A ticking time bomb as SPACs face pressing deadlines to strike deals or close shop

Baby bear market or full on recession? Hard to tell. The S&P 500 is down 13% from its January peak, and briefly fell below the 20% threshold that defines a bear market. As investors try to determine whether the worst of the damage is over, stocks remain volatile. On the heels of a generally disappointing Q1 earnings season, the month of May closed out with stocks posting strong gains– ending seven-week losing streaks for the S&P 500 and Nasdaq and an eight-week slide for the Dow Jones Industrial Average. Recent gains have been driven by a decline in Covid cases in China and speculation over a potential pause in interest rate hikes by the US Federal Reserve later this year. That said, investors remain cautious about whether central banks can raise interest rates to rein in inflation without derailing growth, or worse, tipping the economy into a recession. Oil also continues to gain after the EU supported a partial ban on Russian oil.

For investors who remain active in this market, its clear that total speculation is officially dead and this is a stock-picker’s market. Even so, picking stocks isn’t easy while the Fed is raising interest rates and inflation is hurting both consumers and the broader economy. Amidst the market collapse, we take a deep dive into the state of the SPAC market.

Our bottom line: with so many SPACs facing a ticking time bomb to put money to work, expect continued sloppy deal negotiations by SPACs whose only interest is to stave off losses and get over the goal line, and an uptick in SPAC liquidations. That means low-quality companies at onerous valuations — for the simple purpose of protecting sponsor at-risk capital. Meanwhile, federal regulators continue to close in.

