Will GGPI break the deSPAC curse?

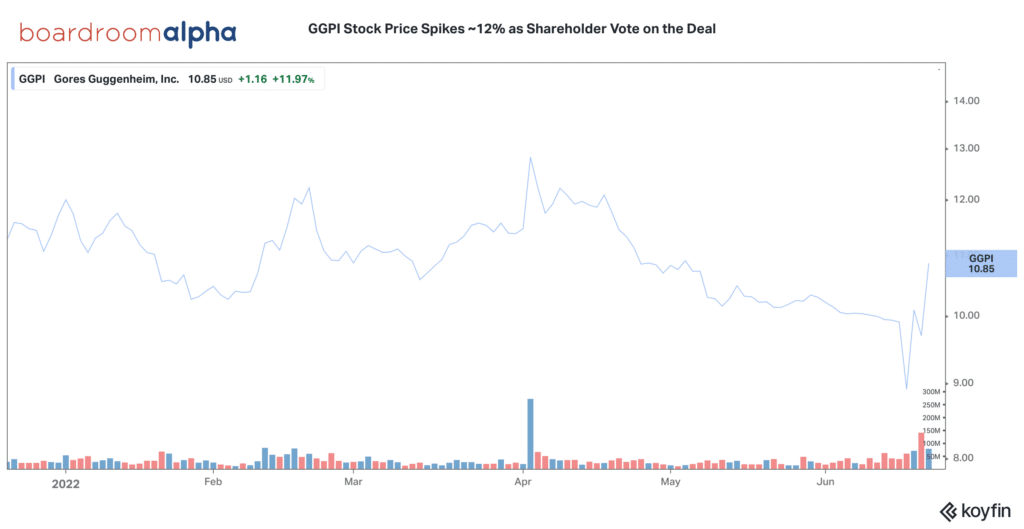

Gores Guggenheim (GGPI) shareholders went to vote today as the stock surged ~12% to $10.85 on the day. This helped it more than recover from the dip it suffered when it went ex-redemption. We’re awaiting details on the vote, but expect redemptions to be low. It is expected to close on the 24th and start trading as PSNY.

GGPI / Polestar Surges on SPAC Vote Day

ICYMI here is some of our recent coverage on Polestar including our conversation with CEO Thomas Ingenlath:

A Quick Look at other EV deSPACs

GGPI/Polestar is the latest in a long line of EV related SPACs to deSPAC. For the most part, it has been a painful process with many losing significant value for shareholders.

Status | Today’s Change ~ Today’s Close | SPAC -> deSPAC

De-SPAC | -2.94% ~ $ 1.65 | SNPR – Tortoise Acquisition Corp II -> VOLTA INC (VLTA)

De-SPAC | .74% ~ $ 5.45 | NBAC – Newborn Acquisition Corp. -> NUVVE HOLDING CORP (NVVE)

De-SPAC | -1.93% ~ $ 5.60 | VTIQ – VectoIQ Acquisition Corp -> NIKOLA CORP (NKLA)

De-SPAC | -3.10% ~ $ 5.63 | ACTC – ArcLight Clean Transition Corp -> PROTERRA INC (PTRA)

De-SPAC | -5.60% ~ $ 7.76 | CLII – Climate Change Crisis Real Impact I Acquisition Corp -> EVGO INC (EVGO)

De-SPAC | -.22% ~ $ 9.02 | SPAQ – Spartan Energy Acquisition Corp. -> FISKER INC (FSR)

De-SPAC | .33% ~ $ 9.11 | KCAC – Kensington Capital Acquisition Corp -> QUANTUMSCAPE CORP (QS)

De-SPAC | -1.25% ~ $ 14.25 | SBE – Switchback Energy Acquisition Corporation -> CHARGEPOINT HOLDINGS INC (CHPT)

De-SPAC | .73% ~ $ 18.03 | CCIV – Churchill Capital Corp IV -> LUCID GROUP INC (LCID)

An Update on Warrant Prices

SPAC warrants continue to trade lower and lower with no bounce in sight. Both warrants for SPACs with deals and those searching are at their lows. With redemptions continuing to average over 80%, deal terminations becoming more regular alongside liquidations, expect warrants to remain at historically low prices.

Elsewhere in SPACs

- EJF Acquisition (EJFA) officially deSPAC’d and will trade as Pagaya (PGY) tomorrow. It has suffered a similar deSPAC fate as most and since ex-redemption has now dropped to under $6. Company has not yet released redemption numbers, but expect them to be high.

- Golden Path Acquisition (GPCO) used its first of 9 extensions to 7/24 and added $0.033 to trust. That brings current NAV to ~$10.13.

