Despite increased scrutiny and apparent investor fatigue, deals are getting done and SPACs remain an attractive path to the public markets

The SPAC “big picture” remains generally unchanged: a double-whammy of an oversaturated market and worsening macroeconomic conditions is threatening new issues, deal execution, and deSPAC performance. Adding to this negative sentiment is the threat of more SPAC regulation from the SEC. While the SEC’s concerns aren’t stopping de-SPAC transactions from being negotiated and completed during 2022, they are likely to mean greater scrutiny of the degree and quality of the SPAC’s disclosure and longer regulatory review periods of proxy statements and registration statements.

For the over 600 SPACs still searching for targets, extensions and more extensions are the norm. The most successful SPAC sponsors are juggling multiple vehicles in the market simultaneously. And, with not nearly enough deals coming to clear out the backlog, more SPACs are pulling the plug on offerings. Expect more SPACs to liquidate in the coming months, making warrant-based arbitrage more complicated.

In March, once again, deal activity remained low, with just 9 deals announced in March. With redemptions still very high and the PIPE market clearly cooling, SPACs that want to get deals done are doing so more creatively. Backstops and other sweeteners are the norm. That said, we continue to see SPACs as a viable path to the public markets and a viable alternative to other forms of private or public capital for many early stage growth companies.

Now that the growth stock bubble has burst, most deSPACs are generally underperforming the market. Momentum-based trading is the norm as we are seeing a fairly predictable pattern of short-squeezes among low-float / highly shorted new issues.

For anyone looking for discounted valuations in deSPACland, now is a good time to start sifting through the wreckage. Many of the more speculative names have overpromised and under-delivered. But, patient investors have an opportunity to invest in important cyclical themes like electric vehicles, fintech, autonomous driving, and more.

While we’ve certainly seen our fair share of missteps, we come away from recent datapoints with the view that SPACs offer retail investors without access to the private equity market a potentially lucrative investment opportunity. Even though likely upcoming regulatory actions may eliminate some of the perceived advantages of a de-SPAC transaction, we expect many targets to view the de-SPAC route to the public markets as more attractive than the traditional IPO .

SPAC IPO slowdown amidst challenging execution and tepid macro

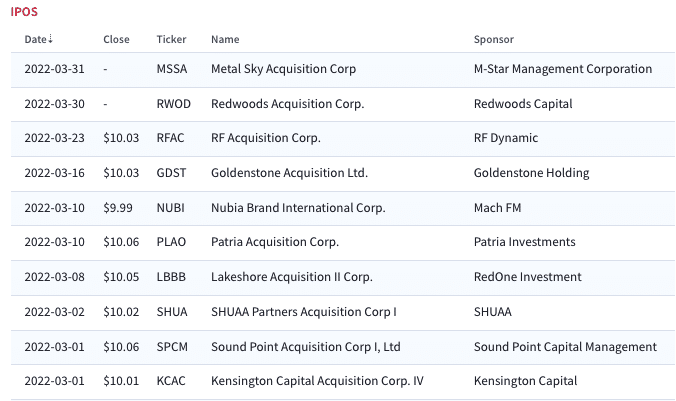

March priced 10 SPAC IPOs, down from 20 SPAC IPOs in February and 109 a year ago. Notable withdrawals included Atlas Crest Investment Corp, led by Ken Moelis,. Atlas withdrew plans for two SPAC IPOs: Atlas Crest III and Atlas Crest IV. Atlas Crest Investment Corp II (ACII) is still searching for a deal. Atlas Crest I merged with aircraft manufacturer Archer Aviation (ACHR), whose shares are struggling at under $5. Silverman Acquisition Corp. I, led by Henry Silverman of Athos Capital Partners, similarly withdrew its IPO plans.

SPAC IPOs are down to a trickle

Source: Boardroom Alpha

We are also seeing a trend toward more cross-border transactions as companies outside of the U.S. seek access to the capital markets. One such example in March is the deal announcement from Thunder Bridge Capital Partners IV (THCP), which announced plans to merge with Coincheck, Inc. Coincheck is a digital asset trading service with the highest number of app downloads in Japan. The transaction values the company at an EV of $1.25B. Also of note: no PIPE.