For SPACs, the urgency to strike a deal or close shop is readily apparent

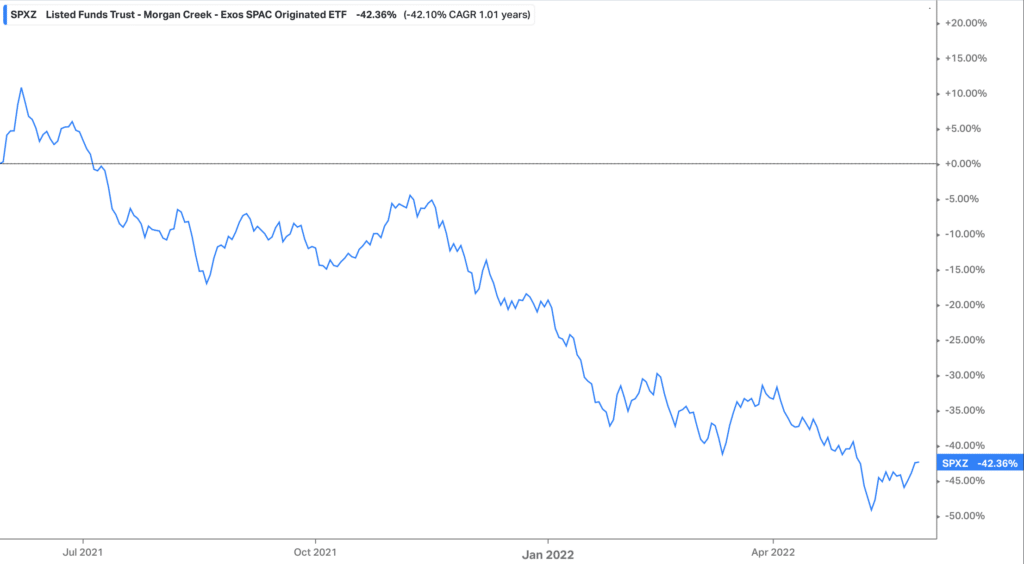

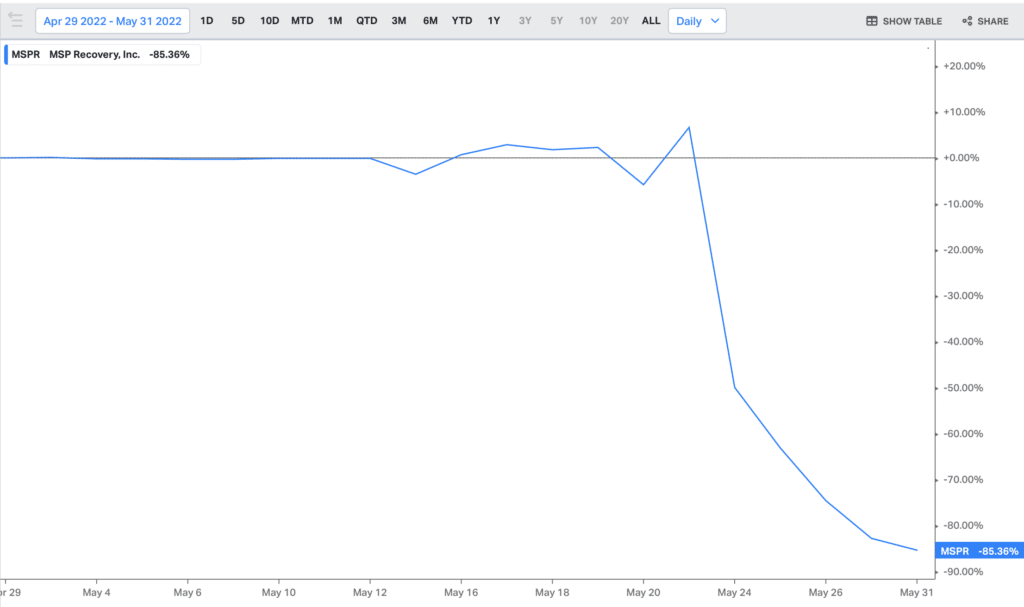

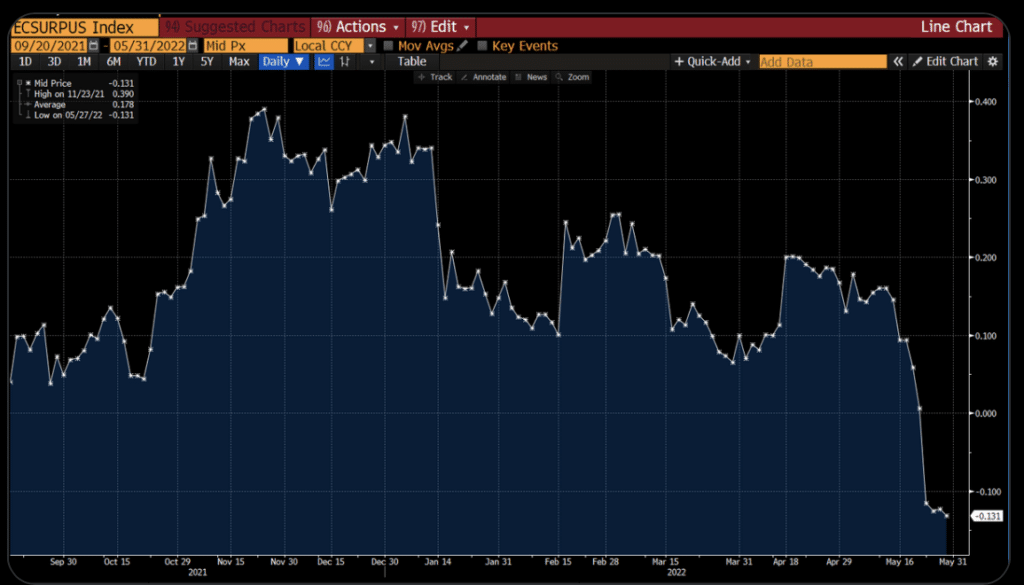

If there’s a single SPAC-related theme for the month of May, it’s that SPACs must scramble to strike deals quickly…or liquidate. This imperative explains the burst of 17 deal announcements in May– the most since December, chipping away at a backlog of nearly 600 SPACs looking for targets. That said, with the majority of targets not expected to be profitable this year or next, the deSPAC outlook remains bleak, with every deSPAC this month trading down sharply. The most egregious deSPAC this month, healthcare litigation MSP Recovery (MSPR), is a case study in value destruction (shares have declined 86% since deSPAC). Shares of most SPACs continue to fall with seemingly no bottom in sight, the product of weakening fundamentals and evaporating cash flows. The Morgan Creek Capital ETF (SPXZ), which consists of pre-and post-merger SPACs, has a one-year performance of -42%, versus -1% for the S&P 500 over the same period. Adding salt to the wound, at least 25 deSPACs which emerged between 2020 and 2021 have issued going-concern warnings. The bottom line: most SPACs have over-promised and under-delivered. In many cases, these companies are not even viable long-term businesses.

deSPAC Performance indicator: Morgan Creek – Exos SPAC Originated ETF

Legislators looming

Adding to the SEC’s ongoing scrutiny of SPACs, more legislators are closing in. U.S. Senator Elizabeth Warren (D-Mass) is the latest to voice concern over the “proliferation” of bad SPAC deals that have resulted in huge losses for retail investors. Warren is working on the “SPAC Accountability Act of 2022″ which would increase the legal liability for various parties involved in SPAC deals as well as enhance investor disclosures and extend lock-ups for SPAC sponsors. “This investigation found that Wall Street insiders have used SPACs as their own personal piggy banks while retail investors have suffered,” Warren said. “This industry is rife with fraud, self-dealing and inflated fees, and the SEC and Congress should continue to act to crack down on these abuses.”

Deals closing…but at a cost

With most bulge bracket investment banks having retrenched from the SPAC market in response to the increasing regulatory risk, a dearth of underwriters has resulted in intensified competition for targets and funding sources. PIPE investors have grown weary of target valuations, size of sponsor promotes, and other deal terms, reducing their willingness to fund de-SPAC transactions absent more favorable terms. The result: SPACs are now increasingly forced to fund deals with more expensive (and often onerous) terms. Alternative financing is now the norm, with SPAC issuances of convertible debt or preferred stock becoming more prevalent along with and other third-party backstop funding arrangements.

So, where does that leave the 594 SPACs actively looking for targets? In a lurch. For starters, extensions and more extensions have become standard operating procedure as it has become increasingly more difficult and time consuming for SPACs to complete their business combinations. This month also saw some SPAC liquidations– a trend we expect to see accelerate in the coming months as many SPACs will be unable to beat the clock.

