Gorilla Technology Group Inc. (GRRR) began trading under its new ticker today, following the closing of its business combination with Global SPAC Partners Co. With a reported redemption rate of ~88%, it became the latest DeSPAC to fall into the low-float community: i.e. the amount of shares currently tradable in the public is quite small. Several months ago, this resulted in several meme-like gamma squeeze trades where the DeSPAC stock would jump rapidly.

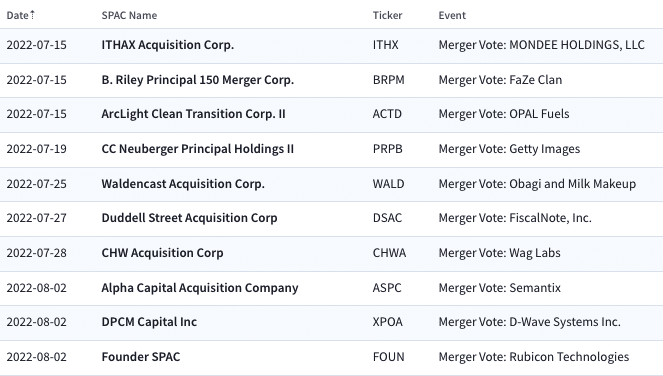

However that trade seemed to have gone away in recent months as the market caught on. GRRR has brought it back (at least for the time being), trading at intra day highs of ~$35, before settling in at $33 for a solid +100% gain on the day. Upcoming merger votes include the below, so keep an eye out, and buyer beware. The trade is quite risky, and oftentimes redemptions can be reversed, thus increasing the float back up.

Elsewhere in SPACs

- Vistas Media, the team behind Vistas Media Acquisition that brought Anghami (ANGH) public, filed for a rare new SPAC. A $200M vehicle, EF Hutton as the UW.

- B. Riley Principal 150 Merger Corp (BRPM) and FaZeClan are finally set to vote (and likely close) on their merger tomorrow. BRPM jumped nearly 12% today, perhaps in anticipation of a low-float trade

- L&F Acquisition Corp (LNFA) and ZeroFox set 8/2 for their merger vote date

- Clover Leaf Capital Corp. (CLOE) is utilizing its first of three 3-month extensions to extend its deadline to 10/22/2022 and depositing $0.10 in trust, bringing current NAV to ~$10.26

- HPX Corp. (HPX) extension approved. 19.5M shares redeemed, or ~77% of the SPAC’s trust

- Crown PropTech Acquisition’s (CPTK) largest PIPE Investor, Golub Capital, pulled its $68M commitment to the $75M PIPE as the deal had not closed by 7/9. With no further financing this deal is in real danger of not closing

Upcoming SPAC Calendar

Full calendar and SPAC database access here

Today’s Price Action

Biggest Gainers

11.21% ~ $ 9.72 | BRPM – B. Riley Principal 150 Merger Corp. (Announced)

7.75% ~ $ 29.74 | DWAC – Digital World Acquisition Corp. (Announced)

3.71% ~ $ 9.79 | ACTD – ArcLight Clean Transition Corp. II (Announced)

2.73% ~ $ 10.20 | CLAY – Chavant Capital Acquisition Corp. (Pre-Deal)

.81% ~ $ 9.94 | LCW – Learn CW Investment Corp (Pre-Deal)

.76% ~ $ 10.55 | BRLI – Brilliant Acquisition Corporation (Announced)

.72% ~ $ 9.86 | POND – Angel Pond Holdings Corp (Announced)

.60% ~ $ 10.12 | CFVI – CF Acquisition Corp. VI (Announced)

.52% ~ $ 9.70 | GHIX – Gores Holdings IX, Inc. (Pre-Deal)

.51% ~ $ 9.82 | AMCI – AMCI Acquisition Corp. II (Announced)

.51% ~ $ 9.87 | SCLE – Broadscale Acquisition Corp (Announced)

.51% ~ $ 9.87 | CHAA – Catcha Investment Corp (Pre-Deal)

.51% ~ $ 9.89 | ACAX – Alset Capital Acquisition Corp. (Pre-Deal)

.50% ~ $ 9.99 | ACAB – Atlantic Coastal Acquisition Corp. II (Pre-Deal)

.50% ~ $ 10.04 | SPK – SPK Acquisition Corp. (Announced)

.49% ~ $ 10.16 | LNFA – L&F Acquisition Corp (Announced)

.41% ~ $ 9.70 | NFYS – Enphys Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.83 | CSLM – Consilium Acquisition Corp I, Ltd. (Pre-Deal)

.40% ~ $ 10.08 | TRON – Corner Growth Acquisition Corp. 2 (Pre-Deal)

.31% ~ $ 9.68 | CDAQ – Compass Digital Acquisition Corp. (Pre-Deal)

Biggest Losers

-7.40% ~ $ 9.26 | PRPB – CC Neuberger Principal Holdings II (Announced)

-3.35% ~ $ 9.81 | NLIT – Northern Lights Acquisition Corp. (Announced)

-2.07% ~ $ 10.24 | FOXW – FoxWayne Enterprises Acquisition Corp. (Pre-Deal)

-1.07% ~ $ 9.95 | ITHX – ITHAX Acquisition Corp. (Announced)

-.99% ~ $ 10.04 | HTAQ – Hunt Companies Acquisition Corp. I (Pre-Deal)

-.79% ~ $ 10.07 | AMAO – American Acquisition Opportunity Inc (Announced)

-.70% ~ $ 9.86 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

-.51% ~ $ 9.80 | NHIC – NewHold Investment Corp. II (Pre-Deal)

-.51% ~ $ 9.85 | PAQC – Provident Acquisition Corp. (Announced)

-.50% ~ $ 10.03 | CNGL – Canna-Global Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.78 | GGMC – Glenfarne Merger Corp. (Pre-Deal)

-.40% ~ $ 9.85 | MSSA – Metal Sky Acquisition Corp (Pre-Deal)

-.40% ~ $ 9.86 | QFTA – Quantum FinTech Acquisition Corp (Announced)

-.40% ~ $ 9.87 | AFAR – Aura Fat Projects Acquisition Corp (Pre-Deal)

-.35% ~ $ 10.07 | ARCK – Arbor Rapha Capital Bioholdings Corp. I (Pre-Deal)

-.31% ~ $ 9.69 | CPAA – Conyers Park III Acquisition Corp. (Pre-Deal)

-.31% ~ $ 9.72 | CLBR – Colombier Acquisition Corp. (Pre-Deal)

-.31% ~ $ 9.78 | GAQ – Generation Asia I Acquisition Ltd (Pre-Deal)

-.31% ~ $ 9.79 | GTPA – Gores Technology Partners, Inc (Pre-Deal)

-.30% ~ $ 9.82 | CPTK – Crown PropTech Acquisitions (Announced)