After nearly 6 weeks off with no issuance, SPAC IPOs finally returned this week with 2 (huge!) new offerings, including 1 from a repeat sponsor

- Pono Capital Two, Inc. (PTWO) priced $100M ($10.25 in trust)

- Mobiv Acquisition Corp (MOBV) priced $87.5 ($10.25 in trust)

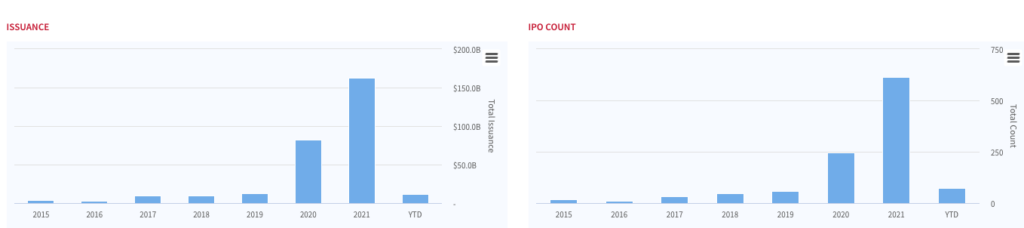

Both IPOs were led by EF Hutton. Unsurprising as we know many of the larger banks are on the sideline of SPAC underwriting as the SEC rules are hashed out. Though it’s welcome to see some new issuance in the market (and trade fine), the pace still lags the last two years by a large amount, and there is still an overabundance of aged SPACs in the system that likely will need to be cleared out.

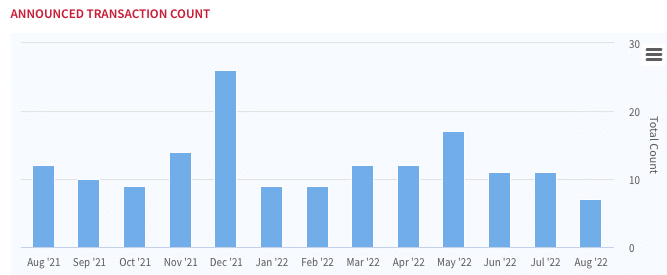

It was also welcome to see a flurry of new deals announced to start off August after just 11 new DAs were announced in June and July, there have already been 7 new pacts in the first week of August. Let’s see which ones get over the finish line.

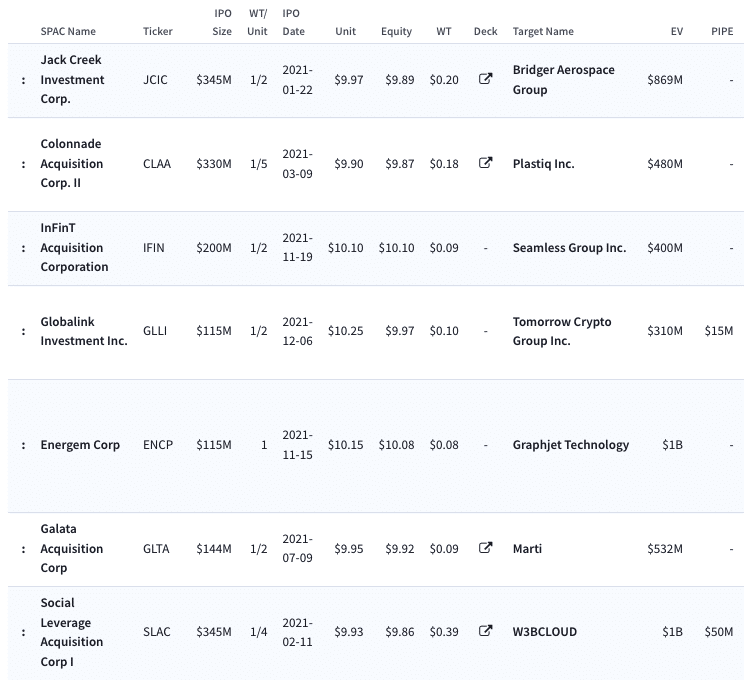

August’s Announced SPAC Deals

Elsewhere in SPACs

- In an interesting move David Simon resigned as Chairman of Simon Property Group Acquisition Holdings Inc. (SPGS) where his son Eli (who is the CEO) will take over as Chairman as well. He remains CEO of SPG.

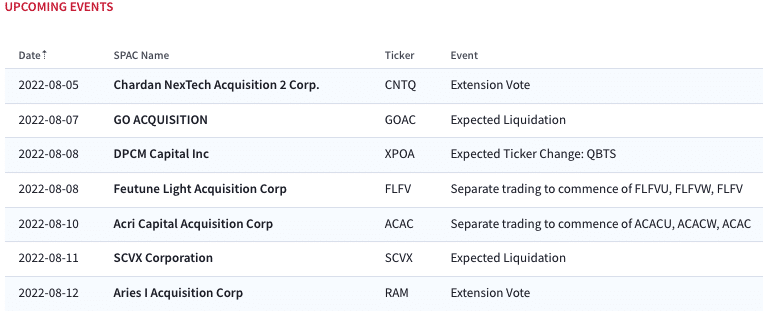

- DPCM Capital Inc. (XPOA) and D-Wave closed their business combination, and the stock will trade as QBTS on Monday. 97% of shareholders elected to redeem.