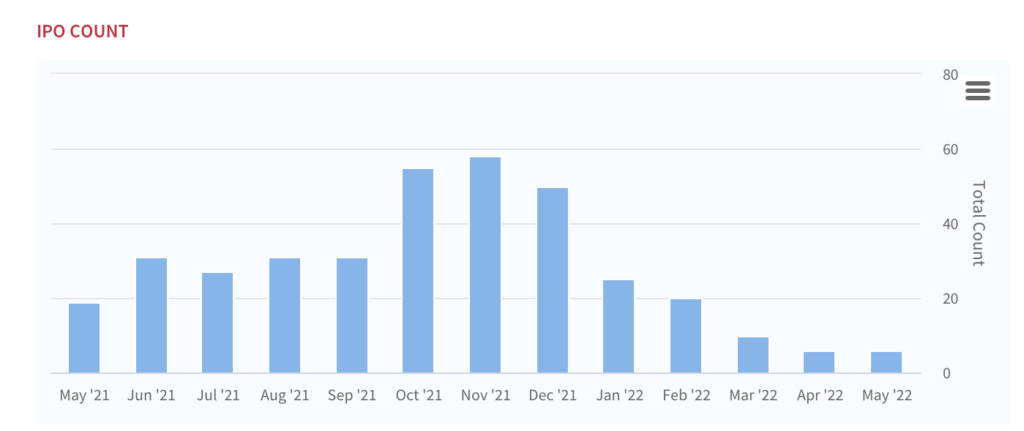

Six SPAC IPOs make it out in May

Not surprising given the combination of rising interest rates and oversaturation, SPAC sponsors have increasingly withdrawn IPO filings rather than lose at-risk capital. The month of May priced 6 SPAC IPOs– flat with April, but down sharply from 19 a year ago.

Among the recent SPAC issues, there are a few key themes: smaller deal sizes, more warrants and continued overfunded trusts. The transaction focus remains fairly diverse but largely weighted toward tech and healthcare. Major banks have largely taken a backseat to SPAC IPO underwriting, for a variety of reasons. Of the 6 deals that did price in May, the most active banks involved were EF Hutton and Chardan.

SPAC IPOs

Six SPAC IPOs in May

With 594 SPACs actively searching for deals, the big picture is largely unchanged from April: not enough M&A activity is getting done. Pre-deal SPACs are largely dead money given reduced execution certainty and reduced investor appetite for pre-revenue growth companies. Of the pre-transaction SPACs remaining, 87% trade below $10– at an average price of $9.86.

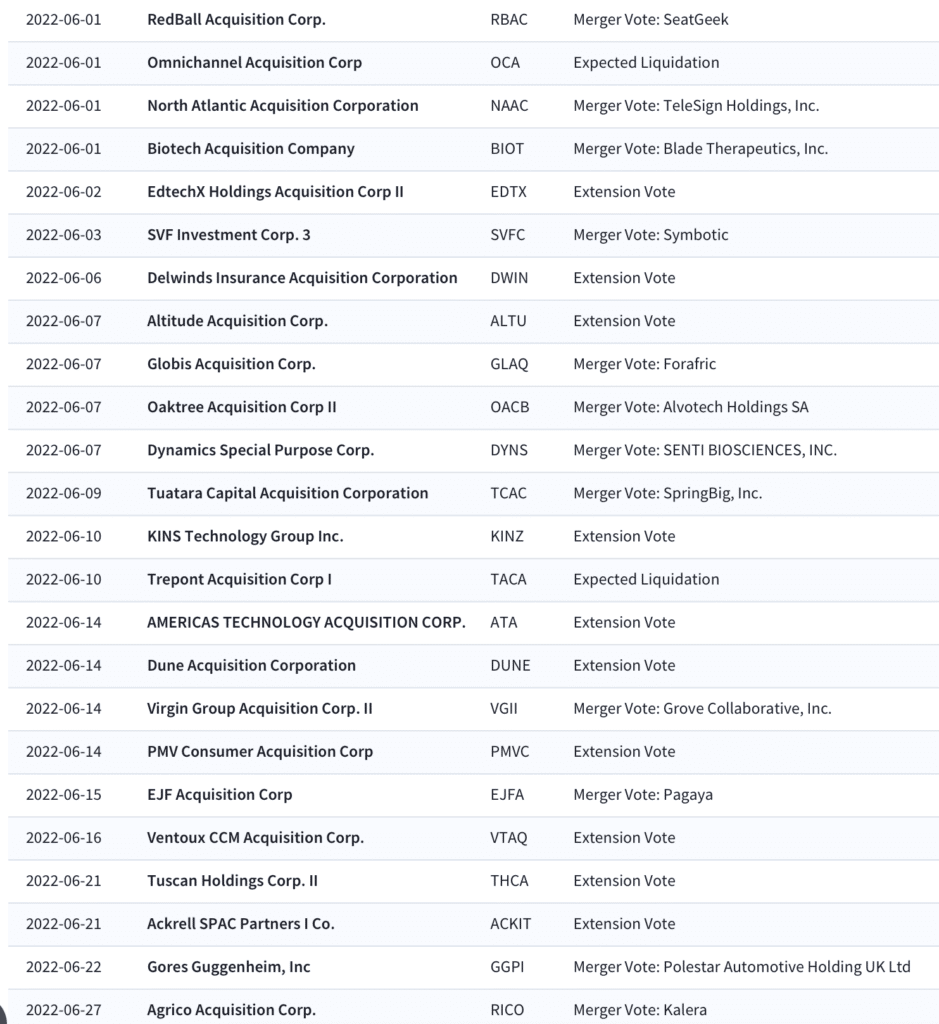

This month also saw SPAC liquidations– most recent being Trepont Acquisition Corp I (TACA) and Omnichannel Acquisition Corp (OCA).

