Andrew Behar, CEO of non-profit shareholder advocacy group As You Sow, on how investors are moving the needle toward corporate transparency and accountability

With the rush of money into ESG investment funds — more than $1 trillion in the last two years — it would appear the business value of sustainability, diversity and social welfare is obvious. While ESG metrics are not commonly part of mandatory financial disclosures, companies are beginning to make information on sustainability, diversity and other metrics available to investors. But much more progress is needed toward transparency and accountability. As a result, investors are increasingly applying non-financial factors into their analysis to identify material risks and growth opportunities. In fact, U.S. corporations are facing an unprecedented wave of shareholder resolutions (over 500 so far this year alone) focused on ESG themes.

Boardroom Alpha sat down with Andy Behar, CEO of non-profit shareholder advocacy organization As You Sow, to discuss some of the key ESG issues for investment managers.

Climate Change

With the 2015 Paris Agreement to limit global warming to well below +2 degrees, climate change has moved back up in the policy agenda. Investors have made it clear they want to know how climate change impacts the businesses they fund. They also want to formulate “Paris-aligned” corporate strategies to continue to work on reducing emissions. And the business case is clear. Investor backing for corporate climate action is supported by growing evidence that companies with better environmental performance also have superior financial performance.

Most companies acknowledge the impact of climate change and many have already pledged to move toward net-zero emissions. Yet, the way companies choose to measure emissions and disclosure climate change risks is fraught with controversy. Successful activist campaigns such as changing directors at Exxon Mobil (XOM) are setting a precedent for investors to demand greater transparency. Other recent activist wins include a push by Green Century Capital Management which culminated in a March 4 vote at the annual meeting of fast food company Jack in the Box (JACK), where 95% of votes cast were in favor of a resolution dealing with sustainable packaging.

Regulators are also calling for greater transparency from companies on climate change and are working on a standardized framework for disclosures. The SEC recently issued new Climate Disclosure rules which mandate that all publicly traded U.S. companies disclose their annual greenhouse-gas emissions and the climate risks their businesses face. If adopted, the proposal would require companies to report their emissions in a standardized way for the first time.

