Polestar CEO Thomas Ingenlath isn’t here for a ‘short, quick win.’ He’s building a premium electric brand that’s nothing like its competitors. Or its parent, Volvo.

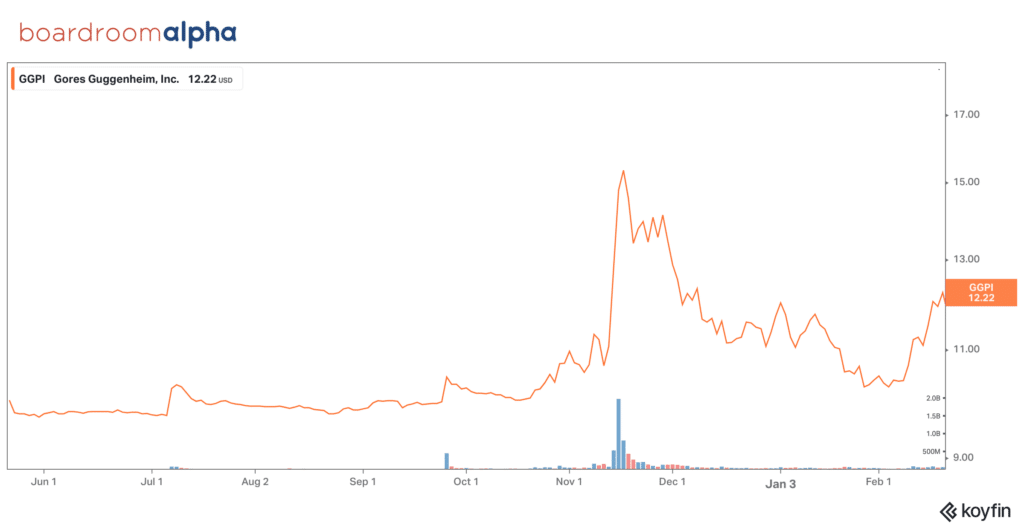

Boardroom Alpha sat down with Thomas Ingenlath, CEO of Electric Vehicle (EV) maker Polestar. Polestar is a global pure-play electric vehicle company that’s having its time in the spotlight. The company is expected to go public in a SPAC merger transaction with Gores Gugghenheim (GGPI) in a transaction valued at approximately $26 billion.

Listen to the podcast to hear more, including how Inglenath commutes to work (hint: its two wheels and sustainable!), and what he’s reading now.

Polestar In the Right Place at the Right Time?

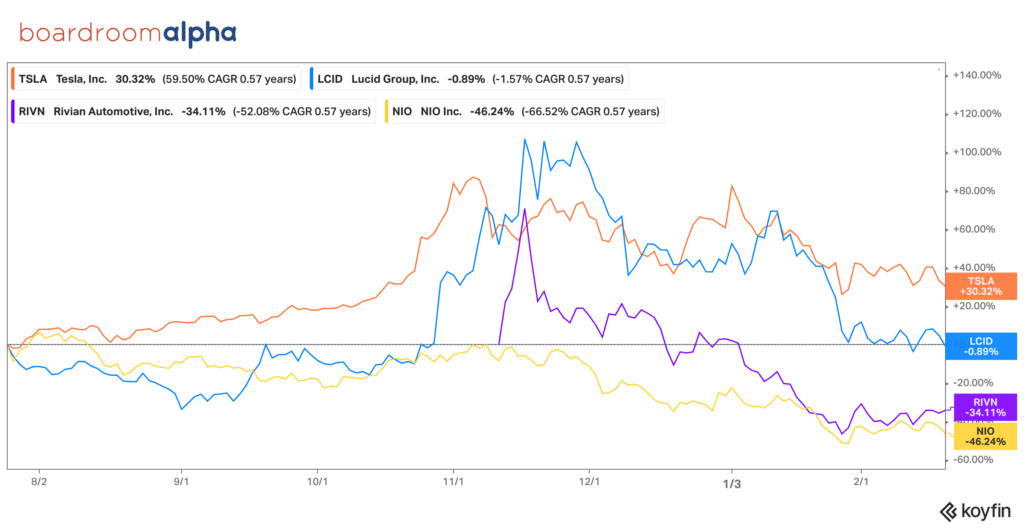

With EVs representing a significant investable portion of the global economy and exponential growth expected over the next decade, Polestar is in the right place at the right time. The EV maker, which is expected to become a public company sometime in the first half of this year, follows on the heels of two other red-hot EV IPOs: Rivian Automotive (RIVN) and Lucid Group (LCID). Both EV startups are essentially pre-revenue companies and are currently valued at over $58 billion and $44 billion, respectively.

