A hawkish Fed and even more cautious SEC are slowing deals….but may raise the bar for more quality SPACs down the line.

The month of April was nothing short of disastrous for the markets. The S&P 500 and the Dow Jones Industrial Average posted the worst April since 1970 — down 8.8% and 4.9%, respectively. The Nasdaq Composite’s 13.2% drop was the biggest since April of 2000. Net-net, the markets are coming to the realization that the Fed is going to get aggressive. The Fed is expected to raise interest rates by 50bp this Wednesday.

So, with a war still waging in the Ukraine and inflation spooking the markets, SPACs have a very steep uphill road to climb. New issues have declined, deal execution is trickier, and of course, deSPAC performance remains disappointing. And while the SEC has made it clear to SPACs — ‘we’re watching’ – the agency’s scrutiny hasn’t stopped de-SPAC transactions from being negotiated and completed this month. Companies we’ve spoken to say it’s more that the process is just taking longer with a more extensive regulatory review of proxy statements and registration statements. The question is whether the window will open again soon, or whether companies will kick the can down the road into 2H22.

For the over 600 SPACs still searching for targets, the scramble continues. Extensions and more extensions are the norm. And, with not nearly enough deals coming to clear out the backlog, more SPACs are pulling the plug on offerings. We expect some SPACs to start liquidating in the coming months, making warrant-based arbitrage more complicated.

In April, once again, deal activity remained low, with just 13 deals announced for the month. With redemptions still very high and the PIPE market clearly cooling, SPACs that want to get deals done are doing so more creatively. That said, we continue to see SPACs as a viable path to the public markets and a viable alternative to other forms of private or public capital for many early stage growth companies.

It’s no surprise that growth stocks struggle in an inflationary environment. As a result, most deSPACs are generally underperforming the market. To put it simply: we’re not compelled to buy much of anything in deSPACland right now. Momentum-based trading continues to be the norm among new issues. And looking ahead, investors may be in for more downside volatility in May unless inflation begins to abate.

SPAC IPO slowdown amidst challenging execution and horrible macro

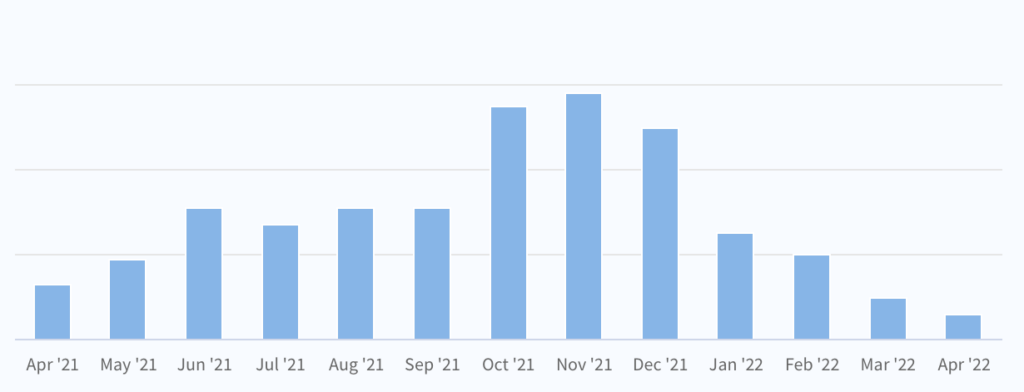

Not surprising given the combination of awful market conditions and oversaturation, April priced 6 SPAC IPOs, down from 10 in March and 13 a year ago. Of these new SPAC issues, transaction focus remains fairly diverse but largely weighted toward tech and healthcare. The latest SPAC IPO, Aimfinity Investment Corp. I (AIMA) completed a $70M offering, with a more complicated Class 1 + 2 warrant structure, hoping to incentivize shareholders to hold. Notably, most SPACs are not limiting themselves to a particular industry or geographic region, although many continue to state that they will not complete a combination with a target headquartered in China or with a majority of its business in China.

Notably, the major banks have all taken a backseat to SPAC IPO underwriting, for a variety of reasons. Of the 6 deals that did price in April, the most active banks involved were EF Hutton and Chardan.

