- SPAC Market Review – October 2022

- Full SPAC Listing

- Podcast: Know Who Drives Return

- Daily SPAC Newsletter

Charts of the Day

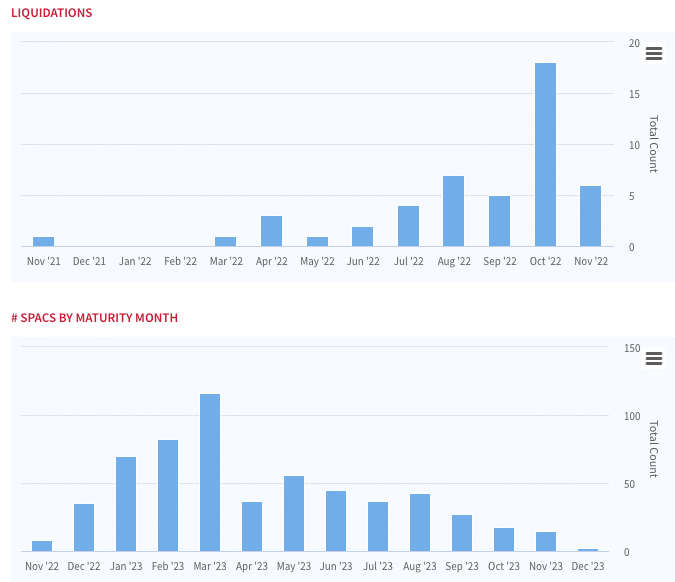

A friendly reminder of the massive wave of completed liquidations (in addition to the not pictured ~50 early votes) and the early 2023 maturity wall of SPACs.

Today in SPACs

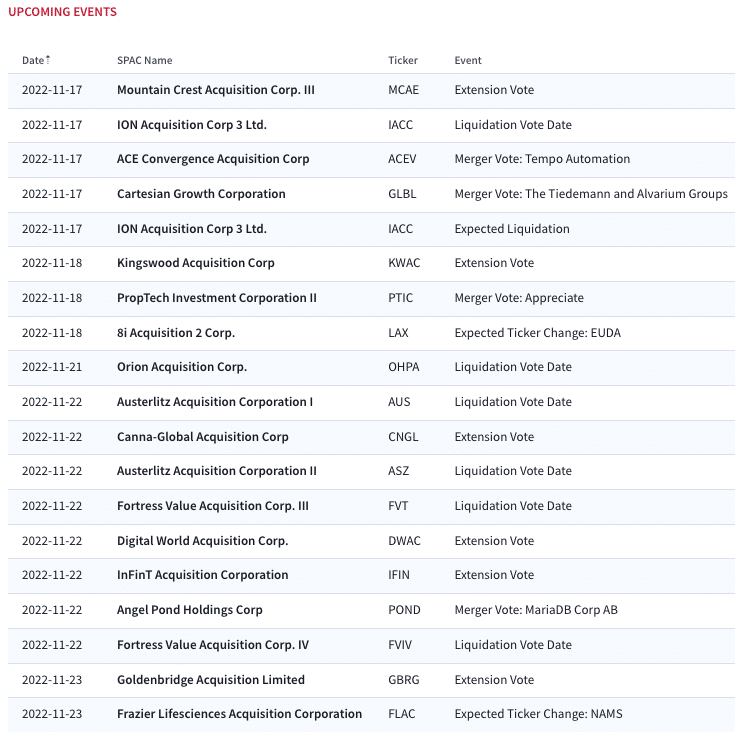

- Cartesian Growth Corporation (GLBL) shareholders approved their deal with Tiedemann Group and Alvarium Investments, though will wait till January 3, 2023 to close the transaction

- French firm Digital Virgo agreed to go public via Goal Acquisitions Corp (PUCK)

- 8i Acquisition 2 Corp. (LAX) and EUDA Health closed their merger and will trade as EUDA tomorrow, 11/18

SPAC Calendar

Today’s SPAC Movers

Biggest Gainers

20.91% ~ $ 10.41 | GLBL – Cartesian Growth Corporation (Announced)

