WEEKLY SNAPSHOT

The Disney / Trian fight continues to be must-see TV. The latest action comes from the founder’s family as nine of his grandchildren write 2 open letters to DIS shareholders (strongly) making the case to support Bob Iger and the current board over Trian/Peltz.

$DIS family supports Iger against Peltz /Trian in 2 open letters to shareholders https://t.co/uqX3M3g4l0

— Boardroom Alpha (@boardroomalpha) March 1, 2024

Last week we flagged a rare instance of a director proactively resigning when Director Ann Fandozzi resigned from the board of RB Global. This week, we may not be able to call it rare. New York Community Bank (NYCB) director Hanif Dahya resigned in protest of their choice of new CEO as the bank reported $2.4 billion more in losses, internal control issues, and its stock dropped 25%.

$NYCB rare to see a director taking a stand — need more of thishttps://t.co/aVlmO2UisA pic.twitter.com/kFP64CnSip

— Boardroom Alpha (@boardroomalpha) March 1, 2024

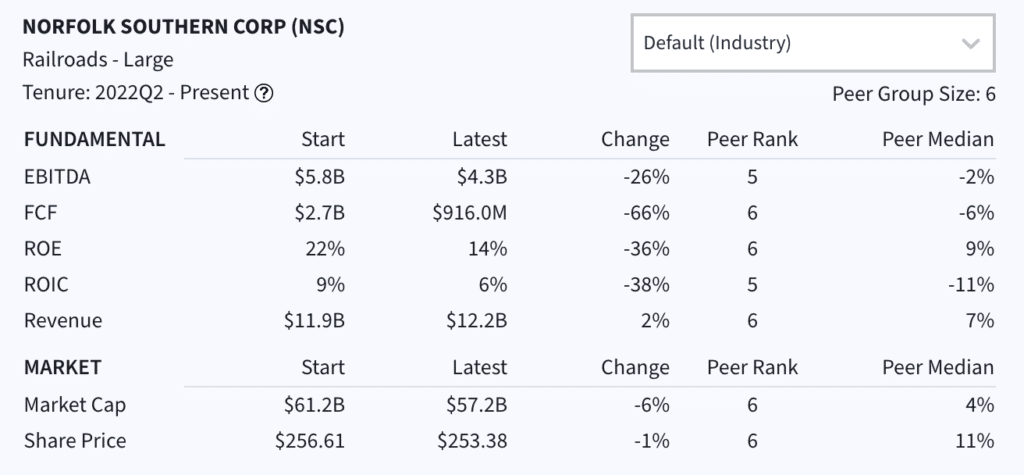

Ancora has kept the heat up on Norfolk Southern (NSC) and today released an open letter to NSC Chairwoman Amy Miles. Ancora makes clear it believes the company is “serving at the pleasure of CEO Alan Shaw — rather than the other way around.” Ancora makes its case in part by citing the board’s decision to increase Shaw’s pay despite poor company performance and failing to hit his performance targets. Based on Shaw’s BA performance scorecard, we’d have questions on a compensation increase as well.

The Starbucks proxy battle also had big news as proxy advisory firm ISS came out in support of electing SBUX’s full slate of directors and voting against the SOC slate.

$SBUX gets ISS support in proxy fight

“Vote FOR ONLY the Starbucks Director Nominees” pic.twitter.com/pgSyygWGKp

— Boardroom Alpha (@boardroomalpha) March 1, 2024

There were also some big moves in the boardroom this week. Celebrated tech CEO Frank Slootman is stepping down from Snoflake (SNOW) and speculation has begun that he could be inline for Alphabet’s (GOOGL) if the backlash from their AI launches heats up too much. Getaround (GETR) founder Samir M Zaid steps aside for Eduardo Iniguez Vazquez who will have a massive turnaround on his hands. Longtime JB Hunt CEO John Roberts ends his successful run and turns the reins over to Shelley Simplson. See the full CEO / CFO executive moves listing below.