- Founder SPAC (FOUN) announced a $150M FPA in conjunction with its proposed combination with Rubicon

- Chardan Nextech Acquisition 2 Corp. (CNTQ) shareholders approved its extension amendment (lowering the cost for extension to $200k), though 76% of shareholders elected to redeem

Upcoming SPAC Calendar

Full calendar and SPAC database access here

Today’s Price Action

Biggest Gainers

2.65% ~ $ 10.08 | RXRA – RXR Acquisition Corp (Pre-Deal)

1.55% ~ $ 7.88 | CHWA – CHW Acquisition Corp (Announced)

1.22% ~ $ 9.95 | AMCI – AMCI Acquisition Corp. II (Announced)

1.20% ~ $ 10.10 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

.82% ~ $ 9.86 | PEGR – Project Energy Reimagined Acquisition Corp. (Pre-Deal)

.71% ~ $ 9.96 | AIMA – Aimfinity Investment Corp. I (Pre-Deal)

.50% ~ $ 10.02 | BYNO – byNordic Acquisition Corporation (Pre-Deal)

.50% ~ $ 10.05 | FTII – Future Tech II Acquisition Corp. (Pre-Deal)

.50% ~ $ 10.10 | PAFO – Pacifico Acquisition Corp. (Announced)

.41% ~ $ 9.81 | ORIA – Orion Biotech Opportunities Corp. (Pre-Deal)

.40% ~ $ 9.99 | BFAC – Battery Future Acquisition Corp. (Pre-Deal)

.40% ~ $ 10.14 | CENQ – CENAQ Energy Corp. (Pre-Deal)

.35% ~ $ 10.10 | CLAY – Chavant Capital Acquisition Corp. (Pre-Deal)

.31% ~ $ 9.80 | TCVA – TCV Acquisition Corp. (Pre-Deal)

.31% ~ $ 9.82 | IACC – ION Acquisition Corp 3 Ltd. (Pre-Deal)

.31% ~ $ 9.82 | XPAX – XPAC Acquisition Corp (Announced)

.31% ~ $ 9.84 | FTPA – FTAC Parnassus Acquisition Corp. (Pre-Deal)

.30% ~ $ 9.87 | ATAQ – Altimar Acquisition Corp. III (Pre-Deal)

.30% ~ $ 9.87 | PLMI – Plum Acquisition Corp. I (Pre-Deal)

.30% ~ $ 9.88 | GNAC – GROUP NINE ACQUISITION CORP. (Pre-Deal)

Biggest Losers

-13.85% ~ $ 8.15 | FOUN – Founder SPAC (Announced)

-1.28% ~ $ 10.06 | SHAP – Spree Acquisition Corp. 1 Ltd (Pre-Deal)

-.82% ~ $ 9.65 | NFYS – Enphys Acquisition Corp. (Pre-Deal)

-.80% ~ $ 9.86 | IPVF – InterPrivate III Financial Partners Inc. (Announced)

-.78% ~ $ 10.21 | CNTQ – Chardan NexTech Acquisition 2 Corp. (Announced)

-.51% ~ $ 9.69 | WAVC – Waverley Capital Acquisition Corp. 1 (Pre-Deal)

-.40% ~ $ 9.85 | MCAC – Monterey Capital Acquisition Corp (Pre-Deal)

-.40% ~ $ 9.93 | JGGC – Jaguar Global Growth Corp I (Pre-Deal)

-.40% ~ $ 9.98 | LBBB – Lakeshore Acquisition II Corp. (Pre-Deal)

-.40% ~ $ 10.03 | HNRA – HNR Acquisition Corp (Pre-Deal)

-.31% ~ $ 9.70 | CORS – Corsair Partnering Corporation (Pre-Deal)

-.30% ~ $ 9.83 | ACQR – Independence Holdings Corp (Pre-Deal)

-.30% ~ $ 9.85 | FACT – Freedom Acquisition I Corp (Pre-Deal)

-.30% ~ $ 9.87 | GLBL – Cartesian Growth Corporation (Announced)

-.30% ~ $ 9.95 | ARTE – Artemis Strategic Investment Corporation (Announced)

-.30% ~ $ 10.02 | SHCA – Spindletop Health Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.04 | FEXD – Fintech Ecosystem Development Corp. (Pre-Deal)

-.30% ~ $ 10.04 | MBSC – M3-Brigade Acquisition III Corp. (Pre-Deal)

-.30% ~ $ 10.06 | AFAC – Arena Fortify Acquisition Corp. (Pre-Deal)

-.30% ~ $ 10.09 | JMAC – Maxpro Capital Acquisition Corp. (Pre-Deal)