“But as so often in life, a certain amount of patience is required.”

Polestar CEO Thomas Ingenlath on GGPI / Polestar Deal Timing

Why Polestar is Different

But Polestar doesn’t want to be anything like its predecessors. Despite comparisons to other EV upstarts, Polestar is a more established company in every sense of the word. The company shipped 29,000 cars last year, generating $1.6 billion in revenue. From its positioning as a design-driven, premium electric brand, to the company’s sustainability focus—Polestar is a unique combination of good long-term fundamentals and smart strategic positioning. Inglenath highlights the company’s revenue and production targets (65,000 cars by year end) and charging infrastructure (800 service points by end of 2022).

“These are valid credibility points that make us that much different to the standard startup.”

Polestar CEO Thomas Ingenlath on hitting revenue and production targets

Polestar is also very different from its parent, Volvo. As the CEO points out, a key advantage is Polestar’s ability to leverage Volvo’s proven manufacturing and other assets so that the company can focus its intellectual capital on its own unique design direction. “We can concentrate all our creativity and capital in investing into what makes our product different to a Volvo, different to competitor cars.”

Inglenath gives a good overview of the company’s ambitious new rollout plan to deliver three additional designs by the end of 2024: the Polestar 3, a luxury SUV; Polestar 4 luxury SUV coupe (2023), and the company’s design pinnacle, the Polestar 5 (2024), noting “we …are very much on schedule.”

With Polestar implicitly trading at 4x projected sales of $6.7 billion, a steep discount to peers (LCID, for example, trades at 10x 2023E sales), many investors may be left to question what the market is missing. Inglenath isn’t too bothered by comparisons. “We are not here for a short quick win,” he says. “It’s definitely the perspective and the value that we want to create over the long term.”

“We are not here for a short quick win,” he says. “It’s definitely the perspective and the value that we want to create over the long term.”

Polestar CEO Thomas Ingenlath on what investors may be missing

Sponsor Overview: GGPI

Gores Gugghenheim is led by Chairman Alec Gores, the founder and CEO of The Gores Group; CEO Mark Stone, who currently serves as a Senior Managing Director of The Gores Group; and President and Director Andrew Rosenfield, who currently serves as the President of Guggenheim Partners.

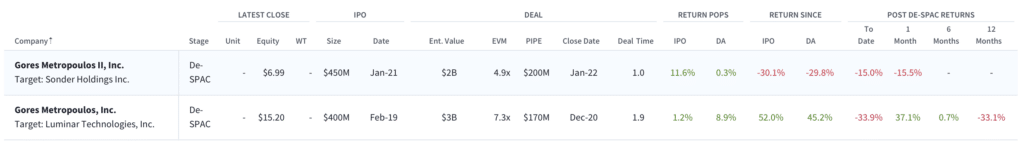

Gores Guggenheim completed its initial public offering in April 2021, raising approximately $800 million in cash. It’s the thirteenth blank check vehicle sponsored by The Gores Group, a reputable sponsor with several successfully completed de-spacing transactions. Notably, in the automotive technology sector, Gores Metropoulos I facilitated a $2.9 billion IPO for lidar sensor maker Luminar Technologies (LAZR) last August. Gores has also remained on the board of post-merger companies including Nikola (NKLA), Clover Health (CLOV) and Luminar, suggesting some level of continued support and involvement in the company’s operations.

Gores Sponsored SPACs

Gores / Metropoulos Sponsored SPACs

Polestar in Brief

Based in Sweden, Polestar was originally spun out of Volvo Car Group in 2016 and is jointly owned 50.5% by Chinese automaker Geely Holding Group (GELF). and 49.5% by Volvo Car Group. Geely acquired Volvo in 2010. Notably, Polestar’s CEO Thomas Ingenlath was previously Senior Vice President of Design at Volvo Cars.

In 2017, Polestar was recast as an electric performance brand. The company is in production with electric cars in 14 markets across Europe, Asia, and the US. Polestar is currently shipping 2 models: the coupe Polestar 1 (a hybrid performance car) and an all-electric sedan, the Polestar 2. The Polestar 3, a luxury SUV model, is expected to ship later this year. An SUV coupe, the Polestar 4, will ship by year end 2023; and the Polestar 5, a luxury sport EV, is expected to ship in 2024.

