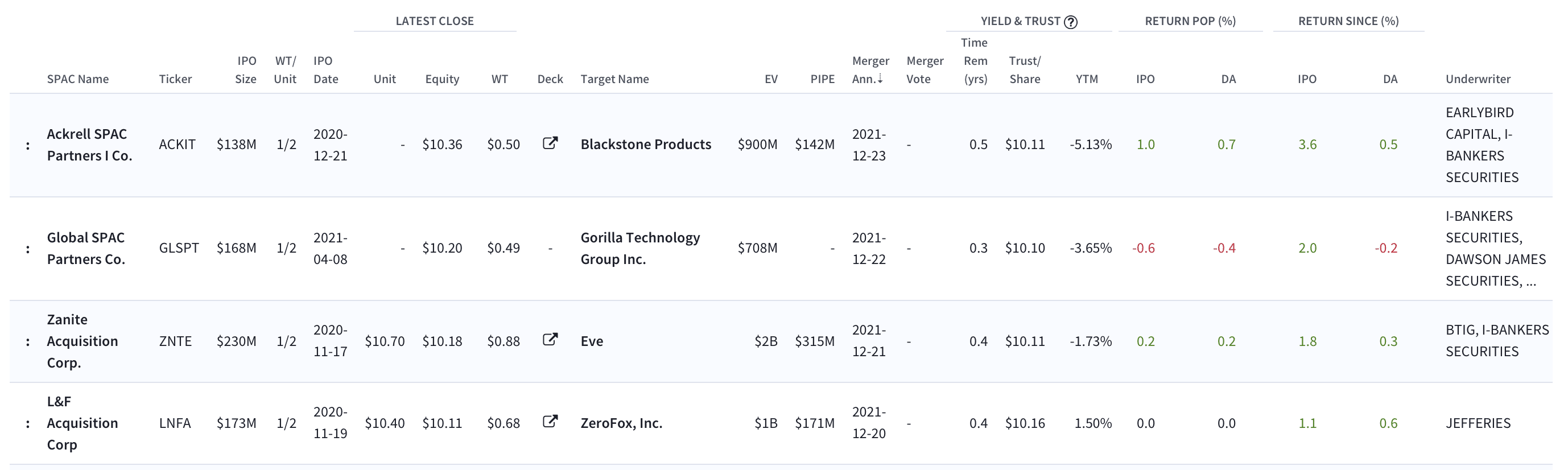

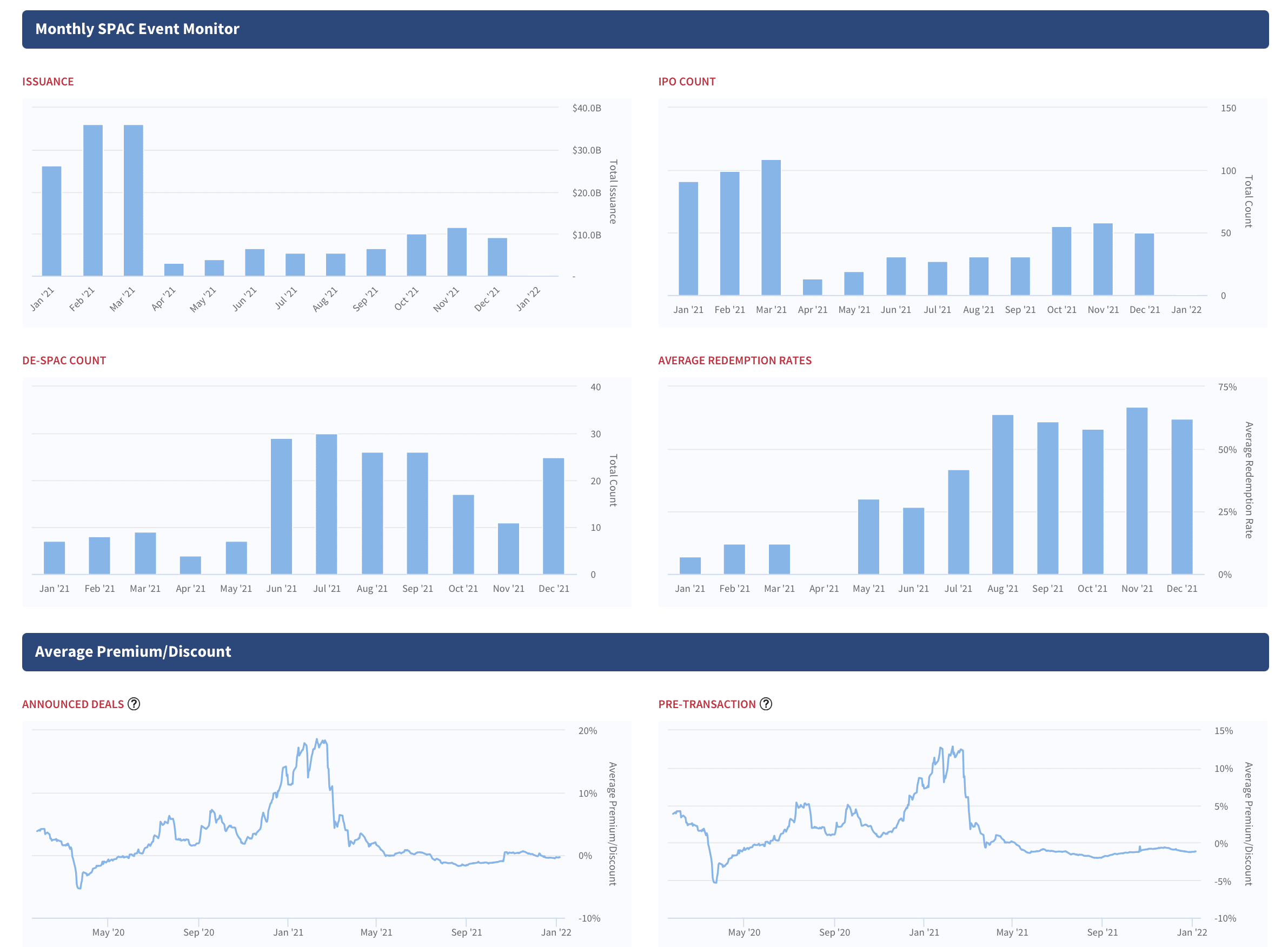

SPAC Market, Warrant, & Redemption Monitors

- Daily SPAC movers — common, units, and warrants

- SPAC Discount/Premium Index

- SPAC IPO volume tracking

