Steve Van Till founded Brivo back in 1999. The cloud-based access control company serves all type of real estate from single-family homes up to commercial buildings. Steve talks to us about Brivo and why in a post-covid world access control is more important than ever – particularly in an increased environment of hybrid work.

Having been almost entirely self-funded for its entire history, Brivo is going public via SPAC to expand sales and accelerate growth. Is it worth taking a bet on the most mature cloud-based access control company out there?

Key Takeaways

On the business

- Early adopters of building and security cloud technology

- Brivo’s platform is used across all property types, though their history is longest in commercial properties

- 750 enterprise accounts including Whole Foods (all locations), DocuSign

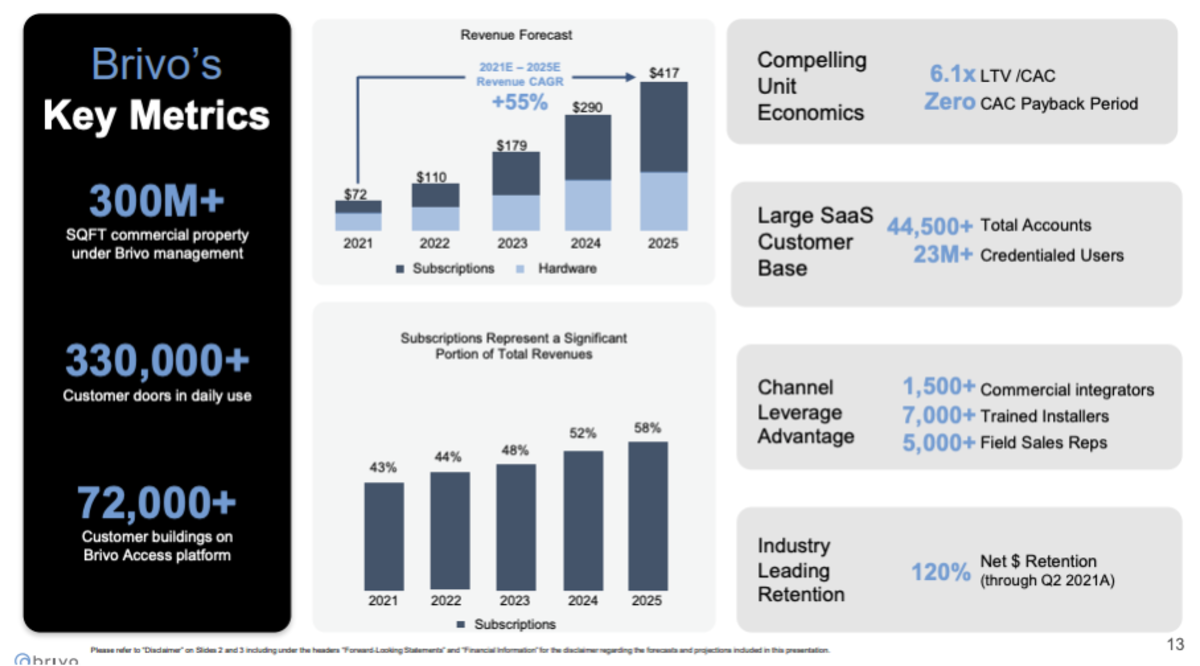

- 95% customer retention with customer relationships ~10-15 years long

- SaaS nature of the service keeps customers renewing

- 40% subscription revenue with balance being hardware, aiming to grow that pie of recurring revenue with high gross margins on both sides

- On competition and opportunity

- Enterprise: Brivo is only mature cloud company, and balance of the market “old iron” who have been slow to adapt to cloud

- Commercial RE: most crowded, but highly fragmented. some newer / smaller VC funded companies

- Multifamily: lot of startups, i.e. Latch (LTCH), where there is a lot of focus

On the deal + growth

- Large and growing TAM amid “PropTech” surge

- The “new normal” of hybrid work (and also co-working space) is driving greater adoption of the need for building security products