ACTIVISM UPDATE

NEW COOPERATION AGREEMENTS

| TARGET | 1-Year TSR | ACTIVIST | SUMMARY | FILING | DATE | STOCK CHANGE | DAYS SINCE |

|---|---|---|---|---|---|---|---|

| INDEPENDENCE REALTY TRUST INC (IRT) | -15.8% | Argosy-Lionbridge Real Estate Securities, Samuel Foster and Marion Kirwin | Added Craig Macnab to the board | View Filing | 2024-03-01 | 0.0% | 0 |

| CITI TRENDS INC (CTRN) | 10.6% | Fund 1 Investments |

|

View Filing | 2024-02-29 | 6.5% | 1 |

| BJS RESTAURANTS INC (BJRI) | 9.4% | Fund 1 Investments |

|

View Filing | 2024-02-28 | 2.7% | 2 |

| ON24 INC (ONTF) | -15.8% | Indaba Capital Management |

|

View Filing | 2024-02-26 | -2.0% | 4 |

LATEST 13D ACTIVIST FILINGS

| FILED | TICKER | COMPANY | FILED BY | OWNERSHIP | 1-Year TSR | SUMMARY | FILING |

|---|---|---|---|---|---|---|---|

| 2024-02-27 | CRTO | CRITEO SA | Petrus Advisers Ltd. | 5.60 | -2.4% | Petrus Advisers sent a letter to Criteo asking it to:

Criteo’s Response to Petrus Letter stated that:

|

2024-02-27 – SC 13D |

| 2024-02-27 | NURO | NEUROMETRIX INC | Fields Ephraim G | 9.30 | -71.6% | Believes the company should liquidate and return the proceeds to shareholders. | 2024-02-27 – SC 13D |

| 2024-02-23 | EAF | GRAFTECH INTERNATIONAL LTD | Undavia Nilesh | 5.74 | -68.8% | Mr. Undavia invested in the company due to its favorable market position and potential for long-term profitability, supported by extensive research. However, he identified serious errors by the current board, particularly in their CEO selection process. Despite seeking collaboration with the board, his attempts were rebuffed, indicating potential entrenchment. Consequently, Mr. Undavia believes the addition of two new board members is necessary to ensure a suitable CEO is chosen. He has nominated two candidates committed to corporate governance best practices, aiming for positive outcomes for shareholders. If the current board obstructs this nomination, Mr. Undavia may pursue a “denial of quorum” campaign to enforce shareholder desire for change. | 2024-02-23 – SC 13D |

LATEST PROXY CONTEST FILINGS

| TICKER | COMPANY | LATEST PROXY | SUMMARY | FILED BY | FILINGS |

|---|---|---|---|---|---|

| DIS | WALT DISNEY CO | 2024-02-06 – DEFC14A | Latest Update On February 29th, nine of Walt Disney’s grandchildren — including Abigail Disney and Roy Disney — put their weight behind Bob Iger and the current board. They forcefully rejected the idea that Trian and Nelson Peltz joining the board would be a positive for the company.Activist / Trian Summary

Activist / Blackwell’s Summary

|

WALT DISNEY CO | 2024-02-29 – DEFA14A 2024-02-27 – DEFA14A 2024-02-27 – DEFA14A 2024-02-26 – DEFA14A 2024-02-26 – DEFA14A |

| Blackwells Capital LLC | 2024-02-29 – DFAN14A 2024-02-28 – DFAN14A 2024-02-27 – DFAN14A 2024-02-26 – DFAN14A 2024-02-26 – DFAN14A 2024-02-23 – DFAN14A |

||||

| Trian / Nelson Peltz | 2024-02-29 – DFAN14A 2024-02-28 – DFAN14A 2024-02-27 – DFAN14A 2024-02-26 – DFAN14A 2024-02-23 – DFAN14A 2024-02-23 – DFAN14A |

