Activism Snapshot

The Norfolk Southern vs. Ancora battle continues to get uglier. In the most recent turn, Jeffrey Sonnenfeld and Steven Tian of the Yale School of Management’s Chief Executive Leadership Institute published an article in Fortune that Ancora believes was a “smear piece”. Ancora’s recent DFAN14A filing details what they believe to be issues with misstatements and omissions in the article and supporting presentation and makes available the series of letters from Ancora and their legal team at Cadwalader asking for retractions and corrections.

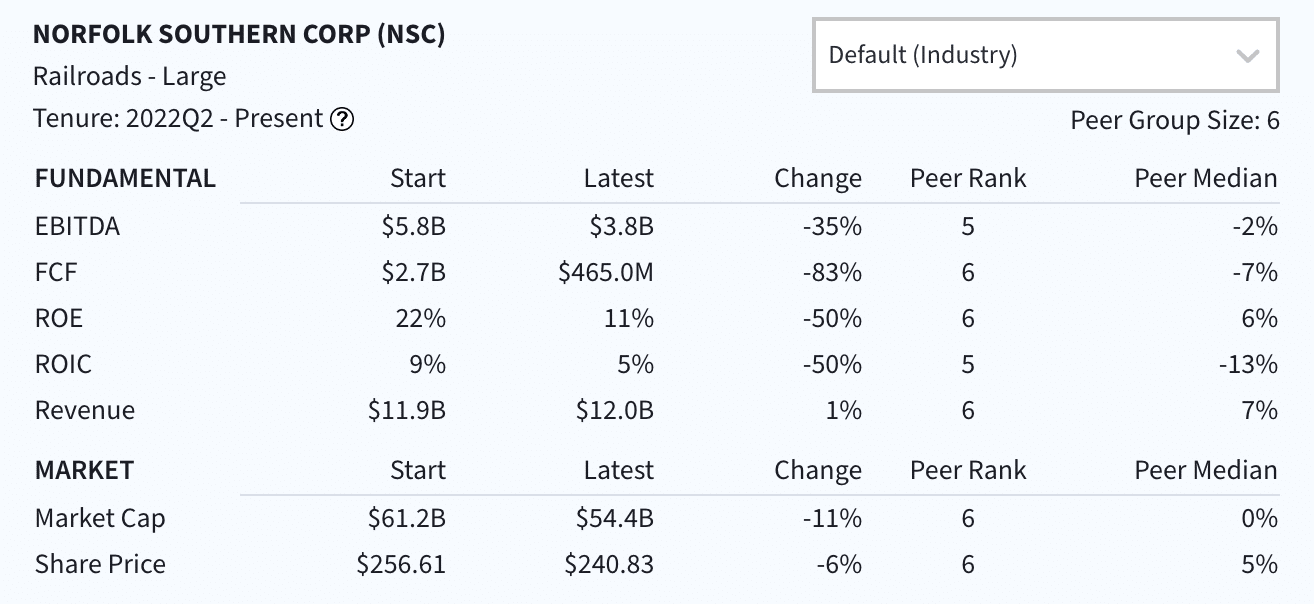

NSC CEO Alan Shaw’s Tenure Lags Peers

Ancora asserts at the end of their second letter that they “…have a history of attacking investors who are running proxy contests against clients of your program’s donors” and wonders if “…Yale is aware of the way you are using their name to advance the agenda of the failing management team of a major American corporation.”

Throughout this proxy season we’ve argued that boards and executives should be held more to account by their shareholders. In this case, a look at some basic metrics over the course of CEO Alan Shaw’s tenure suggests that Ancora (and other concerned investors) may have a case.

Other Activist News

- Orthofix Medical (OFIX) and Engine Capital amended their December 2023 cooperation agreement to allow for Engine to solicit proxies for their nominees (Alan L. Bazaar, Michael M. Finegan or Charles R. Kummeth) in the event that the board believes (in consultation with counsel) that nominating the directors would violate the Board’s fiduciary duties.

