ML stock got crushed in what’s now a very familiar deSPAC narrative. But, with some exciting new services underway and a clearer path to profitability, MoneyLion looks ready to roar.

Boardroom Alpha sat down with Dee Choubey, CEO of fintech MoneyLion (ML). Moneylion is a mobile banking and financial membership platform that went public via SPAC merger with Fusion Acquisition (FUSE). After a career in investment banking, Dee co-founded MoneyLion in 2013 with an ambitious goal: to combine AI, machine-learning technology and behavioral science to bring consumer finance into the future.

Does MoneyLion have what it takes to compete with the big guys? Can MoneyLion become the next super app? Listen to the podcast to find out more.

MoneyLion in Brief

A financial services one-stop shop. More than your basic banking app, MoneyLion’s aim is to provide customers with a complete digital financial solution that shifts them from being in debt to investing in assets. Debt-related offerings include cash advance, and personal and credit-builder loans. On the other side of the spectrum are banking, cash management and e-commerce services. Services primarily target Millennials and Gen-Z consumers, but the company’s demographic appears to be broadening.

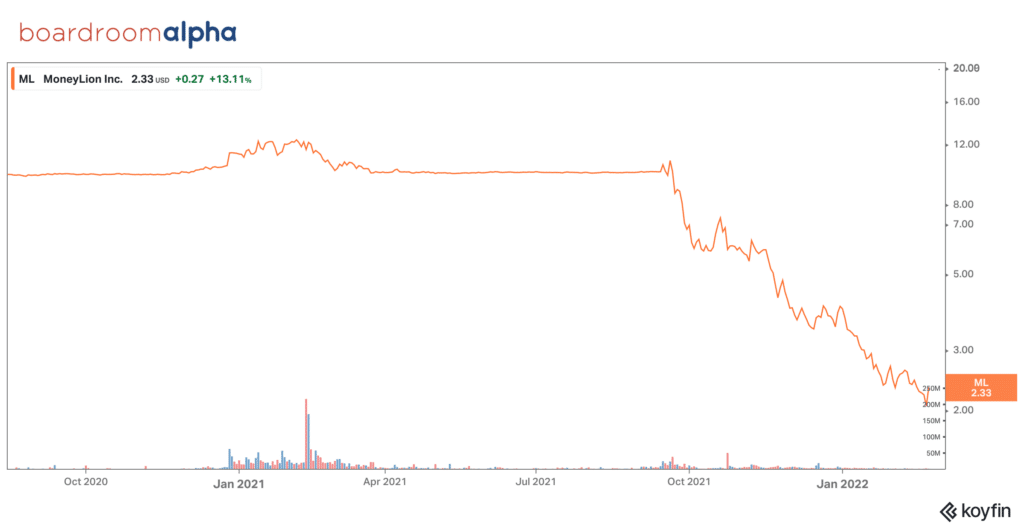

MoneyLion’s (ML) deSPAC Drop Has Been Painful

Differentiation will be key to winning in this space. Like many fintech startups, ML wants to play an advisory role to clients and grow wallet share. But in a sea of low-cost competitors, differentiation is key. MoneyLion is betting that by adding more features, and free and low-cost features– that it will attract new customers and become the primary provider of financial services for its customers.

Examples include:

- RoarMoney — mobile online banking for $1 monthly

- Automated investing tools with a variety of investing options, including ESG portfolios

- Interest-free salary advances with no monthly fees

- Credit Builder Plus — credit-building loans ($19.99/month)

- Financial Heartbeat — evaluates users’ financial situations and delivers personalized advice

Growth has been impressive, even as customers have only just started to use the app. MoneyLion has been adding new customers at a rapid pace. The company currently claims over 6 million members (up from 1 million in 2020)—and projects 9 million members by 2023.

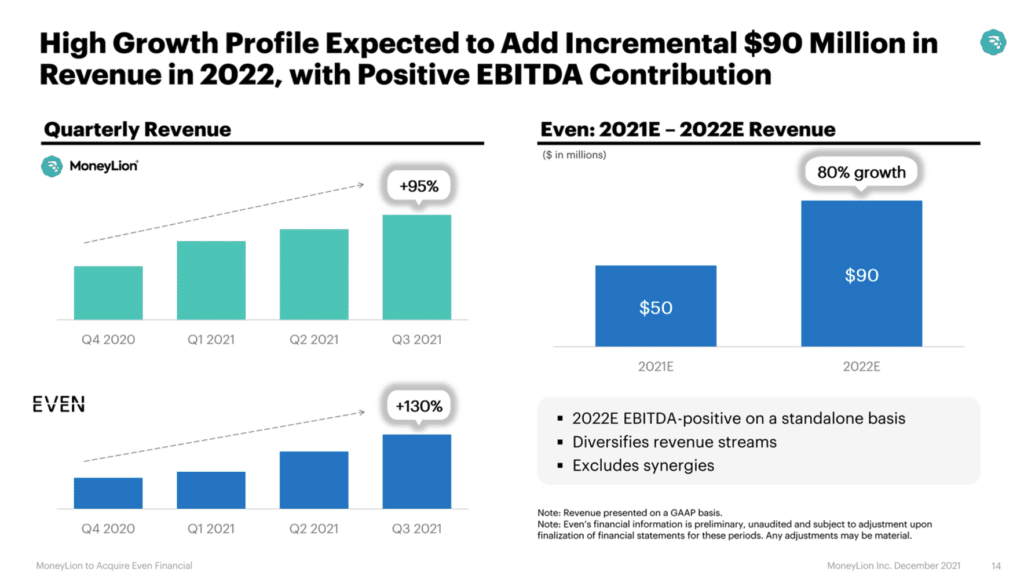

New services like crypto trading and BNPL could make ML a fintech “super-app” and give growth a boost. In September, ML started cryptocurrency trading, starting with Bitcoin and Ethereum, and moving on to other popular coins. Eligible ML customers can buy and sell Bitcoin and Ethereum, as well as roundup debit card purchases in Bitcoin. The company expects to launch a BNPL (Buy Now Pay Later) product via its debit card. Earlier this month, MoneyLion completed its acquisition of B2B fintech Even Financial, which is expected to be accretive to 2022 EPS.