||||

| NSC | NORFOLK SOUTHERN CORP | 2024-02-26 – PREC14A | Latest Update

Activist / Ancora Summary

|

NORFOLK SOUTHERN CORP | 2024-03-01 – DFAN14A 2024-02-29 – DEFA14A 2024-02-26 – PREC14A 2024-02-26 – DEFA14A |

| ANCORA ADVISORS, LLC | 2024-02-28 – DFAN14A 2024-02-23 – DFAN14A |

||||

| WH | WYNDHAM HOTELS & RESORTS INC | 2024-02-27 – PREC14A |

|

WYNDHAM HOTELS & RESORTS INC | 2024-02-26 – PREC14A 2024-02-23 – DEFA14A |

| CHOICE HOTELS INTERNATIONAL INC | 2024-02-27 – PREC14A | ||||

| SBUX | STARBUCKS CORP | 2024-01-25 – DEFC14A |

|

STARBUCKS CORP | 2024-02-29 – DEFA14A 2024-02-27 – DEFA14A 2024-02-23 – DEFA14A |

| Strategic Organizing Center | 2024-02-29 – DFAN14A 2024-02-29 – DFAN14A 2024-02-27 – DFAN14A |

||||

| ELAN | ELANCO ANIMAL HEALTH INC |

|

ELANCO ANIMAL HEALTH INC | 2024-02-29 – DEFA14A 2024-02-29 – DEFA14A |

|

| ANCORA ADVISORS, LLC | 2024-02-29 – DFAN14A |

CEO & CFO MOVES

| COMPANY | MARKET CAP / TSR | ROLE | LEAVING | JOINING | JOINER BIOGRAPHY |

|---|---|---|---|---|---|

| ADMA BIOLOGICS INC (ADMA) | Mkt Cap: $1.2B 1-Yr TSR: 51.0% |

CFO | Brian Lenz 11.9 yrs ; -4.4% TSR |

Adam S Grossman (interim) |

Adam S. Grossman, 46 – Founder, Director, President and Chief Executive Officer Mr. Grossman has been a director of the Company since 2007, has served as the Company’s President and Chief Executive Officer since October 2011 and as the Company’s President and Chief Operating Officer between 2007 and October 2011. Mr. Grossman has over 20 years of experience in the blood and plasma industry. Prior …read full bio |

| ALLIANCEBERNSTEIN HOLDING LP (AB) | Mkt Cap: $3.6B 1-Yr TSR: -11.0% |

CFO | William R Siemers .8 yrs *interim; ; 1.3% TSR |

Jackie Marks | Ms. Marks, age 45, joins the firm with more than 20 years of relevant experience, most recently serving as CFO of Condé Nast Publications from March 2021 to March 2023. Prior to joining Condé Nast, Ms. Marks served as CFO at Mercer from April 2018 to March 2021. Previously, she served in various leadership positions at Thompson Reuters from August 2003 to April 2018….read full bio |

| AMERICAN ELECTRIC POWER CO INC (AEP) | Mkt Cap: $44.8B 1-Yr TSR: 1.0% |

CEO | Julia A Sloat 1.1 yrs ; -11.3% TSR |

Benjamin G S Fowke III (interim) |

Fowke has been a member of AEP’s Board since February 2022, and was chairman and CEO of Xcel for more than a decade until his retirement as CEO in August 2021. He remained executive chairman of the Xcel Board until December 2021. Fowke held a variety of leadership roles at Xcel including chief operating officer and chief financial officer. Fowke has a bachelor’s degree in finance and a…read full bio |

| ARISTA NETWORKS INC (ANET) | Mkt Cap: $86.8B 1-Yr TSR: 100.1% |

CFO | Ita M Brennan 8.8 yrs ; 37.1% TSR |

Chantelle Yvette Breithaupt | Ms. Breithaupt, age 51, has served as Senior Vice President and Chief Financial Officer of Aspen Technology from March 2021 to present. Prior to Aspen Technology, Chantelle spent 7 years with Cisco Systems Inc. She held multiple leadership positions at Cisco, most recently as Senior Vice President, Finance from January 2021 to March 2021, Vice President of Finance – Customer Experience/Servi…read full bio |

