Denny’s CEO John Miller retires later this year after more than a decade. Who’s up for the challenge of reviving casual dining?

Denny’s CEO John Miller retires amidst growing restaurant exodus. Earlier this month, Denny’s (DENN) announced that CEO John Miller will retire later this year. A replacement search is underway. Miller’s exit marks yet another major restaurant CEO change in recent months, including Wingstop (WING), El Pollo Loco (LOCO) Darden Restaurants (DRI), and Starbucks (SBUX). The executive changes may be a reflection of growing confidence in the restaurant market’s stability as we near the end of a global pandemic. Denny’s has done well under Miller. DENN stock price is up 237% since he took the helm, with EBITDA and FCF metrics outperforming peers.

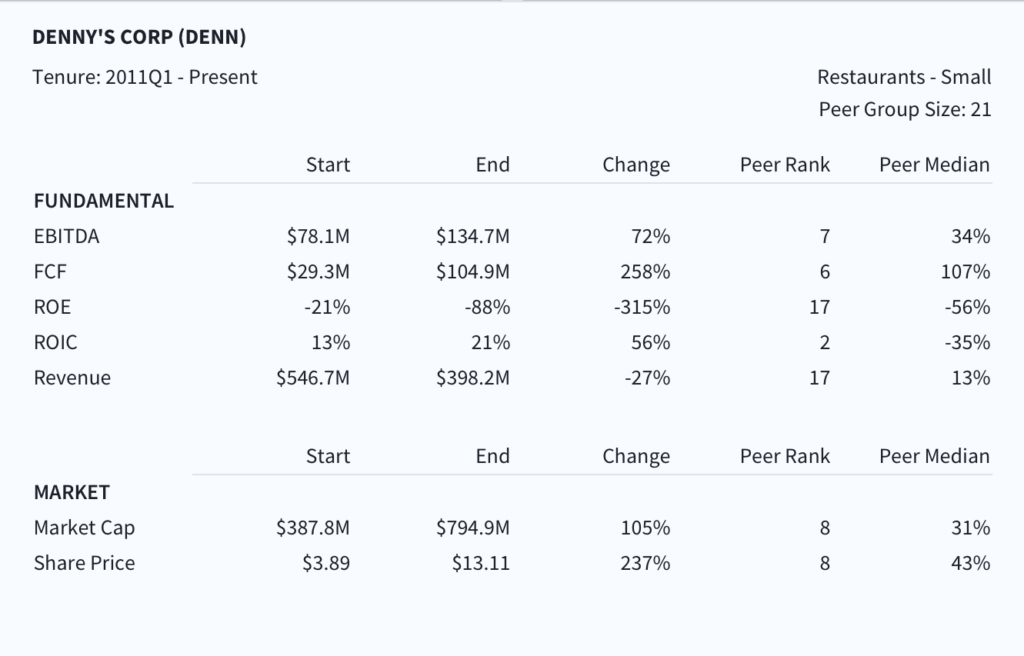

CEO Scorecard: DENN has performed well with Miller at the helm

Miller was quick to adapt and stabilize the business. Denny’s manages one of the largest franchised full-service restaurant chains in the U.S., with ~ 1,640 locations (domestic and international). Like most casual food chains, Denny’s was hit by dining room closures and restrictions at the beginning of the pandemic. Miller was quick to adapt, rolling out two virtual brands– The Burger Den and The Melt Down. The company also announced a partnership to offer deliver from ghost kitchens in urban markets where company was underpenetrated. Miller’s smart investment in digital more than doubled the company’s weekly off-premise restaurant sales. At the same time, DENN’s footprint expansion through its ghost kitchens was done at substantially lower cost compared to brick-and-mortar stores.

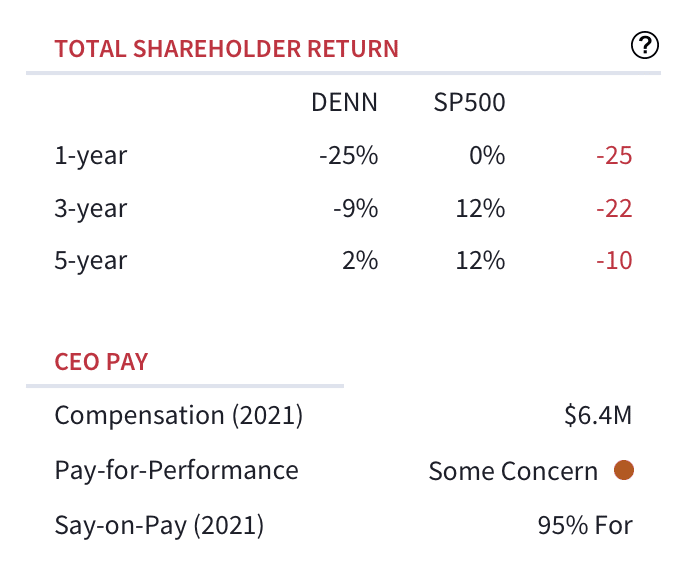

Executive Compensation: some concern. Miller was paid $6.4M in 2021, above the comparable pay-to-total shareholder return (TSR) ratio. Director compensation has also trended above peers and relative to TSR. Shareholders voted 95% in favor of the executive compensation plan last year.

