Regulatory scrutiny has underwriter seeking more clarity on potential legal risks

Citi redlights SPACs for now. Citigroup (C) announced it has temporarily paused new SPAC listings as it awaits feedback from legal advisers regarding liability and other topics. Citi’s move is significant as the firm was the biggest SPAC underwriter in 2021 and the second biggest in 2020. While Citi was an adviser on five SPAC IPOs that raised a combined $1.1 billion this year, each of those listings was announced in 2021.

New rules, new potential liabilties. Last week, the SEC proposed new rules which could require SPACs to disclose more information regarding potential conflicts of interest, as well as make it easier to assume liability over false projections. In particular, the SEC would require the underwriters of SPAC IPOs also underwrite the SPAC’s acquisition transaction. If these proposed rules are adopted, they would significantly expand the potential liability of SPACs, SPAC merger target companies, and SPAC underwriters. In particular, the proposed rules would also make underwriters potentially liable in later financings by the public SPAC—including the deSPAC transaction—as if they were also an underwriter in those financings. According to the SEC, the new rules “should better motivate SPAC underwriters to exercise the care necessary to ensure the accuracy of the disclosure in these transactions.”

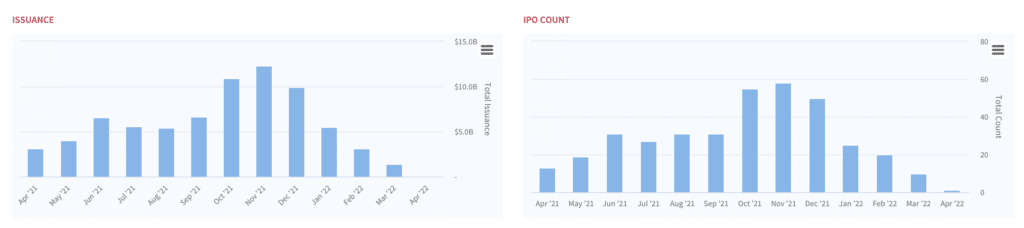

Amidst a tepid macro and poor deSPAC performance, IPOs have already been slowing. The SPAC IPO market started slowing well before U.S. regulators began the SPAC crackdown. March priced 10 SPAC IPOs, down from 20 in February. Also of note, March raised $1.4B– a fraction of the $12.3B issuance peak in November. IPO advisers and others in the ecosystem have informally paused work on SPAC issuance until they can flesh out the impact of the rules. Adding salt to the wound is the relative underperformance of new deSPACs and a broader cooling of the IPO market.

SPAC IPOs are down to a trickle

What’s next? Citi’s pause serves as positive reinforcement for the SEC — even before the agency’s proposed rules go into effect. Looking at the world through the investment banking lens, it’s clear that underwriters already bear substantial liability risk during the IPO process. To extend this liability to potentially much more problematic later transactions in which they played only a tangential role seems like a stretch and likely exceeds the level of risk investment banks are willing to assume. In a worst case scenario, we could see more investment banks refuse to underwrite SPAC IPOs until the SEC adopts final rules. If the proposed rules are adopted as written, that pause could become permanent– effectively ending the SPAC market.

Tightening means more pain for the market– including IPOs. Outside of SPAC IPOs, the headwinds facing the broader IPO market have strengthened in recent months. Bigger step-up increases to interest rates appear more likely. The Fed is also looking to reduce its bond holdings, which would make credit more expensive. Tightening means more pain for the stock market—including IPOs.

For more on the current state of the SPAC market, check out our SPAC Market Review for March.