Boardroom Alpha sat down with Omer Keilaf, CEO of LiDAR tech player Innoviz (INVZ). In a fast-moving technology market where timing is everything, Keilaf tells us why this is crunch-time for the auto safety industry. Almost every major car manufacturer has made (or is making) a decision to deploy lidar tech commercially in the coming months. From a product and company positioning perspective, Keilaf has a lot to feel good about. Innoviz has successfully launched its second-generation LiDAR, awaits commercial production at BMW, and appears to be swirling in RFP/RFI activity. But when it comes to investing in LiDAR stocks, how soon is now?

Innoviz in brief. Innoviz went public in April 2021 via SPAC Collective Growth Corp. (CRGO). The transaction, which netted roughly $370M in proceeds, included a $25M PIPE backed by Phoenix Insurance, Magna International (MGA) and Antara Capital, among others. Other investors include SoftBank (SFTBY), Ventures Asia, Samsung, and auto tec supplier Aptiv PLC (APTV). Innoviz is led by co-founder and CEO Omer Keilaf. Keilaf was a senior officer in Unit 81, the elite technological unit of the Israel Defense Forces (IDF) before diving into opto-mechanics, electrical engineering and MEMS at companies including Consumer Physics, STMicroelectronics (STM) and IDF.

LiDAR 101. We’ve been digging into LiDAR extensively over the past year as a logical extension of the Autonomous Driving (AD) movement. For the tech geeks among us, LiDAR is a fascinating and complicated remote sensing technology involving opto-electronics. However, put more simply, LiDAR sensors measure the distance to target objects by illuminating them with lasers and measuring the reflected pulses. And while self-driving cars sound cool and futuristic, most car makers are considering the technology for today’s more practical ADAS (Advanced Driver Assistance Systems). These are advanced safety features underpinned by LiDAR’s ability to improve a car’s “eyesight”– things like intelligent braking, lane changing assist, and parking. For LiDAR companies, the car market is the target focus for now. But, LiDAR also has applications in other end markets, ranging from robotics and security to agricultural and industrial technology.

BMW is super exciting. We’re just waiting for production. In a murky industry that is quickly becoming bifurcated between the “haves” and “have nots,” Innoviz is only one of a handful of companies that can say they’ve been selected by a major carmaker. That’s a big deal considering there are well over a dozen LiDAR companies touting their wares without any design wins under their belt. Innoviz’s debut LiDAR sensor, InnovizOne was selected by BMW for its fully electric iX autonomous car program. The start of commercial production at BMW (and what that means for revenue growth) is obviously the most significant potential catalyst for the stock right now. We are still watching for the signal as to when production will begin.

Designs wins are scarce. So far, three LiDAR companies have announced production wins– Innoviz, with BMW, Luminar (LAZR), with Volvo (VLVLY) and Daimler, and recent deSPAC Cepton (CPTN), with General Motors (GM). For what it’s worth, several LiDAR companies have disclosed unnamed design wins, although investors for the most part remain nonplussed. On its last earnings call, Innoviz disclosed it was selected by a second unnamed company for use in an automated shuttle service due for production at year end. Not surprisingly, there are no more specific timing updates here.

Product overview. Innoviz is in progress toward full commercialization of three products—InnovizOne, InnovizTwo and Innoviz360. InnovizOne is ready for production and is sold by Innoviz’s partner Magna International (MGA). InnovizTwo is the company’s ‘next-gen’ lidar, offering a lower cost, double the frame rate and smaller form factor (designed to go above the windscreen). Innoviz’s third product, Innoviz360, is a 360 degree lidar solution and has applications beyond passenger vehicles.

Recent lidar market action. We know it’s been a tough market for deSPACs so we’ll bypass the gory details for now. Despite an ice-cold SPAC market, two lidar companies deSPAC’d this year (probably the last): Cepton (CPTN) and Quanergy (QNGY). Both were high redemption, low-float issues that quickly got caught in the short squeeze game. Momentum trading aside, valuations have compressed sharply from their 2021 highs as investors have come to realize that commercial production and revenue generation are largely a 2023 story. Earnings and revenue are non-starters for now. Technology aside, take a close look at balance sheets (cash will be required to weather the storm), and relationships with carmakers and the car distribution ecosystem.