| ARVINAS INC (ARVN) | Mkt Cap: $3.1B 1-Yr TSR: 50.0% |

CFO | Sean A Cassidy 10.6 yrs ; 21.5% TSR |

Randy Teel (interim) |

Dr. Teel, age 45, has served as the Company’s Senior Vice President, Corporate and Business Development since September 2021 and will also continue in those roles where he is responsible for the Company’s corporate strategy, business development, investor relations, and communications functions. From May 2018 to September 2021, Dr. Teel served as the Company’s Vice President of C…read full bio |

| ATI INC (ATI) | Mkt Cap: $6.3B 1-Yr TSR: 21.0% |

CEO | Robert S Wetherbee 5.5 yrs ; 12.2% TSR |

Kimberly A Fields | Ms. Fields, age 54, joined ATI in 2019 as Executive Vice President of ATI’s Flat Rolled Products group, and in 2020 took on leadership of both the Company’s business segments. She was appointed Chief Operating Officer in January 2022 and became President and Chief Operating Officer in July 2023. Prior to joining ATI, Fields was group president for industrial and energy at IDEX Cor…read full bio |

| BIOSIG TECHNOLOGIES INC (BSGM) | Mkt Cap: $6.0M 1-Yr TSR: -94.3% |

CEO | Kenneth L Londoner 6.6 yrs ; -42.0% TSR |

Frederick Hrkac | Frederick D. Hrkac. Mr. Hrkac has served as our director since April 2022 and as an Executive Vice President since November 2023. Mr. Hrkac has more than 30 years of experience in the medical device industry as an executive and corporate board director. He is currently serves on the board of Serres in Helsinki, Finland since September 2018, and Spineart in Geneva, Switzerland as chairman of the bo…read full bio |

| BORGWARNER INC (BWA) | Mkt Cap: $7.2B 1-Yr TSR: -28.5% |

CFO | Kevin Nowlan 4.9 yrs ; .6% TSR |

Craig Aaron | Mr. Aaron, 46, has served as the Company’s Vice President and Controller since December 2022. Prior to serving as the Company’s Vice President and Controller, Mr. Aaron served as the Company’s Vice President and Treasurer from March 2019 to December 2022 and as the Vice President of Finance of BorgWarner Morse Systems from December 2016 to February 2019….read full bio |

| BOSTON BEER CO INC (SAM) | Mkt Cap: $3.7B 1-Yr TSR: -4.8% |

CEO | David A Burwick 5.9 yrs ; 12.2% TSR |

Michael Spillane | Spillane, who joined Boston Beer’s board in 2016, has a broad business background with extensive consumer goods experience. Over the past 17 years, he has held senior positions at Nike, Inc., most recently as President of Consumer Creation and prior to that as President of Product and Merchandising. Additionally, he served as President and CEO of subsidiaries Umbro and Converse, as well as G…read full bio |

| CHEMOURS CO (CC) | Mkt Cap: $2.9B 1-Yr TSR: -40.5% |

CEO | Mark Newman 2.6 yrs ; -4.1% TSR |

Denise Dignam (interim) |

Ms. Dignam, age 58, has been serving as the Company’s President – Titanium Technologies since March 2023. Ms. Dignam joined Chemours in 2015 and has served as our President – Advanced Performance Materials from 2021-2023; Vice President of Global Operations – Fluoroproducts, from 2019 to 2021; Global Senior Business Director – Fluoropolymers, from 2016 to 20…read full bio |

| CHEMOURS CO (CC) | Mkt Cap: $2.9B 1-Yr TSR: -40.5% |

CFO | Sameer Ralhan 4.7 yrs ; 7.1% TSR |

Matthew S Abbott (interim) |

Mr. Abbott, age 48, has been serving as the Company’s Senior Vice President & Chief Enterprise Transformation Officer, with responsibility for Enterprise Capital Projects and Engineering Technology, Information Technology, Cyber Security, Digital and Data Analytics, and Procurement, since June 2023. Mr. Abbott joined Chemours in 2017 and has served as Chemours’ Vice …read full bio |