- Turtle Beach (HEAR) announced that Donerail Group’s represntative on the board — Michelle D. Wilson — is not standing for reelection. According to their May 2022 cooperation agreement, both the Board and Donerail will collaborate to find a replacement director.

- Still no proxy related filings in the Equity Commonweath (EQC) vs. Land & Buildings impending fight. See Land & Buildings original release here.

- And, nothing new yet in the deSPAC Alight (ALIT) impending fight with Starboard. Starboard owns about 8% of ALIT and intends to nominate Keith D. Dorsey, Matthew C. Levin and Coretha Rushing against the three ALIT class 3 directors that will be standing for election.

Catch up on the latest Activism and Governance research from Boardroom Alpha:

- Despite Shareholders Losing Over 3 Years, CEO Pay is Up at These Companies

- 2024 Say-On-Pay Votes: 25 Companies Where Shareholders Are Unhappy

- Vanguard & Blackrock Should Vote “AGAINST” Directors at These April Shareholder Meetings

- Weekly Activism & Executive Moves Review (April 19)

- Weekly Activism & Executive Moves Review (April 12)

- AGM Update April 3, 2024: Disney (DIS) Proxy Contest, Plus Carnival Corp (CCL), FuelCell Energy (FCEL)

CEO / CFO Moves Snapshot

It’s another week where we see Co-CEOs consolidate to a single CEO. Scott Farquhar, the Atlassian (TEAM) Co-Founder, Co-Chief Executive Officer and director, announced that he will step down from his role as Co-Chief Executive Officer, effective as of August 31, 2024. Mike Cannon-Brookes, the company’s other Co-Founder and Co-Chief Executive Officer will become sole CEO. Arena Group (AREN), down 83% over the past year and plagued with issues (e.g. fake AI-based writers, missed payments to partners) hopes that insider Sara Silverstein is the right person to turn the ship around. Keurig Dr Pepper (KDP) is also looks to jump start things by appointing their COO Timothy Cofer to the CEO role. Prior to yesterday when the news was announced alongside positive earnings, KDP was down approximately -10% over the past year.

Check below for all the week’s other notable CEO and CFO changes.

ACTIVISM UPDATE

LATEST COOPERATION AGREEMENTS

| TARGET | 1-Year TSR | ACTIVIST | SUMMARY | FILING | DATE | STOCK CHANGE | DAYS SINCE |

|---|---|---|---|---|---|---|---|

| FREYR BATTERY INC (FREY) | -78.6% | Teknovekst Invest AS |

|

View Filing | 2024-04-18 | -6.5% | 8 |

| MEREO BIOPHARMA GROUP PLC (MREO) | 170.2% | Rubric Capital Management |

|

View Filing | 2024-04-15 | 5.2% | 11 |

NOTABLE 13D ACTIVIST FILINGS

Quick Link: See last week’s 13D filings update

| FILED | TICKER | COMPANY | FILED BY | OWNERSHIP | 1-Year TSR | SUMMARY | FILING |

|---|---|---|---|---|---|---|---|

| 2024-04-25 | CEAD | CEA INDUSTRIES INC | Tunick Brian | 7.40 | -5.4% | summary | 2024-04-25 – SC 13D |

| 2024-04-22 | VCSA | VACASA INC | DAVIDSON KEMPNER CAPITAL MANAGEMENT LP | 9.43 | -55.3% | summary | 2024-04-22 – SC 13D |

| 2024-04-19 | LEE | LEE ENTERPRISES INC | GAMCO INVESTORS, INC. ET AL | 2.76 | 6.3% | summary | 2024-04-19 – SC 13D |

| 2024-04-19 | TAST | CARROLS RESTAURANT GROUP INC | GAMCO INVESTORS, INC. ET AL | 3.27 | 150.9% | summary | 2024-04-19 – SC 13D |

| 2024-04-19 | VAC | MARRIOTT VACATIONS WORLDWIDE CORP | Impactive Capital LP | 7.40 | -25.5% | summary | 2024-04-19 – SC 13D |