“We are European car brand. And I think that that is a culture and the design language that is very much understood in in the premium segment throughout the world.”

Polestar CEO Thomas Ingenlath on Polestar as a luxury European brand

Manufacturing: A strategic business partnership with Volvo and Geely is an important advantage which should allow Polestar to rapidly scale its manufacturing output over the next few years. The company currently operates a single manufacturing facility, the Polestar Production Centre in Chengdu, China. However, unlike most EV competitors, which are investing significantly to build and manage their own manufacturing facilities, Polestar will leverage six production facilities owned by its partners. The Polestar 3 will be manufactured in Volvo’s U.S. assembly plant near Charleston, South Carolina (the same plant building the Volvo S60 and the next-gen XC9).

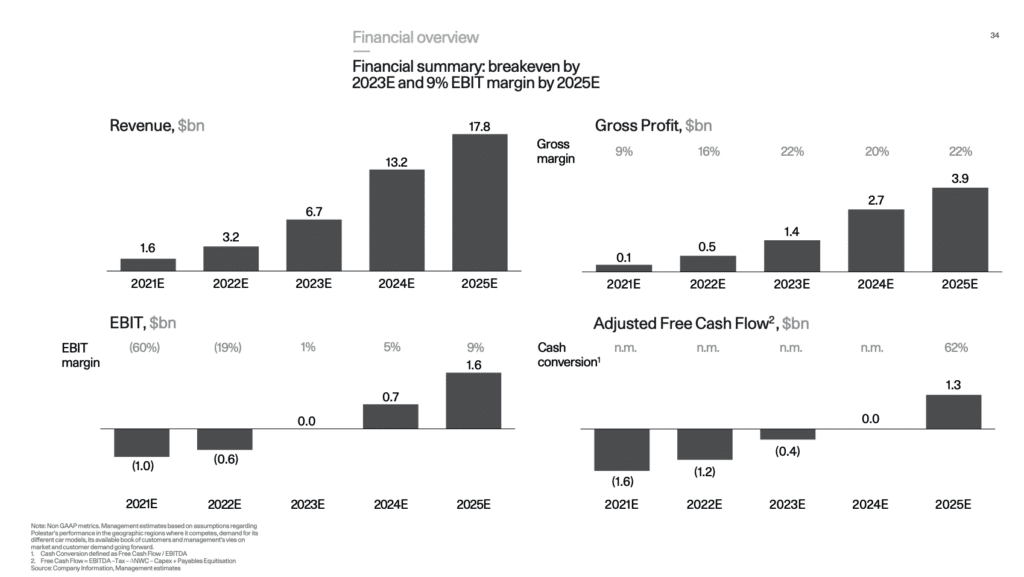

Production and revenue targets: For 2022, Polestar expects to ship 65,000 cars. The company expects to ramp to 750,000 units annually at full production. Rivian and Lucid, which each operate a single U.S. manufacturing facility, expect to ship 150,0000 and 53,000 vehicles respectively, in 2022. By 2023, Polestar expects to be in 30 markets and breakeven on an operating basis. By 2025, the company sees revenue growing at a compounded annual growth rate of 83% to $17.8B, generating roughly 9% margin on earnings before interest and taxes. Polestar also expects to deliver 290K vehicles by the end of 2025. In 2021, Polestar hit its projected revenue target of $1.6B.

Polestar Makes a Splash During Super Bowl

Polestar Key Risks and Catalysts

Polestar’s strategy of leveraging its relationships with Volvo and Geely provides several time-to-market advantages. Global automakers have pursued alliances to respond better to the cost of the transition to electric cars, tougher emission rules and autonomous driving. However, the reliance on external parties for purchasing, manufacturing, engineering, and design comes with long-term tradeoffs. Notably, Polestar has less control over manufacturing costs, as these agreements are structured as a percentage of Volvo/Geely costs plus an incremental markup.

The interdependence of Polestar’s partner relationships may raise questions regarding the company as an independent standalone business longer-term. Accordingly, potential investors should consider the quality and capabilities of both Volvo and Geely. Unfortunately, we have limited transparency into the financial and operational health of Volvo and Geely (a foreign listed company). Since abandoning plans to merge with Volvo in February 2021, Geely appears focused on Polestar as an integral part of its expansion into the global automotive market.