| CHEVRON CORP (CVX) | Mkt Cap: $282.3B 1-Yr TSR: -1.6% |

CFO | Pierre R Breber 4.8 yrs ; 9.0% TSR |

Eimear P Bonner | Ms. Bonner, age 49, joined Chevron in 1998, and currently serves as Vice President of Chevron, a position she has held since August 2021, and as President of the Chevron Technical Center and Chief Technology Officer, positions she has held since February 2021. Prior to that, Ms. Bonner served as general director of Tengizchevroil LLP (“TCO”), in which Chevron has a 50 percent equity ownership inte…read full bio |

| COMPASS PATHWAYS PLC (CMPS) | Mkt Cap: $659.6M 1-Yr TSR: 24.5% |

CFO | Mary -Rose Hughes .4 yrs *interim; |

Teri Loxam | Teri Loxam, age 51, has over 20 years of experience in the pharmaceutical and biotechnology sectors with diverse roles spanning strategy, investor relations, finance, and communications. Ms. Loxam served as Chief Financial Officer of Gameto, Inc., a privately held, clinical-stage biotechnology company from April 2023 until October 2023. Previously, Ms. Loxam served as Chief Financial Officer and C…read full bio |

| ENERPAC TOOL GROUP CORP (EPAC) | Mkt Cap: $1.8B 1-Yr TSR: 25.4% |

CFO | Anthony Colucci 1.8 yrs ; 27.4% TSR |

P. Shannon Burns (interim) |

Mr. Burns, age 53, has served as Head of Financial Planning, Operations, and Decision Support since joining the Company in November 2022. Prior to joining the Company, Mr. Burns was with Harley-Davidson Motor Company, holding various positions in Finance and Investor Relations from August 2011 through November 2022. From June 2007 to August 2011, Mr. Burns was with MillerCoors Brewing Company, ser…read full bio |

| ENTERPRISE PRODUCTS PARTNERS LP (EPD) | Mkt Cap: $59.5B 1-Yr TSR: 15.9% |

CFO | W Randall Fowler | Daniel Boss | R. Daniel Boss Mr. Boss, a Certified Public Accountant, has served as Executive Vice President – Accounting, Risk Control and Information Technology of Enterprise GP since January 2020 and previously served as Senior Vice President (Accounting and Risk Control) from August 2016 to January 2020. On February 12, 2024, the Board promoted Mr. Boss to the position of Executive Vice President and CFO of…read full bio |

| FIGS INC (FIGS) | Mkt Cap: $888.6M 1-Yr TSR: -43.2% |

CFO | Daniella Turenshine 2.3 yrs ; -54.3% TSR |

Kevin Fosty (interim) |

Mr. Fosty, age 52, has served as the Company’s VP, Controller since April 2021. In this role, he has been responsible for the Company’s accounting, financial reporting, tax and financial controls. Prior to joining the Company, from July 2011 to April 2021, Mr. Fosty served as senior director at The Siegfried Group, LLP, within the finance and corporate accounting group, providing contr…read full bio |

| GAIN THERAPEUTICS INC (GANX) | Mkt Cap: $58.0M 1-Yr TSR: 7.9% |

CFO | Charles Evan Ballantyne .9 yrs ; 1.1% TSR |

Gianluca Fuggetta | Mr. Fuggetta, age 35, has served as the Company’s Senior Director and Principal Accounting Officer since January 2023 and served as the Company’s Finance Director from July 2022 to December 2022. Prior to joining the Company, Mr. Fuggetta held various positions of increasing responsibility at PricewaterhouseCoopers from September 2013 until June 2022, most recently holding the po…read full bio |

| GETAROUND INC (GETR) | Mkt Cap: $22.5M 1-Yr TSR: -48.7% |

CEO | Samir M Zaid 1.2 yrs ; -94.7% TSR |

Eduardo Iniguez Vazquez | Mr. Iniguez, 38, previously served as the chief financial officer of Silvus Technologies, a developer of advanced multiple-input, multiple-output communication systems from November 2023 to February 2024. Prior to that, Iniguez served in various capacities at HyreCar, Inc. from May 2022 to May 2023, including serving as its interim chief executive officer from December 2022 to May 2023, when he su…read full bio |