10.60% ~ $ 9.60 | VENA – Venus Acquisition Corporation (Announced)

1.77% ~ $ 9.80 | FLAC – Frazier Lifesciences Acquisition Corporation (Announced)

.99% ~ $ 10.17 | HMA – Heartland Media Acquisition Corp. (Pre-Deal)

.71% ~ $ 9.91 | CORS – Corsair Partnering Corporation (Pre-Deal)

.69% ~ $ 10.16 | APAC – StoneBridge Acquisition Corp. (Pre-Deal)

.69% ~ $ 10.16 | ROCG – Roth CH Acquisition IV Co. (Pre-Deal)

.60% ~ $ 10.02 | GAQ – Generation Asia I Acquisition Ltd (Pre-Deal)

.60% ~ $ 10.14 | FEXD – Fintech Ecosystem Development Corp. (Announced)

.51% ~ $ 9.83 | JAQC – Jupiter Acquisition Corporation (Pre-Deal)

.51% ~ $ 9.90 | NFYS – Enphys Acquisition Corp. (Pre-Deal)

.50% ~ $ 10.09 | CSLM – Consilium Acquisition Corp I, Ltd. (Pre-Deal)

.50% ~ $ 10.10 | KNSW – KnightSwan Acquisiton Corp (Pre-Deal)

.50% ~ $ 10.10 | HHGC – HHG Capital Corporation (Pre-Deal)

.50% ~ $ 10.14 | RACY – Relativity Acquisition Corp (Pre-Deal)

.50% ~ $ 10.15 | CONX – CONX Corp (Pre-Deal)

.49% ~ $ 10.28 | APCA – AP Acquisition Corp (Pre-Deal)

.45% ~ $ 10.01 | TBCP – Thunder Bridge Capital Partners III Inc. (Pre-Deal)

.45% ~ $ 10.14 | CENQ – CENAQ Energy Corp. (Announced)

.41% ~ $ 9.81 | TWCB – Bilander Acquisition Corp. (Pre-Deal)

Biggest Losers

-8.08% ~ $ 9.22 | POND – Angel Pond Holdings Corp (Announced)

-6.34% ~ $ 19.94 | DWAC – Digital World Acquisition Corp. (Announced)

-2.27% ~ $ 11.63 | TINV – Tiga Acquisition Corp (Announced)

-1.96% ~ $ 9.51 | PTIC – PropTech Investment Corporation II (Announced)

-1.04% ~ $ 10.50 | ACEV – ACE Convergence Acquisition Corp (Announced)

-.84% ~ $ 10.03 | ROSS – Ross Acquisition Corp II (Pre-Deal)

-.70% ~ $ 9.96 | DUET – DUET Acquisition Corp. (Announced)

-.68% ~ $ 9.91 | HSAQ – Health Sciences Acquisitions Corporation 2 (Announced)

-.50% ~ $ 9.96 | FWAC – Fifth Wall Acquisition Corp. III (Pre-Deal)

-.49% ~ $ 10.20 | IOAC – Innovative International Acquisition Corp. (Announced)

-.49% ~ $ 10.20 | WNNR – Andretti Acquisition Corp. (Pre-Deal)

-.48% ~ $ 10.47 | VHAQ – Viveon Health Acquisition Corp. (Announced)

-.39% ~ $ 10.11 | SHAP – Spree Acquisition Corp. 1 Ltd (Announced)

-.39% ~ $ 10.14 | GIA – GigCapital5, Inc. (Announced)

-.39% ~ $ 10.17 | IFIN – InFinT Acquisition Corporation (Announced)

-.35% ~ $ 9.95 | INAQ – Insight Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.00 | STRE – Supernova Partners Acquisition Company III, Ltd (Pre-Deal)

-.30% ~ $ 10.05 | SUAC – ShoulderUP Technology Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.11 | ASCA – ASPAC I Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.11 | PTWO – Pono Capital Two, Inc. (Pre-Deal)