Hotly anticipated SPAC expected to trade as PSNY 6/24

—————————————————

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

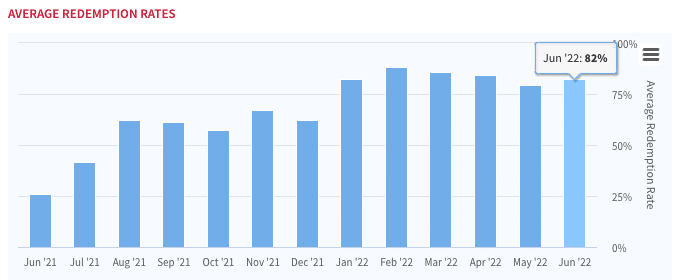

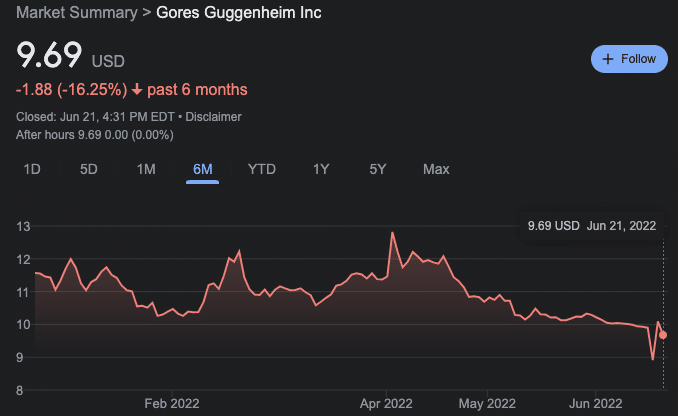

Gores Guggenheim (GGPI) and Polestar is one of the only current pre-close SPAC deals that appears to be positively anticipated by the market (here’s looking at you DWAC). The long awaited merger, announced in September of 2021, is now finally expected to close this week following its merger vote on Wednesday 6/22. To boot, the company said it expects to have a maximum of 25% redemptions as part of its closing process, which would come in far below the recent average redemption rates.

Polestar, an EV company that actually has shipped cars, will trade as PSNY this Thursday, 6/24. ICYMI here is some of our recent coverage on Polestar including our conversation with CEO Thomas Ingenlath. GGPI stock, while down from its highs, has been one of the lone SPAC stocks to trade at a premium to NAV. Shares have dipped below NAV since it went ex-redemption.

Goldenstone Acquisition Rumored to Merge With Roxe

According to a Reuters report, Goldenstone Acquisition (GDST) is rumored to be nearing a $3.6B deal with blockchain-based payments company Roxe Holdings. The deal could be announced as early as Tuesday afternoon. GDST is a $57.5M SPAC that just priced in March-2022 and would mark one of the quickest deal pacts in recent SPAC memory. Particularly surprising given the very negative current market sentiment surrounding both SPACs and the general crypto/blockchain landscape.

SpringBig Clarifies Public Float

Recent De-SPAC SpringBig (SBIG) which saw > 90% redemptions at its merger vote has confirmed that it currently has a 6.6M public share float and $15M on its balance sheet since debuting as a public company following its deSPAC transaction.

Elsewhere in SPACs

SPACs continue to abandon their plans to go public, the latest being Lamar Partnering and Lionheart IV, from Lionheart Capital. Lionheart is the team behind the disaster that is MSP Recovery. Bloomberg with a nice recent take on the MSP Recovery story, its going concern and precipitous drop in share value.

