It’s a continued sign of the times, SPACs are going to find any target that will work. While they certainly aren’t the first to skirt their stated mandate (the mandates are not binding of course), they likely won’t be the last. However, it’s notable when a SPAC is so overtly targeting a specific industry for them to pivot. The latest, Deep Medicine Acquisition Corp. (DMAQ), had of course been targeting healthcare due to the “myriad of the opportunities it offers, as well as our deep expertise in it that can be a source of significant competitive advantage.”

Thus, today, DMAQ announced a $2.55B tie up with Chijet Motor Company, a Chinese automaker that is developing next-gen EV. Little about the deal was made available, and no investor deck that we can see yet. DMAQ isn’t exactly fully up against the gun, they have the option to extend their October deadline twice, albeit at a cost of $0.10 / share each time. Let’s see what happens here.

Not a whole lot to report today aside from extensions and maneuvering. Read below.

Elsewhere in SPACs

- CHW Acquisition Corp. (CHWA) set its Wag! Labs vote for 7/28. ICYMI we spoke to Wag! CEO Garrett Smallwood on our Podcast recently.

- Tailwind Acquisition Corp. (TWND) filed a prelim proxy for a 6mo extension, no contribution

- Foxwayne Enterprises Acquisition Corp. (FOXW) announced that its two 3 month extensions were approved, redemptions not disclosed

- SCVX Corp. (SCVX) set a date for its second extension of the year, voting for a 9mo extension on 7/27. Just $38M remains in their trust following the last one.

- 80% of shares redeemed in Lightjump Acquisition Corp. (LJAQ) extension vote

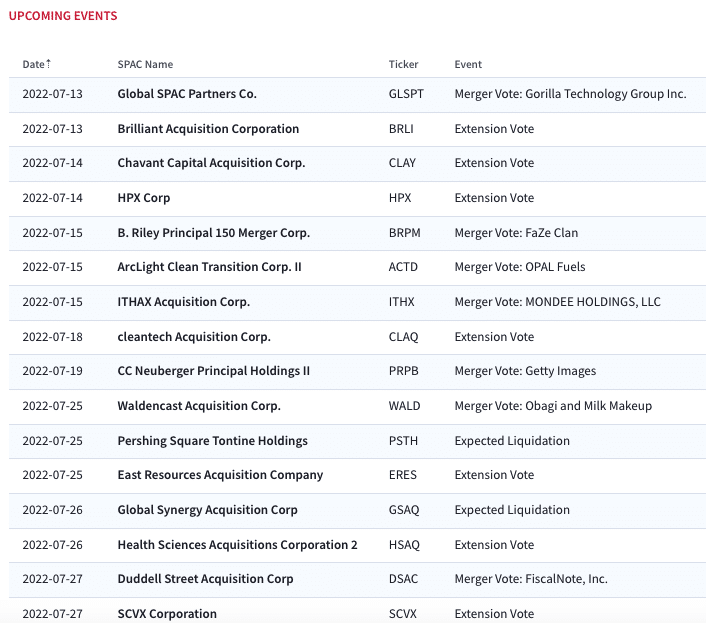

Upcoming SPAC Calendar

Full calendar and SPAC database access here