- Recent SPAC IPO performance

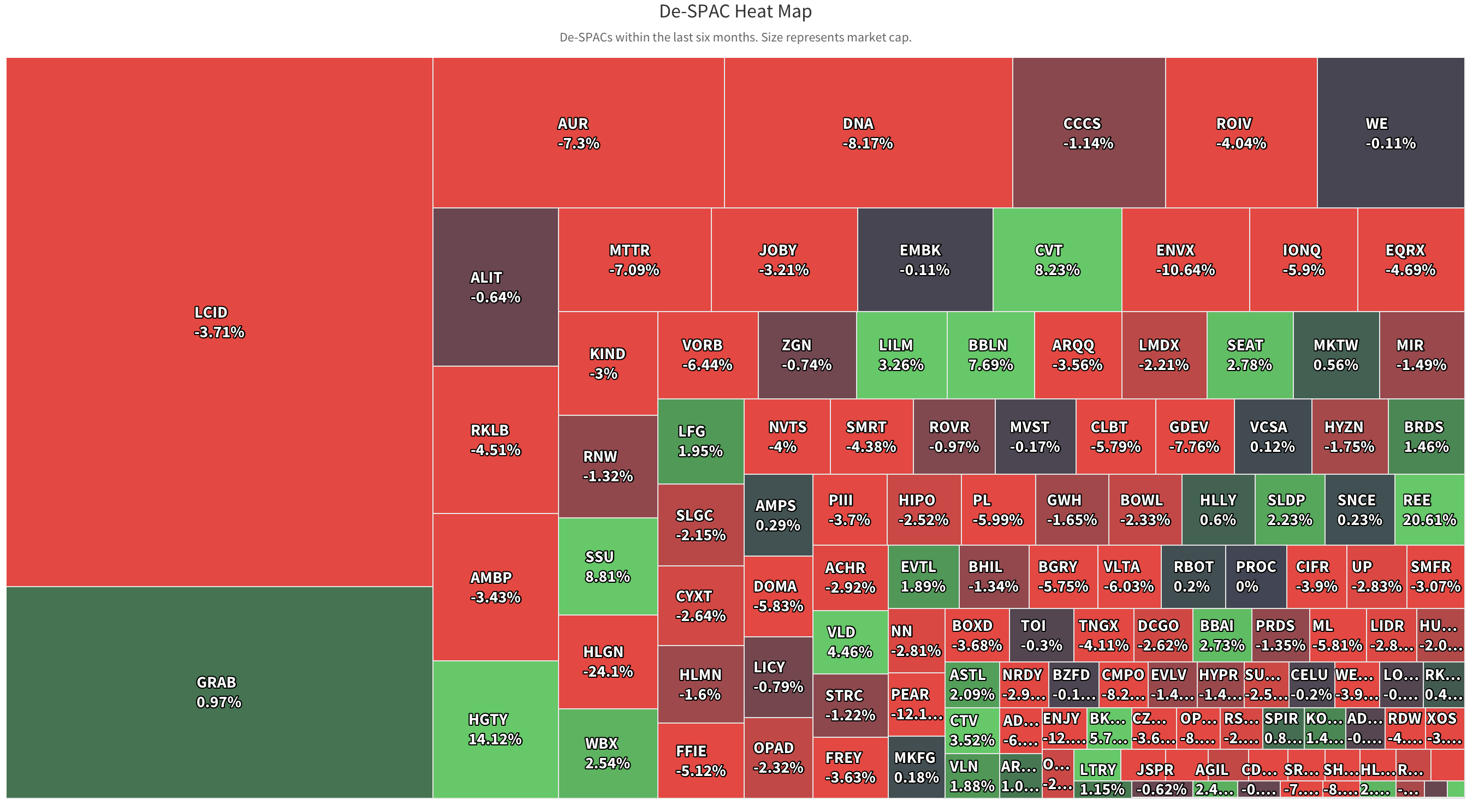

- Recent SPAC Merger performance

- Redemption monitor & outlook

- Warrant monitor with movers, discounts, and more

- SPACs at highs / lows

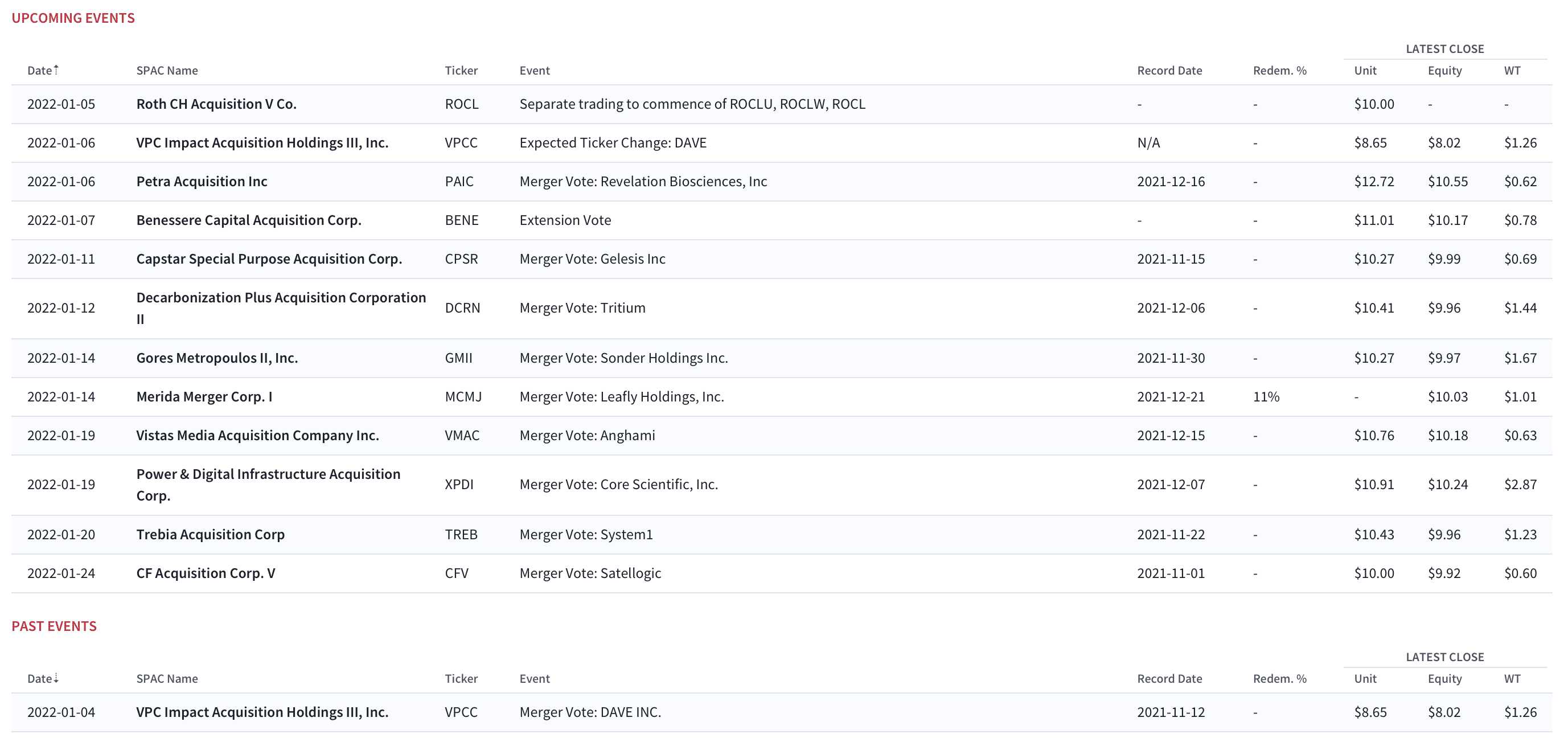

