Forge Global (FRGE) will be a good indicator of whether the SPAC IPO market stays cool.

Forge Global deSPACs with a squeeze; high redemptions. Pre-IPO marketplace Forge Global (FRGE) deSPAC’d today from its sponsor Motive Capital Corp. Motive’s CEO is Blythe Masters, a former senior executive with JPMorgan Chase. Masters also joins Forge’s board. Forge Global, backed by technology investors Peter Thiel and Tim Draper, generated $215.6M of cash proceeds prior to transaction fees and expenses. The deal included a $68.5M PIPE. Redemptions were fairly high on this one at around 76%; proxy called for forward purchase agreements to plug the redemption hole between $50M and $140M.

Creating a more efficient and transparent secondary market. The secondary market isn’t anything new. Pricing is based on supply and demand. Investors purchase shares from private-company employees and other early-stage investors (founders, VCs, etc.). A secondary market allows start-up employees, who receive a large portion of their pay in stock options, to cash out earlier, as opposed to waiting for an IPO. Under SEC rules, trades are limited to accredited investors. As a trading exchange, Forge’s platform brings more transparency and liquidity to what’s historically been a murky space.

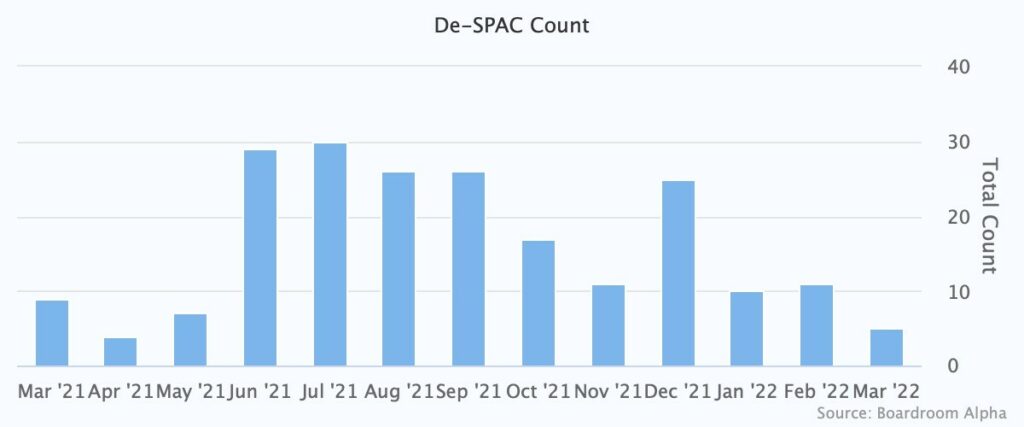

Betting that unicorns stay illiquid. It’s no secret that investor appetite for SPAC-led IPOs has waned. Amidst inflation concerns, rising wages, and supply shortages, growth stocks have recalibrated sharply from their late 2021 highs. ‘Non-traditional’ money (eg. retail investors) have moved deeper into the private markets searching for growth. In many ways, Forge’s success is predicated on the expectation that the SPAC-led IPO market stays cool, allowing privately-held unicorns to remain private, and more highly coveted, longer.

