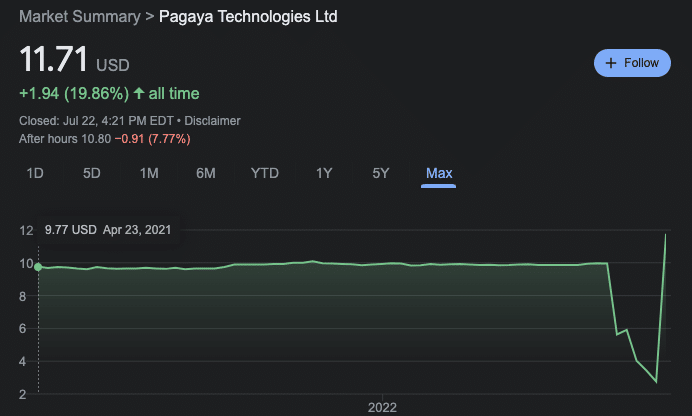

Pagaya Technologies (PGY), an Israeli fintech firm, DeSPAC’ed from EJF Acquisition Corp back at the end of June. Since it began trading standalone shares have been steadily in the low single digits, touching as low as $2.70 just three days ago. However, on Wednesday, the company finally disclosed (buried in an F-1) what its redemption results were. The information showed that PGY only has ~900k public float, making it one of the smallest on the market. Of course, that “memes” a squeeze. PGY shares are on a tear, expect this one to come back down to earth.

Elsewhere in SPACs

- FaZe Clan (FAZE) stock, which closed below $10, is surging in after market after it was disclosed that 15.9M shares (~92%) was redeemed from the SPAC’s trust, making it an extremely low float DeSPAC

- SK Growth Opportunities Corporation (the last SPAC to IPO, remember those?) disclosed that its underwriters exercised $9.4 of its over-allotment.

- CC Neuberger Principal Holdings (PRPB) and Getty Images (GETY) officially closed their deal and GETY will start trading standalone next week

- Richard Branson’s Virgin Group Acquisition III withdrew its planned IPO. It’s previous two DeSPACs, 23andme (ME) and Grove Collaborative (GROV) have struggled early on in the public markets

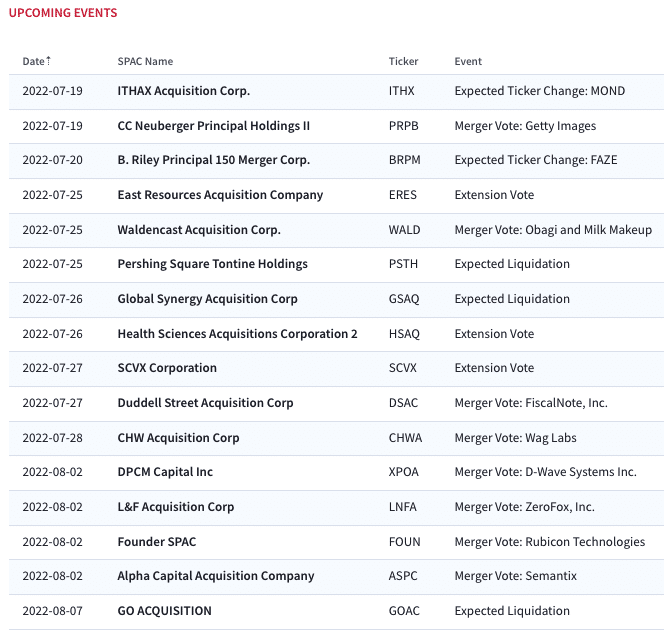

Upcoming SPAC Calendar

Full calendar and SPAC database access here

Today’s Price Action

Biggest Gainers

.90% ~ $ 10.10 | LJAQ – LIGHTJUMP ACQUISITION CORPORATION (Announced)

.62% ~ $ 9.73 | HWEL – Healthwell Acquisition Corp. I (Pre-Deal)

