SPAC market sentiment remains low as maturity wall looms

SPAC land in June predominantly saw a continuation of the market activity we have witnessed over the last few months. Namely, a decline in deals, IPOs, participants, prices (pre- and post-deSPAC) while there was a rise in liquidations, deal terminations, and overall pain.

State of the world: there remain 590 SPACs seeking a target and 120+ trying to get their deals over the finish line. We’ve said it before, but activity needs to ramp up in a big way if sponsors are going to avoid over $180B in SPAC liquidations over the the next 12-18 months.

June saw many investors, sponsors, and banks distance themselves from SPACs. Whether it was PIMCO selling off its at risk capital in Freedom Acquisition I Corp. (FACT) to China Bridge, or Lionheart (of MSP infamy) withdrawing a planned SPAC IPO, increasingly previous SPAC market participants are saying “no thank you” in this current environment.

As for Freedom, Jamie Weinstein (PIMCO head of special situations) resigned from its board, and the SPAC subsequently announced a deal later in the month with human genome sequencing company Human Longevity. The market beat goes on… or does it?

Two additional SPACs threw in the towel and liquidated in June – Trepont Acquisition Corp. I (TACA) and Omnichannel Acquisition Corp (OCA) – with GO Acquisition (GOAC) announcing that they too are going to liquidate in August. And, in what may be a first, it appears as if Gobi Acquisition Corp. (GOBI) might be preparing for an early liquidation after filing a preliminary proxy earlier this month.

Deal Announcements and Terminations

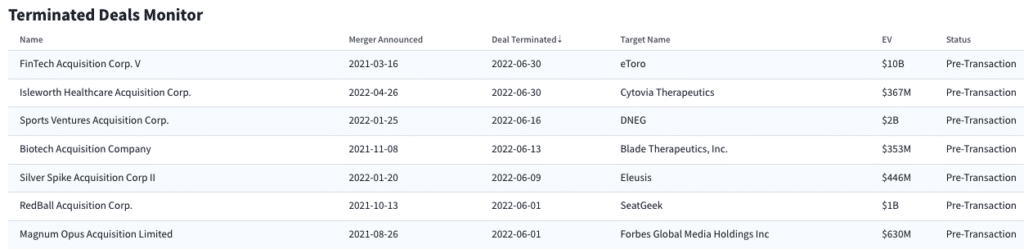

Another 7 deals were called off in June, most often due to “unfavorable market conditions.” Gerry Cardinale and Billy Beane’s RedBall Acquisition Corp (RBAC) calling off its SeatGeek deal and Magnum Opus Acquisition Limited (OPA) nixing plans to take Forbes public were among the most high profile deal terminations in June. Both of those deals, announced much earlier in 2021, were thought to be on track to close. Many will be concerned to see a continued pace of cancelled deals, however, on the bright side, five terminated deals is fewer than the number of SPACs, nine, that made it across the finish line.

7 SPAC deals were terminated in June

New definitive agreement activity remains the biggest concern for the 590 SPACs searching for targets. Just 10 new pacts were announced in June, down almost 50% MoM from May. There are over 130 SPACs searching for targets that are set to expire by the end of January and that skyrockets to > 300 that currently expire by the end of March 2023. At the current pace of deal activity, the market should expect a wave of liquidations that will greatly exceed market participants’ original expectation.

Bill Ackman’s Pershing Square Tontine Holdings (PSTH) has only a few weeks left, the aforementioned Redball Acquisition Corp (RBAC) has until August, and Chamath Palihapitiya’s Social Capital Hedosophia Holdings Corp IV & VI (IPOD & IPOF) are also on the clock with just about 3 months left until their deadlines in October. Of course many SPACs will seek extensions – there have been over 30 such votes already this year and another 7 already on the schedule for July.

The majority of extensions are seeking ~3-6 months of extra time and adding ~$0.10 per share to the trust if the SPAC sponsor is feeling generous. However, if you really want to step it up, go the Dune Acquisition Corp (DUNE) route and enact an 18-month extension to December 2023 with $0 added to trust to compensate shareholders. Unsurprisingly, 93% of shareholders elected to redeem leaving just $8.4M in the $175M SPAC’s trust account. DUNE and its target company TradeZero continue to sue each other, so be sure to keep an eye on that ever developing situation.

