Nope, SOFI won’t print a perfect quarter. But expect stronger hands to prevail, thanks to a still high short interest and Goldman Sachs for the pre-quarter downgrade.

Key points ahead of the quarter

SOFI reports Q4 earnings today aftermarket. Decentralized financial services firm SOFI Technologies reports today aftermarket. Consensus calls for $(0.12) on $279.47M. We think there is a high chance that user numbers will outperform expectations given the company’s even stronger brand recognition. SOFI reached just under 3 million total users in Q3.

Two key metrics to watch. 2022 revenue guidance calls for $1.6 billion (+60% YoY). 2022 EBITDA guidance calls for $390 million (+1000% YoY).

Technisys acquisition is misunderstood. SOFI is spending a lot of cash on marketing and has been on a bit of a spending spree since the pandemic began with the $1.2 billion Galileo deal announced in 2020 and the completion of its bank charter spawning acquisition of Golden Pacific, cost close to $800 million after accounting for the charter. Now, SOFI has made a third acquisition: the $1.1 billion, all-stock acquisition of cloud-based banking platform Technisys. Investors have been very wary of the high cost of the acquisition, especially since SOFI’s $533 balance sheet is weighed down by a total debt of $3.01 billion. In Q3, SOFI reported $30 million in net losses.

Our take: look at the longer-term implications of the deal. While we ‘get it’ that investors are concerned about earnings and cash, we also view the recent deal-related sell-off as overdone. Companies across the board are missing earnings right now, but the difference here is the long-term view and execution. The acquisition is dilutive by ~10% but will generate as much as $800 million in incremental revenue growth and achieve $85 million in annual cost savings through 2025. The dilution was quickly priced into the shares when this deal was announced on February 22, but the upside synergies that the deal provides aren’t priced into the stock.

Show me a stock with a better earnings trajectory right now. The real story at SOFI is the company’s transformation into a diversified business. In 2020, ~83% of SOFI’s top line came from its lending business. Five years from now, the revenue mix will be much more diversified, even though lending is expected to triple in five years. The customer base is in place and growing. It’s not a stretch to see that SoFi has the potential expand operating margins to over 20% this year as customers adopt more products. We recently got an up-close look at earnings power from SoFi’s smaller cousin, MoneyLion (ML), which tells a similar earnings growth story through diversification.

Quick Watch: MoneyLion CEO Dee Choubey

Read our full MoneyLion (ML) report here.

SOFI Near-term catalysts. A flood of student-loan refinancing is about to come online once the emergency Federal deferment program ends on the first of May.

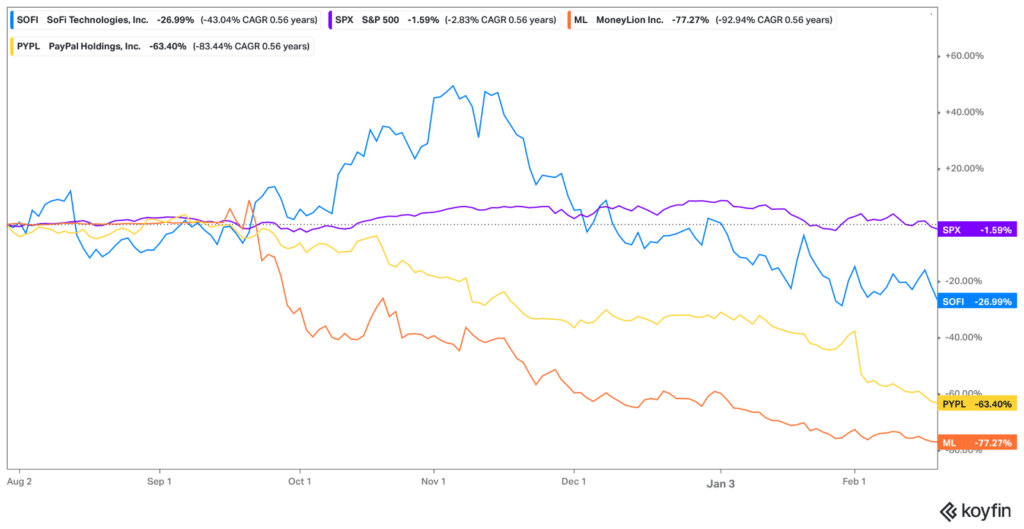

FIntechs have been hammered. We argue a lot has been priced in at these levels.