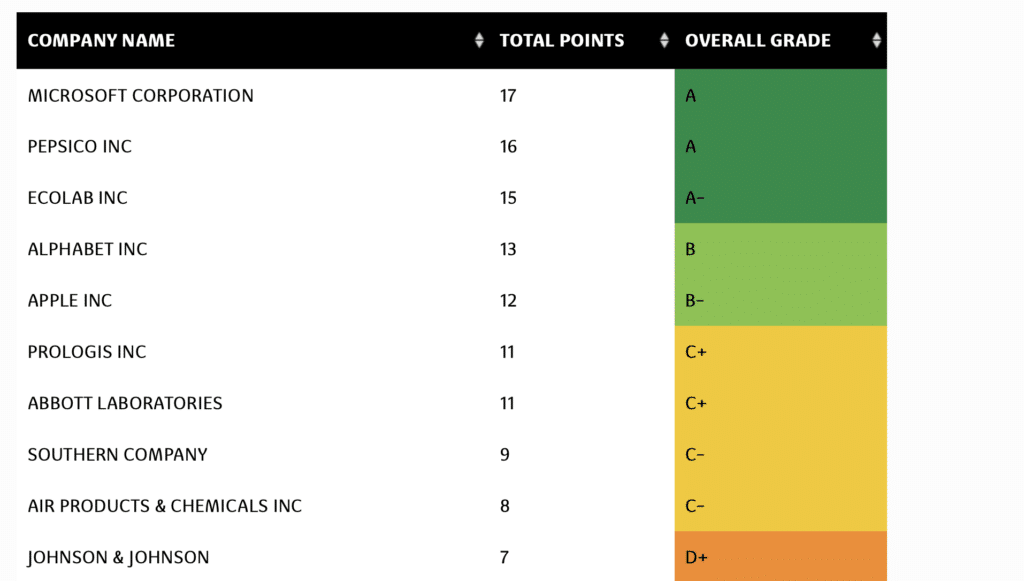

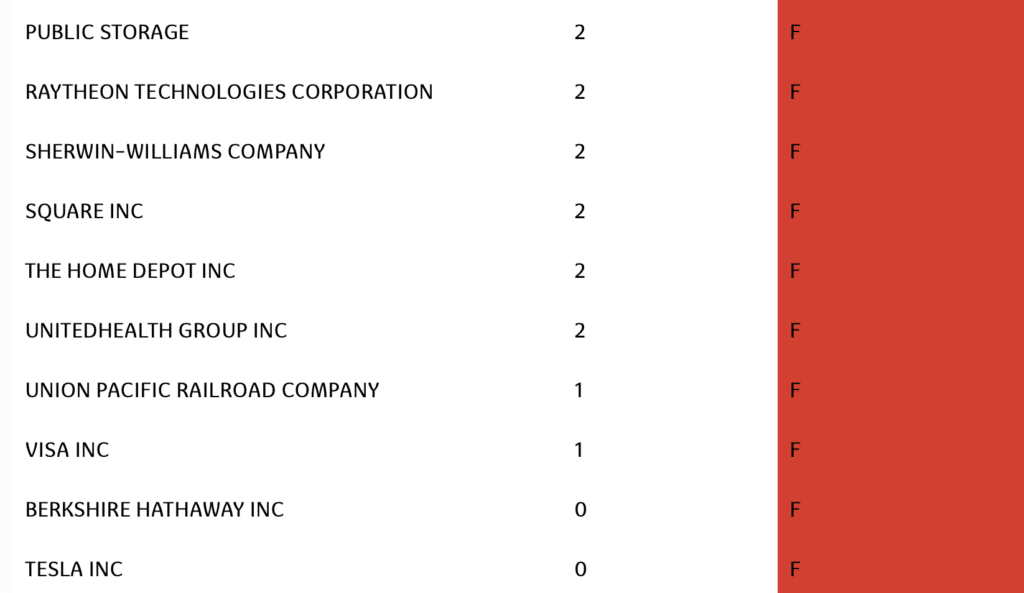

For its part, As You Sow did some independent work on how well 55 companies are progressing toward net zero emissions. Shockingly, electric vehicle (EV) manufacturer Tesla (TSLA) was the worst performer– even below well-known polluters like Chevron (CVX) and Exxon (XOM). Of the companies assessed, two companies, Microsoft (MSFT) and PepsiCo (PEP) were awarded an “A” grade for overall performance– owing to their transparency on greenhouse gas emissions and demonstrated progress toward reducing emission intensity.

Top 10 Net Zero Performers

Worst 10 Net Zero Performers

Many observers suggest that the path toward progress involves linking executive compensation to climate performance. Given its public visibility and carbon-intensive operations, the oil & gas industry has been at the forefront of ESG-related concerns from institutional investors. The largest oil & gas companies—BP, Shell, and Total in Europe and Chevron and ExxonMobil in the United States—all incorporate climate metrics into CEO pay. That said, there is a long way to go toward making these incentives standard practice. The Net Zero study showed out of 48 large corporate emitters in the U.S., only four companies explicitly linked executive pay to a specific emissions reduction.

Gender and diversity

Simply put, diverse organizations perform better. Most studies surrounding diversity in the workplace have found that for every 1% increase in gender diversity, company revenue increases by 3%. Yet, women and minorities still underrepresented in leadership positions.

Most of the initial attention to diversity and inclusion has been on the lack of diversity on corporate boards, which has forced companies to act. All S&P 500 companies now have at least one woman on the board. In the top executive ranks, however, 85% of positions are held by whites, demonstrating the promotion gap that minorities face. And women and minorities continue to under-earn white male colleagues.

While many companies have issued statements in support of diversity, there is little to hold them accountable. But Behar thinks we could be at a watershed moment that will ultimately force companies to begin disclosing more information. In 2022, the number of proposals calling for REAs (Racial Equality Audits) and CRAs (Civil Rights Audits) has more than tripled. Last month, shareholders at Apple (AAPL) voted 53% in favor of the company conducting a third-party civil rights audit.

Executive compensation

Executive pay should be designed to align closely with corporate strategy, which in turn should aim at value creation over the long term. Yet, finding the right balance is difficult in practice. Last year, 16 companies saw their CEO pay packages rejected by more than half of shareholders. Behar walked us through the metrics the agency looks at in order to gauge whether executive compensation is in line with business fundamentals.

Animal Welfare

Animal welfare campaigns are also on the rise– particularly as these concerns intersect with food service industries. Carl Icahn is involved in seeking board seats at McDonald’s (MCD) and Kroger (KR). Icahn has criticized both companies for their pork suppliers’ practice of confining pregnant pigs in gestational crates as opposed to group housing. For more details, see our overview of Icahn’s campaigns at McDonald’s and Kroger. Icahn has also expanded the battle beyond animal welfare to include focusing on what he calls “egregious wage gaps” between Kroger’s chief executive officer and other company employees.

Listen to the podcast for more.

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.