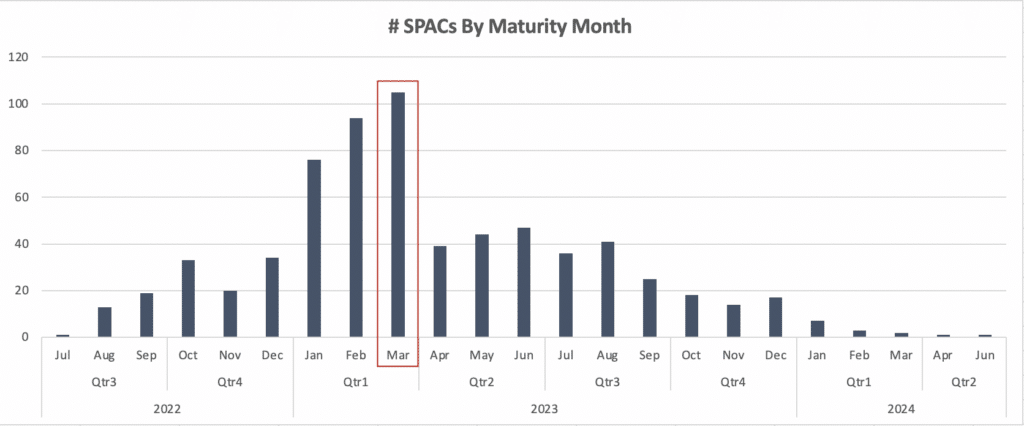

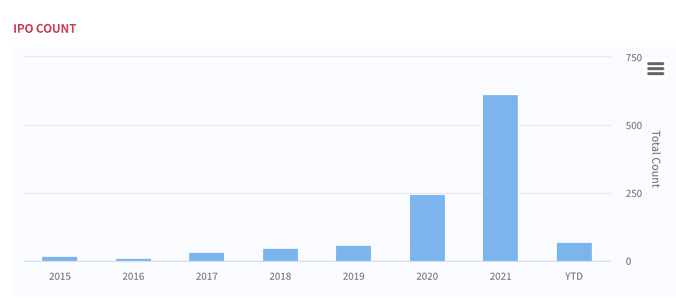

The macro and boarder market narrative continues to be volatile, but for SPACs, the narrative has largely remained the same over the last few months: very low issuance (none in July!), slower deals, liquidations, registration withdrawals and extensions. Pre-deal and pre-close hype are long things of the past, and the yield play remains the prevailing strategy for current SPAC investors. The IPO market fully closed in July with ZERO new pricings, and the backlog doesn’t appear to be large. With a little over 6 months to the looming March 2023 maturity wall, expect primary market activity to remain muted.

Below we recap the month that was for SPACs in July 2022.

Deal Announcements and Terminations

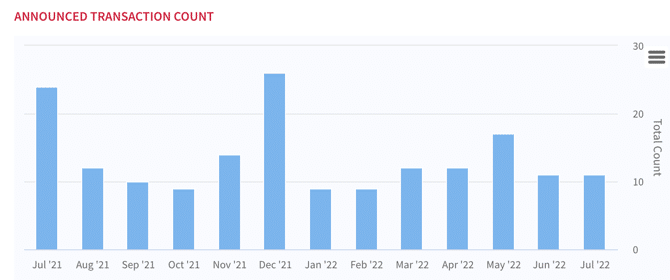

With over 580 SPACs still searching for deals, the reality remains that not enough deals are getting done to clear the backlog of supply. July’s 11 deals barely put a dent in the backlog and there are no signs of deal announcements accelerating. And, even that 11 deals number is misleading given there were 6 terminations — so net net, the backlog of SPACs looking for deals was only reduced by 5. This reinforces our base case that the great liquidation of early 2023 is well on its way. We expect at least 50-75% of SPACs in that time period to liquidate. Recent liquidations have included high-profile SPACs such as the biggest of them all, the $4B Pershing Square Tontine Holdings (PSTH) from Bill Ackman, and Redball Acquisition Corp. (RBAC).