Polestar Competition

As a new EV manufacturer, Polestar faces significant competitive risk, primarily from Tesla, which currently dominates the EV market, but also from other startups. Public perception and branding are important in this sector and for the most part, Polestar’s primary competitors, Tesla and Lucid, are perceived to have superior battery technology and more attractive vehicle designs.

Unlike EV startups Rivian and Lucid, which have targeted specific niches (e.g. SUVs and luxury vehicles). Polestar targets a broader addressable market. A single-motor Polestar 2 MSRP starts at $38,400 (after tax credits). A dual-motor Polestar 2 starts at $42,400 (after tax credits). In contrast, a Lucid Air Dream starts at $77,400 and Rivian’s R1T electric pickup starts at around $67,500.

While Lucid and Rivian are expected to be regional players, at least initially, Polestar appears positioned on a larger addressable market globally. However, the company’s entry into the highly profitable SUV market with the Polestar 3 will face considerable competition. The SUV segment is the largest EV segment, with about 370 total electric car models available in 2020, a 40% increase from 2019. Notably, Rivian, which is currently trading at a $93 market capitalization, is expected to be a formidable player, with its much-anticipated full-size electric SUV, the R1S, expected to ship in 2023. Tesla’s Cybertruck is also expected in 2023.

Polestar’s focus on sustainable materials and manufacturing appears to be a key differentiator. The company wishes to be carbon-free in its entire production process. Polestar also plans to make sustainability declarations, common in industries like food and fashion, standard practice for all its future models.

GGPI / Polestar Transaction Details and Valuation

In December, Gores Guggenheim filed an updated Form F-4 with the SEC which announced revised transaction terms relating to the merger with Polestar and added a $136 million PIPE. The original deal terms, announced in September, called for a $250 million PIPE and approximately $800 million in the Gores Guggenheim trust (assuming no redemptions).

At GGPI’s current share price of $12 and an estimated 2.125 billion shares outstanding, Polestar is implicitly valued at approximately $26 billion. This figure represents the highest valuation for a SPAC in connection with the Gores Group. The company is expected to raise over $995M in cash in the IPO. Notably, the IPO of Rivian Automotive raised nearly $12 billion, making it the largest IPO in the U.S. since 2014.

Polestar will use the $1.05 billion proceeds from the merger to drive three new models to market within the next three years. Post-merger, Polestar will own 94.1% of the overall business. GGPI investors will own 3.8%, the Sponsor will own 0.9%, and the PIPE (private investment in public equity) investors will own the remaining 1.2%. Of note in the capital structure is that the sponsor, GGPI, is expected to retain a 0.9% stake in the company. At a $26B valuation, this stake is worth approximately $240 million for an initial $20,000 investment in founder shares and $18M invested in warrants. While the Sponsor incentive is lucrative, Gores Group has a track record of successful SPAC transactions and engagement of the sponsor beyond the IPO process. The latter bodes well for potentially reducing the fairly predictable pattern of stock volatility characterized by SPAC IPOs around lock-up expirations.

Polestar / GGPI SPAC Investor Presentation

Polestar implicitly trades at approximately 4x projected 2023 sales of $6.7 billion– a significant discount to more established EV pure-plays like Tesla, at over 20x, and Nio (9x), as well as newer EV market entrants such as Rivian and Lucid, which are in limited commercial production and essentially pre-revenue. While the entire EV and related technology sectors have been under pressure in recent weeks, we like the risk/reward at these levels and expect the shares to gain momentum into the SPAC merger.

