If you like juice, fine. If you like fundamentals, LiDAR is still a next-year story

Key points ahead of the quarter

CPTN reports Q4 earnings today aftermarket. Cepton appears to have the relations in pace to make it into the winner’s circle. LiDAR maker Cepton (CPTN) reports Q4 earnings today aftermarket. Numbers really don’t matter. What does: insight into commercial production with automakers and insight into whether Cepton will be one of 2-3 winners in this highly competitive space.

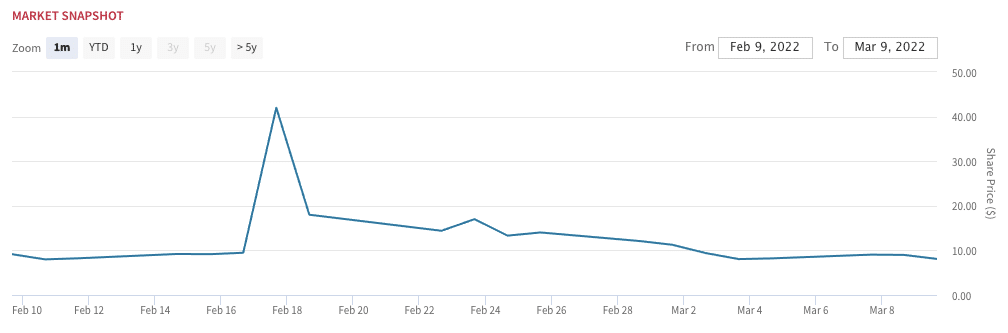

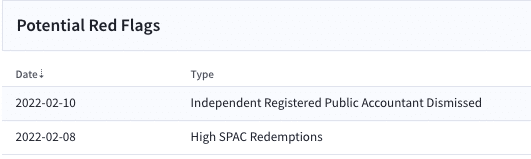

CPTN: After a quick juicing, CPTN shares holding fairly steady since deSPAC. Cepton completed its deSPAC last month via sponsor Growth Capital Acquisition Corp. (GCAC).

Red flags: High redemptions / low float make this a short squeeze. A whopping 90% redemptions results in CPTN having a low float of ~1.6M shares. Short interest is currently over 25% of public float. These dynamics make CPTN ripe for another short squeeze, which is what appears to have occurred in mid-February, when the shares hit a momentary ~$80. Shares are currently holding in at just under $8.

Keep an eye out. Cepton raised a $59.5 million PIPE as part of the financing, and those 5.95M shares have been on file to be registered since late February. Shares should likely add to the public float sooner rather than later, potentially adding some downward pressure.

Cepton could make it into the winner’s circle, eventually. Cepton claims to have won the largest known ADAS LiDAR series production award in the industry to date (based on the number of vehicle models awarded), by a leading global top five automotive OEM. The company is engaged with other top-ten OEMs. Speculation has centered around Ford (F) as the potential customer– given the disclosure by Cepton that the auto customer is Detroit-based, as well as public comments from Ford citing its relationship with Cepton. That said, the question is timing. Critics say that both the form factor and price need to come down materially before carmakers adopt the technology at scale.

…but most LiDAR companies are at least a year away from full-scale volume production. CPTN’s growth projections call for $15 million in revenue this year, ramping to $250 million in 2024 (240,000 sensor units). Like most emerging tech companies, Cepton doesn’t project an adjusted profit until 2024, when it anticipates that a considerable portion of its revenue will come from automotive sensors used in ADAS. In the near term (before auto shipments start sometime next year), Cepton anticipates that most of its revenue will come from LiDAR sensors used in Internet of Things (IoT) applications.

On the sidelines for now. We’re absolutely not ruling CPTN out in the lidar race. We think there is a real technology edge here. That said, given the squeeze set-up going into the print, we don’t feel the need to play with fire. Sorry for the mixed metaphor. We’ll wait for the fast-money to move out of the name, which gives us a quarter or more to hear more about what’s going on at Cepton.

We Recently Sat Down with CPTN CEO Dr. Jun Pei

CEO Dr. Jun Pei joined the Know Who Drives Return podcast last month. You can watch below or read the full analysis here.