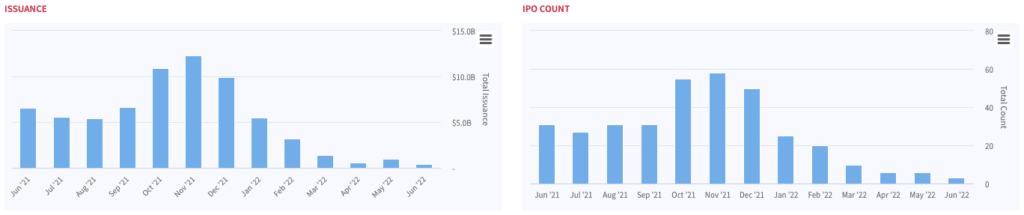

SPAC IPOs, So 2021

The SPAC IPO market has fallen off a cliff in 2022, with very little issuance on both total volume and number of IPOs vs. the last two years. We saw just 3 SPAC IPOs in June for a total of $384M in issuance which are by far the lowest months we’ve seen in the last two years. By contrast June 2021 saw over 30 IPOs for nearly $6.5B in SPAC capital. The drop off in issuance can be attributed to a variety of factors which have overall contributed to the downturn in the SPAC market, namely: poor DeSPAC performance, oversupply of outstanding SPACs, major banks turning away from the capital markets, and increased threat of SPAC regulation from the SEC.

We wouldn’t expect SPAC IPO activity to tick up any time soon. Perhaps in 2023 when the market begins to really clear out will the primary market tick up once again.

All that being said, SPAC IPOs are not alone, as the traditional IPO market has also cooled off in terms of both performance and issuance as well.

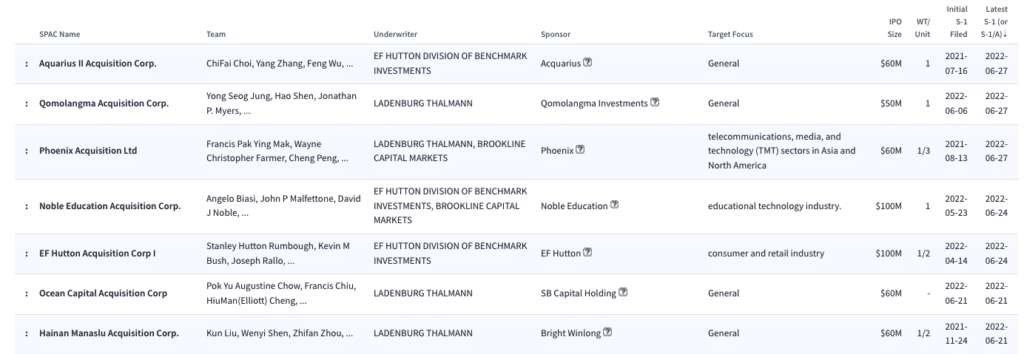

And while GS and JPM may have taken a back seat for now, the boutiques are up and running working on SPAC IPOs. We continue to see new S-1s and amendments coming thru the pipeline.

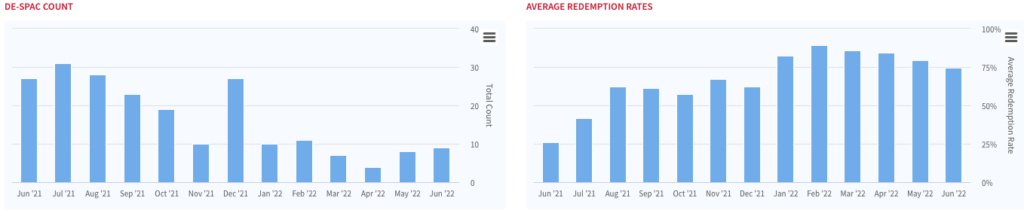

A Check in on DeSPACs

There were just 9 SPACs to officially DeSPAC in June. While it’s a tick up from the dreadfully slow months of March-May, it is well below the 27 that completed in June 2021. With SEC reviews taking much longer and skyrocketing redemptions creating financing holes, deals are taking longer to close. Redemption rates, while down, are still averaging ~75% of SPAC trusts. This dynamic is causing SPACs and sponsors to seek backstop agreements, forward purchase agreements, or other forms of financing to plug funding holes. The dip in average redemptions can be attributed to the financing factors just mentioned, and GGPI / Polestar standing out from the crowd.

