Richard Clayton, Research Director at the Strategic Organizing Center Investment Group (SOC) on why shareholders should say “no” to the proposed acquisition by MSFT at this Thursday’s vote

Shareholders vote this Thursday on the $68.7 billion proposed acquisition of Activision Blizzard (ATVI) by software giant Microsoft (MSFT). Amidst both a “sexual harassment crisis” and regulatory review, will the company’s recent Board refresh be enough to assuage shareholders and move the deal forward? To help answer that question, Boardroom Alpha sat down with Richard Clayton, Director of Research at the Strategic Organizing Center (SOC) Investment Group. Founded in 2006, the SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center, a coalition of unions representing more than four million members. Clayton shares his take on Activision’s recent governance moves and why the proposed takeover by Microsoft isn’t in the best interest of shareholders.

Transaction Highlights:

- Shareholder vote to approve Microsoft acquisition will be held on April 28; results expected on May 4

- ATVI’s board of directors encourages shareholders to vote in favor; majority needed for deal to close

- If merger is not approved, Activision Blizzard warns stock will “decline significantly”

- If the deal falls through, Activision Blizzard and Microsoft will have to pay each other a termination fee; $2.27 billion from Activision and between $2 billion and $3 billion from Microsoft.

Key Shareholder Issues:

- Observers remain critical of the company’s handling of sexual harassment and discrimination lawsuits

- Continued Board refreshment may be needed despite last week’s appointment of two female executives

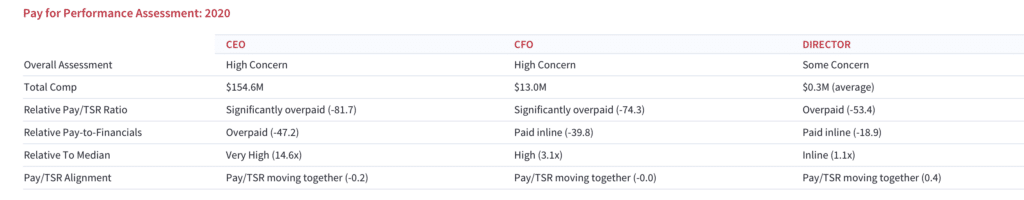

- Executive compensation and incentives for CEO Bobby Kotick remain a concern; only 55% of shareholders voted in favor of executive compensation plan in the company’s most recent Say-on-Pay vote

- In March, the Wall Street Journal reported that three Activision Blizzard shareholders with links to Kotick — Barry Diller, David Geffen, and Alexander von Furstenberg— are under investigation, having bought $108 million worth of shares just four days before the deal announcement.

Overpaid? Activision Pay for Performance Assessment

More from Boardroom Alpha

To dive deeper into the Activision Blizzard story, check out our analysis “Tidying Up: Activision Blizzard Refreshes Board Ahead of Microsoft Deal.”

Want to know how shareholders are pushing for more transparency and accountability on key issues such as climate change, executive compensation, governance and human rights policy? Check out our recent podcast with Andrew Behar, CEO of non profit shareholder advocacy group As You Sow, to learn why now is a watershed moment for ESG investing.

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.