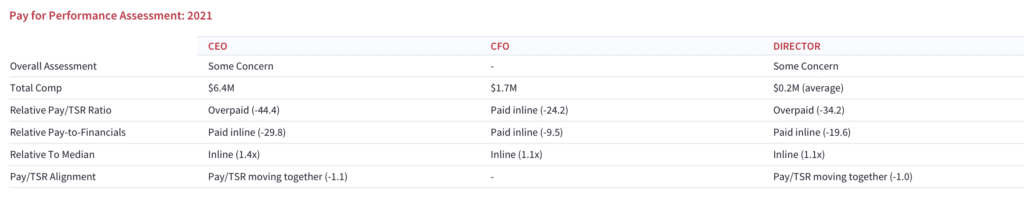

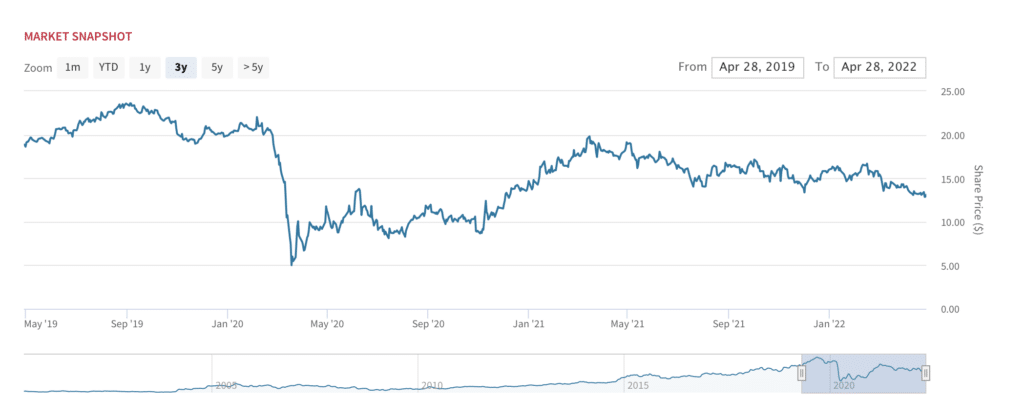

An affordable dining option facing inflationary cost pressures. By now its no secret that the entire food service industry is facing a combination of supply chain disruptions and inflationary cost pressures. A tight labor market has also pressured margins. DENN stock has declined 18% year-to-date, slightly below a 12% decline for the S&P500 over the same period.

DENN stock: Shares have been volatile amidst broader sell-off, despite positive outlook

Revenue leverage should abate cost pressures; margins should improve this quarter. For FQ1, consensus estimates call for $0.13 on sales of $102 million. We think there could be upside to these numbers on the heels of increased dine-in and off-premise sales. Also of note: margins, which were heavily impacted by one-time items in Q4 should see sequential improvement this quarter. Q4 operating margins were 17.7% ex-one-time items. DENN’s franchise and license revenues have improved substantially, allowing the company to absorb some of the inflationary pressures (commodities and labor) and expand margins. In Q4, DENN opened 7 new franchisee-operated restaurants, and closed 14. DENN’s kitchen modernization and digital transformation efforts should also bear fruit over the next few quarters. DENN also raised menu prices by 2% last quarter, and indicated that a few more price increases could be implemented this year. An employee overtime and training budge is also expected to translate to 50bps-100bps in margin. Change sin menu mix and waste management an also provide incremental leverage.

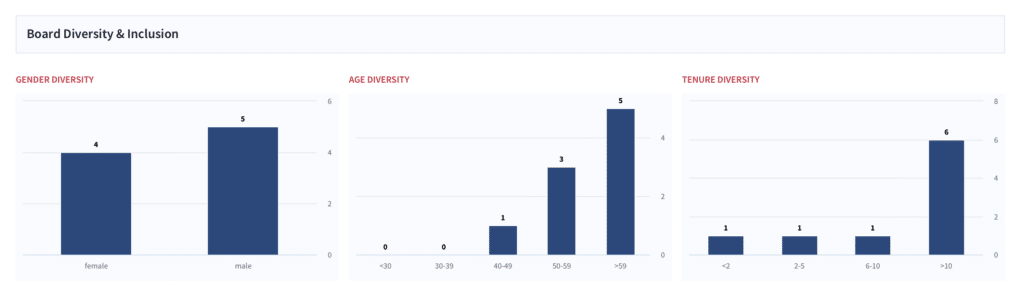

DENN: Board Diversity & Inclusion Snapshot

DENN Insider trading activity: Not much action

New CEO will need to drive comparable store sales growth. DENN’s biggest growth lever is comparable store sales growth, which for now, remains below the mid-single digits. The company plans to accelerate its footprint development, and expects to expand the number of restaurants in the double-digits on a year-over-year basis. Comparable store sales growth will be driven by menu innovation, loyalty program, and convenience.

DENN reports F1Q earnings next Tuesday; shares look attractive with margin leverage ahead. DENN shares look attractive here at 12x EBITDA, at the low end of peers. Cracker Barrel Old Country Store (CBRL), Ruth Hospitality Group (RUTH) and BJ’s Restaurants (BJR) trade in a range of 12x to 14x EBITDA. We think the company is set up well into the print considering the easing of COVID restrictions coupled with a busy summer travel season. While margins remain a watch point, DENN should benefit from the next phase of post-pandemic recovery and improving operating conditions. We think there is upside to consensus estimates as Denny’s raises prices to balance some of its cost pressures. New initiatives, including cloud kitchens, restaurant remodels, and updated menu offerings, should also bear fruit over the next few quarters.

Latest Podcast: The Green Energy Movement will be Digitized, says Voltus CEO Gregg Dixon

Our latest podcast gets an up close look at a company that’s at the center of the green energy movement and an interesting name on our radar as a pure-play ESG investment. Boardroom Alpha sat down with Gregg Dixon, CEO of Voltus.

Voltus recently announced it will go public via a SPAC merger with Broadscale Acquisition Corp (SCLE). The transaction, which is expected to close 1H 2022, values Voltus at an equity value of $1.3B.

Listen to the podcast and read our overview on the Voltus story here.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.