SPAC Calendar

Biggest Daily Movers

Biggest Gainers

9.79% ~ $ 10.88 | KNSW – KnightSwan Acquisiton Corp (Pre-Deal)

2.11% ~ $ 28.58 | DWAC – Digital World Acquisition Corp. (Announced)

1.70% ~ $ 10.19 | GGAA – Genesis Growth Tech Acquisition Corp. (Pre-Deal)

1.40% ~ $ 10.11 | LAAA – Lakeshore Acquisition I Corp. (Announced)

1.12% ~ $ 9.94 | TZPS – TZP Strategies Acquisition Corp. (Pre-Deal)

1.02% ~ $ 9.95 | NVAC – NorthView Acquisition Corp (Pre-Deal)

.90% ~ $ 10.05 | HCMA – HCM Acquisition Corp (Pre-Deal)

.82% ~ $ 9.89 | MEAC – Mercury Ecommerce Acquisition Corp (Pre-Deal)

.81% ~ $ 9.94 | GDST – Goldenstone Acquisition Ltd. (Pre-Deal)

.80% ~ $ 9.94 | GIAC – Gesher I Acquisition Corp. (Announced)

.80% ~ $ 10.09 | GIA – GigCapital5, Inc. (Pre-Deal)

.79% ~ $ 10.15 | TOAC – Talon 1 Acquisition Corp (Pre-Deal)

.72% ~ $ 9.86 | KRNL – Kernel Group Holdings, Inc. (Pre-Deal)

.71% ~ $ 9.98 | FIAC – Focus Impact Acquisition Corp. (Pre-Deal)

.70% ~ $ 10.05 | MNTN – Everest Consolidator Acquisition Corp (Pre-Deal)

.61% ~ $ 9.82 | RACB – Research Alliance Corp. II (Pre-Deal)

.61% ~ $ 9.89 | OHAA – Opy Acquisition Corp. I (Pre-Deal)

.60% ~ $ 9.99 | GDNR – Gardiner Healthcare Acquisitions Corp. (Pre-Deal)

.60% ~ $ 10.00 | BYNO – byNordic Acquisition Corporation (Pre-Deal)

.51% ~ $ 9.81 | ARRW – Arrowroot Acquisition Corp. (Pre-Deal)

Biggest Losers

-12.42% ~ $ 9.80 | NHIC – NewHold Investment Corp. II (Pre-Deal)

-8.34% ~ $ 9.89 | CIIG – CIIG Capital Partners II, Inc. (Pre-Deal)

-6.22% ~ $ 9.95 | HAIA – Healthcare AI Acquisition Corp. (Pre-Deal)

-5.88% ~ $ 9.60 | NLIT – Northern Lights Acquisition Corp. (Announced)

-4.67% ~ $ 10.01 | TRON – Corner Growth Acquisition Corp. 2 (Pre-Deal)

-3.96% ~ $ 9.69 | GGPI – Gores Guggenheim, Inc (Announced)

-1.32% ~ $ 9.74 | BLEU – bleuacacia ltd (Pre-Deal)

-1.28% ~ $ 10.02 | USCT – TKB Critical Technologies 1 (Pre-Deal)

-1.21% ~ $ 9.78 | DISA – Disruptive Acquisition Corp I (Pre-Deal)

-1.10% ~ $ 9.88 | ZING – FTAC Zeus Acquisition Corp. (Pre-Deal)

-1.07% ~ $ 5.57 | EJFA – EJF Acquisition Corp (Announced)

-1.01% ~ $ 9.79 | BYTS – BYTE Acquisition Corp. (Pre-Deal)

-.96% ~ $ 9.78 | GTPB – GORES TECHNOLOGY PARTNERS II, INC. (Pre-Deal)

-.81% ~ $ 9.85 | SHQA – Shelter Acquisition Corporation I (Pre-Deal)

-.80% ~ $ 9.97 | DUNE – Dune Acquisition Corporation (Announced)

-.71% ~ $ 9.85 | ROCL – Roth CH Acquisition V Co. (Pre-Deal)

-.70% ~ $ 9.90 | DSAC – Duddell Street Acquisition Corp (Announced)

-.68% ~ $ 10.20 | KINZ – KINS Technology Group Inc. (Pre-Deal)

-.62% ~ $ 9.63 | IPAX – Inflection Point Acquisition Corp. (Pre-Deal)

-.61% ~ $ 9.72 | TCVA – TCV Acquisition Corp. (Pre-Deal)

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.