| HEALTH CATALYST INC (HCAT) | Mkt Cap: $487.2M 1-Yr TSR: -40.4% |

CFO | Bryan Truman Hunt 3.2 yrs ; -36.8% TSR |

Jason Alger | Mr. Alger will continue as the Company’s principal accounting officer. Mr. Alger has served as the Company’s Chief Accounting Officer and principal accounting officer since January 2021. Mr. Alger has served as the Company’s Senior Vice President of Finance since September 2017, and as Controller since April 2013. Prior to joining the Company, Mr. Alger was at the public accounti…read full bio |

| HELEN OF TROY LTD (HELE) | Mkt Cap: $3.0B 1-Yr TSR: 10.9% |

CEO | Julien Mininberg 9.9 yrs ; 7.0% TSR |

Noel Geoffroy | NOEL M. GEOFFROY Chief Operating Officer COO Since: 2022 Age: 52 Ms. Geoffroy joined the Company in May 2022 to serve as its COO. Prior to joining the Company, Ms. Geoffroy had served as Head of North America Consumer Healthcare at Sanofi S.A., a global healthcare company, and held such position since January 2019. Prior to that she served in various leadership roles from December 2012 to December…read full bio |

| HUNT J B TRANSPORT SERVICES INC (JBHT) | Mkt Cap: $21.3B 1-Yr TSR: 15.1% |

CEO | John N Roberts 13.5 yrs ; 14.5% TSR |

Shelley Simpson | Ms. Simpson, 52, has served as the Company’s President since August 1, 2022. Prior to becoming President, she served as Chief Commercial Officer from 2017 to 2022 and Executive Vice President of People and Human Resources from 2020 to 2022. From 2017 to 2020, she served as the Company’s President of Highway Services, a position created by combining the Company’s executive managem…read full bio |

| JAZZ PHARMACEUTICALS PLC (JAZZ) | Mkt Cap: $7.4B 1-Yr TSR: -15.3% |

CFO | Renee D Gala 4.0 yrs ; -2.1% TSR |

Philip Johnson | Previously, Mr. Johnson, age 59, served as the Group Vice President of Finance, Treasurer, at Eli Lilly and Company, Inc., an international biotechnology company, from January 2018 to March 2024. Prior to that, Mr. Johnson served in various roles in the finance organization. Mr. Johnson holds a B.S. in Finance from the University of Illinois and a Master of Management from the Kello…read full bio |

| KALTURA INC (KLTR) | Mkt Cap: $190.5M 1-Yr TSR: -31.1% |

CFO | Yaron Garmazi 2.6 yrs ; -54.0% TSR |

John Doherty | Mr. Doherty, age 59, most recently served as Chief Financial Officer and Chief Operating Officer for Magic Leap, Inc. Prior to joining Magic Leap in 2020, Mr. Doherty served as Chief Financial Officer of InterXion Holding N.V., a data center services provider, from 2018 to 2020. In addition, Mr. Doherty held a variety of financial roles at Verizon Communications Inc., most recently serving as Seni…read full bio |

| LANTHEUS HOLDINGS INC (LNTH) | Mkt Cap: $4.5B 1-Yr TSR: -11.6% |

CEO | Mary Anne Heino 8.6 yrs ; 27.9% TSR |

Brian A Markison | Mr. Markison has 40 years of healthcare experience, including executive roles at King Pharmaceuticals, Fougera Pharmaceuticals and RVL Pharmaceuticals plc, as well as senior level roles at Bristol-Myers Squibb. Mr. Markison has maintained a steadfast focus throughout his career on oncology, virology, and diagnostics, leading the successful commercial introduction of numerous therapeutics…read full bio |

| LIVANOVA PLC (LIVN) | Mkt Cap: $3.0B 1-Yr TSR: 15.8% |

CEO | William A Kozy .9 yrs *interim; ; 19.8% TSR |

Vladimir A. Makatsaria | Mr. Makatsaria, 51, most recently served as Company Group Chairman at Johnson & Johnson (“J&J”) MedTech as head of Ethicon, a global leader in the surgical technologies market, a position he held since October 2018. Prior to that, Mr. Makatsaria was at J&J Medical Devices, Asia Pacific, where he served as Company Group Chairman and member of the Global Operating Committee f…read full bio |