- Expecting 55% revenue CAGR from $72M this year out to $417M in 2025

- Goal to get to majority SaaS revenue by 2024

- Use of proceeds for the SPAC deal is to expand the sales effort

- Haven’t really raised new capital for the business since 2000. 2015 sale was really a re-cap and liquidity event for management

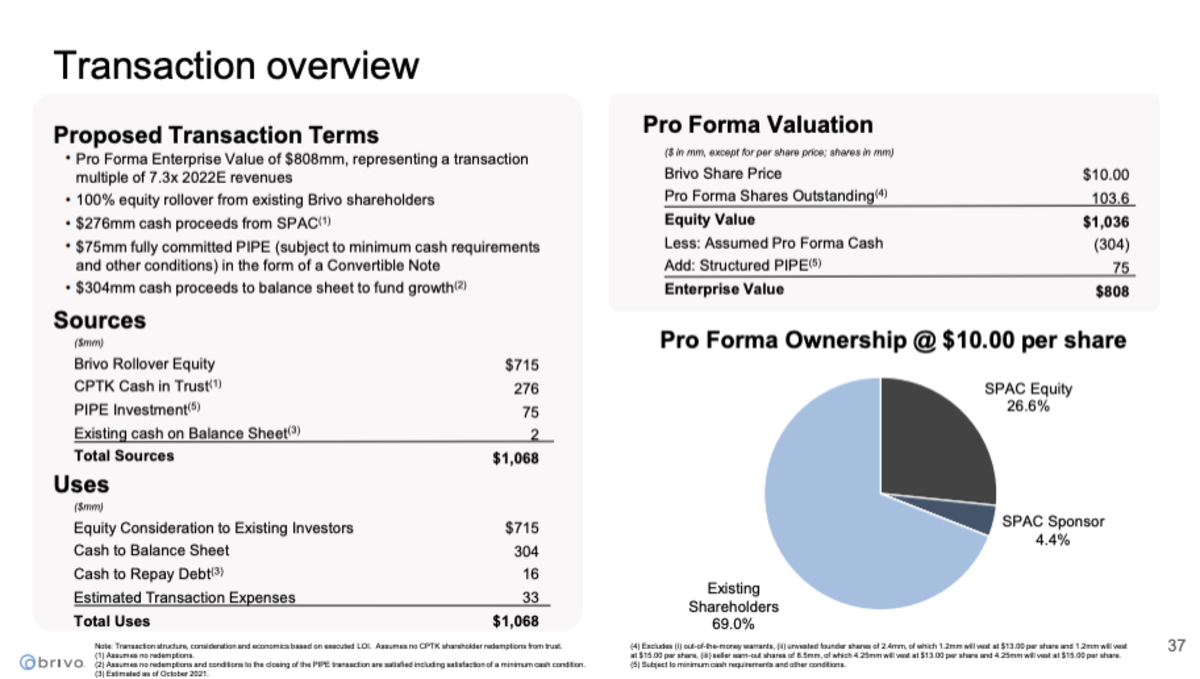

- $75M PIPE is structured as a convert

- Crown was chosen by Brivo (among several inbound SPAC offers) due to:

- Philosophical alignment in PropTech

- Operating experience of crown with >1mm square feet of managed real estate

- Looking to be acquisitive and buy companies in adjacent product areas

- Workplace and tenant experience (e.g. CRM) – focusing on the people

Deal Overview

- SPAC: Crown PropTech Acquisitions (CPTK)

