Voltus is gearing up for a $1.3B SPAC IPO in the coming months. We chat with CEO Gregg Dixon, who shares how the company is leading the charge to decentralize, decarbonize and digitize our energy resources.

Our latest podcast gets an up close look at a company that’s at the center of the green energy movement and an interesting name on our radar as a pure-play ESG investment. Boardroom Alpha sat down with Gregg Dixon, CEO of Voltus.

Voltus recently announced it will go public via a SPAC merger with Broadscale Acquisition Corp (SCLE). The transaction, which is expected to close 1H 2022, values Voltus at an equity value of $1.3B.

Broadscale Acquisition Corp. (SCLE) Performance

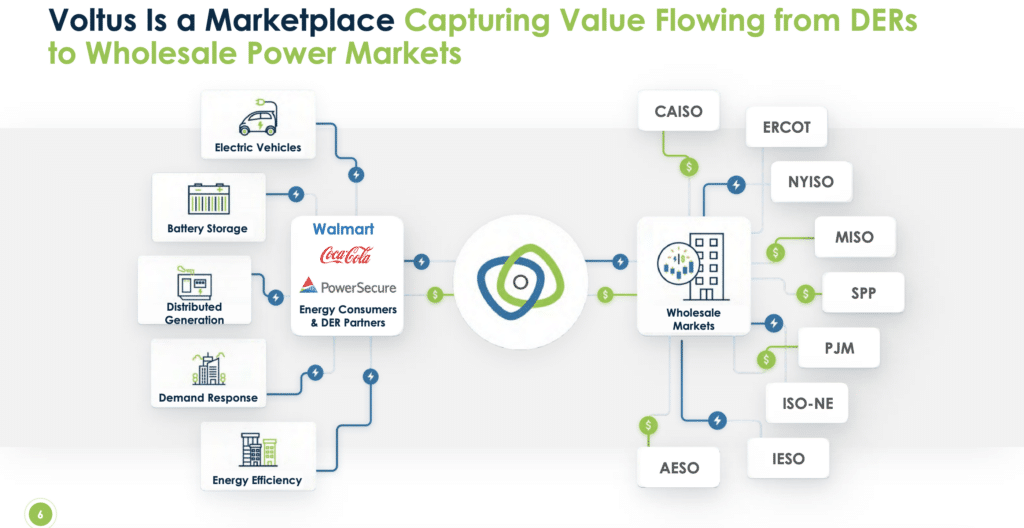

Voltus uses software to manage decentralized electricity systems known as Distributed Energy Resources (DERs) for a list of over 600 customers, including Coca-Cola Co.(COKE) and Home Depot (HD). DERs are essentially anything that consumes, produces or stores electricity and can be connected to a grid. Examples include a company’s electricity demand, demand response, distributed generation (e.g., solar), energy storage, energy efficiency, electric vehicle (EV) batteries, and electric-vehicle charging.

Dixon aptly describes Voltus as the AirBNB of the electricity grid. Voltus partners with grid operators in the U.S. and Canada to connect their DERs to larger markets. The company currently operates one of the largest energy databases in the world, collecting near-real-time information and processing around 2 million daily transactions that reflect changes in DER market positions, prices, registrations, and asset schedules. Put simply, Voltus makes every DER a financial asset, allowing customers to sell their excess electricity back to the grid.

The benefits of decentralizing and digitizing energy resources are two-fold. First, by connecting to Voltus, corporate customers save money while getting more reliable and sustainable electricity. Second, there’s a greater good: increasing adoption of DERs will help reduce our dependence on fossil-fuel-consuming power plants– and in turn, help decarbonize the economy.

For DER asset owners– which include large corporations like Home Depot (HD), Coca-Cola (COKE) and Simon Property Group (SPG)– Voltus helps maximize return on their electricity assets. The company pays customers to connect its tech to their Distributed Energy Resources. At the same time, electricity grids pay Voltus to connect their DERs to the company’s platform.

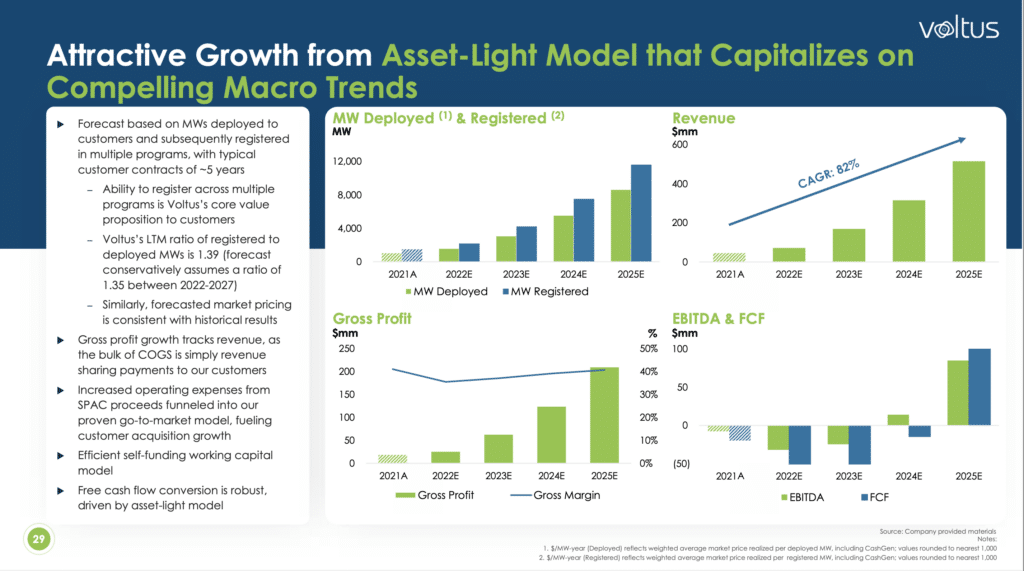

Voltus leverages a software-as-a-service business model, which carries healthy gross margin (~40%), strong customer retention, and importantly, a recurring revenue profile, with an average contract term length of roughly five years. The company is early in the demand curve and growing at a triple digit rate right now, modeling an 82% CAGR from 2021-2025. Voltus generated roughly $42 million in revenue in 2021. By 2023, the company projects that number will grow to over $170 million– supported by a current contracted backlog of approximately $275 million and a current pipeline of approximately $1.3 billion. Also in sharp contrast to most of the emerging growth stories we’ve seen among SPACs, Voltus appears to have a very tangible path to profitability free cash flow. And, Voltus is one of the few green-energy technology companies with an asset-light business model that doesn’t need heavy CAPEX or tangible assets to grow.

Investors looking closely at ESG mandates take note: Voltus is a company deeply committed to diversity and inclusion. Women make up 45% of the company’s leadership team and 38% of the board of directors.

Voltus is coming to the public markets amidst a more challenging macro and increasing scrutiny of SPAC IPOs. That said, we expect the company’s massive addressable market, ESG alignment and unique business model to resonate with growth investors.

Listen to the podcast for more.

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.