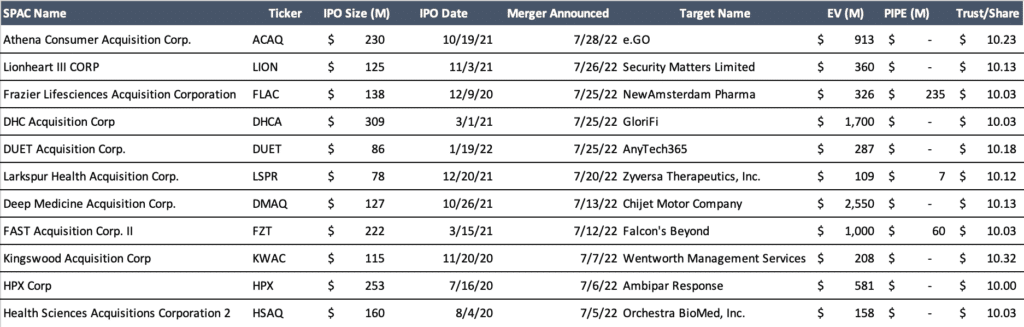

July SPAC Deal Announcements

Monthly Announced SPAC Deals – Pace Remains Too Slow to Avoid Significant Liquidations

For the deals that were announced, a few highlights:

- Lionheart II Corp. (LION) struck a deal with an Australian public company as its target, and plans to list on Nasdaq. You might remember the Lionheart Capital team as the same backers of MSP Recovery, one of the worst performing DeSPACs ever

- DHCA Acquisition Corp (DHCA) agreed to a $1.7B deal with GloriFi, a fintech company that appears to very much be in still building mode

- Athena Consumer Acquisition Corp (ACAQ) turned back the clock to 2021 with its plan to take a German Electric Vehicle producer public

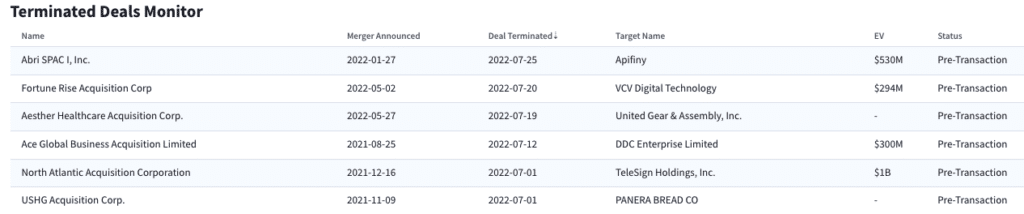

In addition to the 11 new DAs signed, several deals decided to call it quits. Again prevailing “market conditions” tending to be the culprit for the majority of the cancellations. Of note:

- Danny Meyer’s USHG Acquisition Corp (USGH) abandoned its plans to help take Panera Bread public

- Digital asset deals say no thanks: Both Abri SPAC I / Apifiny and Fortune Rise / VCV Digital technology deals were called off

- Dune Acquisition Corp. (DUNE) and TradeZero continue to spar with each other in court about their previously announced deal.

SPAC IPOs – On Complete Shut Down

Last month we discussed how the IPO market had gotten very cold (though, to be fair it’s broad IPOs and not just SPACs). However, July takes the cake as a grand total of 0 SPACs came to market. Again, not to be super repetitive, it’s not surprising that activity is down given the glut in the market, though it’s still notable that nobody decided to bring a new vehicle to market this entire month. Perhaps when everyone is back from their “Summer Holiday” IPOs will return.

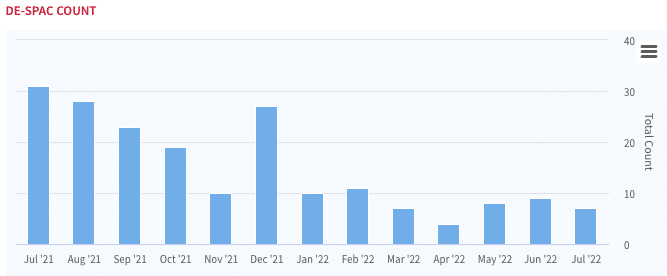

A Check in on DeSPACs

Consistent with all stages of the SPAC market, DeSPAC activity also continues to be muted, with just 7 transactions able to get across the finish line this month. There are still over 110 SPACs with announced transactions that are seemingly inching towards getting done. Sponsors, targets, and risk capital investors are all aligned in getting deals done at (seemingly) any cost.

