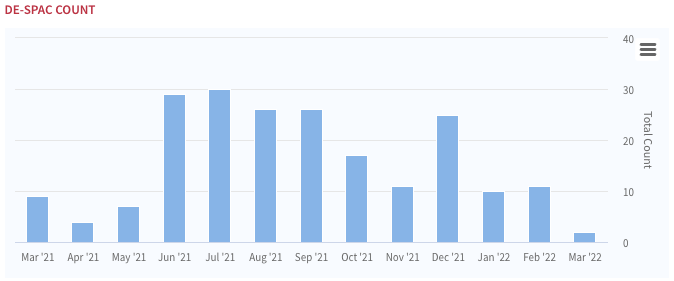

It can be said that throughout 2021, the “secret sauce” of the SPAC market was nearly ubiquitous PIPE financing, which helped support valuations and guarantee available capital. But, with over 600 SPACs out there searching for a deal, the PIPE market has gotten a lot tighter. Notably, deSPAC count is down to 2 so far this month, down from 9 last March.

By now, we’re all familiar with the confluence of factors causing the downward trajectory in completed SPAC mergers: regulatory scrutiny, disappointing operating results from many de-SPACed companies, and a market oversaturated with SPACs seeking deals.

A clogged PIPE market and other headwinds closing the exits

As we’ve seen in recent weeks, even SPACs with deal announcements aren’t out of the woods yet. Without committed financing, we are starting to see many SPAC deals priced at aggressive 2021 valuations fall through the cracks. Today, we’ll take a deeper dive into recent SPAC deal announcements and how they’re getting done.

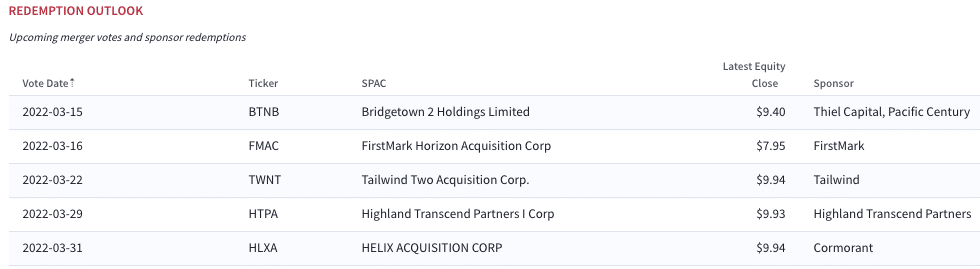

Volatility ahead: upcoming merger votes and sponsor redemptions

Given market conditions, we expect to see more deal sweeteners and especially deal cancellations as we navigate volatile markets for the foreseeable future.

SPAC merger announcements this month

Competitive market leads to creative financing in many deSPAC combinations

In a crowded, competitive market, SPACs have started to get creative. With so many SPACs still seeking targets, we are starting to see many deSPAC deals announced with alternative financing structures. Some SPACs have raised funds through issuance of convertible debt, providing investors with fixed returns with potential upside through convert features. Several recent deSPAC transactions have included commitments for 5-year convertible notes with semi-annual interest ranging between 6% and 7% and conversion prices between $11.50 and $12.00. Many include interest make-whole payments in cash depending on when notes are converted. Examples include:

- Buzzfeed (BZFD)

- Boxed (BOXD)

- Bigbear.ai (BBAI)

Other deSPAC transactions have used common equity PIPEs but have included warrants together with a lockup of the shares and warrants—to increase potential PIPE return. One recent example is satellite imaging provider Satellogic (SATL). For more details, see our recent podcast with CEO Emiliano Kargieman here