- ICYMI yesterday, Lamar Partnering and Lionheart IV, from Lionheart Capital. Lionheart is the team behind the disaster that is MSP Recovery. Bloomberg with a nice recent take on the MSP Recovery story, its going concern and precipitous drop in share value.

- On Friday, June 24th, Northern Lights Acquisition (NLIT) shareholders will vote on their deal with Safe Harbor financial

- GDST / Roxe deal became definitive:

Biggest Daily Movers

Biggest Gainers

11.87% ~ $ 10.84 | GGPI – Gores Guggenheim, Inc (Announced)

.80% ~ $ 9.94 | GIAC – Gesher I Acquisition Corp. (Announced)

.70% ~ $ 10.05 | MNTN – Everest Consolidator Acquisition Corp (Pre-Deal)

.62% ~ $ 9.69 | IPAX – Inflection Point Acquisition Corp. (Pre-Deal)

.62% ~ $ 9.74 | CORS – Corsair Partnering Corporation (Pre-Deal)

.61% ~ $ 9.82 | RACB – Research Alliance Corp. II (Pre-Deal)

.60% ~ $ 10.00 | BYNO – byNordic Acquisition Corporation (Pre-Deal)

.50% ~ $ 9.99 | SHUA – SHUAA Partners Acquisition Corp I (Pre-Deal)

.50% ~ $ 9.99 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

.45% ~ $ 9.98 | LGTO – LEGATO MERGER CORP. II (Announced)

.41% ~ $ 9.80 | BGSX – Build Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.80 | CRZN – Corazon Capital V838 Monoceros Corp (Pre-Deal)

.41% ~ $ 9.80 | PLMI – Plum Acquisition Corp. I (Pre-Deal)

.41% ~ $ 9.81 | FZT – FAST Acquisition Corp. II (Pre-Deal)

.41% ~ $ 9.82 | DISA – Disruptive Acquisition Corp I (Pre-Deal)

.40% ~ $ 9.93 | NFNT – Infinite Acquisition Corp. (Pre-Deal)

.40% ~ $ 9.94 | CHWA – CHW Acquisition Corp (Announced)

.40% ~ $ 9.98 | WNNR – Andretti Acquisition Corp. (Pre-Deal)

.40% ~ $ 9.99 | TETE – Technology Telecommunication Acquisition Corp (Pre-Deal)

.36% ~ $ 9.81 | GTPB – GORES TECHNOLOGY PARTNERS II, INC. (Pre-Deal)

Biggest Losers

-9.42% ~ $ 9.23 | RICO – Agrico Acquisition Corp. (Announced)

-8.65% ~ $ 8.77 | NLIT – Northern Lights Acquisition Corp. (Announced)

-8.52% ~ $ 9.95 | KNSW – KnightSwan Acquisiton Corp (Pre-Deal)

-2.53% ~ $ 9.65 | GHIX – Gores Holdings IX, Inc. (Pre-Deal)

-2.34% ~ $ 27.91 | DWAC – Digital World Acquisition Corp. (Announced)

-1.27% ~ $ 10.07 | KINZ – KINS Technology Group Inc. (Pre-Deal)

-1.06% ~ $ 9.84 | TZPS – TZP Strategies Acquisition Corp. (Pre-Deal)

-1.00% ~ $ 9.95 | HCMA – HCM Acquisition Corp (Pre-Deal)

-.99% ~ $ 10.05 | TOAC – Talon 1 Acquisition Corp (Pre-Deal)

-.81% ~ $ 9.79 | DNZ – D and Z Media Acquisition Corp. (Pre-Deal)

-.80% ~ $ 9.89 | DUNE – Dune Acquisition Corporation (Announced)

-.71% ~ $ 9.75 | GBBK – Global Blockchain Acquisition Corp. (Pre-Deal)

-.71% ~ $ 9.82 | VII – 7GC & Co. Holdings Inc. (Pre-Deal)

-.70% ~ $ 9.98 | LFAC – LF Capital Acquisition Corp. II (Pre-Deal)

-.61% ~ $ 9.80 | TRCA – Twin Ridge Capital Acquisition Corp. (Pre-Deal)

-.61% ~ $ 9.83 | OHAA – Opy Acquisition Corp. I (Pre-Deal)

-.60% ~ $ 9.88 | HMA – Heartland Media Acquisition Corp. (Pre-Deal)

-.60% ~ $ 9.93 | GDNR – Gardiner Healthcare Acquisitions Corp. (Pre-Deal)

-.60% ~ $ 10.01 | PAFO – Pacifico Acquisition Corp. (Announced)

-.51% ~ $ 9.84 | MCAG – Mountain Crest Acquisition Corp. V (Pre-Deal)

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.