SPAC Calendar

- SPAC shareholder deal votes

- Unit splits into common & warrants

- SPAC extension votes

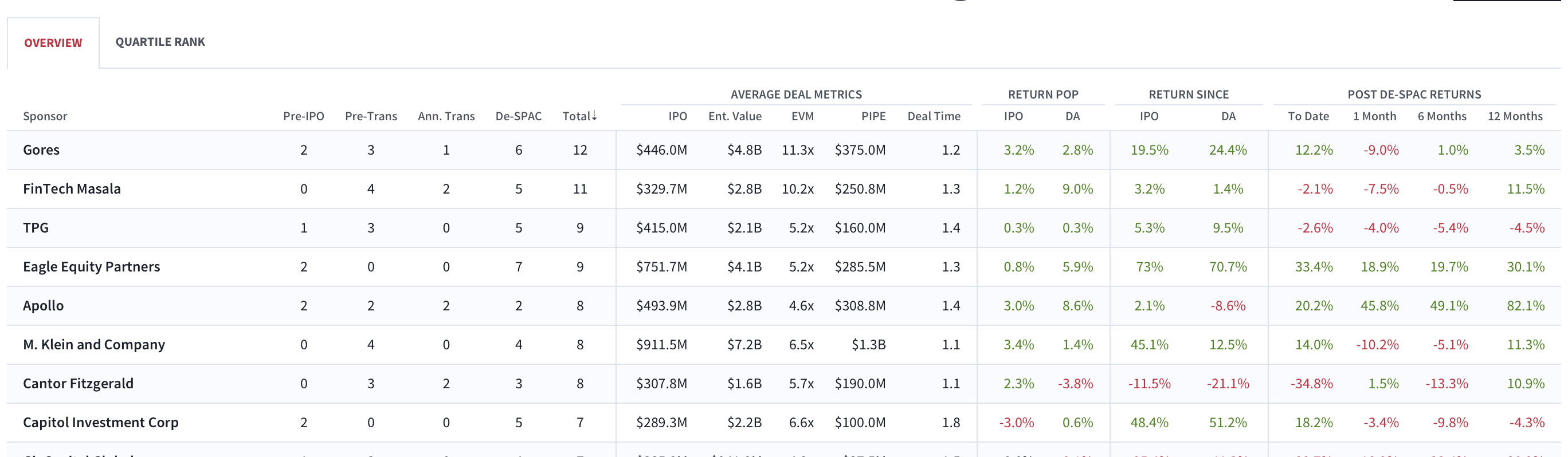

SPAC Sponsor Performance Tracking

- Full SPAC performance track record

- Deal metrics

- Sponsor rankings

SPAC CEO, CFO, and Director Tracking

- SPAC track record for every individual CEO, CFO, and SPAC director.

- Public company track record— ratings, analytics and context each individual’s performance at the top of a public company.

