- SPAC Market Review – September 2022

- Full SPAC Listing

- Podcast: Know Who Drives Return

- Daily SPAC Newsletter

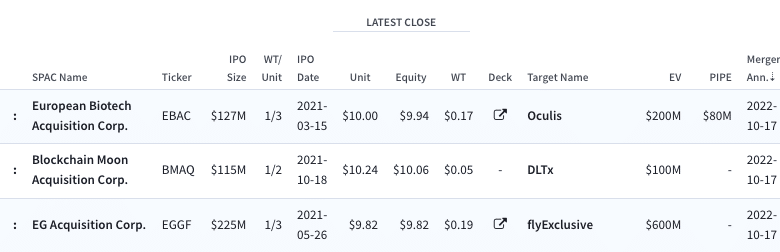

Happy Monday! 3 new Definitive Agreements were announced today (or technically 2 if you count a Saturday international deal), to kick things off with a little bit of a Merger Monday bang. Included were another private jet company choosing the SPAC route, and a biotech:

We recap the rest of the day’s SPAC news below.

Elsewhere in SPACs

- Malacca Straits Acquisition Corp. (MLAC) is likely the lowest-float pre-deal SPAC as it disclosed it has just over 500k shares left in trust following its extension vote

- Sanaby Health Acquisition Corp. I (SANB) will liquidate on 10/19 at ~$10.22 share

- Bridgetown Holdings Limited (BTWN) disclosed it has over 15M shares left in trust following its extension vote

- African Gold Acquisition Corp. (AGAC) is being investigated by the SEC and the DOJ advised that a grand jury subpoena has been issued against them

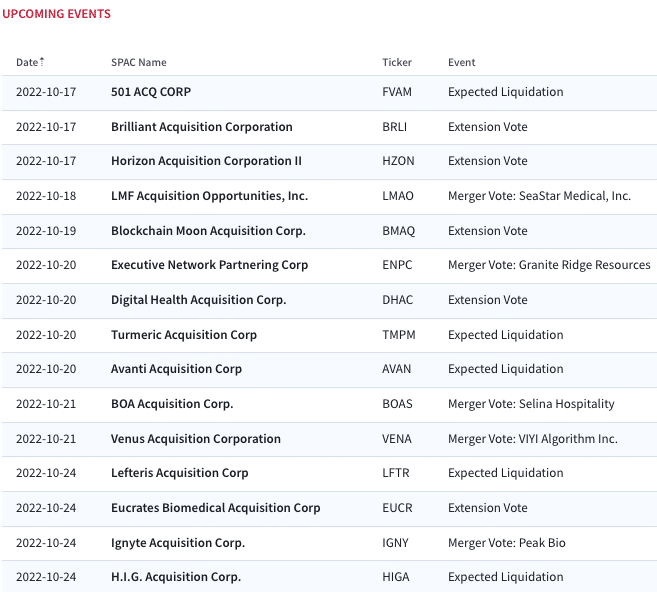

SPAC Calendar

Today’s Movers

Biggest Gainers

1.96% ~ $ 10.38 | MTRY – Monterey Bio Acquisition Corp (Pre-Deal)

1.83% ~ $ 9.99 | PANA – Panacea Acquisition Corp. II (Pre-Deal)

1.59% ~ $ 10.25 | MAAQ – Mana Capital Acquisition Corp. (Announced)

1.11% ~ $ 10.00 | PNAC – Prime Number Acquisition I Corp. (Pre-Deal)

.92% ~ $ 9.92 | BTWN – Bridgetown Holdings Ltd (Pre-Deal)

.90% ~ $ 10.14 | HNRA – HNR Acquisition Corp (Pre-Deal)

.81% ~ $ 9.94 | XPDB – Power Digital Infrastructure Acquisition II Corp. (Pre-Deal)

.81% ~ $ 10.01 | INTE – Integral Acquisition Corp 1 (Pre-Deal)

.79% ~ $ 10.18 | TGR – Kimbell Tiger Acquisition Corp (Pre-Deal)

.77% ~ $ 10.43 | MPAC – Model Performance Acquisition Corp (Announced)

.70% ~ $ 10.02 | ARTE – Artemis Strategic Investment Corporation (Announced)

.70% ~ $ 10.07 | BRAC – Broad Capital Acquisition Corp (Pre-Deal)

.61% ~ $ 9.82 | SLVR – SILVERspac Inc (Pre-Deal)

.61% ~ $ 9.96 | INAQ – Insight Acquisition Corp. (Pre-Deal)

.60% ~ $ 10.13 | ARGU – Argus Capital Corp. (Pre-Deal)

.52% ~ $ 10.20 | TETE – Technology Telecommunication Acquisition Corp (Pre-Deal)

.51% ~ $ 9.84 | PEGR – Project Energy Reimagined Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.91 | IPVI – InterPrivate IV InfraTech Partners Inc. (Pre-Deal)

.50% ~ $ 9.99 | DUET – DUET Acquisition Corp. (Announced)

.50% ~ $ 10.03 | WWAC – Worldwide Webb Acquisition Corp. (Pre-Deal)

Biggest Losers

-7.89% ~ $ 16.11 | DWAC – Digital World Acquisition Corp. (Announced)

-6.87% ~ $ 9.22 | LMAO – LMF Acquisition Opportunities, Inc. (Announced)

-1.39% ~ $ 9.90 | BOAS – BOA Acquisition Corp. (Announced)

-1.25% ~ $ 10.55 | HHGC – HHG Capital Corporation (Pre-Deal)

-.77% ~ $ 10.30 | FLYA – SOAR Technology Acquisition Corp. (Pre-Deal)

-.59% ~ $ 10.18 | ACEV – ACE Convergence Acquisition Corp (Announced)

-.51% ~ $ 9.81 | HWKZ – Hawks Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.82 | DGNU – Dragoneer Growth Opportunities Corp. III (Pre-Deal)

-.40% ~ $ 9.95 | HZON – Horizon Acquisition Corporation II (Announced)

-.40% ~ $ 9.98 | SMAP – Sportsmap Tech Acquisition Corp. (Pre-Deal)

-.40% ~ $ 10.03 | ALOR – ALSP Orchid Acquisition Corp I (Pre-Deal)

-.40% ~ $ 10.08 | SHAP – Spree Acquisition Corp. 1 Ltd (Pre-Deal)

-.35% ~ $ 9.94 | CHAA – Catcha Investment Corp (Pre-Deal)

-.30% ~ $ 9.83 | PSPC – Post Holdings Partnering Corporation (Pre-Deal)

-.30% ~ $ 9.88 | SPTK – SportsTek Acquisition Corp. (Pre-Deal)

-.30% ~ $ 9.89 | IPVF – InterPrivate III Financial Partners Inc. (Announced)

-.30% ~ $ 9.92 | LDHA – LDH Growth Corp I (Pre-Deal)

-.30% ~ $ 10.13 | AMAO – American Acquisition Opportunity Inc (Announced)

-.29% ~ $ 10.24 | MCAA – Mountain Co. I Acquisition Corp. (Pre-Deal)

-.29% ~ $ 10.43 | MBTC – Nocturne Acquisition Corporation (Pre-Deal)