2024 PROXY CONTEST RESULTS

| TICKER | COMPANY | ACTIVIST | MEETING DATE | SUMMARY |

|---|---|---|---|---|

| SCOR | COMSCORE INC | 180 Degree Capital | N/A | RESULT SUMMARY

|

| M | MACY’S INC | Arkhouse Management | May 17, 2024 | RESULT SUMMARY

FIGHT SUMMARY

|

| DIS | WALT DISNEY CO | Trian / Nelson Peltz Blackwell’s |

April 3, 2024 | RESULT SUMMARY: DISNEY / IGER PREVAIL

Proxy Contest Summary Notes

|

| ELAN | ELANCO ANIMAL HEALTH INC | Ancora | N/A | RESULT

Proxy Fight Summary

|

| MRC | MRC GLOBAL INC | ENGINE CAPITAL | N/A | RESULT

Proxy Fight Summary

|

| SBUX | STARBUCKS CORP | Strategic Organizing Center (SOC) | March 15, 2024 | Vote Results – MARCH 15, 2024

Proxy Fight Summary

|

| WH | WYNDHAM HOTELS & RESORTS INC | CHOICE HOTELS INTERNATIONAL INC | N/A | RESULT

March 11, 2024 — Choice abandons it’s takeover effort and proxy contest BACKGROUND

|

LATEST PROXY CONTEST FILINGS

| TICKER | COMPANY | LATEST PROXY | SUMMARY | FILED BY | FILINGS |

|---|---|---|---|---|---|

| AHT | ASHFORD HOSPITALITY TRUST INC | 2024-04-09 – PREC14A |

|

Blackwells Capital LLC | 2024-04-09 – PREC14A |

| BHR | BRAEMAR HOTELS & RESORTS INC | 2024-04-11 – PREC14A |

|

BRAEMAR HOTELS & RESORTS INC | 2024-04-23 – DEFA14A 2024-04-11 – DEFA14A 2024-04-11 – DEFA14A 2024-04-11 – PREC14A 2024-04-02 – PREC14A |

| Blackwells Capital LLC | 2024-04-15 – DFAN14A 2024-04-12 – DFAN14A 2024-04-10 – DFAN14A 2024-04-10 – DFAN14A |

||||

| CCI | CROWN CASTLE INC | 2024-04-11 – DEFC14A |

|

CROWN CASTLE INC | 2024-04-25 – DEFA14A 2024-04-24 – DEFA14A 2024-04-22 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A 2024-04-15 – DEFA14A 2024-04-15 – DEFA14A |

| Boots Parallel 1, LP | 2024-04-23 – DFAN14A 2024-04-22 – DFAN14A 2024-04-22 – DFAN14A 2024-04-22 – DFAN14A 2024-04-19 – PRRN14A 2024-04-16 – PRRN14A 2024-04-16 – DFAN14A |

||||

| EAF | GRAFTECH INTERNATIONAL LTD | 2024-04-02 – DEFC14A |

|

GRAFTECH INTERNATIONAL LTD | 2024-04-18 – DEFA14A 2024-04-17 – DEFA14A |

| Undavia Nilesh | 2024-04-23 – DFAN14A 2024-04-22 – DFAN14A 2024-04-15 – DFAN14A |

||||

| GNK | GENCO SHIPPING & TRADING LTD | 2024-04-17 – DEFC14A |

|

GENCO SHIPPING & TRADING LTD | 2024-04-24 – DEFA14A 2024-04-22 – DEFA14A 2024-04-18 – DEFA14A 2024-04-17 – DEFA14A 2024-04-16 – DEFC14A 2024-04-16 – DEFA14A |

| GK Investor LLC | 2024-04-18 – DFAN14A 2024-04-17 – DEFC14A 2024-04-15 – PRRN14A 2024-04-08 – PREC14A |