Amidst market volatility, SPAC IPOs continue to sputter

Six SPAC IPOs in April

With 606 SPACs actively searching for deals, the big picture is largely unchanged from March: not enough M&A activity is getting done. Pre-deal SPACs are largely languishing given reduced execution certainty. And of the deals that are getting done, we are seeing continued tweaking of deal terms to get over the goal line.

Deal announcements bumped up slightly

Merger announcements are holding steady: 13 merger announcements in April, up from 10 in March. While there are currently 109 pre-close SPACs with DAs that look ready to reach the finish line. This month was heavy on biotech and healthcare related names.

April SPAC merger announcements

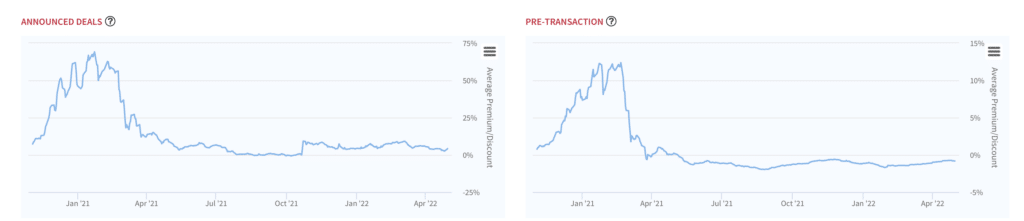

SPACs as yield instruments? Pre-merger arbitrage opportunity has diminished

Arb traders could once count on a fairly predictable pattern of SPACs popping on announced deals. But this phenomenon is no longer. The average premium over IPO price for SPACs with announced deals is now a scant 4.2%. That’s down from 9% in October 21 (the last big spike on the graph) and a high of 69% in January 2021. And of course SPACs without a transaction announcement are basically dead money, unless they are moved purely by rumor and speculation. The best example this month is UTA Acquisition Corp. (UTAA), which was speculated to be merging with OnlyFans.

In a volatile market, deal cancellations (and even multiple deal cancellations) are the norm

The cancellation trend continues. With most pre-deal SPACs now trading below $10, the still high rate of redemptions means there’s often not enough cash in trust to meet the deal’s requirements. More announced deals are failing to make it to fruition. There’s also the possibility that if one or more parties don’t think the initial valuation will be supported by investors, the target company may decide it’s better to remain private for now.

It’s not easy getting transactions over the the goal line. Several SPACs called off mergers in April, across a variety of sectors. And one, East Stone Acquisition Corporation (ESSC) is on its second deal termination. Earlier this month ESSC announced a DA with Dubai-based smart electric vehicle (EV) company ICONIQ Holding Limited (NWTN). East Stone terminated its previously announced combination agreement with JHD Holdings Limited (JHD). The SPAC also terminated a merger agreement with Ufin Holdings in February 2021. We’ll see if this one sticks.