Given heightened investor concerns around China-related stocks, Asia-focused SPACs are making their ex-China focus very clear. A couple of March SPAC IPOs stated an ex-China focus:

- RF Acquisition Corp. (RFAC), led by CEO Tse Meng Ng, CEO and co-founder of Singapore-based Ruifeng Wealth Management, priced a $100M offering earlier this month. SPAC makes its ex-China focus very clear: “We shall not undertake our initial business combination with any entity with its principal business operations in China (including Hong Kong and Macau).”

- Lakeshore Acquisition II (LBBBU), the second SPAC formed by Bill Chen, CEO of Shanghai Renaissance Investment Management, similarly will not execute a transaction in China, Hong Kong or Macau.

SPAC IPOs in March

Source: Boardroom Alpha

With hundreds of SPACs actively searching for deals, the big picture is largely unchanged from February: not enough M&A activity is getting done. Not surprisingly, pre-deal SPACs are largely languishing given reduced execution certainty. And of the deals that are getting done, we are seeing continued tweaking of deal terms to get over the goal line.

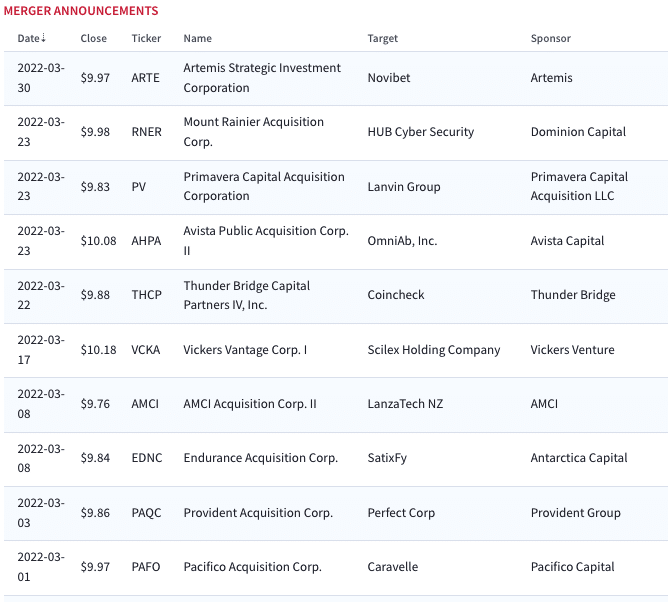

Deal announcements holding up

Merger announcements are holding steady: 10 merger announcements in March. While there are currently 104 pre-close SPACs with DAs that look ready to reach the finish line, there were a few noteworthy names with announced deals in March, including

- Primavera Capital (PV), which is merging with fashion house Lanvin Group

- AMCI Acquisition Corp. II (AMCI), which is merging with carbon capture and transformation (CCT) company LanzaTech NZ

- Avista Public Acquisition Corp. II (AHPA), which is merging with OmniAB, the antibody discovery businessof Ligand Pharmaceuticals (LGND). This one is a more complicated SPAC transaction as it involves a tax-free spin-off of Ligand’s OmniAB business through a RMT (Reverse Morris Trust) transaction ahead of the merger.

March SPAC merger announcements

Source: Boardroom Alpha

Deal cancellations on the rise

The cancellation trend continues. With most pre-deal SPACs now trading below $10, the still high rate of redemptions means there’s often not enough cash in trust to meet the deal’s requirements. More announced deals are failing to make it to fruition. There’s also the possibility that if one or more parties don’t think the initial valuation will be supported by investors, the target company may decide it’s better to remain private for now.

Several SPACs called off mergers in March, across a variety of sectors:

- EO Charging / First Reserve Sustainable Growth Corp. (FRSGU)

- Packable / Highland Transcend Partners I Corp. (HTPA)

- Memic Innovative Surgery / Medtech Acquisition Corp (MTAC)

Liquidations

Not only did issuance slow down further, but the clock is ticking for those SPACs that are still deal hunting. We expect to see an increase in liquidation this year as many SPACs that completed their IPOs in 2020 and have get to find a merger partner approach their deadline periods. Of the SPAC newcomers, we are seeing a shortened timeframe to complete a business combination. Whereas last year we were seeing a timeframe of 18-24 months, we are now seeing timeframes as short as 9 months (albeit with built-in extensions).

