Introduction

Welcome back to Boardroom Alpha’s monthly reflections on the SPAC market, we’re glad you’re still here! October was certainly an active month in terms of Pre-Deal SPAC positioning, given the continued volume of extension votes and, now, an influx of accelerated liquidations into 2022 (nearly 30). In addition, October saw a spike in new DAs that we haven’t seen in some months. Yet, DeSPAC performance remains incredibly poor, deal committed financing is almost non-existent, and 99% redemptions are making SPAC trust’s irrelevant. We wrap all the month’s activities below.

Rushing out the door, accelerating liquidations

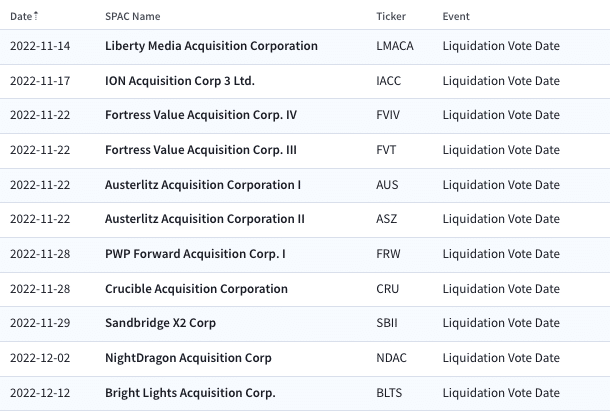

Last month we wrote about the potential for the excise tax to cause unintended economic pain on sponsors by triggering a new 1% tax if and when a SPAC were to liquidate and redeem its shares. Three such SPACs indicated in September that they wanted to avoid this uncertainty and simply liquidate in 2022. The floodgates have opened, as now upwards of ~30 SPACs have indicated they will do just that – caveat that two of them, AUS & ASZ, aren’t US domiciled – though still want to get out.

The broad consequences here are fairly minimal, although it can be a boon for yield-focused fixed income style investors. The pull forward in maturity (by as much as 4 months in some cases) will vastly reduce the duration of these assets and increase the yield that the SPACs will deliver. Thus, we have seen a ~2-3% increase in share price for SPACs that have indicated they will pull up their liquidation dates.

This dynamic is likely short lived, as once we get into 2023 fates are seemingly sealed. But for those looking to optimize the yield play, it may be worth looking out for US domiciled SPACs, with no deals announced, and maturities in the next few months.

Companies that have set early liquidation vote dates

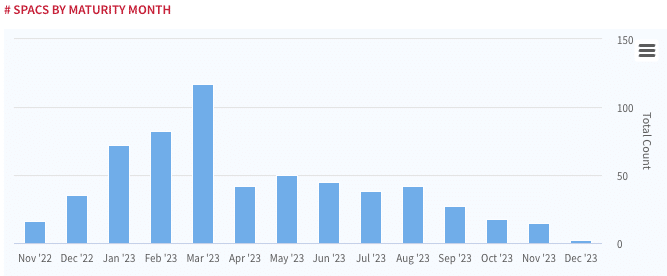

The Great Maturity Wall and Liquidations

The looming maturity wall in early 2023 is still largely in sight – though this might be slightly abated due to the aforementioned accelerated liquidations. The capital will still be returned to the market, but albeit on a bit more spread out basis that originally envisioned.

Bright side? Perhaps after March 2023 some normalcy can return to SPACs?

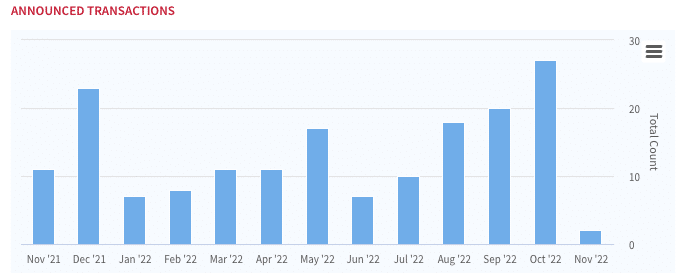

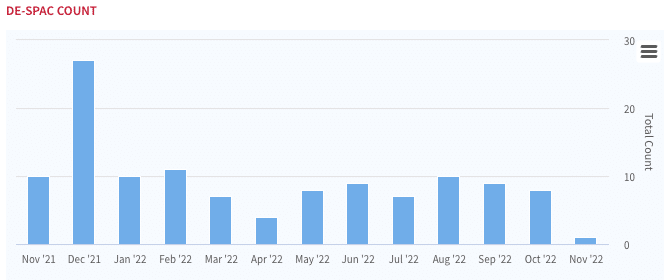

SPAC Merger Activity

Announced transactions really spiked in October, with 26 new deals being struck — the highest number in over a year. Though, given the incentives, it’s not not entirely shocking as hoards of SPACs are nearing their maturity dates and deals need to get done.