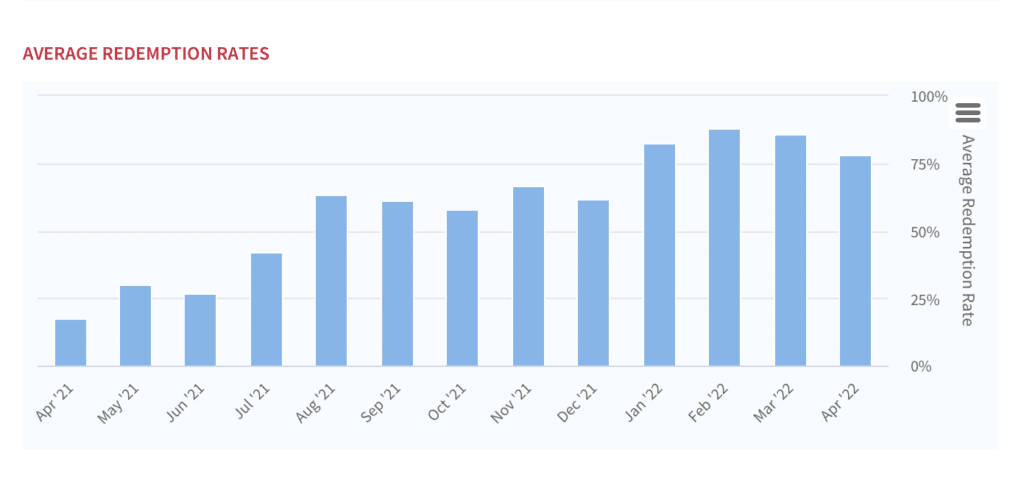

Redemptions decline for the third consecutive month

Not surprisingly, SPAC shareholders are asking for their money back instead of funding mergers. That said, redemptions have now declined for the third consecutive month. Redemptions were 78% in April, down from 85% in March and just 17% a year-ago. The lower redemptions can be partly attributed to sweeteners and non-redemption agreements to shareholders, making it slightly more appealing for them to hang onto shares.

Redemptions: Higher quality or more honey in the pot? Three sequential quarters of improvement

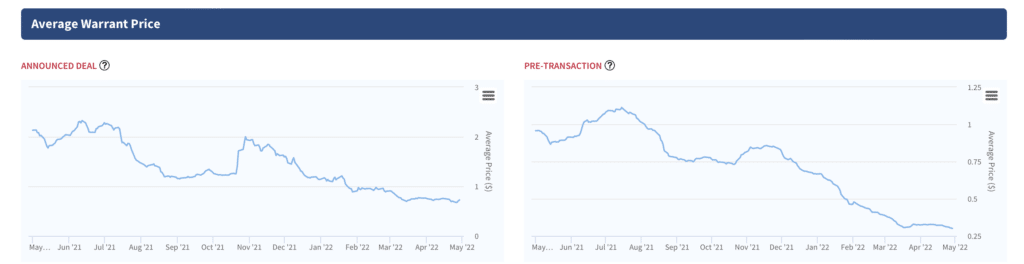

Increased warrant coverage and new models

While last year saw SPACs with minimal warrant coverage, a cooling market has swung the pendulum in the other direction. The number of shares that may be purchased by exercising warrants included in the units sold in SPAC IPOs has generally increased. Warrants have also come under increased regulatory scrutiny by the SEC for being misclassified as equity in many situations. Also of note: in late April, the New York Stock Exchange withdrew a proposal seeking to allow it to list SPAC warrants. The main concern was over whether investors would have adequate rights to bring private litigation.

Several SPACs have faced litigation alleging the way they hold funds prior to an acquisition violates the Investment Company Act. The biggest litigation target, Pershing Square Capital Management, supports the NYSE effort. Bill Ackman says his revised SPARC (Special Purpose Acquisition Rights company) structure results in less stock dilution and lower underwriting costs. In the SPARC model, instead of putting cash upfront, shareholders hold onto the cash until the SPARC identifies the company it plans to merge with. PSTH will distribute warrants to the shareholders of Pershing Square Tontine Holdings for free. If the SPARC isn’t involved in a transaction at that time, it will conduct a shareholder vote to return the capital to shareholders. Shareholders would still own a publicly-traded warrant that entitles them to invest in the company’s next transaction at net asset value when it is announced.