DeSPACs are trading terribly, but if a sponsor’s cost basis is $2-3 / share (in some instances) anything is better than liquidation and losing all the risk capital.

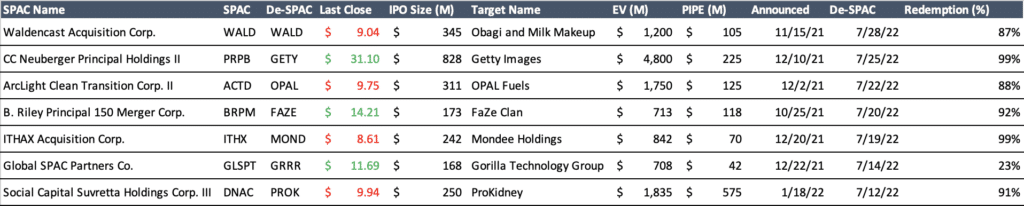

Of the deals to debut this month, performance has actually been OK, though likely due to propped up share prices thanks to the high redemption / low float trade. Gorilla Technology (GRRR), FazeClan (FAZE), and Getty Images (GETY) have all gotten the “meme” treatment and have quick runs up when official redemption numbers were released.

It’s no secret that redemptions remain ridiculously elevated. In our interview with Scott Ford (see below), CEO of Westrock Coffee which is merging with Riverview Acquisition Corp (RVAC), he said that they wouldn’t be shocked with “100% redemptions.” Until any sort of actual deal excitement returns, redemptions are will continue to be elevated.

Getty Images (GETY) set the record for the largest amount of SPAC capital redeemed. Its SPAC, CC Neuberger Principal Holdings II raised $828M in its IPO back in July 2020 (the good ol’ days). Over 82M of those shares redeemed, thus diminishing the ultimate SPAC trust to just over $5M. Trust sizes as it relates to post-transaction capitalization, simply do no matter in the current environment. But, for yield investors, they rightly remain fixated on current trust and price and are looking for the right yield play (more below).

What’s Next? Upcoming SPAC Calendar

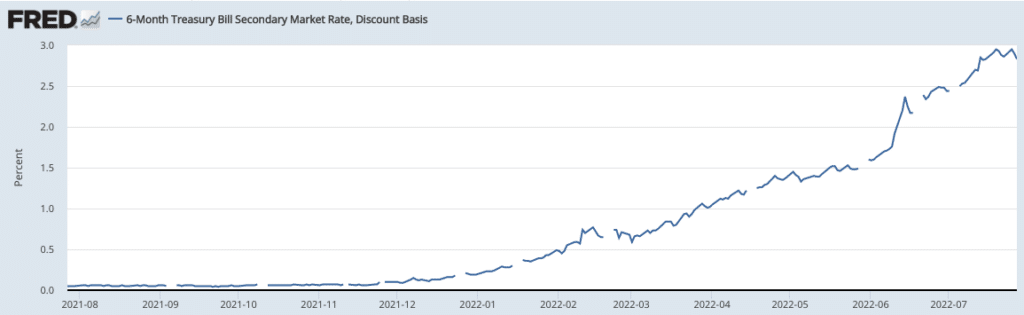

Playing for Yield

The SPAC yield trade remains very much in play. With the average pre-deal SPAC still trading at a heavy discount to NAV there is a significant opportunity for investors to benefit from free yielding investments. While note splashy, the playbook is now well known and readily executable. Couple that with the rising rate environment and for the first time in recent memory, we might actually start to see some real appreciation in trust’s thanks to rising rates. Assuming SPACs are investing in short term treasuries, look out for trust appreciations down the line.