On March 3, 2025, Daktronics, Inc. (NASDAQ: DAKT) entered into a Cooperation Agreement with Alta Fox Capital Management. As part of the agreement, Daktronics will expand its Board and appoint a new director, while Alta Fox will support DAKT’s reincorporation efforts and agree to certain voting and standstill provisions. Both parties will also dismiss legal claims and abide by non-disparagement terms.

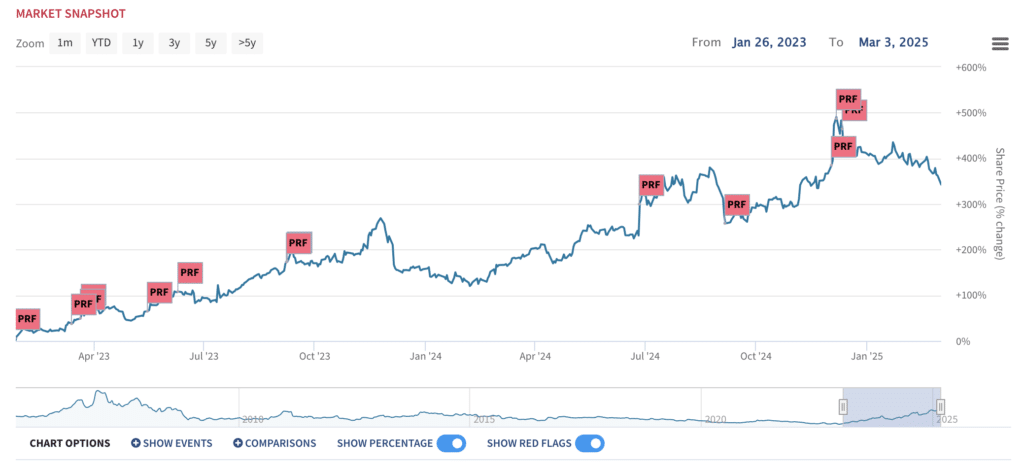

Daktronics is on a big run since Alta Fox first became involved with its initial 13D filing on January 2023 and Conor Haley and team noted their disappointment in the board’s governance and strategy. In March 2023 the firms entered into an initial cooperation agreement. DAKT shareholders will likely be glad to see their continued focus and push on the board and management.

Under the new agreement, Daktronics will increase the Board’s size and appoint Peter Feigin as a director with a term expiring in 2027, also placing him on the Transformation Committee. The DAKT has committed to governance changes, including requiring a Lead Independent Director if the Chairperson is not independent, hiring an independent compensation consultant by March 31, 2025, and holding an investor day before year-end. Additionally, at least one incumbent director will not be re-nominated at the 2025 annual meeting. Daktronics will also amend its Rights Agreement to accelerate its expiration.

Peter Feigin is an interesting choice given he has no public company board experience, but he is an operator at the highest level in the sports world. He currently serves as President of the 2021 NBA champion Milwaukee Bucks and has a background in sports and event marketing and operations.

In return, Alta Fox will cease its solicitation efforts related to the Daktronics’ reincorporation vote and support the move to Delaware. During the standstill period (until after the 2027 annual meeting), it will generally vote in line with the Board’s recommendations, except in specific cases where ISS and Glass Lewis both take a contrary stance or on Extraordinary Transactions. Alta Fox will agreed to a cap on its share ownership at 5,973,599 shares, and will refrain from activities such as proxy solicitations or influencing Board decisions.

Alta Fox and Daktronics have been going back and forth in the press and courts (e.g. here, here, and here) leading up to signing the cooperation agreement. Alta Fox isn’t the only investor that was opposed to the board’s proposed changes. In February, Chris Colvin’s Breach Inlet Capital sent a letter to shareholders stating their intention to vote against reincorporation and the change to cumulative voting. In the letter they also voiced support for Alta Fox stating they believed Daktronics made “a threat (and ultimately concerted action) to eliminate a valuable right to all shareholders.”