| MACERICH CO (MAC) | Mkt Cap: $3.5B 1-Yr TSR: 45.7% |

CEO | Thomas E. O’Hern 5.1 yrs ; -12.6% TSR |

Jackson Hsieh | Mr. Hsieh, age 63, previously served as President and Chief Executive Officer of Spirit Realty Capital, Inc. and as a member of its board of directors from May 2017 until its merger with Realty Income in January 2024. Prior to joining Spirit in September 2016, Mr. Hsieh served as Managing Director and Vice Chairman of Investment Banking at Morgan Stanley, Vice Chairman and Sole…read full bio |

| MARKETAXESS HOLDINGS INC (MKTX) | Mkt Cap: $8.1B 1-Yr TSR: -36.8% |

CFO | Christopher R Concannon .3 yrs |

Ilene Fiszel Bieler | Ilene Fiszel Bieler, age 55, has served as Executive Vice President, Global Head of Investor Relations and Chief Operating Officer of State Street Global Markets and Global Credit Finance of State Street Corporation (“State Street”), a global financial services and bank holding company, from 2022 to present, Executive Vice President, Global Head of Investor Relations of State Street fr…read full bio |

| MURPHY USA INC (MUSA) | Mkt Cap: $8.7B 1-Yr TSR: 64.2% |

CFO | Malynda K West 10.6 yrs ; 25.1% TSR |

Galagher Jeff | Mr. Jeff has previously served as the Senior Vice President, FP&A, Treasurer and Chief Transformation Officer at Dollar Tree Stores, Inc. since 2023. Prior to his time at Dollar Tree, Mr. Jeff was Senior Vice President, Finance and Head of Strategy and Transformation at Advance Auto Parts from 2020 to 2023. Prior to 2020, Mr. Jeff was Vice President, U.S. Merchandising Strategy, Pricing and As…read full bio |

| NEXTDOOR HOLDINGS INC (KIND) | Mkt Cap: $862.1M 1-Yr TSR: 6.3% |

CEO | Sarah Friar 2.5 yrs ; -52.8% TSR |

Nirav N Tolia | Mr. Tolia, age 52, has served on the Board since November 2021, and has served as the Executive Chair of Hedosophia, an investor in the Company, since September 2021. Mr. Tolia is a co-founder of Nextdoor, Inc. (“Nextdoor”) and previously served as its Chief Executive Officer from September 2010 to December 2018. Before co-founding Nextdoor, Mr. Tolia was an Entrepreneur in Residence a…read full bio |

| PAR PACIFIC HOLDINGS INC (PARR) | Mkt Cap: $2.2B 1-Yr TSR: 30.0% |

CEO | William Pate 8.5 yrs ; 8.2% TSR |

William Monteleone | Mr. Monteleone, age 40, served as the Company’s President since January 2023, as Executive Vice President and Chief Financial Officer from January 2022 to January 2023, as Senior Vice President and Chief Financial Officer from March 2017 to January 2022, as Senior Vice President of Mergers & Acquisitions from January 2015 to March 2017, and as Chief Executive Officer from June 2013 …read full bio |

| SERES THERAPEUTICS INC (MCRB) | Mkt Cap: $147.4M 1-Yr TSR: -77.4% |

CFO | David Arkowitz 2.8 yrs ; -65.9% TSR |

Marella Thorell | Mr. Shaff, age 48, has served as the Company’s President and Chief Executive Officer and a member of the Board since January 2019. Previously, he served as the Company’s Chief Operating and Financial Officer and Executive Vice President from January 2018 until January 2019 and as the Company’s Chief Financial Officer from November 2014 until January 2019. From January 2012 to Nov…read full bio |