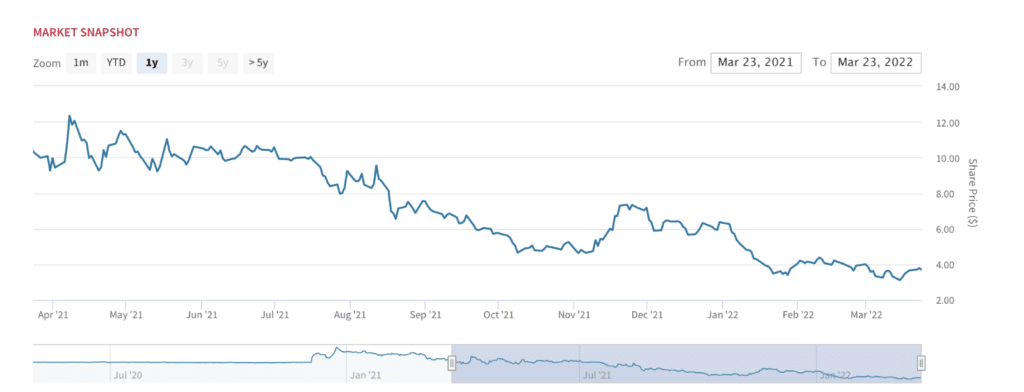

INVZ: It’s a familiar pre-revenue, pre-commercial production story

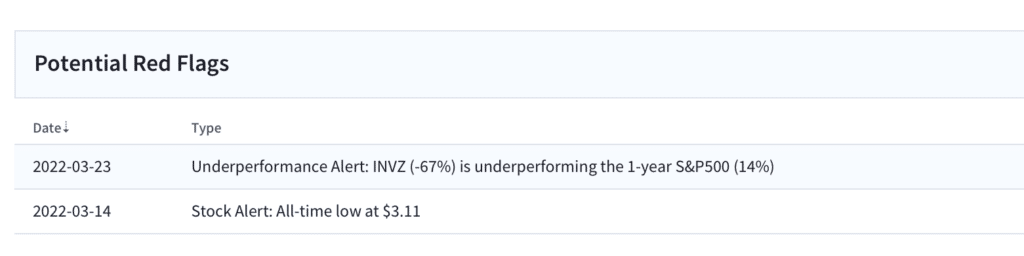

Patience is a virtue? Potential red flags. The main thing to note here is the underperformance of INVZ stock relative to benchmarks. That said, rising inflation, macro headwinds and general multiple compression have pressured all pre-revenue, pre-earnings growth stocks.

Once bitten, twice shy. We get it: LiDAR is an early-stage growth market and newly minted public companies can feel pressured to assure investors that revenues are coming soon. But, as we’ve seen at EV badboys like Nikola (NKLA) and Lordstown Motors (RIDE), those conversations can get dangerously overstretched. Already, a handful of EV companies have overstated orders, revenues, and even functionality, as in the case of Nikola (did that electric-powered truck just roll downhill?). As a result, smart investors are asking follow-up questions when it comes untangling “revenues” and “order book.”

Tomayto, Tomahto. There’s a similar sense of urgency among LiDAR players to prove their bona fides, so to speak. On its most recent Q4 earnings call, Innoviz reported $1.7M in revenues and discussed an over $2.6 billion order book, adding $200 million last quarter. Looking closer, Innoviz uses the term “order book” to describe “total lifetime projected orders from awarded accounts.” At the end of the day, this “order book” is a projected weighted average. It’s all theory at this point.

Commercialization doesn’t happen by magic. If the countless production delays and cancellations among carmakers have shown us anything, it’s that getting from design, to design win, and then on to commercial production– is still a complicated process. Fellow lidar player Luminar (LAZR) announced delays in commercialization to late 2022/2023 owing to “challenges with outsourced manufacturing.” Most LiDAR companies are making high-quality samples in smaller quantities; but getting from thousands of units to one million units or more is a huge leap fraught with risk.

INVZ stock: Bargain shopping at these levels. We love discount shopping. And INVZ stock is cheap by any measure, at 1.5x book. With LiDAR selections taking place just about everywhere, it’s not a matter of if, but when. We don’t like many LiDAR stocks, but we’re feeling good about Innoviz’s positioning and tech and expect the company to be a survivor in an industry ripe for shakeout. The big picture questions for us: Does a “production win” really mean production? How locked down are these wins? Could carmakers change their mind and implement another LiDAR supplier? And of course, how much, and when? Our take: be patient, and take a ‘buy-the-basket’ approach to LiDAR. Put INVZ stock in your shopping cart, along with LAZR (on pullbacks, since it’s the priciest) and perhaps a few others as potential fliers next year. Now, like the rest of us, wait.

For more background, check out our recent LiDAR-related podcasts with Cepton (CPTN) CEO Jun Pei and AEye (LIDR) CEO Blair LaCorte.