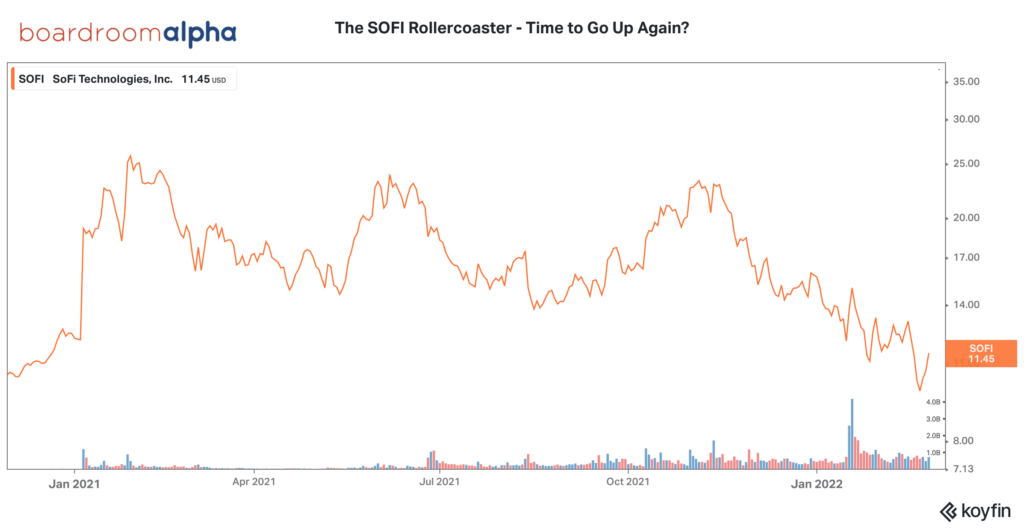

SOFI stock is down ~30% YTD, and the short thesis looks stale. We’re long at these levels

Short interest has come down, but still high. Shorts at ~12% of float.

With shares down ~40% over the past 12 months, we think most of the retail-driven momentum is out of the stock. No doubt: SOFI stock is a growth stock in a shaky market, spurred by concerns over inflation and rising interest rates. But SOFI stock has fallen—hard. Despite the company having received its long-awaited federal banking charter earlier, shares are still down 27% YTD and are trading near their all-time lows. Trading volume has been heavy but we think most of the retail-driven momentum is out of the stock and it’s more in the hands of long-term holders now.

We love a low bar going into a print. Goldman Sachs recently downgraded its price target to $14 (from $16) just days ahead of the print.

SOFI is a transformation story, with underpinning strong demand. The big picture is important here. SOFI’s financial services products– primarily the SoFi money account, the company’s credit card, and its brokerage account—are up 179% year over year. SOFI achieved this growth without the freedom to compete on interest rates with their competitors. But now, as a bank, a key disadvantage is removed. SOFI can now set its own rates and loan terms to be even more competitive with the commercial banks. The potential for future revenue and earnings growth is there.

Best house on the block. A decent print could bounce SOFI back to ~$15 levels. SOFI is no doubt a stock that will continue to remain volatile. But it’s also the bellwether of the neo-banking sector, with undoubtedly the largest customer base and the most diversified business model compared to other recently-listed fintechs. We like the odds on SOFI becoming an unmatchable one-stop-shop for all consumer financial demands. The long term view is that SOFI’s recent acquisitions will prove smart, as they differentiate from the competition in a rapidly saturating space (more than 10,000 fintech startups in the US alone).

The bottom line: if you want to play in this space, SOFI is the lead horse to bet on right now. At an EV to sales of 6x, we’re much more inclined on the long side here. A decent print and we think the stock can trade back up to ~$15 levels it saw in January.