No exit? De-SPAC count, March 2021 to present

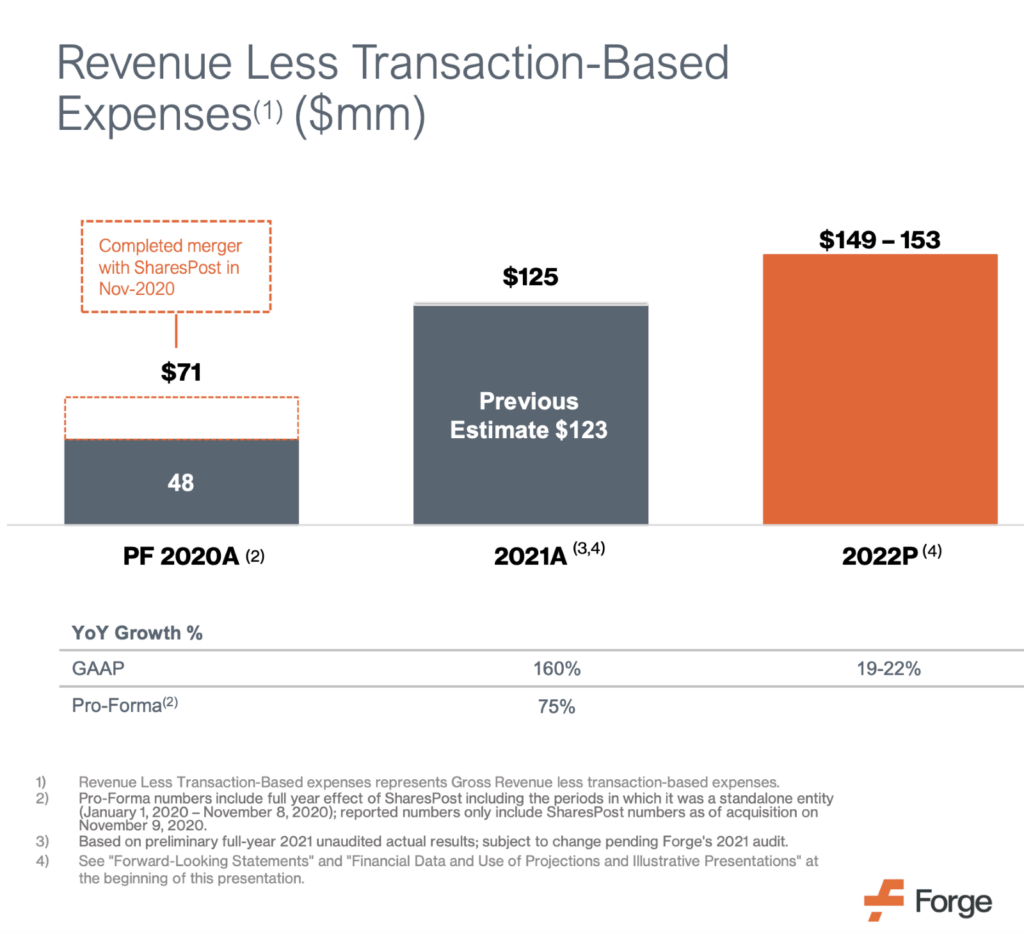

SharesPost acquisition adds scale. In November 2020, FRGE acquired competitor SharesPost for $160M. For 2021, the company said it exceeded $12 billion in cumulative trading volume.

Not the only game in town. Competitors include Zanbato (privately held), which is backed by JPMorgan Chase (JPM), and EquityZen (privately held).

Market Overview

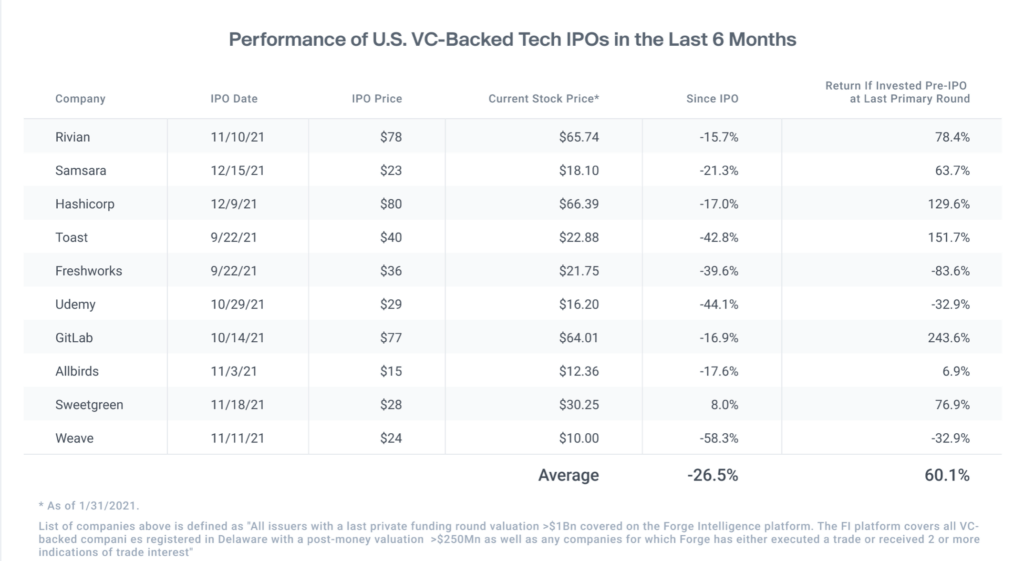

IPO market hasn’t been kind. Public markets have seen significant multiple compression. New entrants in 2022 haven’t fared well. Stock prices of U.S. VC-based tech IPOS are down on 27% in the last 6 months. That compares to a return of 60% for pre-IPO companies at their last primary funding round.