Electric Vehicles Overview

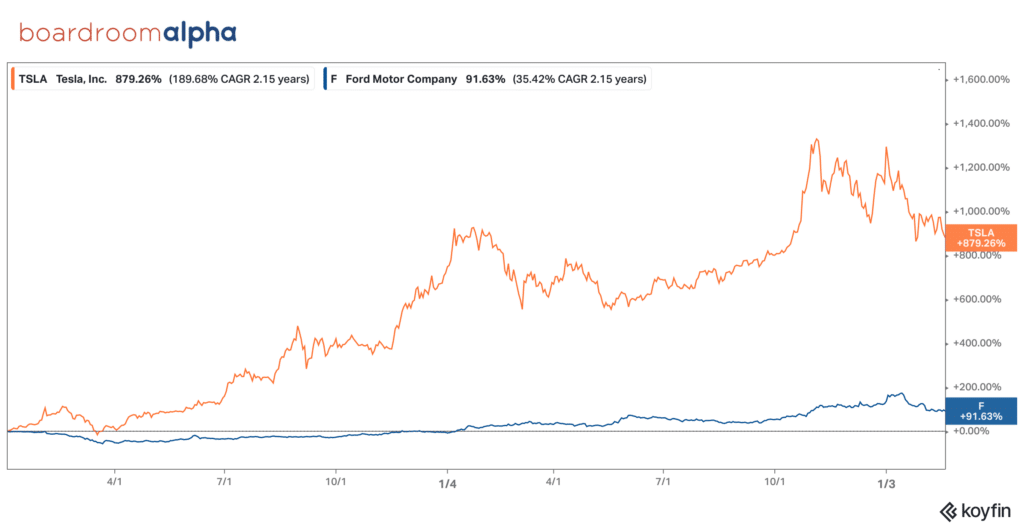

Last year was nothing short of a meteoric year for electric vehicle (EV) stocks. As global sales of EVs exploded, legacy automakers announced plans to pump billions of dollars into the movement toward a more sustainable future– and stock prices got a much-needed lift. Several high-profile EV startups, including Lucid Group (LCID) and Rivian Automotive (RIVN) successfully tapped the public markets on the promise of EV technology. The godfather of EV companies, Tesla (TSLA) hit a $1000 share price in October and joined the trillion dollar club, along with Google (GOOG, GOOGL), Amazon (AMZN) and Apple (AAPL). A ‘rising tide lifts all boats’ scenario ensued as FOMO investing influenced retail and institutional investors alike.

Laws of Gravity: EV stock performance since LCID IPO July 2021

- Tesla stock continued to climb– despite supply chain constraints, a short-lived short call by Michael Blurry, plenty of noise from competitors, and even some panic over Elon Musk’s stock sales. Tesla delivered 936,000 EVs in 2021—an 87% increase YoY, and more than the entire industry combined. TSLA bulls get support from Cathie Wood, who continues to tout a $3000 “base case” for the stock.

- Lucid Group emerged following a successful deSPAC from parent Churchill Capital Corp IV, raising $4.5 billion. A combination of luxury design, California vibes, and better battery performance sent LCID shares up to $55 by November. Investors swooned over CEO Peter Rawlinson, the design brains behind Tesla’s Model S, and have been largely unbothered by the Lucid Air’s $77,000 sticker price and company’s lack of commercial, scale production.

- Rivian won the title of biggest IPO since Facebook/Meta (FB), raising nearly $12 billion. The carmaker won a deal with Amazon for 100,000 delivery vans. But then, so did Stellantis (STLA).

- Also in SPACs, the Volvo/Geely-backed Swedish EV maker Polestar (GGPI) showed investors that it’s possible for an EV company to come to market with both revenues and commercial production. Polestar will combine with SPAC Gores Guggenheim and use the $1.05 billion proceeds from the merger to drive three new models to market within the next three years.

- Old-school car makers General Motors (GM) and Ford (F) claim they’re not missing the EV boat, investing a combined $65 billion ($35 billion at GM and $30 billion for Ford) – in electric vehicles. Ford became cool again, largely due to bold moves by CEO Jim Farley, who’s been evangelical about EVs (aiming for 600,000 by 2023). Impressive numbers on the F-150 electric pickup truck (200,000 pre-orders) and a $1.2 billion investment in EV-maker Rivian are strong early indicators. GM says it can sell 1 million electric vehicles globally by 2025.

SPACs have been the way to go for most EV startups

The past two years have seen an unprecedented number of SPAC-backed, electric vehicle-related IPOs. Start-ups Nikola (NKLA), Lordstown Motors (RIDE), Canoo (GOEV), Faraday Future (FFIE), Fisker (FSR) and Lucid Group all went public through SPAC deals over the last two years.

Aggressive growth projections and delayed profitability: Caution is required

But in the race toward any new technology, not everyone can come out a winner. The market has very clearly begun to separate the wheat from the chaff. Since the start of the year, sentiment on EV stocks has cooled, reflecting risk-on trading activity commensurate with rising interest rates. The most speculative stocks, with little-to-no earnings, have been the first to drop as interest rates rise. Supply chain constraints and increased costs continue to dampen results. Ford reported disappointing Q4 earnings, last week sending the shares down 30%.