Warrant trends

Market volatility curbs new issues

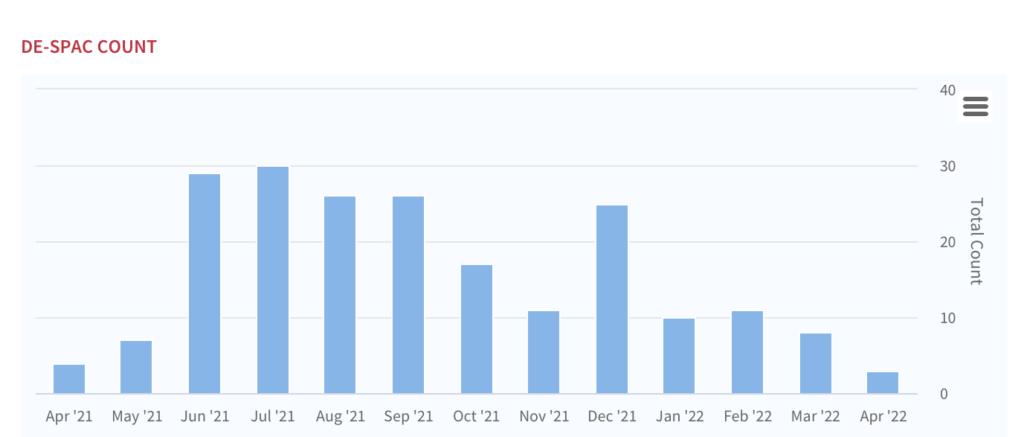

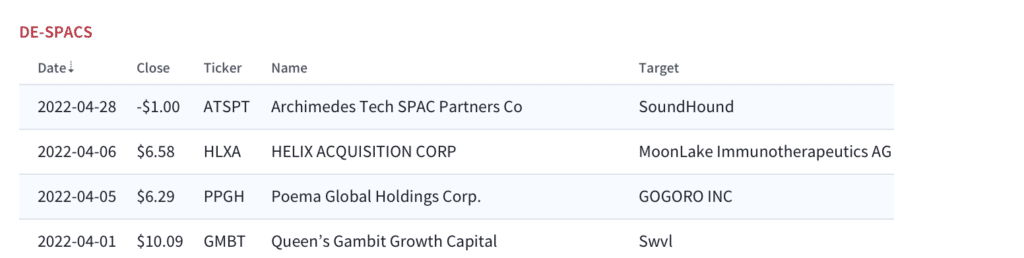

WIth the U.S. capital markets experiencing the longest extended period of high volatility since the 2008 financial crisis, it’s not surprising that fewer SPACs made it out this month. April saw a total of 4 deSPACs, down from 8 in March and flat versus 4 a year ago:

- Soundhound (SOUN) – AI/voice recognition

- MoonLake Immunotherapeutics AG (MLTX) -immunotherapy for treatment of inflammatory disease

- Gogoro (GGR)– Taiwanese battery-swapping for urban electric mobility

- Swvl Holdings (SWVL)– UAE-based shared transportation

deSPAC count: Market volatility is closing the exits

April deSPACs

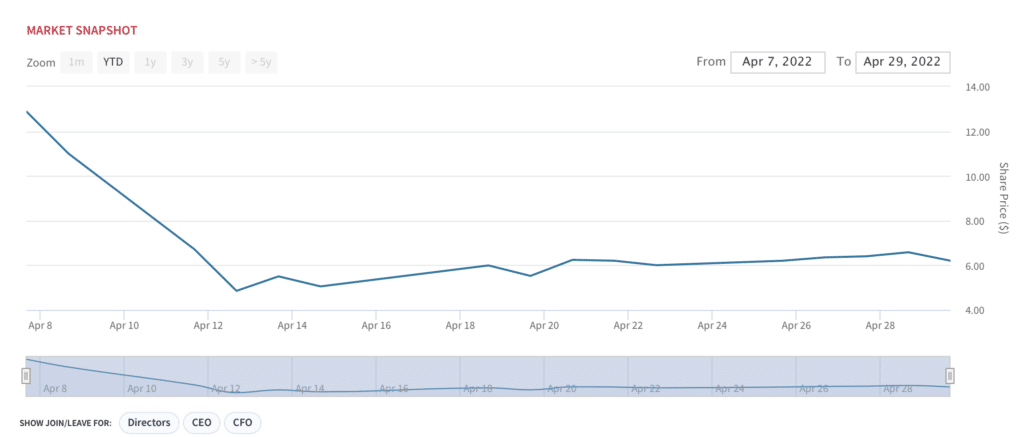

deSPAC performance in April was nothing short of disastrous, with all four April deSPACs trading down sharply from their IPO price.