Straight talk: the IPO market has cooled

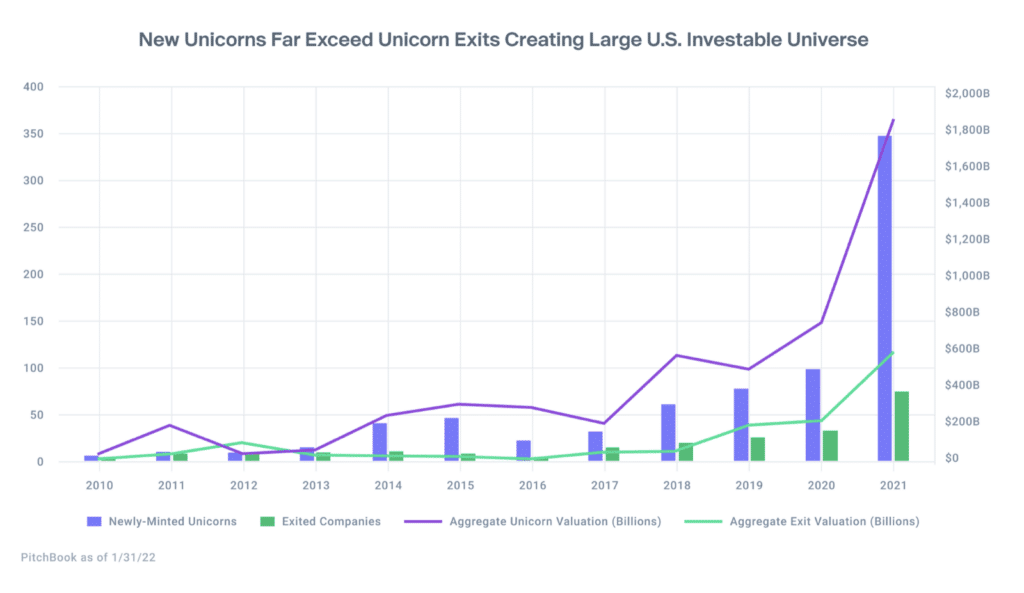

Cooling IPOs have a trickle-down effect. A cooling IPO market stimulates the market for private shares. However, it also has a trickle-down effect on private company primary financings. Pre-IPO shares are pricing 10-30% lower in the first quarter of 2022 than they were in the fourth quarter of 2021, according to Crunchbase. EquityZen anticipates that upcoming primary rounds for private companies on its exchange will likely reflect lower valuations.

Unicorns all around us

FRGE Stock: Expect more volatility ahead

We like the vision. Looking for more comfort on growth projections. For 2022, FRGE calls for $149-$153M in revenue, up from $125M in 2021. Beyond 2022, the company targets long-term organic revenue growth of 20-25%, driven largely by projected growth in the customer base, increased uptake of Forge Data, the company’s web-based trading app, and international expansion.

FRGE: Historical and Projected Revenues

FRGE stock: tail wags the dog. In many ways, FRGE is the Punxutawney Phil of the IPO market. That said, the better FRGE does over time, the more likely that private unicorns begin to reconsider the public markets, which in turn limits FRGE’s addressable market and outlook. Another key consideration: FRGE’s business model relies on supply. SpaceX, for example, one of the most active companies in secondary trading, has its own internal marketplace where employees and venture capitalists can sell stock to invited investors.

A more liquid pre-IPO market could be good for the IPO market. If pre-IPO liquidity was a bit more normalized, public markets would probably be less volatile because a lockup IPO exit wouldn’t create the 20-30% + turnover we’ve been seeing lately.

Expect shares to re-set lower post-squeeze. Redemption updates are becoming a trading catalyst as the market capitalizes on low float / highly shorted deSPACs. In the near-term we see downside risk to the shares as yesterday’s fast-money squeeze abates. Electric Vehicle (EV) charging network Allego NV (ALLG), which deSPAC’d last week, is a good example of this trading action. Also luxury vacation rental supplier Inspirato (ISPO), which shot up to $93 before falling back down to ~$9. Alpha Tau Medical Ltd (DRTS) could be next in the squeeze queue.