- SPAC Market Review – October 2022

- Full SPAC Listing

- Podcast: Know Who Drives Return

- Daily SPAC Newsletter

Chart of the Day

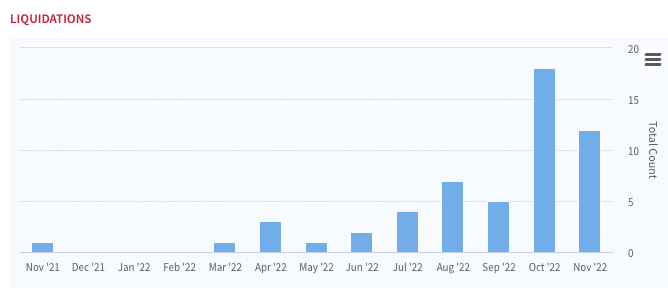

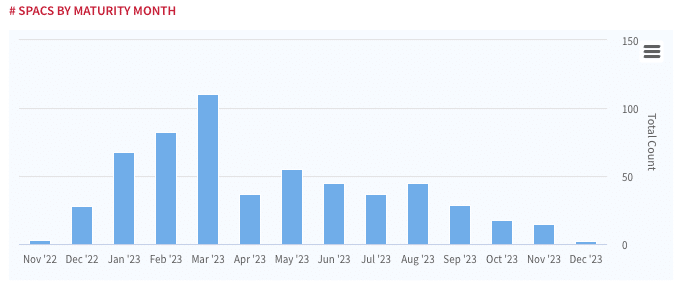

Happy (early) Thanksgiving! The SPAC market itself seems to be doing the most eating as 53 SPACs have already liquidated without a deal in 2022 and over 30 have scheduled EARLY liquidation votes.

That liquidation number is likely to remain elevated as we continue to creep closer to the great maturity wall of early 2023.

This Week in SPACs

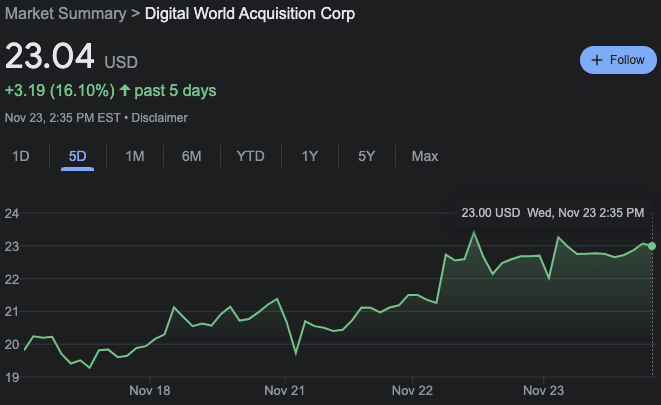

- “Trump SPAC” Digital World Acquisition Corp (DWAC) FINALLY scraped enough shareholders together to extend its deadline date out till September 2023. The SPAC’s shares have spiked on the news

- Gores makes it official as three different Gores SPACs (GTPA, GTPB, GSEV) have set their early liquidation votes for Mid-December and all signs are pointing to an early liquidation

- Despite the holiday shortened week, 5 SPACs announced DAs:

- Hainan Mansalu (HMAC) and Able View, $400M EV

- Forest Road Acquisition Corp. II (FRXB) and HyperloopTT, $600M EV

- Western Ventures Acquisition Corp. (WAVS) and Cycurion, $170M EV

- CIIG Capital Partners II (CIIG) and Zapp, $573MM EV

- Industrial Tech Acquisitions II (ITAQ) and NEXT Renewable Fuels, $530M EV

- OceanTech Acquisition Corp. (OTEC) needs over 500k shares to reverse their redemptions in order to effect their voted extension

- Serial SPAC sponsor Northern Star is bucking the liquidation trend and filed preliminary extension vote proxies for three of their outstanding SPACs NSTB, NSTC, and NSTD

- Three SPAC deals closed and began trading under new tickers

- ACEV –> Tempo Automation (TMPO)

- PTIC –> Appreciate Holdings (SFR)

- FLAC –> NewAmsterdam Pharma (NAMS)

- Angel Pond Holdings Corp. (POND) shareholders approved their deal with MariaDB, no word on redemptions nor time to close

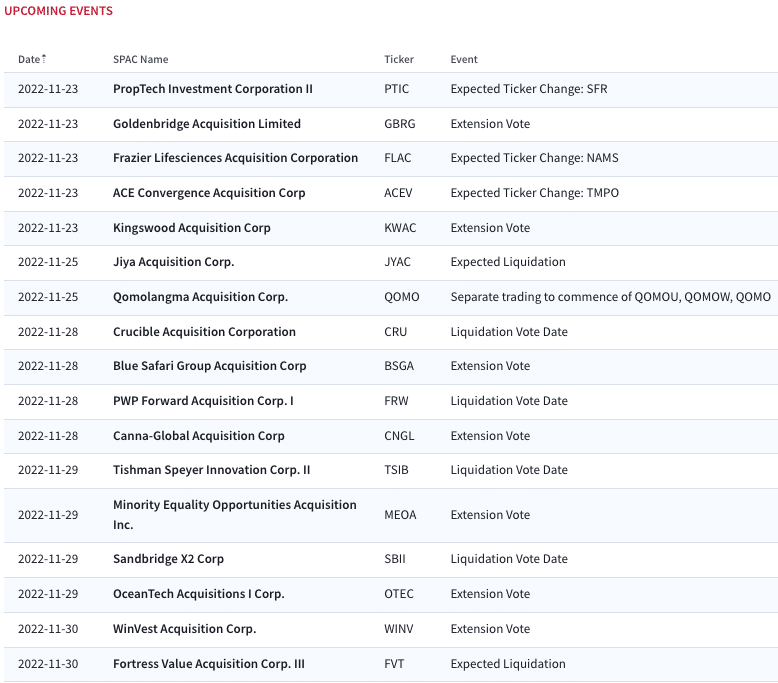

SPAC Calendar