Maybe it’s the dog days of summer, or a continuation of the weaker equity market, but times are slow in SPACs. Aside from the barrage of extensions (see calendar) and occasional DA, market activity is very slow. There hasn’t been a SPAC IPO since June, and we’re only hearing of a handful in the pipeline.

While there have been a few DAs, the old excitement (volume, chatter) is missing. Can always chalk it up to “nobody’s in their seats” though, it feels more sentiment based. That being said, all is not dead and activity still creeps about. So, stay tuned. We rundown the (slow) news day.

Elsewhere in SPACs

- ArcLight Clean Transition Corp. II (ACTD) and OPAL Fuels closed their SPAC deal with shares set to trade as OPAL tomorrow

- The second (though first named) of Chamath’s Social Capital Suvretta Line, DNAA, filed its definitive proxy for the Akili Interative deal, and the vote is set for 8/18

- Last night, Larkspur Health Acquisition Corp. (LSPR) officially announced a tie-up with Zyversa Therapeutics at a $109M EV

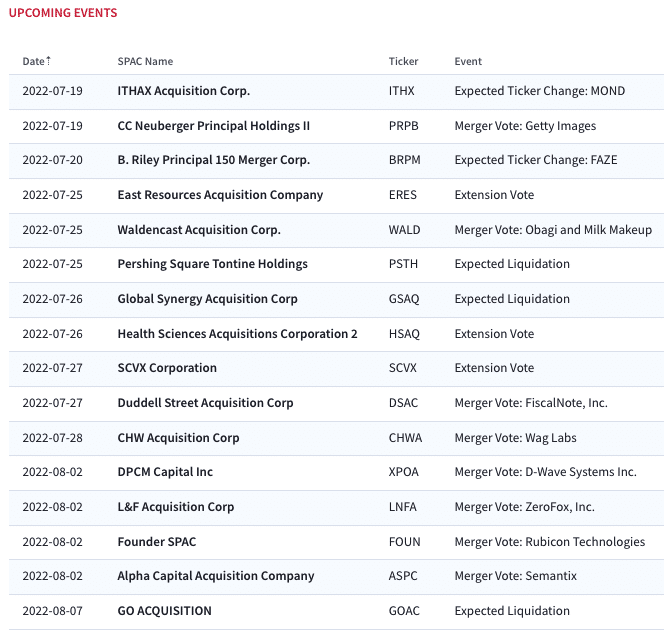

Upcoming SPAC Calendar

Full calendar and SPAC database access here

Today’s Price Action

Biggest Gainers

8.06% ~ $ 32.58 | DWAC – Digital World Acquisition Corp. (Announced)

3.13% ~ $ 8.57 | PRPB – CC Neuberger Principal Holdings II (Announced)

2.06% ~ $ 9.90 | NLIT – Northern Lights Acquisition Corp. (Announced)

.62% ~ $ 9.73 | HWEL – Healthwell Acquisition Corp. I (Pre-Deal)

.61% ~ $ 9.86 | NHIC – NewHold Investment Corp. II (Pre-Deal)

.61% ~ $ 9.91 | VBOC – Viscogliosi Brothers Acquisition Corp (Pre-Deal)

.60% ~ $ 10.07 | UPTD – TradeUP Acquisition Corp (Pre-Deal)

.60% ~ $ 10.09 | CFVI – CF Acquisition Corp. VI (Announced)

.56% ~ $ 9.93 | LCW – Learn CW Investment Corp (Pre-Deal)

.51% ~ $ 9.87 | CPTK – Crown PropTech Acquisitions (Announced)

.51% ~ $ 9.87 | FSRX – FinServ Acquisition Corp. II (Pre-Deal)

.50% ~ $ 10.03 | HCMA – HCM Acquisition Corp (Pre-Deal)

.46% ~ $ 9.80 | EGGF – EG Acquisition Corp. (Pre-Deal)

.45% ~ $ 10.01 | LGVC – LAMF Global Ventures Corp. I (Pre-Deal)

.41% ~ $ 9.70 | IPAX – Inflection Point Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.82 | BRIV – B. Riley Principal 250 Merger Corp. (Pre-Deal)

.41% ~ $ 9.82 | NDAC – NightDragon Acquisition Corp (Pre-Deal)

.41% ~ $ 9.84 | ANZU – Anzu Special Acquisition Corp I (Pre-Deal)

.41% ~ $ 9.89 | RJAC – Jackson Acquisition Co (Pre-Deal)

.41% ~ $ 9.89 | PEPL – PepperLime Health Acquisition Corp (Pre-Deal)

Biggest Losers

-10.29% ~ $ 8.98 | WALD – Waldencast Acquisition Corp. (Announced)

-2.78% ~ $ 10.14 | CLAY – Chavant Capital Acquisition Corp. (Pre-Deal)

-1.14% ~ $ 10.37 | FOXW – FoxWayne Enterprises Acquisition Corp. (Pre-Deal)

-.89% ~ $ 10.01 | LJAQ – LIGHTJUMP ACQUISITION CORPORATION (Announced)

-.80% ~ $ 9.92 | GWII – Good Works II Acquisition Corp. (Pre-Deal)

-.78% ~ $ 10.14 | VTAQ – Ventoux CCM Acquisition Corp. (Announced)

-.41% ~ $ 9.66 | TRTL – TortoiseEcofin Acquisition Corp. III (Pre-Deal)

-.41% ~ $ 9.72 | DUNE – Dune Acquisition Corporation (Announced)

-.40% ~ $ 10.00 | SPK – SPK Acquisition Corp. (Announced)

-.38% ~ $ 10.35 | ATA – AMERICAS TECHNOLOGY ACQUISITION CORP. (Announced)

-.31% ~ $ 9.75 | FWAC – Fifth Wall Acquisition Corp. III (Pre-Deal)

-.31% ~ $ 9.78 | TSPQ – TCW Special Purpose Acquisition Corp (Pre-Deal)

-.31% ~ $ 9.78 | GAQ – Generation Asia I Acquisition Ltd (Pre-Deal)

-.30% ~ $ 9.85 | MCAC – Monterey Capital Acquisition Corp (Pre-Deal)

-.30% ~ $ 9.86 | RFAC – RF Acquisition Corp. (Pre-Deal)

-.30% ~ $ 9.90 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

-.30% ~ $ 9.96 | ALSA – Alpha Star Acquisition Corp (Pre-Deal)

-.30% ~ $ 9.97 | GOBI – Gobi Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.01 | CND – Concord Acquisition Corp (Announced)

-.25% ~ $ 10.03 | SHAP – Spree Acquisition Corp. 1 Ltd (Pre-Deal)