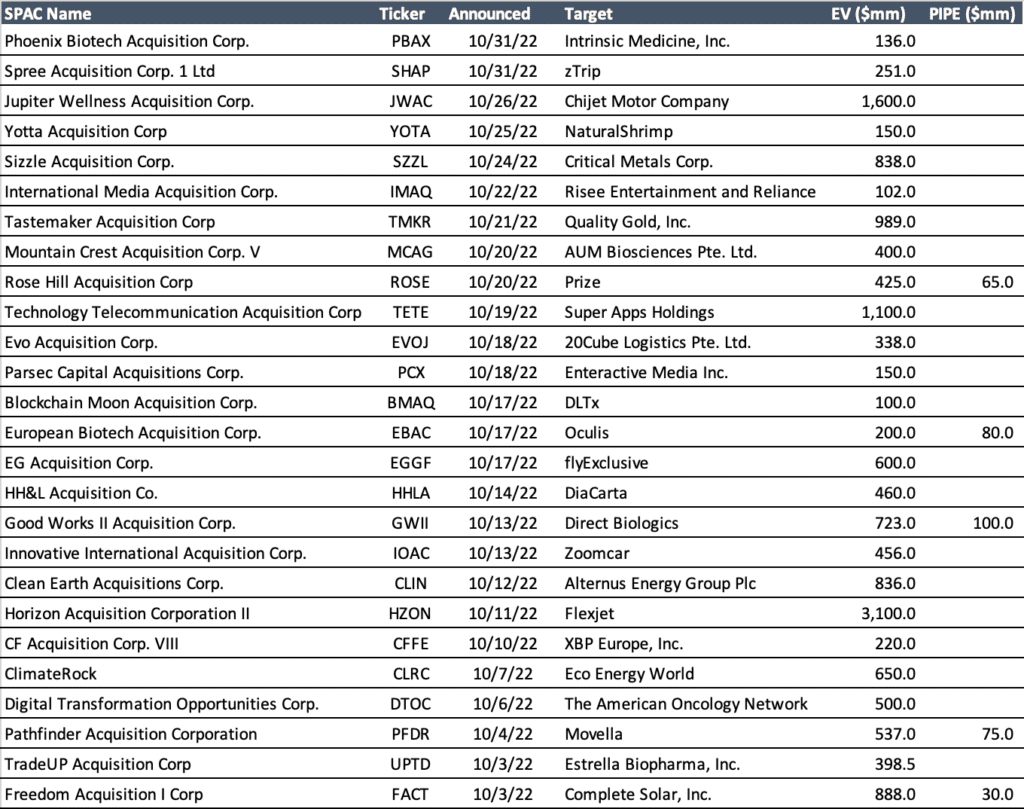

A few highlights:

- Just a few weeks after terminating a deal with Deep Medicine Acquisition Corp. (DMAQ), Chinese EV maker Chijet struck a deal with Jupiter Wellness Acquisition Corp. (JWAC), ironically both SPACs Chijet have now agreed to deals with were originally targeting healthcare companies

- Yotta Acquisition Corp. (YOTA) agreed to take former meme stonk NaturalShrimp (SHMP) in an uplist deal valuing the company at $150M

- Horizon Acquisition Corp. (HZON) landed the biggest deal of the month with a $3B valuation on its private jet co Flexjet. Private aviation companies have become sort of a favorite sector for SPACs.

October SPAC Deal Announcements

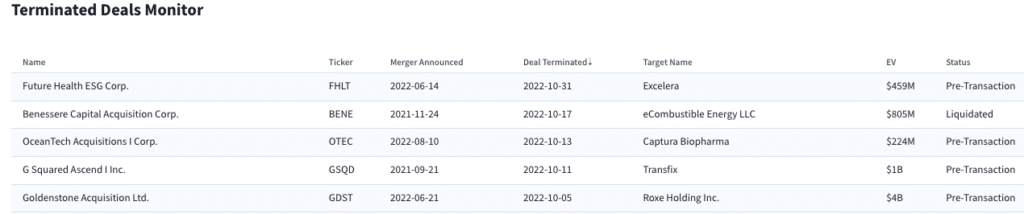

October’s Terminated SPAC Deals

Amid the barrage of merger announcements, there were just 5 deals that had called it quits in October. While higher than September’s, it remains below the elevated levels we saw in the Summer months.