| SILICON LABORATORIES INC (SLAB) | Mkt Cap: $4.4B 1-Yr TSR: -23.0% |

CFO | Mark D Mauldin .3 yrs *interim; |

Dean Butler | Mr. Butler, age 41, joins Silicon Labs from Synaptics Incorporated, where he has served as Senior Vice President and Chief Financial Officer since October 2019. Prior to joining Synaptics, Mr. Butler served as Vice President of Finance at Marvell Technology, Inc. from July 2016 to October 2019, served as Controller of the Ethernet Switching Division at Broadcom, …read full bio |

| SNOWFLAKE INC (SNOW) | Mkt Cap: $62.0B 1-Yr TSR: 22.0% |

CEO | Frank Slootman 4.8 yrs ; -2.1% TSR |

Sridhar Ramaswamy | Mr. Ramaswamy holds a B.S. degree in Computer Science from the Indian Institute of Technology Madras and M.S. and Ph.D. degrees in Computer Science from Brown University. Mr. Ramaswamy is qualified to serve on the Board because of his leadership experience and his business and technical experience, including his extensive cloud and infrastructure expertise and his experience in artificial intellig…read full bio |

| SPECTRAL AI INC (MDAI) | Mkt Cap: $32.5M 1-Yr TSR: -80.1% |

CEO | Wensheng Fan .4 yrs ; -80.8% TSR |

Peter M Carlson | Mr. Carlson, age 59, will receive annual base compensation of $550,000. He will be eligible for an annual target bonus of $550,000 payable upon the achievement of certain milestones and performance goals, as specified by the Board. He will be granted restricted stock units (RSUs) under and subject to the terms of the Company’s 2022 Long Term Incentive Plan on the date of employment, to acqui…read full bio |

| SUNPOWER CORP (SPWR) | Mkt Cap: $545.4M 1-Yr TSR: -79.3% |

CEO | Peter Faricy 2.8 yrs ; -53.7% TSR |

Thomas H Werner | Mr. Werner, 64, previously served as the Company’s chief executive officer from June 2010 to April 2021, as a member of the Board from June 2003 and as chairman of the Board from May 2011 to November 2021. From 2001 to 2003, before joining the Company, he held the position of chief executive officer of Silicon Light Machines, Inc., an optical solutions subsidiary of Cypress Semiconductor Cor…read full bio |

| SYNAPTICS INC (SYNA) | Mkt Cap: $3.9B 1-Yr TSR: -14.9% |

CFO | Dean Warren Butler 4.3 yrs ; 26.9% TSR |

Michael E Hurlston (interim) |

Michael E. Hurlston President, Chief Executive Officer and Director Age: 56 Director Since 2019 Committees: None Michael E. Hurlston has been a director and the President and Chief Executive Officer of the Company since August 2019. Prior to joining the Company, Mr. Hurlston served as the Chief Executive Officer and a member of the board of directors of Finisar Corporation from January 2018 to Au…read full bio |

| XOMETRY INC (XMTR) | Mkt Cap: $887.9M 1-Yr TSR: -35.7% |

CFO | James M Rallo 2.8 yrs ; -31.3% TSR |

James Miln | Mr. Miln, age 50, served in various roles at Yelp Inc. (“Yelp”) from February 2019 to February 2024, including most recently as its Senior Vice President, Finance and Investor Relations from January 2021 to February 2024. Mr. Miln also served as Yelp’s Vice President, Financial Planning and Analysis, from February 2019 to January 2021, and as Yelp’s Interim Chief Financial …read full bio |

More from Around the Web

The Activist Investor

- 8 Hot Topics in Activism

- Summary of Activism in 2023 and a Preview of Activism in 2024

- PJT Partners 2024 Proxy Season Preview

- BlackRock Updated 2024 U.S. Proxy Voting Guidelines

- Trends in S&P 500 Board of Director Compensation

Boardroom Alpha Governance FAQs

- FAQ: What are Activist Cooperation Agreements?

- Director Overboarding

- Say-on-Pay Voting: What You Need to Know

- Universal Proxy Cards — What You Need to Know

Boardroom Alpha Quick Links