Glorified extension cords or SaaS story? With EV charging margins ~20%, the software/cloud angle looks like a stretch without better visibility into long-term profitability and earnings growth

Allego makes it out of the gate. Amidst a more tepid macro for SPAC IPOs, European electric vehicle (EV) charging network provider Allego (ALLG) debuts today as a public company, having deSPAC’d from Spartan Acquisition Corp. III. PIPE investors include Landis+Gyr (LDGYY), and funds managed by private equity firm ECP Investments, British investor Ian Osborne’s Hedosophia, and EV maker Fisker (FSR).

Pan-European EV charging. Founded in 2013, Allego is an EV charging company which has deployed over 26,000 charging ports across 12,000 public and private locations, spanning 12 European countries. In 2018, the Company was acquired by Meridiam, a sustainable infrastructure developer and investor. Meridiam along with management hold a 75% stake in the company.

The big picture: a tepid macro and cooling investor sentiment surrounding SPACs. Deals are declining, redemptions are up. Investors aren’t convinced on execution and less tolerant of pre-revenue companies in “growth” markets.

IPO count: A downhill slope

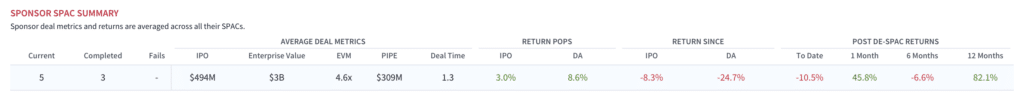

SPAC Sponsor: Apollo Global Management

Spartan Acquisition Corp. III is the third SPAC formed by Apollo Global Management targeting the energy transition space. The company is led by CEO and Chairman Geoffrey Strong, who is a Senior Partner at Apollo, and CFO and CAO James Crossen, who serves as the CFO for Private Equity and Real Assets at Apollo. Apollo’s previous SPACs include Spartan Acquisition II (SPRQ), which went public in November 2020 and completed its merger with US residential solar financing platform Sunlight Financial (SUNL) in July 2021, and Spartan Energy Acquisition, went public in August 2018 and completed its acquisition of EV auto developer Fisker in October 2021. With respect to the Allego merger, high redemptions are the main red flag here (98%+).

EV Market & Business Model

Demand underpinned by sustainable EV growth, particularly in Europe. The EV charging market is expected to grow at a 44% at a CAGR between 2022-2027. In particular, the market for Europe is expected to grow at a much higher pace than in the U.S., owing to the size of the EV market — which is 2x the size of the U.S. market. The number of EVs in Europe is expected to grow to nearly 20 million by 2025, as compared to 3 million today. The combination of a high urbanization rate and a scarcity of in-home parking sets up for sustainable demand for public EV charging locations that provide reliable and convenient charging.

Business model relies on scale. ChargePoint (CHPT) is the current market leader from a revenue perspective (and the largest in the U.S.). Other comparables include Wallbox (WBX), EVgo (EVGO), Blink Charging Co. (BLNK), Volta (VLTA). (BEEM), First Reserve (FRSG), Tritium Dcfc (DCFC), and Nuvve Holding (NVVE). Most EV charging infrastructure providers derive revenue from sale of hardware, software and services. The most highly valued stocks in this space have a recurring software-as-a-service (SaaS) model that’s attached to their hardware. So as hardware sales increase, recurring revenues should also trend higher. These dynamics should be positive for margin expansion over the long term. That said, the best performers in this space are generating margins in the 20% range for now. ChargePoint, the leader in this space from a revenue perspective ($200M in 2021) generated a 21.6% gross margin in Q4. The company raised guidance for the year to $230 million, up 15% from the guidance provided in Q3.

Building a smart and fast-charging network. A key differentiator for the company is its proprietary software, called Allamo, which identifies charging locations and provides payment solutions. Allamo analyzes traffic statistics and leverages proprietary databases to forecast EV charging demand, allowing ALlego to optimize its network for ‘premium’ charging sites in high demand locations. Whereas many competing EV charging networks offer slower charging technology, Allego’s focus is on fast and ultra-fast charging locations, which maximize utilization rates and carry higher gross margins. Charging speed is becoming a key differentiator for passenger EVs (people want to charge quickly) and also fleet operators. Last week, Allego announced a deal with Tamoil Italia to establish 11 EV charging stations in northern Italy.