Redemptions decline slightly

SPAC shareholders are increasingly asking for their money back instead of funding mergers. As we’ve seen in recent weeks, the high rate of redemptions is a recurring theme which is preventing deals from getting done. Redemptions have steadily increased over the past three consecutive months. Redemptions were 82% in February, down from 89% in February and just 4% a year-ago. The lower redemptions is can be partly attributed to sweeteners and non-redemption agreements to shareholders, making it slightly more appealing for them to hang onto shares.

Redemptions: Modest improvement in March

Source: Boardroom Alpha

More creative deal financing as PIPE market cools

Given the numerous challenges in announcing and completing de-SPAC transactions, financing sources other than the funds held in the trust account are now more important than ever.

A tightening of the PIPE market for investments in a private placement by institutional investors has created more difficult conditions for executing de-SPAC transactions. In recent weeks, we are seeing much smaller sized PIPEs relative to the amount of funds held in trust. And, an increasing number of recent de-SPAC transactions have not included PIPE financing committed as of the announcement date.

Converts are an attractive financing tool

We are also seeing more convertible or other debt securities and warrants in recent transactions compared to last year. These provide early investors with fixed returns with potential upside through convert features. Several recent deSPAC transactions have included commitments for 5-year convertible notes with semi-annual interest ranging between 6% and 7% and conversion prices between $11.50 and $12.00. Many include interest make-whole payments in cash depending on when notes are converted. Deals often have a 15% over-allotment option. A number of issuers, including Sofi Technologies (SOFI) and Lucid Group (LCID) accessed the market just a few months after the de-SPAC close. Borrow tends to be lower for deSPACs, but those that are executing well with a long-term shareholder base are finding success.

- E-commerce grocery supplier Boxed (BOXD), which deSPACed in December from Seven Oaks Acquisition, included an $86 million convert. The notes have an interest rate of 7% and convert to stock at $12 per share. Interest is payable in-kind or in cash, giving the company greater flexibility with its cash flows. The convertible was subject to a minimum cash condition. As an additional inventive, Seven Oaks transferred 125,000 founder shares to the lead convert investor. The deal also included a $34 million PIPE. Shares trade ~$10.

- Analytics specialist Bigbear.ai Holdings (BBAI) which deSPACed in December from GigCapital4, issued a $200M convert at 6% which is convertible at $11.50. Note holders who elect to convert before the third anniversary of issuance get a cash payment equal to 12 months of interest; if they choose to convert on or after the third anniversary of the initial issuance but before the fourth anniversary, they receive any remaining amounts that would be owed from the conversation date up to, but excluding, the fourth anniversary of the initial issuance of the notes. Shares trade ~$8.80.

- Jonah Peretti’s beleaguered news and entertainment media company Buzzfeed (BZFD), which deSPACed from 890 5th Avenue Partners in December, issued a $150M convert. The notes mature in 2026 and have an interest rate of 7.0%, but this bumps up to 8.5% if there is less than $144 million in the SPAC’s trust account at closing. The notes are convertible at an initial conversion price of the lesser of $12.50 and a 25% premium to the lowest per share price at which any equity of the SPAC is issued prior to the closing. If a noteholder elects to convert after the one-year anniversary, but before the three-year anniversary, of the issuance of the notes, the SPAC must pay an interest-make-whole payment in cash. The indenture governing the convertible notes also includes restrictive covenants to limit the ability of the issuer to incur additional debt. Shares trade ~$5.26.

It’s important to point out that the trend towards issuance of convertible securities instead of common equity in a PIPE financing scenario may create adverse consequences for deSPACs. Convertible securities must have a conversion premium of at least 10% and the conversion price must have a floor to ensure that the number of shares issuable upon conversion is not unlimited. The convert structure conflicts with the preference of PIPE investors for price protection through the inclusion of “full ratchet” or “down round” protection if securities are issued at a lower price.