- Full biographies including age, gender, education, and race/ethnicity

- Relationship analytics

- History of insider buying and selling

- Ties to activist firms

- History of M&A

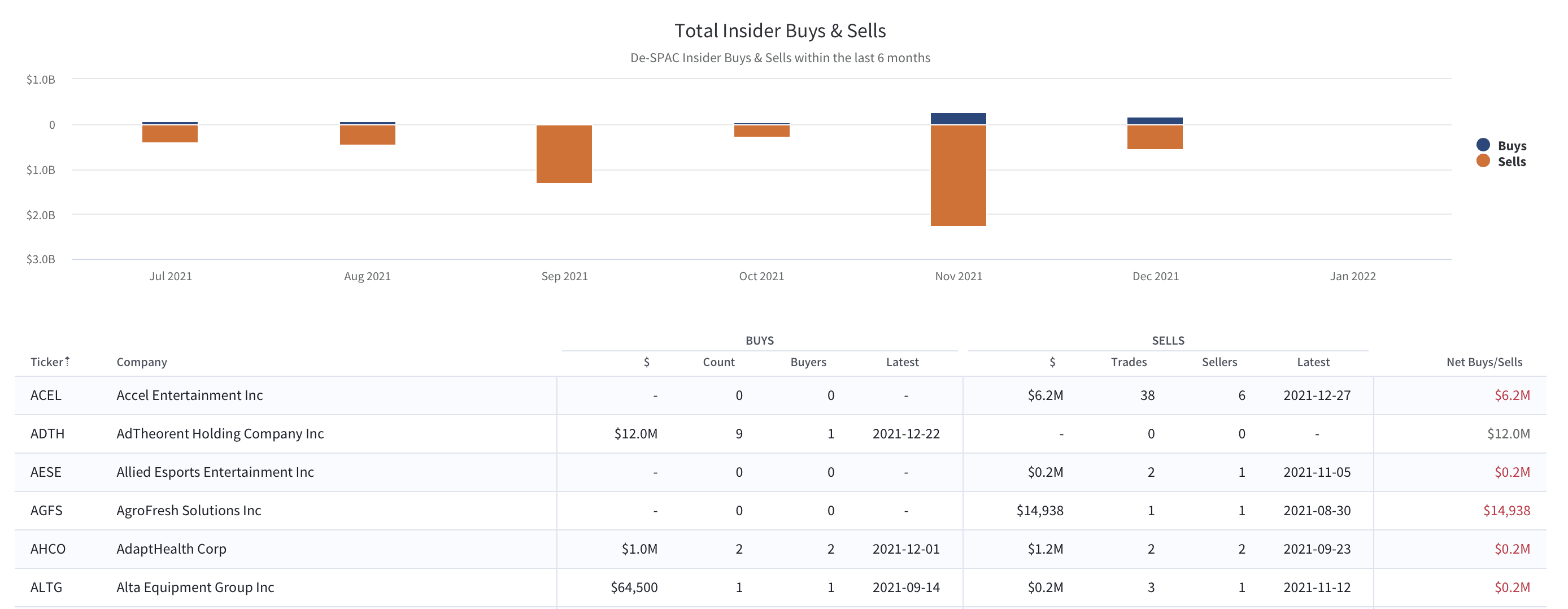

SPAC Insider Buying / Selling Alerts & Tracking

- Insider buying / selling alerts

- Track insider buying and selling for every SPAC team member

- DeSPAC Insider Buying / Selling Tracker

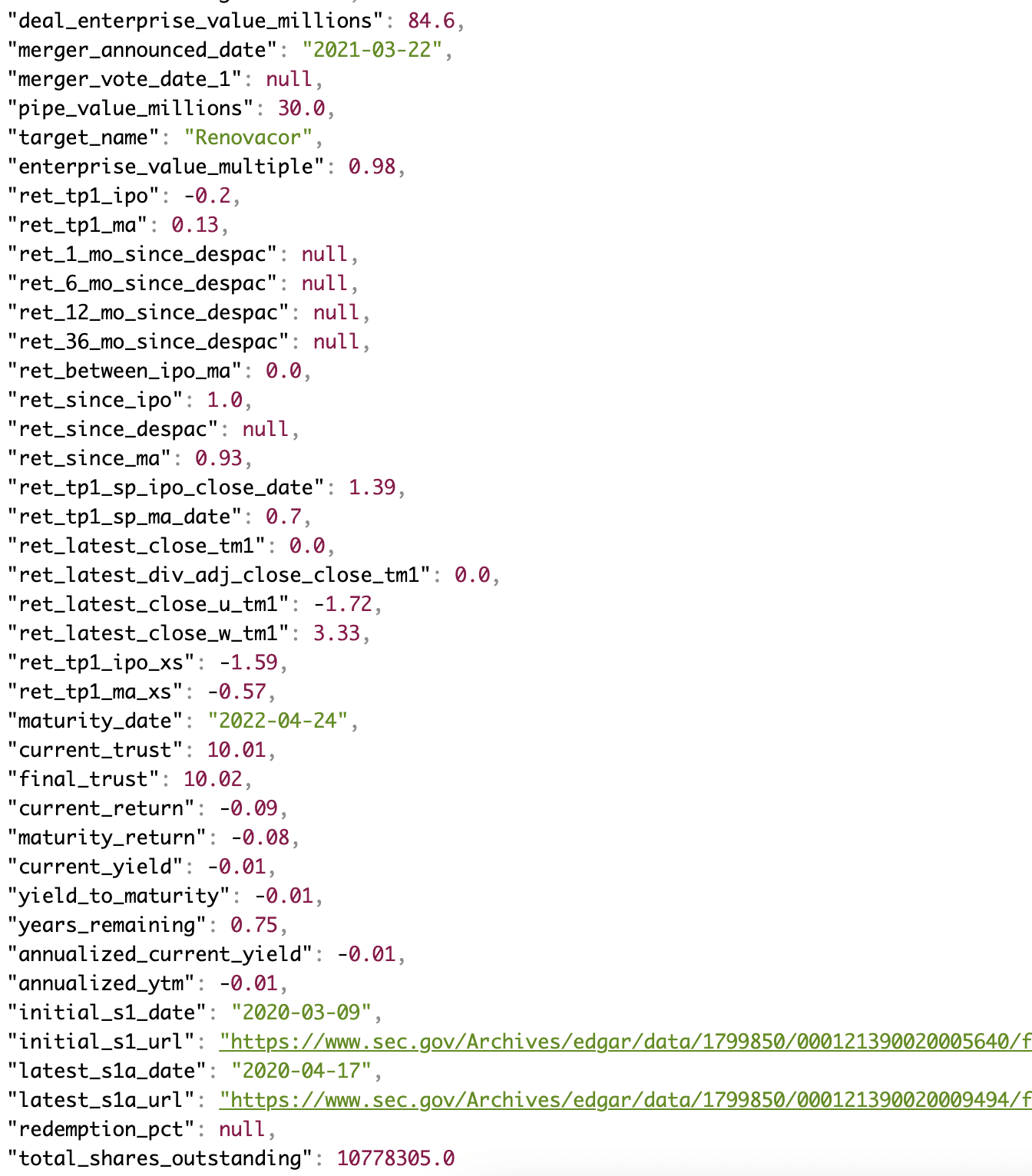

SPAC Database & API

Power your internal models and research systems with Boardroom Alpha’s comprehensive SPAC database.

SPAC Profiles

- Tickers

- Status

- IPO Date

- Target Focus

- Deadline Date

- Sponsor

- Size

- Trust

- Underwriters

Price Performance

- Latest close

- IPO Pop

- Deal Announcement Pop

- Return since deal announcement

- De-SPAC Returns

- Yield-to-Maturity

- Trust at maturity

SPAC Deal Details

- Deal Target Company

- Announced Date

- Merger Vote Date

