A SPAC IPO to end a rough week. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

SPAC IPO: RENEU

Cartesian Growth Corp.II (RENEU) priced a $200M IPO. $10.30 in cash in trust. The SPAC will focus on “established high-growth companies that operate in a manner consistent with the United Nations Principles for Responsible Investment.” The Company’s sponsor is an affiliate of Cartesian Capital Group, a global private equity firm specializing in providing growth capital to transnational businesses. Cartesian Growth Corp. II is led by Chairman and CEO Peter Yu, and CFO Beth Michelson.

DKDCA Extends

Data Knights Acquisition Corp. (DKDCA) extends until August. SPAC adds $0.10 to trust. NAV ~$10.30.

Elsewhere in SPACs

- Boardroom Alpha SPAC market review for April.

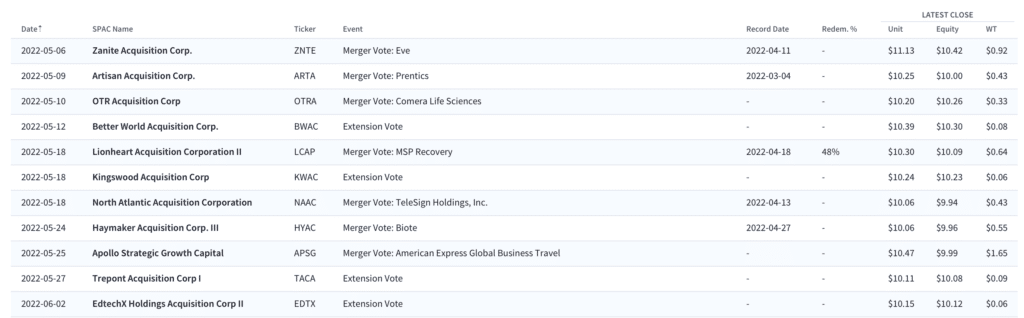

Upcoming Events

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.