||||

| HCC | WARRIOR MET COAL INC | 2024-03-14 – DEFC14A |

|

WARRIOR MET COAL INC | 2024-04-15 – DFAN14A 2024-04-11 – DEFA14A 2024-04-11 – DEFA14A |

| American Federation of Labor Congress of Industrial Organizations | 2024-04-15 – DFAN14A 2024-03-26 – DFAN14A2024-03-18 – PRRN14A |

||||

| MASI | MASIMO CORP | 2023-05-24 – DEFC14A |

|

MASIMO CORP | 2024-04-15 – DFAN14A 2024-04-02 – DEFA14A 2024-04-01 – DEFA14A |

| Politan Capital Management LP | 2024-03-25 – DFAN14A | ||||

| MFIN | MEDALLION FINANCIAL CORP | 2024-04-18 – PREC14A |

|

MEDALLION FINANCIAL CORP | 2024-04-18 – PREC14A |

| ZimCal Asset Management, LLC | 2024-04-18 – PREC14A 2024-04-12 – DFAN14A 2024-04-11 – DFAN14A 2024-04-10 – PREC14A |

||||

| NSC | NORFOLK SOUTHERN CORP | 2024-03-26 – DEFC14A |

Activist / Ancora Summary

|

NORFOLK SOUTHERN CORP | 2024-04-25 – DEFA14A 2024-04-25 – DEFA14A 2024-04-23 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A 2024-04-19 – DEFA14A |

| Ancora | 2024-04-25 – DFAN14A 2024-04-24 – DFAN14A 2024-04-22 – DFAN14A 2024-04-22 – DFAN14A 2024-04-19 – DFAN14A 2024-04-15 – DFAN14A |

||||

| SBOW | SILVERBOW RESOURCES INC | 2024-04-10 – DEFC14A |

|

SILVERBOW RESOURCES INC | 2024-04-22 – DEFA14A 2024-04-10 – DEFA14A 2024-04-09 – DEFC14A 2024-04-09 – DEFA14A |

| Kimmeridge Energy Management Company, LLC | 2024-04-16 – DFAN14A 2024-04-11 – DFAN14A 2024-04-11 – DFAN14A 2024-04-10 – DEFC14A 2024-04-09 – PRRN14A |

||||

| SPRU | SPRUCE POWER HOLDING CORP | 2024-04-17 – PREC14A |

|

Clayton Partners LLC | 2024-04-18 – DFAN14A 2024-04-17 – PREC14A |

| WSR | WHITESTONE REIT | 2024-04-05 – DEFC14A |

|

Erez REIT Opportunities LP | 2024-04-24 – DEFA14A 2024-04-24 – DEFA14A 2024-04-05 – DEFA14A 2024-04-04 – DEFC14A 2024-04-02 – PRRN14A 2024-03-19 – PREC14A |

| WHITESTONE REIT | 2024-04-23 – DFAN14A 2024-04-22 – DFAN14A 2024-04-22 – DFAN14A 2024-04-09 – DFAN14A 2024-04-05 – DEFC14A 2024-04-02 – PRRN14A |

||||

| WT | WISDOMTREE INC | 2024-04-19 – PREC14A |

|

WISDOMTREE INC | 2024-04-19 – PREC14A |

| ETFS Capital Limited. | 2024-04-18 – DFAN14A 2024-04-17 – PREC14A |

||||

| XPER | XPERI INC | 2024-04-17 – DEFC14A |

|

Rubric Capital Management LP | 2024-04-17 – DFAN14A 2024-04-17 – DEFC14A |

| XPERI INC | 2024-04-17 – DEFC14A 2024-04-17 – DEFA14A |

CEO & CFO MOVES

| COMPANY | MARKET CAP / TSR | ROLE | LEAVING | JOINING | JOINER BIOGRAPHY |

|---|---|---|---|---|---|

| 374WATER INC (SCWO) | Mkt Cap: $181.8M 1-Yr TSR: -52.8% |

CEO | Jeffrey Mark Quick .6 yrs *interim; ; -26.5% TSR |

Chris M Gannon | Gannon brings extensive experience in scaling companies and deep expertise in capital markets and engineering. As the former President and CEO of Energy Recovery, Inc. (NASDAQ: ERII), he spearheaded the company’s rapid growth in the core water business and its expansion into the wastewater and refrigeration markets. His leadership saw a quadruple increase in market capitalization and a tripl…read full bio |