SEC scrutiny, SPAC blowups, and shamed execs — Adding drama to the EV sector: a lack of transparency around revenues and orders, unrealistic financial projections, investigations by the DoJ and SEC, and plenty of executive upheaval and scandal. The SEC taught EV makers Nikola, Canoo,Lordstown and Workhorse Group (WKHS) that being honest about pre-orders (and financials) is important. Lordstown ultimately admitted it missed production targets because it was out of cash, forcing a resignation of both its CEO and CFO. Nikola founder Trevor Milton is scheduled to go on trial in April for allegedly defrauding investors in the company’s IPO.

Supply chain challenges continue to be an overhang on vehicle production targets. In particular, the most important ingredients that make up EV LFPs (lithium iron phosphate batteries) – lithium, phosphate, and graphite—are in short supply.

China’s EV dominance over the EV supply chain becomes very clear as the country controls more than half of the world’s lithium processing and refining and has three-fourths of the lithium-ion battery megafactories in the world. China has also halted all export of phosphate. As a result, EV makers have started to turn to other sources. Last month, Tesla announced a contract in Mozambique for lithium. More sourcing deals are expected as EV batteries are the primary limiting factor for growth in this market.

Emerging EV tech: with too many players chasing too few customers, consolidation is likely

Emerging EV tech hasn’t fared as well — stocks in emerging EV technologies such as solid-state batteries, autonomous driving, and LiDAR—have come under the most pressure. Commercialization is 1-2 years away for most of these companies, pushing meaningful revenues into 2023-2024. Despite several high-profile announcements with car makers, few are generating meaningful revenues.

LiDAR: Luminar (LAZR) has been the top performer here, owing to a number of announced relationships and partnerships (listen to our podcast with Polestar CEO Thomas Ingenlath to hear more about Luminar’s relationship with Polestar). Cepton (CPTN), which is one of two LiDAR deSPACs to debut this year, has also been a strong performer out of the gate—largely owing to a relationship with Ford.

See our latest podcasts with AEye and Cepton here:

- Blair LaCorte, CEO of AEye, On Why Now is the Time to Look at LiDAR

- Cepton CEO Dr. Jun Pei Is Feeling Confident That the Company Has What It Takes to Lead in LiDAR

Next-gen batteries: Despite cool tech, commercial production is largely pushed out to the 2023/2024 timeframe. As a result, most of these stocks are taking a back seat for now as the big EV makers turn to old school lithium phosphate batteries. Key names: Quantumscape (QS), Solid Power (SLDP), Romeo Power (RMO).

EV charging infrastructure: Lots of SPAC IPOs here. The largest category, which includes companies such as Blink Charging (BLNK), Volta (VLTA) and EVGo (EVGO) build and operate their own charging networks. Others, like Beam Global (BEEM)and Chargepoint (CHRG), provide stations and software to third-party operators. Finally, companies such as Wallbox NV (WBX), which is part-owned by Spanish energy company Iberdrola SA (IBDRY), primarily makes chargers for homes and businesses. Operating model/long-term profitability is the primary overhang on these stocks for now.

Consolidation is likely. With dozens of companies in LiDAR and charging, and only a handful of customers, we continue to expect a market shakeout.

EV Valuations have pulled back, creating an attractive entry point

The electric vehicle market is in the early innings of a sustained double digit growth cycle and displacement of combustion engine vehicles. Electric vehicles currently account for only a fraction of total global vehicle sales, and most research suggests industry growth at compound annual rates in the high 20s through 2030. It’s clear that for now, investors seem to be valuing EV startups at a significant premium to legacy carmakers.

A tale of two carmakers: Tesla and Ford stock performance: 2020 to present

That said, valuations have cooled as the market is now starting to take a much more discerning view about which EV companies are going to get products finished from a design perspective, manufacture them on time, on budget, and at scale, and find customers to buy them.

With several large-scale automotive companies with storied histories transitioning to electric vehicles, these companies will supplement the smaller, EV-focused companies, like Tesla, Rivian, and Lucid, contributing large-scale production operations with relatively limitless amounts of capital. We continue to look for stocks with a well-capitalized balance sheet, manufacturing prowess and market focus.

Boardroom Alpha’s SPAC Research & Data Platform

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Research and Data service.