The new normal: MLTX performance since deSPAC

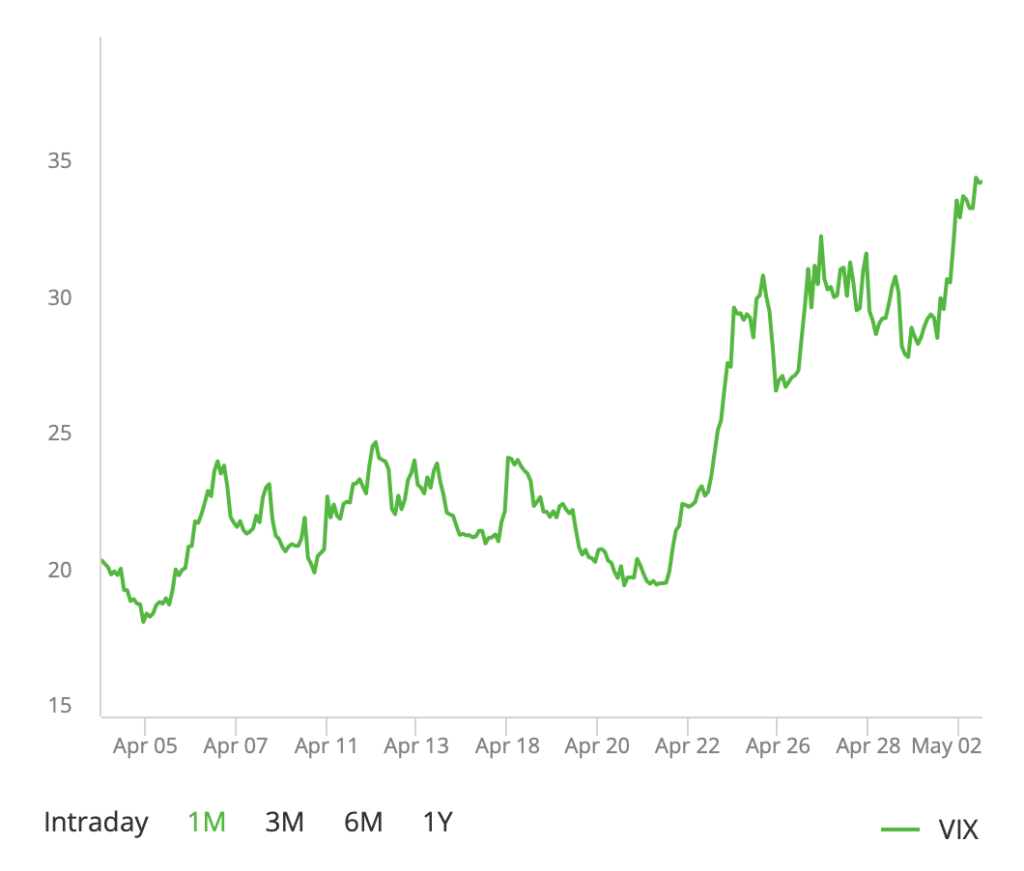

The question is whether or not the IPO window is closed — not only for SPACs, but also traditional IPOs. The VIX, which represents the market’s expectation for volatility over the next month, will be the key indicator to watch. Elevated VIX readings (20 and above) tend to keep initial public offerings from pricing. As of today’s writing, the VIX is at ~35.

VIX: Heading in the wrong direction

Continued uncertainty will likely push new issues out to 2H. The increasing frustration has put pressure on the most anticipated new issues such as Volvo- and Geely-backed Electric Vehicle (EV) maker Polestar / Gores Guggenhein (GGPI), which was expected to be completed in the first half of this year. GGPI shares continue to trade at a discount to other EV pure-plays, despite already-contracted valuation multiples across the board.