| ALTERNUS CLEAN ENERGY INC (ALCE) | Mkt Cap: $26.4M 1-Yr TSR: -96.8% |

CFO | Joseph Emil Duey .3 yrs |

Vincent Browne (interim) |

Vincent Browne, Chairman and Chief Executive Officer Vincent Browne is our Chairman and Chief Executive Officer. Mr. Brown brings a wealth of experience with his extensive background of over 20 years in senior and c-suite level management in the areas of finance and operations, including M&A, project finance and capital market transactions across listed and private companies. From 2017 to present…read full bio |

| ARENA GROUP HOLDINGS INC (AREN) | Mkt Cap: $21.7M 1-Yr TSR: -83.2% |

CEO | Cavitt Randall .2 yrs |

Sara Silverstein | Ms. Silverstein previously served as General Manager – Finance Arena of the Company since November 2021. Prior to that, she was Executive Editor at Business Insider from 2013 to 2020. Ms. Silverstein started her career at a hedge fund and has been working in the media industry for the past 14 years, including other positions with Bloomberg Media. Ms. Silverstein has a bachelor’s …read full bio |

| ATLASSIAN CORP (TEAM) | Mkt Cap: $51.5B 1-Yr TSR: 28.2% |

CEO | Scott Farquhar 1.9 yrs |

Consolidating to single CEO | Mike Cannon-Brookes, the company’s other Co-Founder and Co-Chief Executive Officer will become sole CEO. |

| BEACON ROOFING SUPPLY INC (BECN) | Mkt Cap: $6.2B 1-Yr TSR: 62.4% |

CFO | Carmelo Carrubba .3 yrs *interim; |

Prithvi Gandhi | Mr. Gandhi has served as the Vice President of Finance and Chief Financial Officer of TAMKO Building Products LLC, a national building products manufacturer and supplier, since August 2022. Mr. Gandhi previously served as the Chief Financial Officer of Fast Radius, Inc. (previously NASDAQ: FSRD), a cloud manufacturing and digital supply chain company, from August 2021 to July 2022. Prior to joinin…read full bio |

| CNH INDUSTRIAL NV (CNHI) | Mkt Cap: $18.5B 1-Yr TSR: -19.4% |

CEO | Scott W Wine 3.5 yrs ; 8.1% TSR |

Gerrit A Marx | Gerrit Marx has more than 20 years of experience in roles of increasing importance in different locations around the world and in a variety of industrial segments, with a specific in-depth focus on automotive industries. He holds a degree in Mechanical Engineering (“Diplom Ingenieur”) and an MBA (“Diplom Kaufmann”) from RWTH Aachen University, and a Doctorate in B…read full bio |

| DAVE & BUSTER’S ENTERTAINMENT INC (PLAY) | Mkt Cap: $2.1B 1-Yr TSR: 51.4% |

CFO | Michael Quartieri 2.4 yrs ; 24.3% TSR |

Darin E. Harper | Mr. Harper previously served as CFO of World Choice Investments, LLC, a leading operator of large, themed family entertainment attractions from May 2023 to present. He was previously with the Company from June 2022 through December 2022 in an executive role following the acquisition of Main Event Entertainment, Inc. (“Main Event”) by the Company in June 2022. Prior to that, he was EVP, Chief Finan…read full bio |

| FORWARD AIR CORP (FWRD) | Mkt Cap: $607.6M 1-Yr TSR: -78.9% |

CEO | Michael L Hance .2 yrs *interim; |

Shawn Stewart | Mr. Stewart, age 50, previously served as President and Managing Director, North America at CEVA Logistics, a global end-to-end logistics company, from April 2020 to March 2024. Prior to being named President and Managing Director, North America, Mr. Stewart held numerous leadership positions of increasing responsibility at CEVA Logistics since joining its predecessor, EGL, Inc., in 1995, includin…read full bio |