Deal announcements picked up considerably

With the pressure on to close, merger announcements trended up in May: 17 merger announcements, up from 13 in April. There are currently 118 pre-close SPACs with DAs that are looking to reach the finish line. Once again, this month was heavy on biotech, healthcare, and electric vehicle (EV) related names. Of the total population of SPACs with deal announcements, 61% trade below $10; the average price is currently $10.29. SPACs are continuing to take longer to close deals amidst the softer financing environment and a longer SEC review process.

May SPAC merger announcements

Time to look elsewhere for arb opportunities

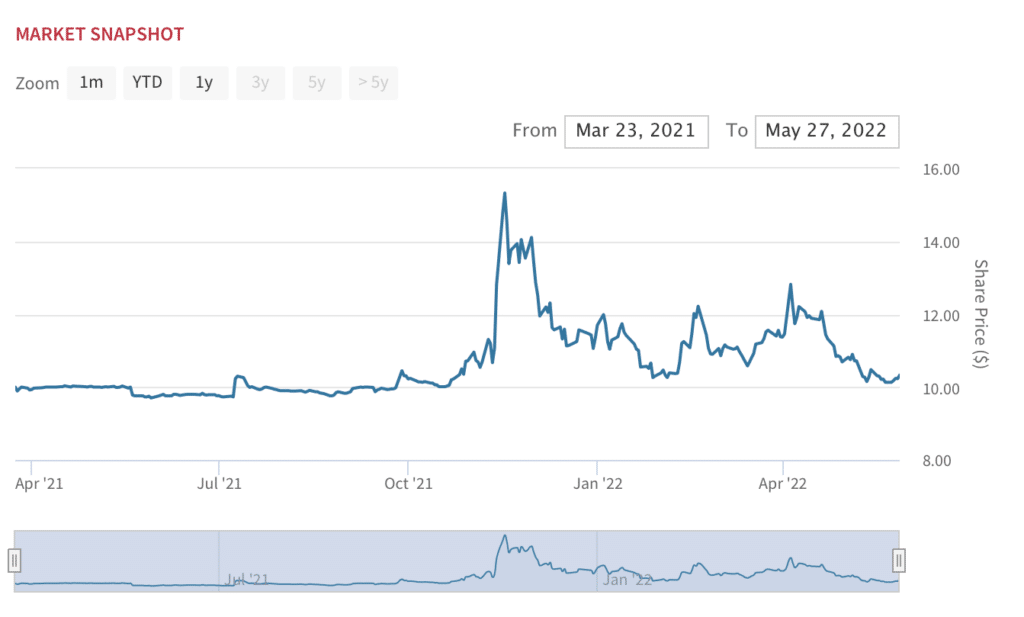

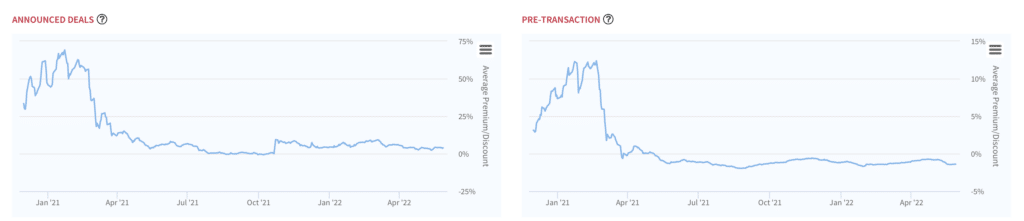

With most retail investors having learned by now not to chase SPAC deal rumors, it’s essentially ‘game over’ for SPAC arbitrage on deal announcements. The average premium-over-IPO price for SPACs with announced deals is now 3.92% for May, down from 4.2% last month. That’s down from 9% in October 21 (the last big spike on the graph) and a high of 69% in January 2021. Case in point: Gores Guggenheim (GGPI), which is merging with electric vehicle maker Polestar and is considered one of the most experienced SPAC sponsors in the game, currently trades at $10.30– down 37% from a 52-week high of $16.41 in November 2021.