.61% ~ $ 9.91 | VBOC – Viscogliosi Brothers Acquisition Corp (Pre-Deal)

.60% ~ $ 10.05 | PWUP – PowerUp Acquisition Corp. (Pre-Deal)

.60% ~ $ 10.07 | GEEX – Games & Esports Experience Acquisition Corp. (Pre-Deal)

.56% ~ $ 9.93 | LCW – Learn CW Investment Corp (Pre-Deal)

.52% ~ $ 9.75 | IPAX – Inflection Point Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.80 | FWAC – Fifth Wall Acquisition Corp. III (Pre-Deal)

.51% ~ $ 9.85 | LVRA – Levere Holdings Corp (Pre-Deal)

.51% ~ $ 9.94 | IGTA – Inception Growth Acquisition Ltd (Pre-Deal)

.50% ~ $ 9.96 | GDST – Goldenstone Acquisition Ltd. (Announced)

.50% ~ $ 10.08 | GVCI – Green Visor Financial Technology Acquisition Corp I (Pre-Deal)

.41% ~ $ 9.74 | DALS – DA32 Life Science Tech Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.76 | FICV – Frontier Investment Corp (Pre-Deal)

.41% ~ $ 9.85 | IVCP – Swiftmerge Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.87 | COVA – Crescent Cove Acquisition Corp. (Announced)

.41% ~ $ 9.89 | PEPL – PepperLime Health Acquisition Corp (Pre-Deal)

.40% ~ $ 9.96 | DNAA – Social Capital Suvretta Holdings Corp. I (Announced)

.40% ~ $ 9.96 | PRLH – Pearl Holdings Acquisition Corp (Pre-Deal)

.40% ~ $ 9.98 | RCFA – RCF Acquisition Corp. (Pre-Deal)

Biggest Losers

-3.24% ~ $ 9.87 | BCAC – Brookline Capital Acquisition Corp. (Pre-Deal)

-3.04% ~ $ 31.59 | DWAC – Digital World Acquisition Corp. (Announced)

-3.03% ~ $ 9.60 | NLIT – Northern Lights Acquisition Corp. (Announced)

-.89% ~ $ 8.90 | WALD – Waldencast Acquisition Corp. (Announced)

-.41% ~ $ 9.78 | BRIV – B. Riley Principal 250 Merger Corp. (Pre-Deal)

-.40% ~ $ 9.97 | TGAA – Target Global Acquisition I Corp. (Pre-Deal)

-.36% ~ $ 9.82 | POND – Angel Pond Holdings Corp (Announced)

-.31% ~ $ 9.66 | JAQC – Jupiter Acquisition Corporation (Pre-Deal)

-.31% ~ $ 9.78 | GAQ – Generation Asia I Acquisition Ltd (Pre-Deal)

-.31% ~ $ 9.78 | TIOA – Tio Tech A (Pre-Deal)

-.30% ~ $ 9.81 | RACB – Research Alliance Corp. II (Pre-Deal)

-.30% ~ $ 10.06 | CFVI – CF Acquisition Corp. VI (Announced)

-.26% ~ $ 10.11 | CLAY – Chavant Capital Acquisition Corp. (Pre-Deal)

-.26% ~ $ 9.77 | EGGF – EG Acquisition Corp. (Pre-Deal)

-.21% ~ $ 9.68 | TWCB – Bilander Acquisition Corp. (Pre-Deal)

-.21% ~ $ 9.71 | PSPC – Post Holdings Partnering Corporation (Pre-Deal)

-.21% ~ $ 9.72 | PFTA – Portage Fintech Acquisition Corp. (Pre-Deal)

-.20% ~ $ 9.82 | CSLM – Consilium Acquisition Corp I, Ltd. (Pre-Deal)

-.20% ~ $ 9.85 | FSRX – FinServ Acquisition Corp. II (Pre-Deal)

-.20% ~ $ 9.89 | BHAC – Crixus BH3 Acquisition Corp. (Pre-Deal)