On MoneyLion’s differentiated strategy

“There are lots of super apps. But you know, we’re playing a different strategy. And I think one of our strategies, one of the most interesting ones, we recently acquired a media company [MALKA Media Group] So we now can create our own content. We have thousands of creators, that are athletes, celebrities, influencers. And a lot of people didn’t understand why we acquired that company, because it wasn’t traditionally what a challenger bank fintech company would do. But what it allows us to do is it really allows us to own an authentic conversation about the culture of money, it allows us to engage with segments of the population that haven’t really been taught about financial services in the right way or in or in a thorough way. So it allows us to acquire those consumers as listeners to our conversation in a way that’s highly differentiated.”

Dee Choubey, CEO of MoneyLion

In a sea of downward guidance, ML bumped numbers up. For 2022, ML has guided to revenue of $285 million. Note that guidance doesn’t include targets for the new crypto platform–which already has over 80,000 customers – or the upcoming BNPL product. 2023 guidance calls for revenues of $525 million– $101 million above original guidance announced at the timing of the SPAC transaction in February 2021.

The Big Picture

Fintechs have capitalized on technology lower costs, and a big blind spot among traditional banks….Fintechs like MoneyLion have done very well at attracting younger consumers who have been underserved by banks. More versatile tech and lower overhead gives companies like MoneyLion the ability to offer more lower-cost and no-fee services than big banks.

Competition from mainstream banks is intensifying… Competition from mainstream banks is intensifying as many have started to offer fintech-inspired services like paycheck access and no-free overdrafts. CapitalOne (COF) has eliminated overdraft fees for consumer banking customers, while continuing to provide free overdraft protection. Bank of America (BAC) has nixed nonsufficient funds fees and has cut back overdraft fees.

…but they’re still largely missing the ‘advice’ layer. MoneyLion, like other fintechs, competes with the consumer banks by offering digital-based context and advice to consumers, taking all their linked accounts under advisement—something traditional banks don’t do. The company helps customers answer questions like “should I invest, should I pay off a loan, and how can I save more effectively?” Banks also tend to recommend their own products and services—whereas companies like ML recommend financial products from multiple providers.

On what the big banks are missing….

“When you look at what’s happening to the labor force…right now, 30% of Americans are working multiple jobs. The money center banks have a really hard time underwriting that consumer money line. Because we’re so algorithm based, we’re able to ingest income streams from multiple different incomes, income sources, jobs….and see that, hey, this person is making $70,000 a year 80,000 or $100,000 a year, whereas the bank may only give them credit for earning $20,000 or $30,000 a year. We’re instead able to go out to our customers and say, ‘Hey, we’ve got a credit offer for you. We’ve got investment management tailored for how you get paid in a way that resonates with the changes in the labor force.’ So we saw a step function increase in the usability of our product through the pandemic, while the banks were retreating.”

Dee Choubey, CEO of MoneyLion

On the dominance of Paypal…

“Yeah…PayPal is the OG right there. They are the largest digital bank out there. And, you know, I think they have a very specific merchant checkout feature that works. But what you realize is that you have to…you know, again, I go back to the advice layer. You have to be able to converse with consumers and help them about what to do next. And that’s where we play. And that’s where we see the gap in the market.”

Dee Choubey, CEO of MoneyLion

Fintech stocks have collapsed, owing to interest rate fears. MoneyLion’s market cap currently hovers around ~$535 million. Higher interest rates have been a drag on ML stock and the entire fintech sector. MoneyLion’s business model depends heavily on customers borrowing money, so interest rates and loan defaults will matter.

ML stock: Discounted valuation, evidence of traction on new products will be key

DeSPAC pain. ML stock collapsed following its deSPAC transition, despite raising its guidance into the close of the SPAC merger. The company closed a $250 million PIPE at $10 per share, but 25.9 million shares were redeemed. As a result, MoneyLion ended up raising ~$341 million, versus its original plan for $600 million.

Operating losses are a concern; ARPU growth will be the most closely-watched metric. The company appears to have a strong funnel to growth customers and ARPU. With its existing customer base alone, MoneyLion expects to growth ARPU from $55 to $155 with the addition of 1+ products per customer. With 2+ products, the company forecasts ARPU growth to $235. Notably, the company’s 1.5 customers added in the last year are only just beginning to use the app. The company targets profitability in 2023.

MoneyLion: Even Financial Acquisition should accelerate path to revenue and earnings growth

ML’s lending offerings have come under regulatory scrutiny, creating headline risk. The company disclosed civil investigative demands in three consecutive years (2019-2021) concerning its membership model and its compliance with the Military Lending Act. MoneyLion also received subpoenas from the SEC concerning a subsidiary, the Invest in America Credit Fund LLC, through which the company’s credit and payroll advance products are financed.

Valuation isn’t factoring in for shift into new products….ML trades at a big discount to SoFi. SoFi no doubt is the biggest and most feature-rich of the new fintechs, but shares trade at a healthy premium to the group at ~5x 2023E revenues of $2.1 billion. MoneyLion trades at ~1x 2023E revenues of $525 million. The stock is getting hit largely owing to the company’s current reliance on credit products and ongoing losses. At these levels, we think the risk/reward is largely priced in.