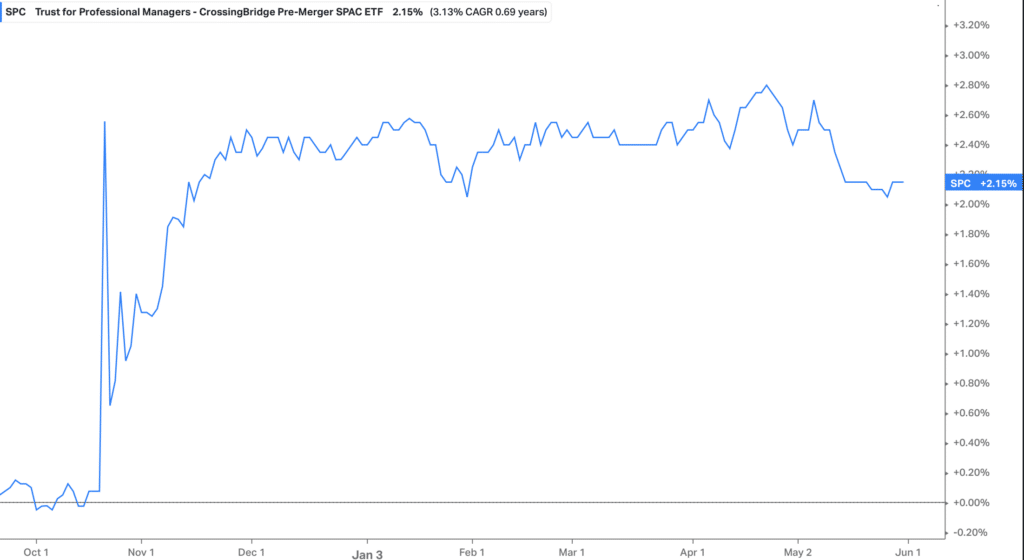

Crossingbridge Advisors Pre-Merger SPAC ETF (SPC), which invests purely in pre-merger SPACs, is essentially flat year-to–date (-0.29% to be precise)– in-line with the S&P 500 over the same period.

Investors playing in pre-merger SPACs would have been better off taking Warren Buffet’s lead and trading into big M&A opportunities by buying names like video game maker Activision (ATVI) into its merger with Microsoft (MSFT). Same goes for the merger arb play at Twitter (TWTR) which trades well below Elon Musk’s offer price. That being said, considerable value could still be found in SPAC warrants (although certainly a much higher risk trade with no floor) for SPACs that ultimately announce deals.

GGPI: Down 37% from peak levels in November 2021

Average premium-over-IPO price for SPACs with DAs was 3.92% in May

Redemptions creep upward, albeit below March levels

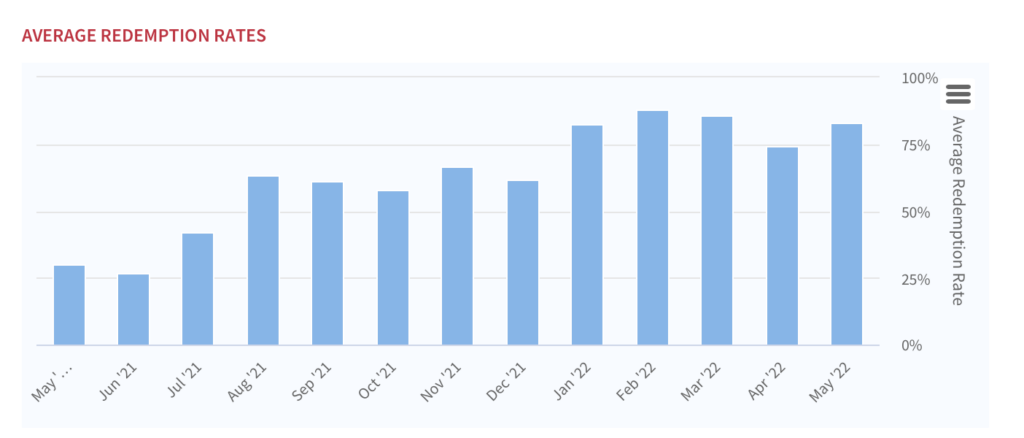

Redemptions remain high enough that SPACs are forced to rely on creative ways to plug the gap. A worsening macro has resulted in an increased in redemptions in May following three consecutive quarters of decline. Redemptions were 83% in May, up from 78% in April and just 29% a year-ago.

Redemptions bump back up, but below March levels

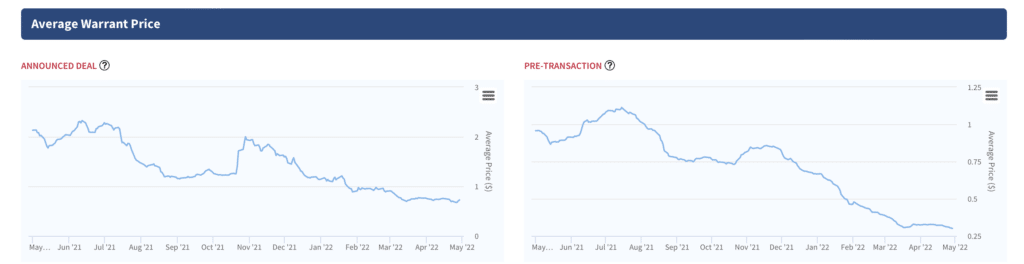

Increasing execution risk continues to impact SPAC warrant prices. The average warrant price on SPACs with announced deal was $0.55 at the end of May, down from $0.74 a month ago. Warrant prices on even more speculative pre-transaction SPACs have fallen precipitously– $0.21 at the end of May, down from $0.29 in April.