- Enterprise Value

- EV Multiple

- PIPE

- PIPE participants

- Redemptions

SPAC Team

- CEO

- CFO

- Board of Directors

SEC Filings

- 8-K Current Reports

-

Prospectuses

-

Registrations

- Insider buying / selling

SPAC Structure

- Warrants / Unit

- Warrants / Share

- Rights / Unit

- Rights / Share

- Separation Date

Investors

- Detailed investor information

News & Events

- Press releases

- People moves

- Stock alerts

- Filing alerts

- Insider alerts

- Deal alerts

SPAC Research & Resources

More SPAC research, analysis, and data from Boardroom Alpha

Daily SPAC Market Analysis

Daily SPAC Newsletter

SPAC

Listing

Know Who Drives Return Podcast

SPAC Analysis

SPAC Daily: DWAC Circus Continues

Digital World Acquisition (DWAC) adjourns extension meeting till October and the rest of the day’s SPAC news.

SPAC Daily: DWAC Adjourns Extension vote

Trump SPAC DWAC adjourns its extension vote until Thursday, raising the odds that the sponsor will have to pay up for its extension.

SPAC Market Review – August 2022

In our latest SPAC market review we take a look at August. A spike in DAs has not done enough to move the needle, and SPAC winter continues.

SPAC Daily: DWAC Extension Vote Looms

SPAC Market Review – July 2022Full SPAC ListingPodcast: Know Who Drives ReturnDaily SPAC Newsletter DWAC Set For Extension Vote Next Week The so-called "Trump SPAC" Digital World Acquisition Corp. (DWAC) is holding an extension vote on September 6th. TRUTH Social CEO...

SPAC Daily: Ackrell Calls it Quits and Liquidates

Ackrell SPAC Partners I Co. (ACKIT) confirmed it terminated its deal with Blackstone and will liquidate, plus the rest of today’s SPAC news.

SPAC Daily: DWAC is Sinking

Digital World Acquisition Corp. (DWAC) continues its slide back to reality, and the rest of the day’s news in SPACs.

Monthly SPAC Market Reviews

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.