Overfunded trust accounts

As a result of larger investments of at-risk capital by SPAC sponsors, and to attract more IPO-stage investors, SPAC sponsors have continued to over-fund SPAC trust accounts by placing additional funds in the trust. SPAC sponsors are now commonly over funding trusts so that they begin with about $10.20 for each unit sold rather than $10. This overfunding gives stockholders even more incentive to pursue a “buy and redeem” strategy and attracts more IPO investment. The flip side of overfunded trust accounts is that the greater the redemptions, the decreased likelihood that the public shares will trade above the redemption price at the time of the business combination. It’s also expensive for sponsors because the overfunding comes from their pockets– usually it’s from sales of warrants or units to SPAC sponsors at the time of the IPO.

Backstops

Amidst rising redemptions and smaller PIPEs, SPACs are finding it more difficult to ensure the availability of adequate cash to provide sufficient liquidity to the surviving company. As a result, we are seeing more backstop arrangements whereby the backstop investor typically receives cash or equity compensation for its backstop commitment.

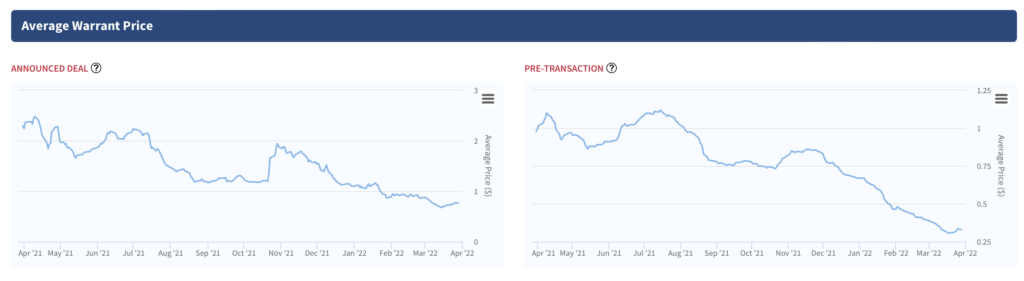

Increased warrant coverage

While last year saw SPACs with minimal warrant coverage, the pendulum has swung in the other direction owing to a cooling market. The number of shares that may be purchased by exercising warrants included in the units sold in SPAC IPOs has generally increased. Warrants have also come under increased regulatory scrutiny. FINRA issued an advisory last August cautioning investors of “the risks associated with these speculative securities” as an increasing number of warrants are becoming worthless owing to missed redemption deadlines and liquidations.

Warrant trends

Source: Boardroom Alpha

Regulatory climate

In late March, the SEC debuted new proposed rules – mostly around disclosures, incomplete information and insufficient protection against conflicts of interest and fraud. Proposed changes include:

- Amending the definition of a “blank check company” to make the liability safe harbor for forward-looking statements, such as business forecasts, unavailable in filings by SPACs. The move would leave SPACs open to investor lawsuits as a result of overly aggressive projections.

- Requiring that the SPAC’s private business target be a co-registrant when the company files an S-4.

- Better policing of conflicts of interest, fees and potential dilution.

- Updating the Securities Act of 1933 to limit the types of financial statements that can be made by SPACs and their merger targets.

“Investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud, and conflicts,” said SEC Chair Gary Gensler. The SEC will vote to approve the rules after a 60-day period for public comment on its proposal.

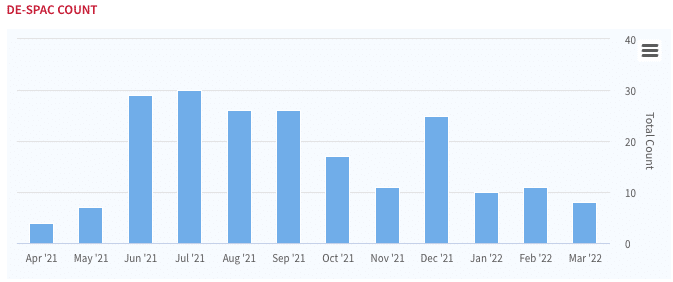

deSPACs: Still making it out, but messier out of the gate

The “overfunding” of trust accounts and tighter deadlines for completing the initial business combination are working to reduce the likelihood of a successful de-SPAC transaction by increasing the likelihood of redemptions and shortening the length of time to identify a suitable target, negotiate and execute a business combination agreement, complete the SEC review process, get shareholder approval and close. Given the messy macro, it’s not surprising that fewer deSPACs made it out this month. March saw a total of 8 deSPACs, down from 11 in February and 9 a year ago.