Benessere Capital Acquistion Corp. (BENE), who is led by DWAC’s Patrick Orlando, decided to throw in the towel and liquidate after the termination of their deal with eCombustible, while the other 4 SPACs that terminated DAs are still (for the time being) searching for a new deal target.

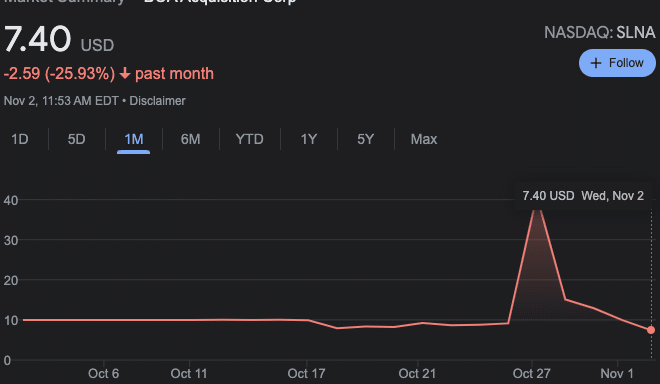

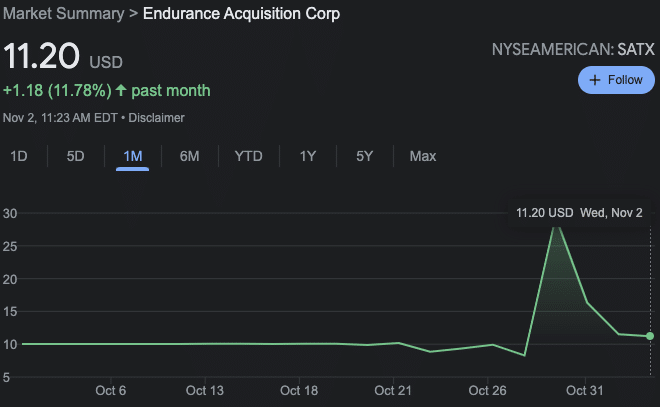

DeSPAC trade makes a return

After a few sleepy weeks (sorry memers), the low-float skyrockets returned in DeSPAC land amidst 8 companies officially changing tickers. Soaring high redemptions remains the name of the game (~99% for October), and with a dearth of committed capital in the DeSPAC process, it’s no surprise that most deals are not being well received. Save for a few lucky traders who can hit the low-float, DeSPAC land remains a dangerous place.

SLNA (SPAC BOA Acquisition Corp) shares skyrocketed to $40 before settling back down to earth

SATX (SPAC Endurance Acquisition Corp.) shares also tipped $30 dollars before settling down to a respectable $11

So who’s next? Take a look at the upcoming merger votes, and potential DeSPAC fun coming this month and next.

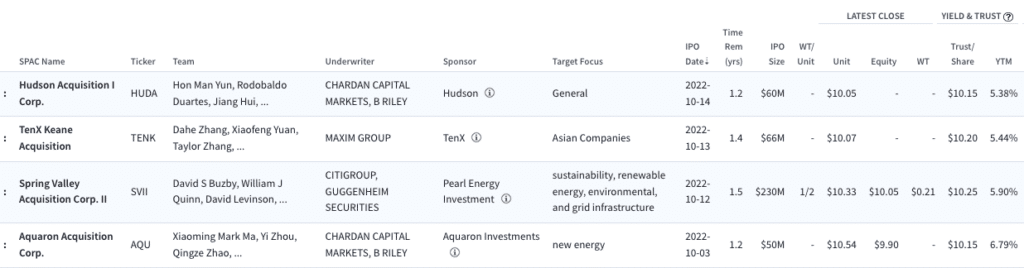

SPAC IPOs

In what continues to be the norm, we saw a few SPAC IPOs hit the tape with 4 ultimately pricing in October. Nothing much to write home about besides a return of the bulge bracket banks, as Citigroup underwrote Spring Valley Acquisition Corp. II (SVII) $230M IPO. A welcome sign for the return of quality IPOs from (a) a repeat sponsor group and (b) one of the largest and most trusted underwriters.

What’s next?

SEC guidance on SPAC rules? Clarification of excise tax for US domiciled companies? A return to a more normal market as things clear out and odd technicalities don’t dominate? Who knows if we could be so lucky. Thanks for reading along and continuing to follow Boardroom Alpha for all things SPAC.