Allego Outlook

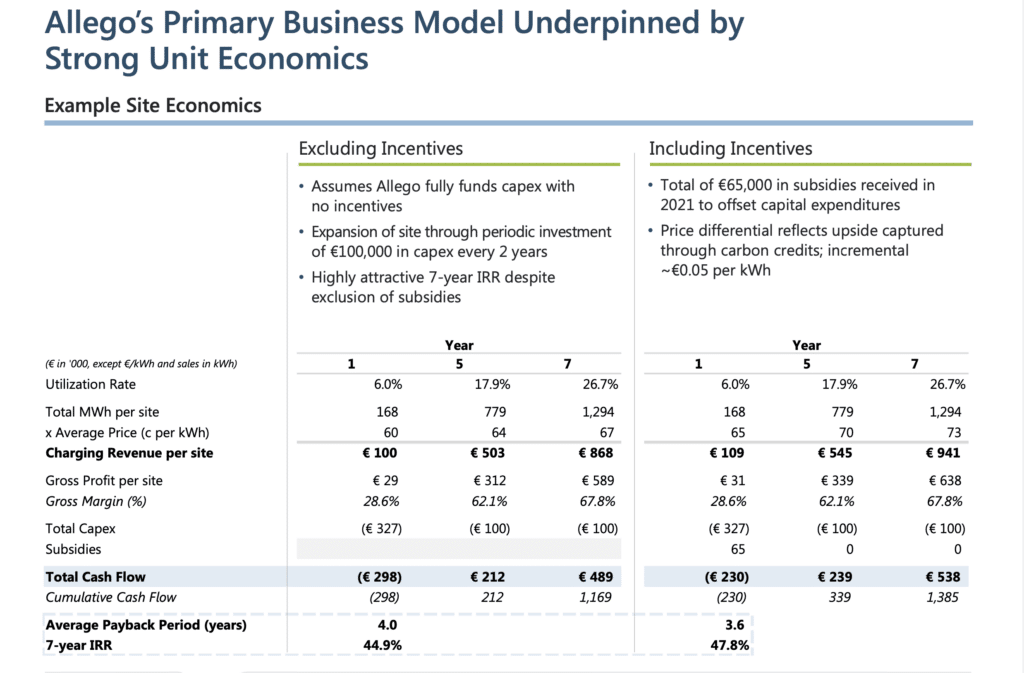

We’re taking a ‘wait and see’ approach to the margin expansion story for now. Allego generated revenue of $100M in 2021, putting it in second place behind ChargePoint (~$200M). However, Allego is the only charging provider that is already EBITDA breakeven. Credit is due here: most competitors are reporting significant cash burn as they build out their networks. The company also expects an average pay-back period of 3.6 years (including incentives) per charging site. Importantly, Allego claims its software and value added services model can expand margins from the high 20% to 60%+ by year 5 of operations. While we appreciate the earnings power of a software-driven business model, we await more evidence of differentiation that prevents EV charging from becoming a commoditized business longer-term.

Setting up for a squeeze play. Back of the envelope estimates: based on the company’s stated $161M of proceeds and a $150M PIPE, Allego’s float looks to be around 1.1M shares. It’s unclear whether this $161M is cash raised or cash to the balance sheet- likely the former, which implies 98%+ redemptions.

Ultimately this is a fuel/power market. Expect consolidation. Almost every EV charging infrastructure provider is calling for hockey-stick revenue growth. We’d like to see the profitability story follow suit. For now, this is is a crowded market and, like many parts of the EV value chain, we expect heavy consolidation. Scale is what’s needed for any of these company’s to demonstrate earnings leverage. Newer EV charging players are likely to leverage their war chest of cash to make land grab acquisitions. Longer term, as the space matures, we expect to see utilities and oil companies get more interested and acquire infrastructure and software providers in earnest. It also makes a lot of sense for fuel retailers such as Shell (SHEL) and BP get into this space. Given their vast customer base and roadside real estate, these conglomerates may be in a better competitive position than pure-play EV networks. Similarly, power companies can leverage their expertise in managing the grid.