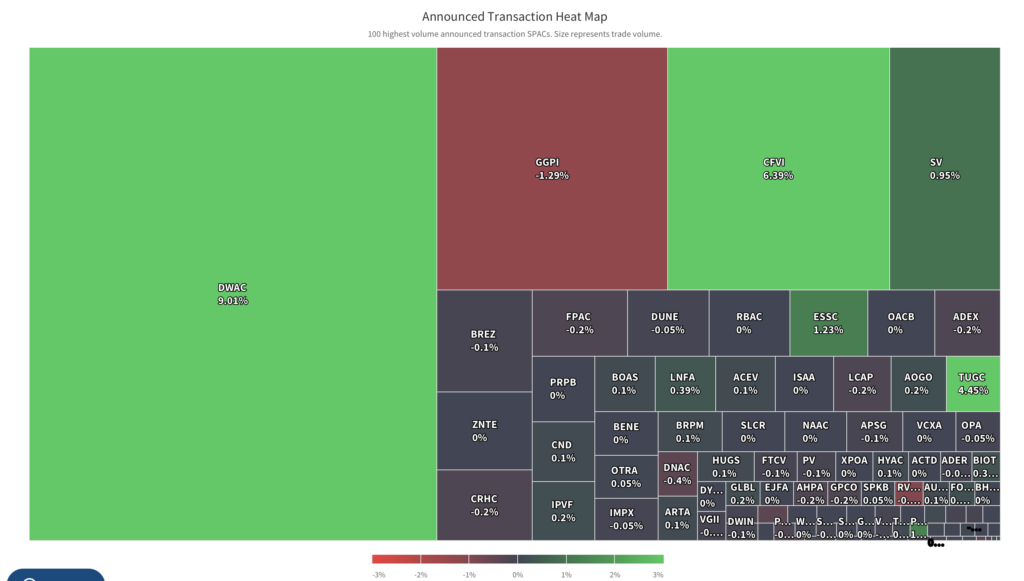

Transaction Heat Map: DWAC (Truth Social) and CFVI (Rumble) are still hot; GGPI (Polestar) is cooling