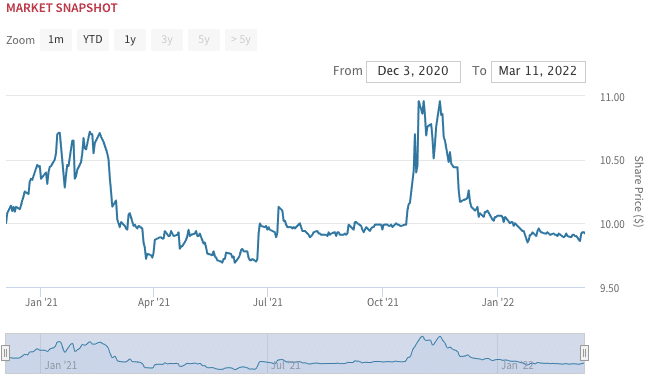

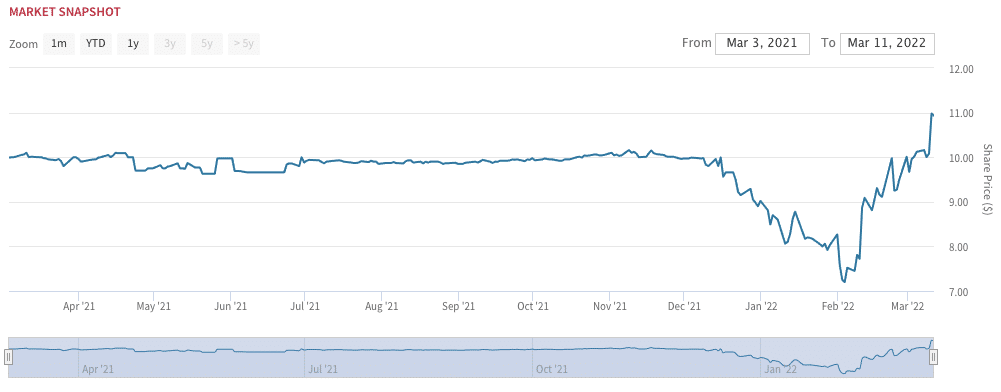

SATL: bouncing back

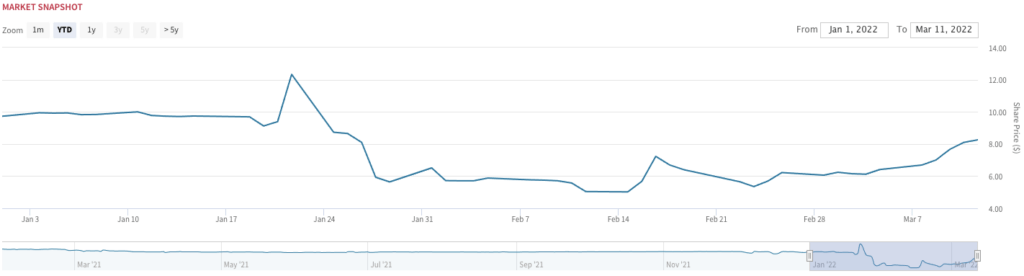

Far Peak Acquisition Corp. (FPAC) / Bullish Global is another example. Bullish operates a regulated global cryptocurrency exchange for institutional and retail customers and is a division of blockchain software company Block.one. Investors include Peter Thiel’s Thiel Capital and Founders Fund and investment bank Nomura. Since a pop on the deal announcement last November, shares have steadily declined and trade just below trust. Merger closing date has been extended to May 9th. The merger is expected to close in 2Q.

FPAC has fizzled since November’s DA pop

We are also starting to see a combination of common and preferred equity PIPEs. Isos Acquisition Corp., which completed its merger with Bowlero (BOWL) in December, is one example. BOWL is currently trading ~$11, with PIPE investor Soros Fund Management holding a 5.4% ownership stake.

BOWL: Holding up relatively well

Skin in the game: backstops against shareholder redemptions

Ultimately, one of the main purposes of the PIPE is to serve as a backstop against shareholder redemptions and provide more execution certainty– that is, greater assurance that the transaction will close even amidst SPAC shareholder redemptions and with a certain amount of cash on the balance sheet.

Some deals have the SPAC sponsor, or another shareholder specifically commit to provide a financial backstop against some or all shareholder redemptions. Recent examples include:

- Endurance Acquisition Corp. (EDNC) /SatixFy

- $29 million PIPE (downside protection to $6.50/non-dilutive share transfer) with participation from institutional investors including Sensegain Group and Antarctica Capital, and $75 million from CF Principal Investments LLC, an affiliate of Cantor Fitzgerald. The Company also closed on an additional financial commitment of $55 million from Francisco Partners.

- FirstMark Horizon (FMAC) / Starry

- allocated an additional 1M shares to non-redeeming stockholders; 2.4M shares out of 41.4M public shares have agreed not to redeem in exchange for bonus shares

- Aurora Acquisition Corp. (AURC) / Better Holdco – revised merger terms in December reduced SoftBank’s PIPE commitment to $750 million, to be provided through interest-free bridge financing. Mass layoffs have cast doubt on completion of this one, which is pushed to Sept. 30, 2022.

Sponsor participation in PIPEs

Another interesting trend we’ve seen in recent transactions is for SPAC sponsors to make meaningful contributions to the PIPE. This contribution is included in deal announcements as evidence of the sponsor’s longer-term commitment to the company’s future. Three such deSPACs across three very different sectors:

- The Oncology Institute (TOI)

- SIGMA Sports United GmbH (SSU)

- Wallbox B.V. (WBX) — Euro EV charging network infrastructure provider WBX has been the best performer of this group. With EV carmaker stocks (RIVN, LCID, STLS) under pressure owing to disappointing production numbers, investor interest has turned to derivative EV plays (charging, lidar etc.)

Other sweeteners: Board observer rights, discounted shares

Individual PIPE investors typically don’t get board representation or board observer rights, owing to the size of their position and because information received by a director or board observer could constitute material nonpublic information which would prohibit a PIPE investor from reselling shares. But, that didn’t stop at least one SPAC from getting over the goal line:

- Pardes Biosciences (PRDS) – DeSPACed January; $75M PIPE included the SPAC sponsor and a strategic investor, Gilead Sciences Inc. (GILD) Gilead obtained the right to designate a board observer who will attend all meetings in a non-voting capacity and receive all materials provided to the board.

Some deals, like the failed merger between DPCM Capital and Jam City, included discounted shares. And in yet other cases, there has been no PIPE or other financing at all:

- Big Cypress Acquisition Corp. / SAB Biotherapeutics – June 21, 2021 – no PIPE or other financing and no minimum cash condition