Warrant trends

Market volatility curbs new issues

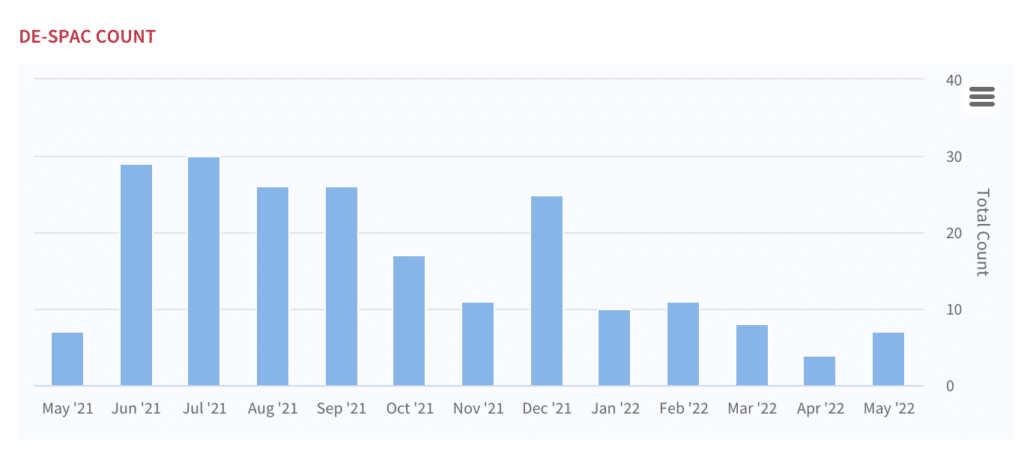

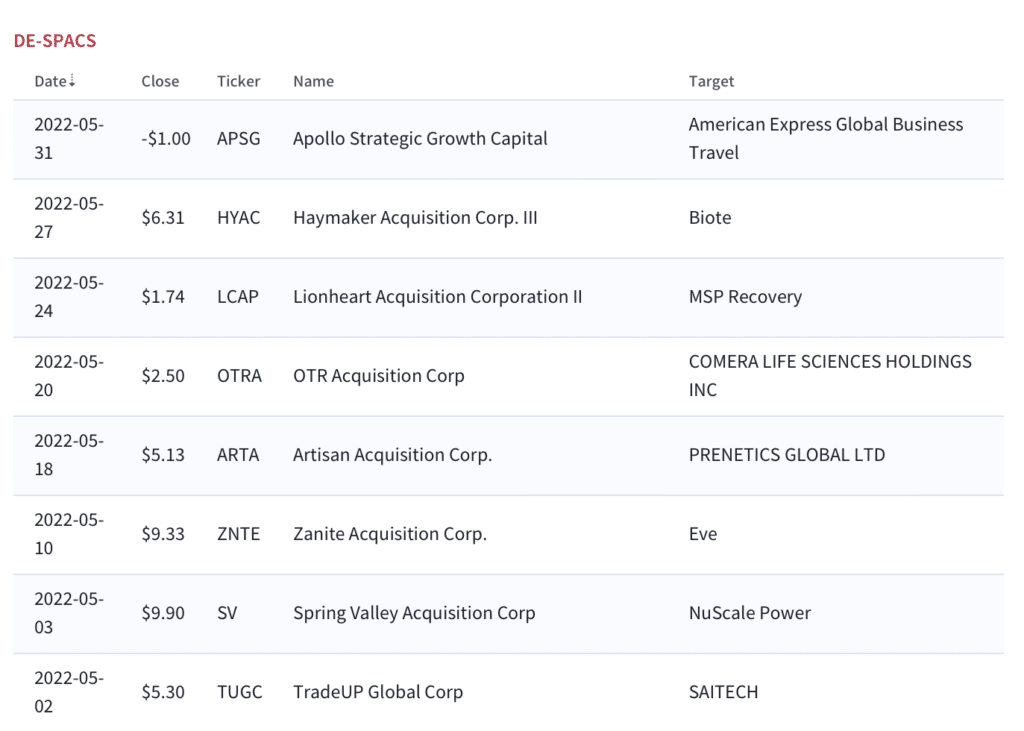

WIth the U.S. capital markets experiencing the longest extended period of high volatility since the 2008 financial crisis, fewer SPACs made it out this month. May saw a total of 8 deSPACs, up from 4 in April and flat with a year ago:

- American Express Global Business Travel (GBT) – business travel

- Biote (BTMD) – hormone replacement therapy

- MSP Recovery (MSP) – Medicare/Medicaid litigation

- Comera Life Sciences (CMRA) – subcutaneous drug delivery

- Prenetics (PRE) – genomics and diagnostics

- Eve Holding (EVEX) – electric vertical take-off and landing (eVTOL) vehicles

- NuScale Power (SMR) – modular nuclear reactors

- SAITECH (SAI) – clean Bitcoin mining

deSPAC count: More action in May

May deSPACs

As inflationary concerns shift investors away from growth stocks and into income-producing, high-quality defensive stocks, it’s not surprising that deSPAC performance remains abysmal. By now it is very clear that de-SPACs have generally underperformed across the board, regardless of SPAC size, transaction date, or even market sector. Accordingly, all 8 May deSPACs are trading down sharply from their IPO price. The poster child of shameful deSPAC performance this month: Medicare litigation firm MSP Recovery (MSP), which deSPAC’d on May 24th and currently trades at $1.48 — an 85% decline in just 5 days of trading. Of course, given the company has no revenues or earnings in an unsavory collections business, we’d say this is an example of an efficient market.

