On the heels of disastrous Q1 results, we take a closer look at fundamentals and governance

We’re all for plant power..but 0% gross margin? BYND’s operating losses leave a bad taste. Shares down 53% YTD. Beyond Meat is a maker of plant-based meat alternatives using pea and other plant protein isolates. While the company’s IPO in May 2019 captured the vegan zeitgeist of the moment, shares have fallen 53% YTD amidst inflationary pressures plaguing the food sector. Q1 results, reported earlier this week– were nothing short of disastrous. EPS of $(1.58) on sales of $109.5 million– was well below consensus of $(0.97) on sales of $112.4 million. The primary culprit: skyrocketing costs (+97% year-over-year). Despite Beyond’s enthusiasm about its “marinated and slow-roasted” vegan jerky snack launched in March via a joint venture with PepsiCo (PEP), the product also weighed on margins. “While we’re thrilled with its early sales performance and strong customer response, Beyond Meat jerky manufacturing, still in its infancy, was a significant headwind on gross profitability this quarter,” Beyond CFO Phil Hardin said on the earnings call. Despite the lack of transparency on a path to profitability, the company did maintain its 2022 revenue target of $560 – $620 million.

Selling at cost? BYND’s gross margin collapsed to 0.2%– down from 30.2% a year ago. Notably, a doubling of SG&A expense produced only a 1% YoY increase in revenue.

BYND: Market Snapshot

How big a market is plant-based eating, anyway? Looking more closely at revenue trends, we are increasingly cautious on just how big, and how profitable, a market there is for plant-based foods. Total volume (which excludes pricing impacts or currency fluctuations) increased 12.4% in Q1. However, net revenue per pound declined by 10%. The company attributes the decline to increased discounts for international customers and reduced prices in the European Union. Consumers are also shifting from refrigerated meat substitutes to frozen alternatives. In the U.S., while total revenue increased 4% (aided by the plant-based jerky launch), food service revenue (which includes sales to restaurants and college campuses) declined 7.5% during the quarter. While Beyond’s grocery segment reported sales growth of 6.9%, sales of products other than the jerky reported declining sales. Our take: Consumers aren’t embracing meat substitutes as enthusiastically as they did previously. The secret irony is that many critics view them as unhealthy, citing concerns over artificial processing and fat and sodium content.

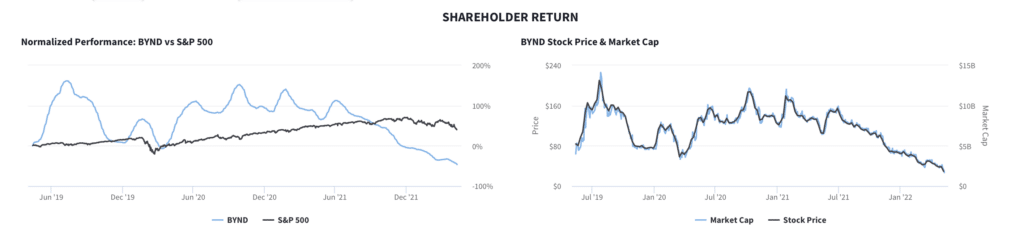

Shares have underperformed since initial post-IPO fanfare. While the company initially benefitted from an ESG narrative as well as high profile celebrities turning to plant based diets, BYND shares have since underperformed the S&P500 over the past 1 and 3-year periods. As of this writing, shares trade at ~$31 — 24% above their IPO price of $25. BYND shares have delivered negative returns over the past 1 and 3-year periods– TSR was -68% and -23%, respectively– versus -6% and +13% for the S&P 500 over the same period.

BYND: Declining shareholder return

Cash burn is another key concern. BYND spent $165.2 million of net cash on operating activities in the quarter, leaving a remaining cash balance of $547.9 million. The cash burn begs the question of whether the company will need to pursue a capital raise in the coming months.

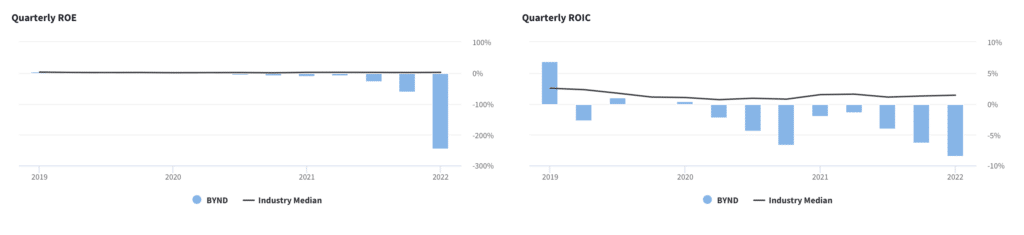

BYND: Quarterly ROE and ROIC trends

It’s still early in the manufacturing curve…but meat alternatives need to come down in price. Vegans in the US represent approximately 3% of the population, by most estimates. Still tiny– but Beyond Meat is targeting a mainstream consumer audience. The good news here is that meat consumption rates have shot up globally, with production roughly five times higher globally than 50 years ago. While we agree that the company should increasingly convert customers with more traditional diets (ie. not just vegans) to its products, it’s worth noting that meat alternatives are still very expensive compared to traditional animal meat.