| INSULET CORP (PODD) | Mkt Cap: $11.5B 1-Yr TSR: -48.5% |

CFO | Lauren Budden .5 yrs *interim; ; -2.3% TSR |

Ana Maria Chadwick | Ms. Chadwick, 52, has served as Executive Vice President and CFO of Pitney Bowes Inc. since January 2021. From 2001 to 2021, she served in a variety of leadership positions at GE Capital. Most recently, from 2019 to 2021, Ms. Chadwick was President and CEO of GE Capital Global Legacy Solutions, where, from 2016 to 2019, she served as CFO and Chief Operating Officer. From 2014 to 2016, she was Cont…read full bio |

| KEURIG DR PEPPER INC (KDP) | Mkt Cap: $45.9B 1-Yr TSR: -3.0% |

CEO | Robert James Gamgort 1.4 yrs ; -10.6% TSR |

Timothy P Cofer | Mr. Cofer, 55, joined the Company in November 2023 as Chief Operating Officer. Before joining the Company, he served as the Chief Executive Officer of Central Garden & Pet, a public company in the pet and garden industries. Previously, he served as the Executive Vice President and Chief Growth Officer of Mondelēz International from 2016 to 2019, where he led the company’s consumer- and c…read full bio |

| MANNKIND CORP (MNKD) | Mkt Cap: $1.1B 1-Yr TSR: 5.6% |

CFO | Steven B Binder 6.8 yrs ; 16.5% TSR |

Christopher B Prentiss | Christopher Prentiss has been appointed as our Chief Financial Officer, effective April 22, 2024. Since September 2022, Mr. Prentiss served as Chief Financial Officer of ADARx Pharmaceuticals, Inc., a privately held clinical-stage biotechnology company. Between April 2015 and November 2021, he held a series of finance positions of increasing responsibility at the commercial-stage biotech company A…read full bio |

| NORDSON CORP (NDSN) | Mkt Cap: $14.9B 1-Yr TSR: 20.3% |

CFO | Stephen F Shamrock .5 yrs *interim; ; 22.3% TSR |

Daniel Roy Hopgood | Since 2012, Mr. Hopgood has had roles of increasing responsibility at Eaton Corporation (NYSE: ETN), a multinational power management company. Since 2021, he served as Eaton’s controller and chief accounting officer where he led the global accounting and reporting, as well as developing and executing Eaton’s global financial strategy. From 2017-2021, he served as senior vice president,…read full bio |

| TACTILE SYSTEMS TECHNOLOGY INC (TCMD) | Mkt Cap: $336.8M 1-Yr TSR: -21.3% |

CEO | Daniel L Reuvers 4.0 yrs ; -26.3% TSR |

Sheri Louise Dodd | Sheri Dodd Age: 55 Tactile Director Since: January 2021 Committees: * Compensation and Organization Committee * Nominating and Corporate Governance Committee Ms. Dodd currently serves as Vice President and General Manager at Medtronic plc, leading the Medtronic Care Management Services’ remote patient monitoring business. She joined Medtronic in March 2010 and has served in Vice President positi…read full bio |

| VELO3D INC (VLD) | Mkt Cap: $61.0M 1-Yr TSR: -89.4% |

CFO | Bernard Chung .6 yrs ; -77.3% TSR |

Mr. Hull Xu | Mr. Xu, age 50, served as Chief Financial Officer at Cepton, Inc., a provider of lidar-based solutions for automotive and other applications (“Cepton”), from April 2022 to January 2024, and VP of Finance and Strategy at Cepton Technologies, Inc., Cepton’s predecessor, from January 2021 to April 2022. Prior to Cepton, Mr. Xu served as a director at RBC Capital Markets, LLC f…read full bio |