- Sponsor: Crown Acquisitions

- Deal announced November 10, 2021

- $808M enterprise value

- $75M PIPE: Golub Capital Credit Opportunities + Eagle Eye Networks

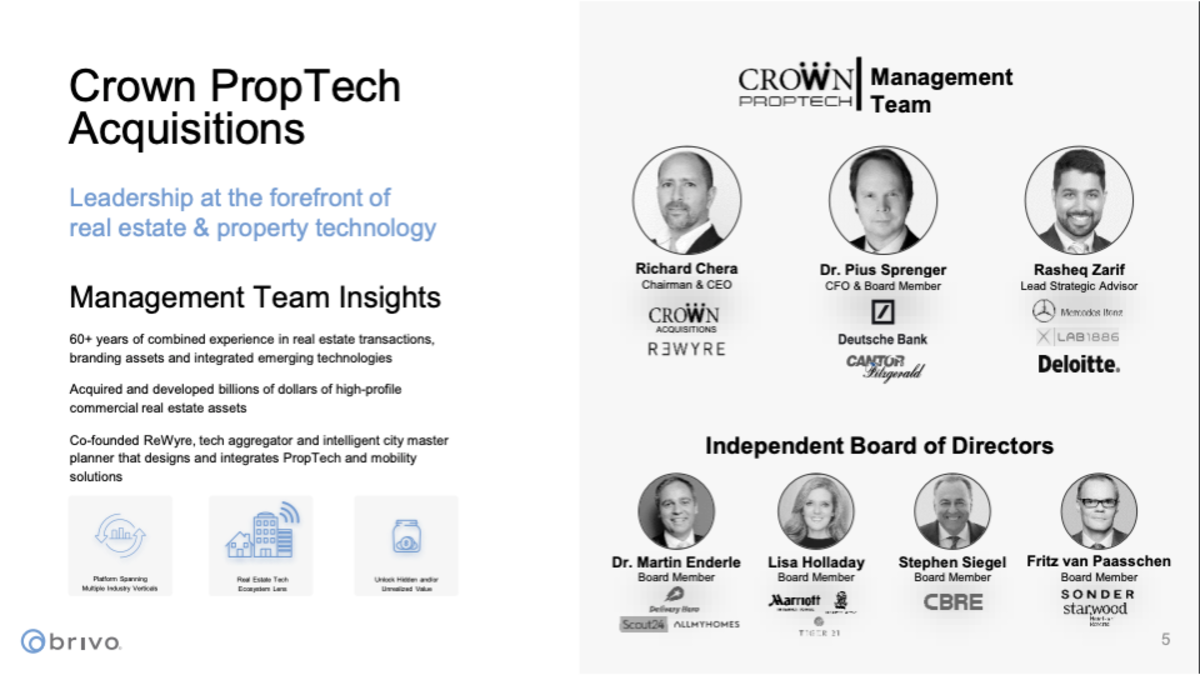

SPAC Sponsor: Crown PropTech

First time SPAC sponsor Crown Acquisitions has deep commercial real estate experience and is led by Richard Chera.

Steve mentions that Crown’s philosophical alignment, roots in Brivo’s customer base, and Crown’s operating history as all reasons for alignment. In addition Cera is the founder of a PropTech aggregator, REWYRE, that matches supply and demand which is an additional channel that Brivo can utilize to grow customers.

Topics Discussed

- Steve’s history and founding of Brivo

- Real estate areas of coverage and enterprise customer base

- Mix of software vs. hardware in Brivo’s business

- Breakdown of growth expectations

- PropTech secular trends as a positive tailwind for the company

- Fundraising, SPACs, and why they picked the crown team

- Competitive landscape (enterprise, commercial, and multifamily)

- Brivo’s leadership team

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.

The Know Who Drives Return Podcast

See all the latest episodes and full backlog here.

- Greenbox POS Talking Blockchain and Stablecoin Coyni

- SPAC Sponsor Spotlight: Live Oak Merchant Partners

- BM Technologies’ (BMTX) Luvleen Sidhu on Becoming a Bank and FinTech Evolution

- Will SeatGeek’s Primary Strategy Propel them to Ticketing Victory?

- Why Navitas Semiconductor (NVTS) Is the Next Big Thing in Chips with CEO Gene Sheridan

- Chad Rigetti on why Superconducting and Rigetti is the Best Bet on Quantum Computing

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report.)