Yotta Acquisition, the latest SPAC IPO, has a tech/blockchain focus. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

SPAC IPO: Yotta Acquisition Corp. (YOTAU)

Yotta Acquisition Corp. (YOTAU) priced a $100M offering. $10 in cash in trust. Unit = Share + Warrant + Right 1/10. The SPAC will focus on high technology, blockchain, software and hardware, e-commerce and social media. Yotta is led by CEO Hui Chen, and CFO Robert L. Labbe.

SWAG / Nogin Announces $60M Convertible Offering

$60M convertible offering (or “PIPE” depending on how you look at it) for Software Acquisition Group III (SWAG) / Nogin. The 7.00% notes are due in 2026. Can be increased by a $10M accordion feature.

Analyst Day: Semantix / ASPC

Analyst day presentation for ASPC / Semantix highlights $23M in non-redemption agreements, coupled with a $94M PIPE. Company still expects $85M in minimum cash (no change).

Elsewhere in SPACs

- Quick exit for Beachbody Company (BODY) CFO Sue Collyns, who is leaving to “transition to a new chapter of opportunities.” BODY stock is down ~86% since deSPAC.

Biggest Gainers

1.31% ~ $ 10.07 | EVGR – Evergreen Corp (Pre-Deal)

.82% ~ $ 9.81 | SCAQ – Stratim Cloud Acquisition Corp. (Pre-Deal)

.81% ~ $ 9.90 | AURC – Aurora Acquisition Corp. (Announced)

.62% ~ $ 9.77 | GFGD – Growth for Good Acquisition Corp (Pre-Deal)

.61% ~ $ 9.97 | PORT – Southport Acquisition Corporation (Pre-Deal)

.60% ~ $ 10.04 | SHCA – Spindletop Health Acquisition Corp. (Pre-Deal)

.55% ~ $ 10.16 | LCAP – Lionheart Acquisition Corporation II (Announced)

.55% ~ $ 10.90 | ESSC – East Stone Acquisition Corporation (Announced)

.51% ~ $ 9.81 | AFAQ – AF Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.82 | HPLT – Home Plate Acquisition Corp (Pre-Deal)

.51% ~ $ 9.92 | ROCL – Roth CH Acquisition V Co. (Pre-Deal)

.50% ~ $ 10.13 | GGGV – G3 VRM Acquisition Corp. (Pre-Deal)

.45% ~ $ 9.96 | SPK – SPK Acquisition Corp. (Announced)

.42% ~ $ 9.67 | NFYS – Enphys Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.81 | GXII – GX Acquisition Corp. II (Pre-Deal)

.41% ~ $ 9.84 | KAII – Kismet Acquisition Two Corp. (Pre-Deal)

.40% ~ $ 9.99 | ITAQ – Industrial Tech Acquisitions II, Inc. (Pre-Deal)

.40% ~ $ 10.03 | IQMD – Intelligent Medicine Acquisition Corp. (Pre-Deal)

.39% ~ $ 10.28 | ATA – AMERICAS TECHNOLOGY ACQUISITION CORP. (Pre-Deal)

.37% ~ $ 10.84 | THCA – Tuscan Holdings Corp. II (Pre-Deal)

Biggest Losers

-5.94% ~ $ 45.91 | DWAC – Digital World Acquisition Corp. (Announced)

-2.95% ~ $ 9.87 | GSRM – GSR II Meteora Acquisition Corp. (Pre-Deal)

-2.57% ~ $ 11.77 | GGPI – Gores Guggenheim, Inc (Announced)

-1.20% ~ $ 9.88 | DYNS – Dynamics Special Purpose Corp. (Announced)

-1.13% ~ $ 10.53 | IPOF – Social Capital Hedosophia Holdings Corp VI (Pre-Deal)

-1.00% ~ $ 9.91 | MEAC – Mercury Ecommerce Acquisition Corp (Pre-Deal)