deSPAC count: A clogged PIPE market and other headwinds are closing the exits

Source: Boardroom Alpha

Low-float Short Squeezes are a Key Theme

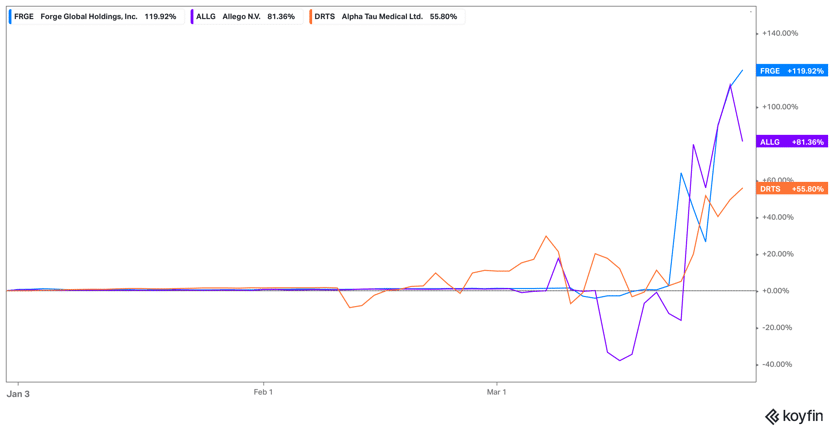

With the macro as it is, deSPACs are mostly still faltering out of the gate. One trend in particular we have been seeing is short squeezes among low float, high redemption new issues. Luxury vacation rental provider Inspirato (ISPO), which deSPAC’d in February, was a notable example of this phenomenon. Shares shot up to ~$55 before falling back down to ~$9. March saw short squeezes among several deSPACs:

- EV charging infrastructure provider Allego (ALLG)

- Pre-IPO trading marketplace Forge Global (FRGE)

- Alpha-radiation cancer therapy specialist Alpha Tau Medical (DRTS)