Key themes to watch

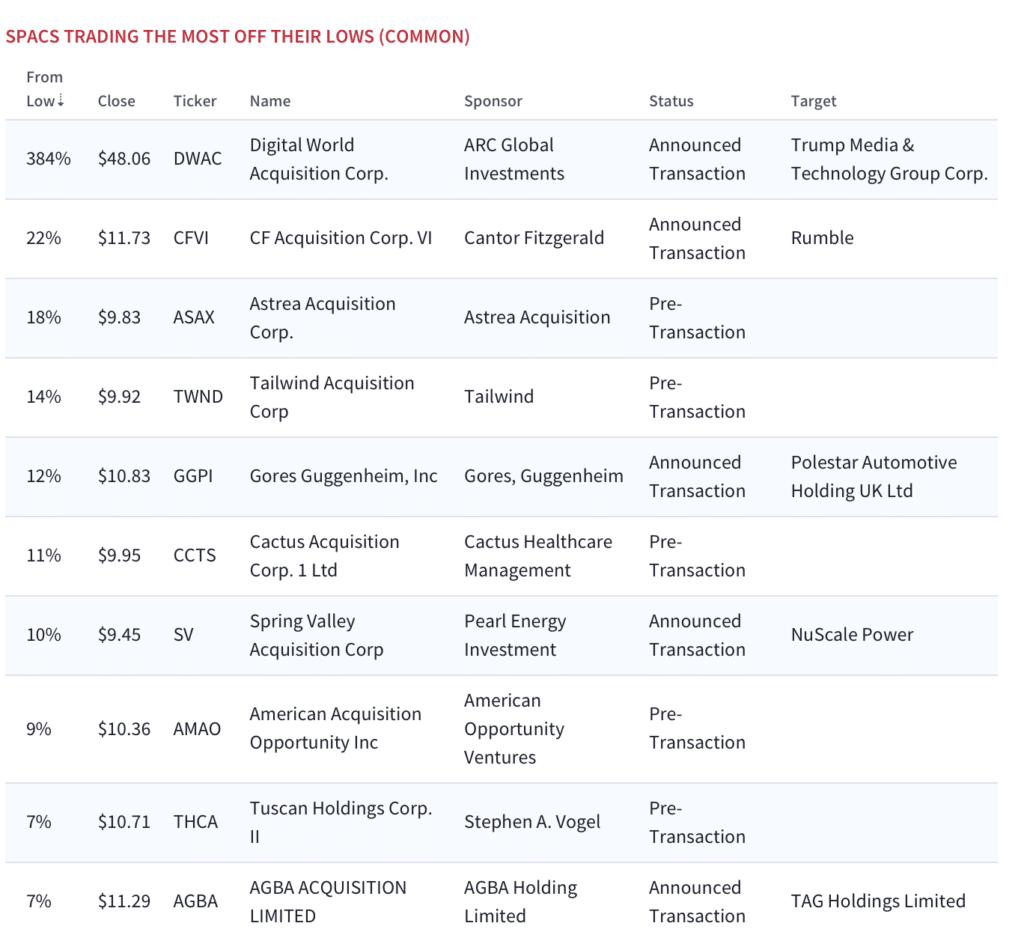

Now that Elon Musk has brought Twitter (TWTR) under his wing, the conversation around free speech has intensified. “Red Nation” investing ideas remain a key theme. Two SPACs with announced transactions that are social media plays on right wing politics are Digital World Acquisition Corp. (DWAC) / Truth Social and CF Acquisition VI (CFVI) / Rumble. DWAC and CFVI are trading up 380% and 22% off their lows, respectively. Donald Trump’s return to the platform after several months’ hiatus has renewed momentum into DWAC stock. See our detailed analysis on DWAC here. Black Rifle Coffee (BRCC) is another idea in this space.

In the ESG arena, we continue to like the bioplastics space as a play on the transition away from fossil fuels. Boardroom Alpha recently chatted with the CEOs of Danimer Scientific (DNMR) and Origin Materials (ORGN) — two early stage growth plays on this theme.

Also in ESG, we are eagerly awaiting the public debut of Voltus, a SPAC merger with Broadscale Acquisition Corp (SCLE). The transaction, which is expected to close 1H 2022, values Voltus at an equity value of $1.3B. Check out our podcasts here:

Who’s Next?

There are still over 600 SPACs looking for a merger target, and they are still largely trading at a discount to NAV at ~$9.90 for the average common pre-deal SPAC.

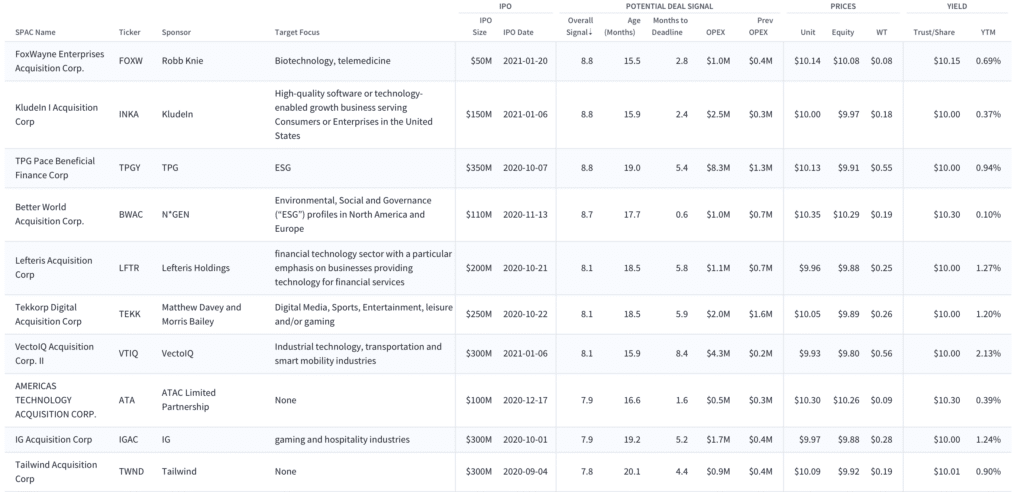

Which SPAC could be the next to announce a deal? Boardroom Alpha’s Potential Deal Screener takes into account several factors including a SPAC’s age, time to deadline and OpEx trends to help predict who might be the next deal. Three SPACs on our tracker score an 8.8 on the overall signal: FoxWaye Enterprises Corp. (FOXW), which has a biotech/ telemedicine focus; Kludeln I Acquisition Corp. (INKA), which has a software / tech focus; and TPG pace Beneficial Finance Corp. (TPGY) in ESG.

Who’s Next? Potential SPAC Deals

SPAC Calendar for May

Merger votes in April include a few high-profile names. Next big merger vote to watch: ACE Convergence Acquisition Corp. (ACEV), which plans to merge with electronics manufacturer Tempo Automation.

Know Who Drives Return Podcast

Boardroom Alpha’s team talks to the public company and SPAC leaders that are driving return for shareholders, delivering on ESG promises, and more.

See all the episodes here and make sure to subscribe using your favorite podcast app so you don’t miss a single episode.