-.89% ~ $ 9.97 | FGMC – FG Merger Corp. (Pre-Deal)

-.67% ~ $ 10.33 | IPOD – Social Capital Hedosophia Holdings Corp IV (Pre-Deal)

-.58% ~ $ 10.21 | HUGS – USHG Acquisition Corp. (Announced)

-.56% ~ $ 9.83 | OEPW – One Equity Partners Open Water I Corp. (Pre-Deal)

-.53% ~ $ 11.26 | CFVI – CF Acquisition Corp. VI (Announced)

-.51% ~ $ 9.72 | LITT – Logistics Innovation Technologies Corp. (Pre-Deal)

-.41% ~ $ 9.80 | ASAX – Astrea Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.89 | FTCV – FinTech Acquisition Corp. V (Announced)

-.40% ~ $ 10.00 | CPAQ – Counter Press Acquisition Corp (Pre-Deal)

-.40% ~ $ 10.04 | GOGN – GoGreen Investments Corp (Pre-Deal)

-.38% ~ $ 10.41 | SV – Spring Valley Acquisition Corp (Announced)

-.33% ~ $ 9.79 | BGSX – Build Acquisition Corp. (Pre-Deal)

-.31% ~ $ 9.70 | WAVC – Waverley Capital Acquisition Corp. 1 (Pre-Deal)

-.30% ~ $ 9.81 | SSAA – Science Strategic Acquisition Corp. Alpha (Pre-Deal)

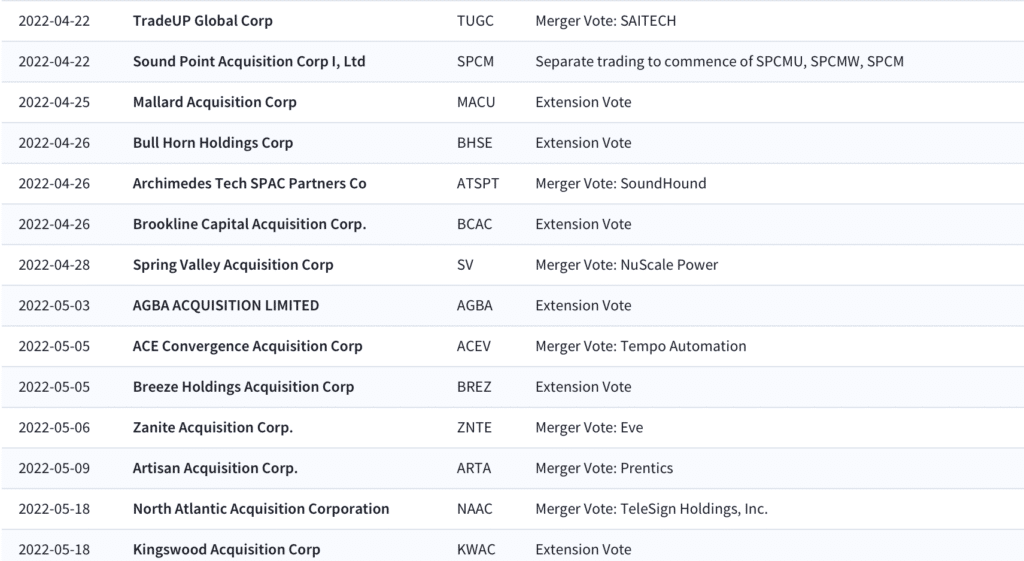

Upcoming Merger and Extension Votes

Want to dive deeper into the world of biomaterials? Check out our latest podcast with Origin Materials (ORGN). We talk with co-CEOs John Bissell and Rich Riley about how Origin’s technology converts plant-based material into a wide variety of carbon negative materials– from textiles, packaging, automotive parts and more. The stock is on an upward move after yesterday’s news of a strategic partnership with LVMH to develop sustainable low-carbon footprint packaging for the perfumes and cosmetics industry. And see our detailed overview here.

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.