MSPR performance since deSPAC

Market volatility likely to push out new issues to 2H

Despite the end last week to a painful run of losses, most strategists are skeptical about whether a bottom has been established. Market action suggests investors are still not ready to ‘buy the dip.’ While the Federal Reserve is on track to raise rates several more times from here, critics have suggested that raising interest rates may tip the economy into a recession. This uncertainty is apparent in the VIX, the market’s expectation for volatility over the next month. As background, elevated VIX readings (20 and above) tend to keep initial public offerings from pricing. As of today’s writing, the VIX is at ~28, down from 32 at the start of the month. For now, investors seem to be selling into any strength. We expect continued uncertainty to push more quality SPAC issues out to 2H.

VIX: Still elevated

Citigroup Economic Surprise Index: lowest levels since September 2021

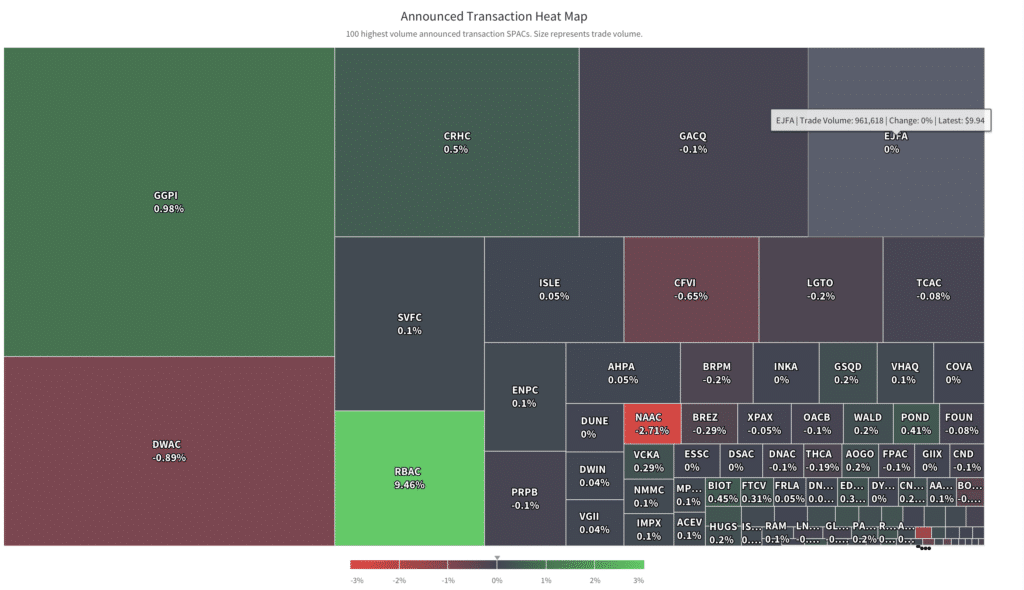

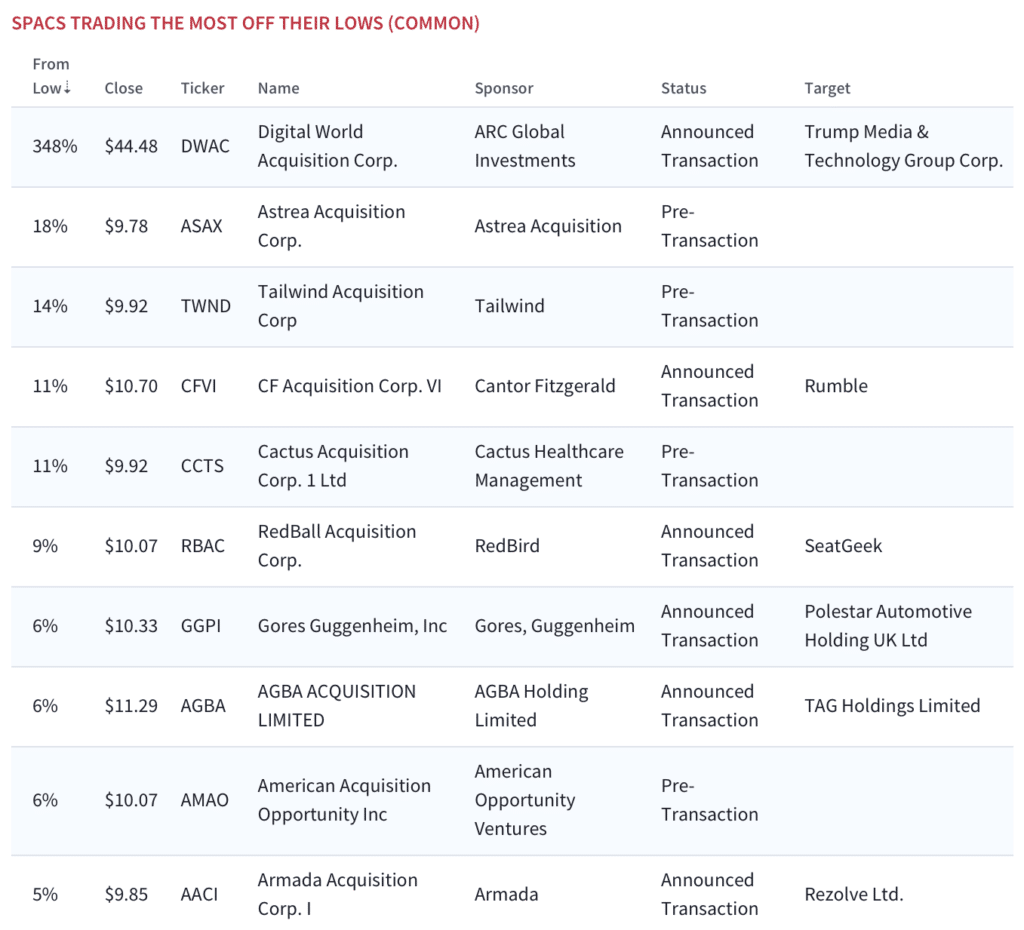

Transaction Heat Map: GGPI and DWAC remain crowd favorites

Key themes to watch

With midterm elections coming up in November and the battle over free speech raging on, the value of the Trump social media following is apparent at Digital World Acquisition Corp. (DWAC), whose shares have bounced 348% from recent lows. DWAC is expected to merge with Donald Trump’s Trump Media & Technology Group (TMTG), which owns the Truth Social network.

In the category of ‘quality growth’ stories, GGPI/Polestar is an important name to watch, particularly with the merger vote date now scheduled (June 22nd). As mentioned previously, GGPI shares have been under recent pressure — down 14% year-to-date. Like almost every major carmaker, Polestar lowered its 2022 sales guidance from 65,000 vehicles to 50,000 vehicles, stating that the “reduction for 2022 is 100% attributable to the lockdowns in China.” The company’s Form F-4 has also been approved by the SEC, clearing the runway for deSPAC.