Life as a low-float / high short deSPAC: ALLG, FRGE, DRTS

Source: Koyfin

March deSPACs

Source: Boardroom Alpha

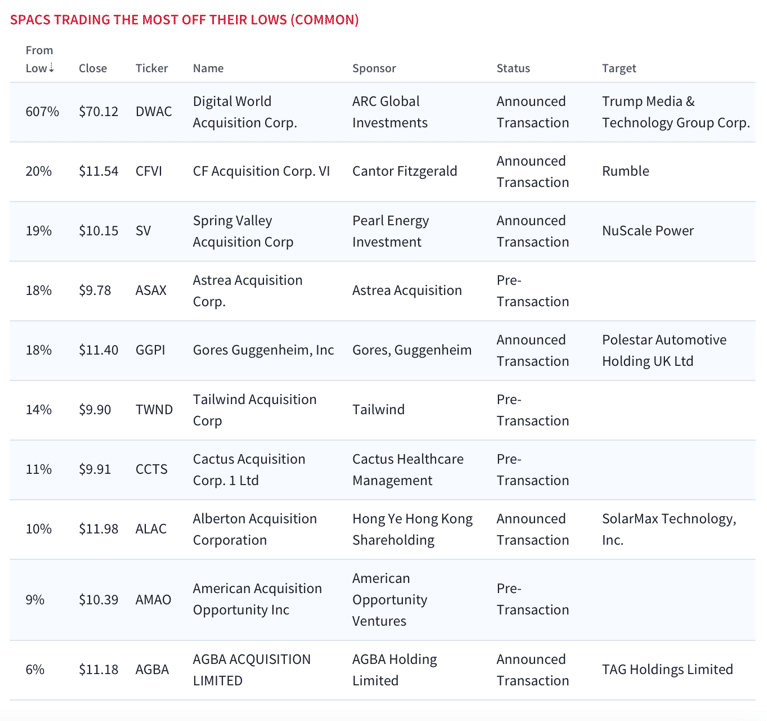

EVs, space, and “red nation” ideas remain in the spotlight

Electric Vehicles (EVs) remain one of the most important investment themes this year. Gores Guggenheim (GGPI), which is expected to complete its merger with EV maker Polestar in the next several months, remains one of the most important SPACs to watch. Also in the EV space is charging infrastructure provider Allego (ALLG), which deSPACed in March. See our detailed analysis on ALLG here).

Given the current political climate, “Red Nation” investing ideas continue to be a key theme. Two SPACs with announced transactions that are social media plays on right wing politics are Digital World Acquisition Corp. (DWAC) / Truth Social and CF Acquisition VI (CFVI) / Rumble. DWAC and CFVI are trading up 60% and 20% off their lows, respectively. See our detailed analysis on DWAC here. Black Rifle Coffee (BRCC) is another idea in this space.

Source: Boardroom Alpha

Who’s Next?

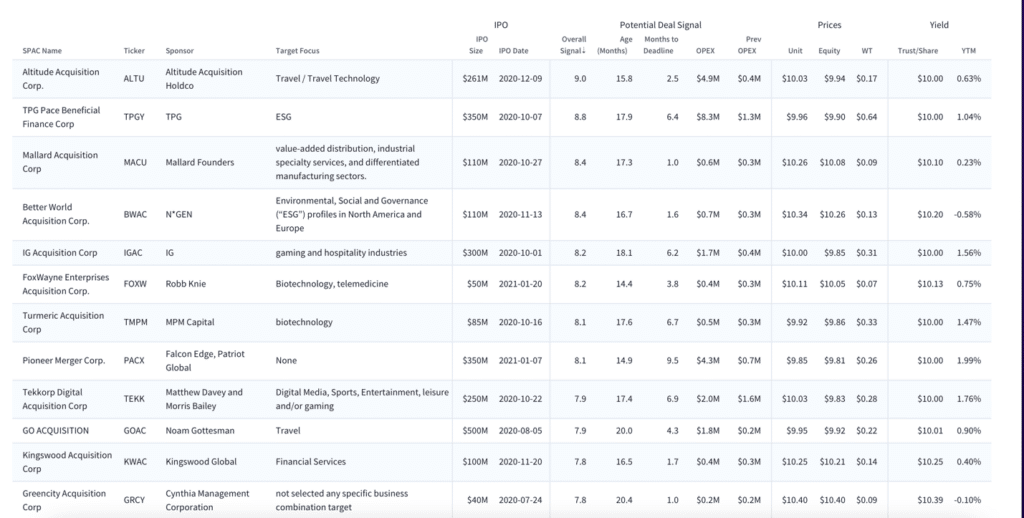

There are still over 610 SPACs looking for a merger target, and they are still largely trading at a discount to NAV at ~$9 for the average common pre-deal SPAC.

Which SPAC could be the next to announce a deal? We recently released a Potential Deal Screener that takes into account several factors including a SPAC’s age, time to deadline and OpEx trends to help predict who might be the next deal. One SPAC on our tracker, Altitude Acquisition Corp. (ALTU), which has a travel / travel technology focus, scores 9.0 on the overall signal. Also of note: TPG pace Beneficial Finance Corp. (TPGY), which has an ESG focus, scores an 8.8.

Who’s Next? Potential SPAC Deals

Source: Boardroom Alpha

SPAC Calendar for April

Merger votes in April include a few high-profile names. Next big merger vote to watch: Global SPAC Partners Co. (GLSPT), which plans to merge with Gorilla Technology Group.

Source: Boardroom Alpha

Know Who Drives Return Podcast

Boardroom Alpha’s team talks to the public company and SPAC leaders that are driving return for shareholders, delivering on ESG promises, and more.

See all the episodes here and make sure to subscribe using your favorite podcast app so you don’t miss a single episode.