At long last Gores Guggenheim (GGPI) and EV maker Polestar (PSNY) closed their SPAC transaction. It had been one of the more anticipated DeSPACs in recent memory, and has stood out as an outlier in an otherwise poor SPAC market. GGPI saw just 20% redemptions at its merger vote, and PSNY shares are holding up nicely since ticker change, trading > $10. By contrast just 2 other DeSPACs out of 17 since May are trading above $10, those being Symbotic (SYM) and NuScale Power (SMR).

So, Who’s Next?

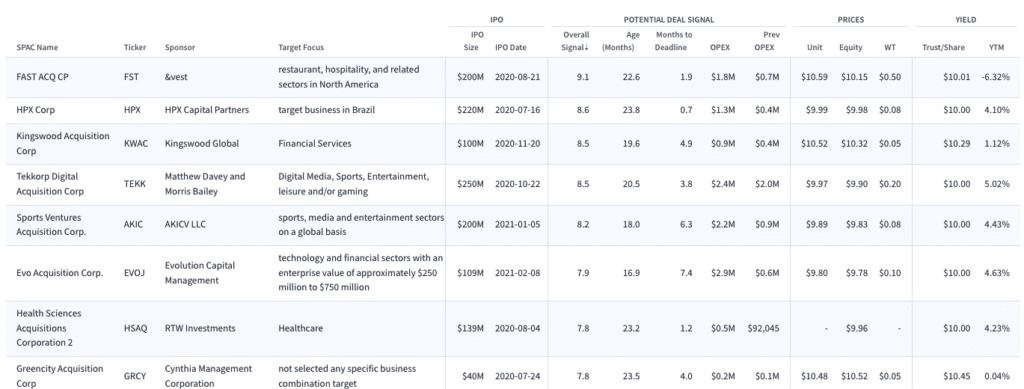

Boardroom Alpha’s potential deal screener takes a look at which SPAC might be next to announce a definitive agreement. While equity prices haven’t been moving much recently on DA’s, warrants have the potential to move a lot. Of course a much riskier trade, but the average pre-deal warrant is trading at 15c! Incredible value for a SPAC that ultimately finds a target.

Playing for Yield

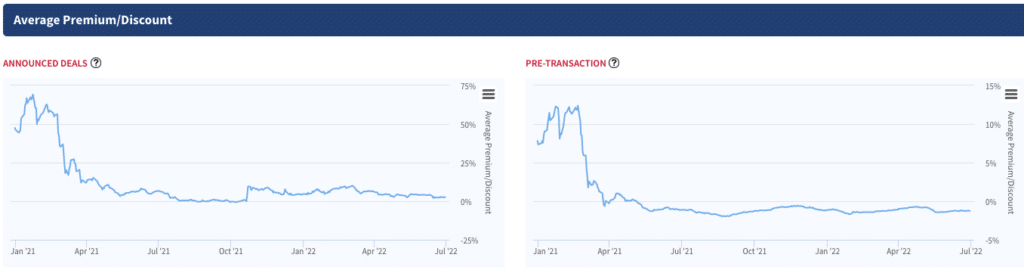

SPACs are trading at the largest discount to NAV than ever before, resulting in free yield to be had from investing in pre-deal SPACs at steep discounts. With maturities upcoming and liquidations on the rise, yield-focused investors are finding incredible value with SPACs and the potential for upside surprises.

SPACs with announced deals are trading at a very small premium but that’s mostly due to Digital World Acquisition Corp (DWAC) the so-called “Trump SPAC” that is looking to take TMTG (Truth Social) public. DWAC shares are way down from their peak last fall and have been in the ~$25 range. Earlier this week they got hit with more subpoenas and now the deal looks increasingly unlikely to close.

What’s Next?

Unless we see broad recovery in equities (and perhaps a recession avoidance) we wouldn’t expect a dramatic shift in sentiment in SPACs. Unfortunately that likely results in more canceled deals and liquidations in the immediate term. In the longer term the outlook for the market is uncertain as the irrational exuberance of SPAC market participants combined with the macro/overall market decline have brought SPACs to the brink.