Who’s Next?

There are still almost 600 SPACs looking for a merger target, and they are still largely trading at a discount to NAV at ~$9.90 for the average common pre-deal SPAC.

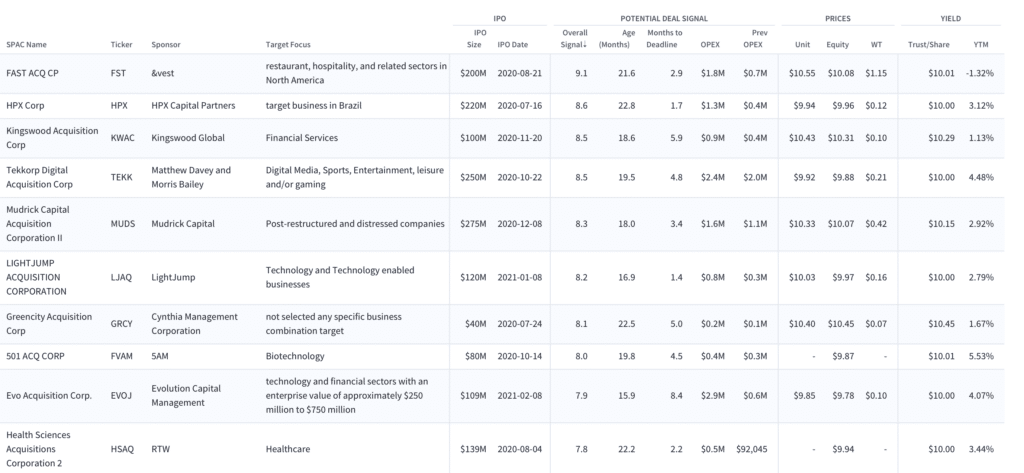

Which SPAC could be the next to announce a deal? Boardroom Alpha’s Potential Deal Screener takes into account several factors including a SPAC’s age, time to deadline and OpEx trends to help predict who might be the next deal. One SPAC on our tracker scores a 9.1 on the overall signal: Fast Acquisition Corp. (FST), which has a restaurant/hospitality focus. Trending at or above 8.5 are HPX Corp. (HPX), which has a Brazil focus; and Kingswood Acquisition Corp. (KWAC) in financial services; and Tekkorp Digital Acquisition Corp.(TEKK), in digital media/sports/entertainment.

Who’s Next? Potential SPAC Deals

SPAC Calendar for June

Merger votes in June include a few high-profile names. One to watch: Richard Branson-backed Virgin Group Acquisition Corp.II (VGII), which plans to merge with natural consumer products specialist Grove Collaborative. Another interesting name on our watch-list: Delwinds Insurance Acquisition Corp. (DWIN), which plans to merge with life insurance and epigenetic testing specialist FOXO Technologies [For more detail, check out our recent podcast with FOXO CEO Jon Sabes, “FOXO Technologies CEO Jon Sabes Is About to Disrupt the Insurance Industry“.

Know Who Drives Return Podcast

Boardroom Alpha’s team talks to the public company and SPAC leaders that are driving return for shareholders, delivering on ESG promises, and more.

See all the episodes here and make sure to subscribe using your favorite podcast app so you don’t miss a single episode.