Competition is increasing– and more than just meat. Privately-held Impossible Foods, which is backed by investors including Khosla Ventures, Google Ventures, and Bill Gates– is Beyond’s closest competitor. The company is creating “bleeding” burgers and is also working on replicating whole cuts of meat. Similar to Beyond Meat, Impossible Foods was founded out of environmental concerns and the view of using science to recreate the texture and characteristics of meat using plant-based proteins. Memphis Meats is another company to watch, as it is creating a meat alternative but is using animal stem cells to do so. Tyson Foods (TSN), one of the largest meat production and manufacturing companies, is an investor. Tyson was an early investor in Beyond but backed out before the company’s IPO. Additionally, Beyond faces competition from meal replacements and dairy alternatives.

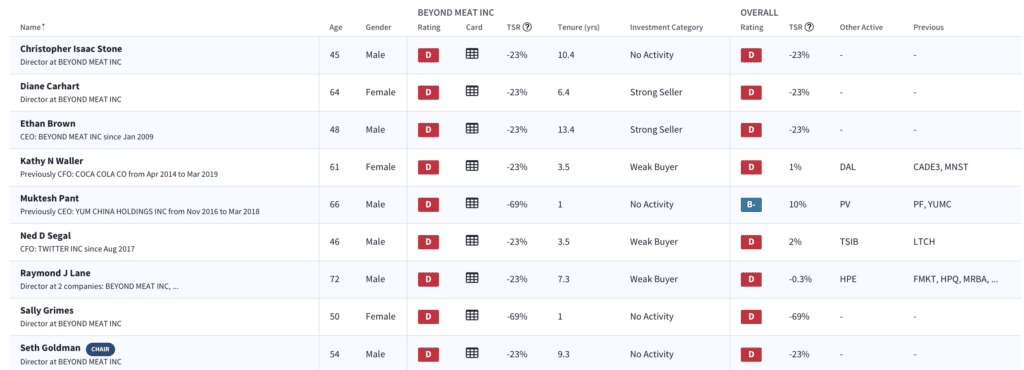

Red flag: governance. Board chair, Seth Goldman, is not independent. Also note that board elections are staggered.

BYND’s current board

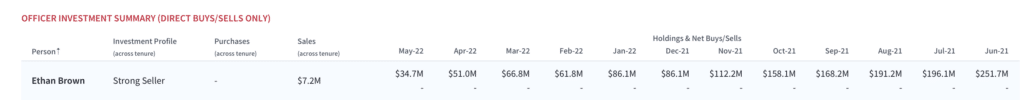

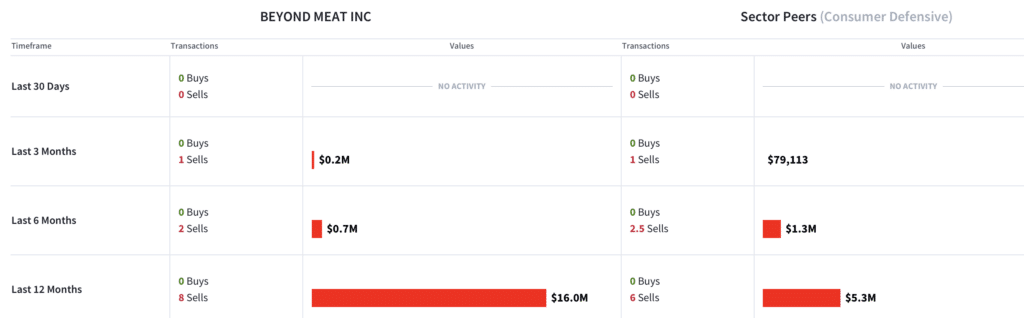

Red flag: insider selling. Insiders sold $16.0 million worth of stock over the past 12 months, well above sector norms. CEO Ethan Brown has sold $7.2 million worth of stock over his tenure. Director Diane Carhart is the other strong seller on the board, having sold $6.9 million. Amidst the sharp decline in BYND stock during this period, we’d like to see management’s interests better aligned.

CEO Ethan Brown has been a strong seller of stock

BYND: Heavy insider trading

Putting a fork in it for now. An overhaul is necessary here. We view the board as largely inert and would like to see meaningful strategic action. BYND has failed to secure meaningful partnerships with fast-food chains. Dunkin’ Donuts stopped selling Beyond Meat’s breakfast sausage at its 9,000 retail locations last year, and the company has yet to launch a permanent menu item with McDonald’s (MCD). [Maybe Carl Icahn can change this]. While in the near term, the market has voted with its feet, we struggle to see a near-term fundamental catalyst for the shares until management can convince investors this is a profitable business (of course a takeout is a possibility at these levels). Management will need to stabilize and grow margins and demonstrate a path to profitability before we can get more constructive.

Latest Podcast: NYC Pension Funds Want Amazon Accountable for Human Capital

Our latest podcast explores the ESG situation at Amazon (AMZN), which is facing activist pressure as employees demand better working conditions. The tech giant has drawn increasing criticism for its treatment of workers, including claims of poor working conditions at its warehouses and attempts to block unionization. To dive into the details on why Amazon is failing in human capital management, Boardroom Alpha sat down with Michael Garland, Assistant Comptroller for Corporate Governance and Responsible Investment at the New York City Office of the Comptroller. Garland details the NYC Pension Funds’ campaign– along with New York State Comptroller Thomas DiNapoli and trustees of all five of the New York City Retirement Systems– to unseat two Amazon board members responsible for human capital management– Daniel Huttenlocher and Judith McGrath. Amazon’s annual shareholder meeting is coming up on May 25th.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.