Match Group (MTCH) is on its third CEO since it spun off from IAC in June 2020 and, according to reports, Anson Funds is about to launch a proxy fight to drive changes. Anson joined high-profile activists Starboard, Elliott in building stakes in 2024 and beginning to push for changes. Unfortunately for all investors, to date, the company’s governance and performance largely hasn’t changed direction. Anson Funds is newer to activism, but under Sagar Gupta — an ex-analyst at Legion Partners who joined in 2023 — is making a big push. Anson adds the prospective proxy fight with Match to its recent cooperation agreement with Five9 in December of 2024 that saw Gupta added to the board.

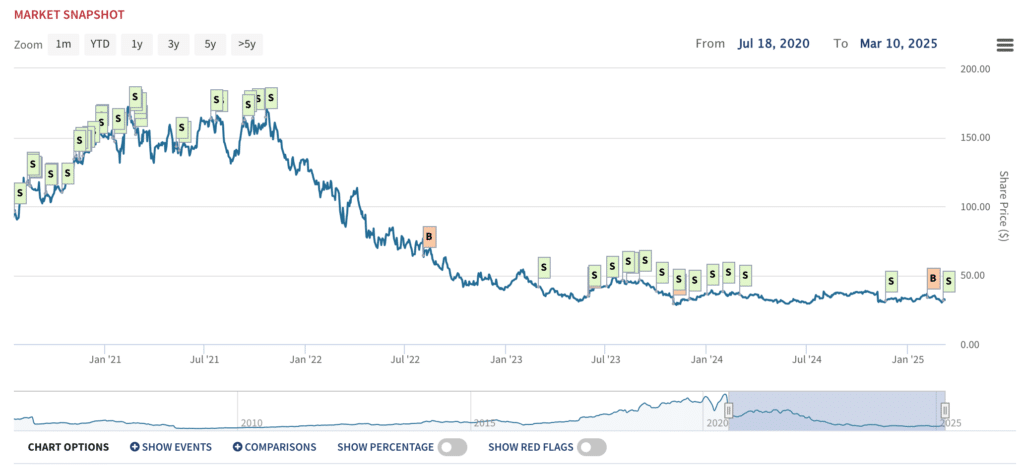

What are Match Group (MTCH) insiders telling investors when all they do is sell the stock?

New CEOs, Same Board, Same Results?

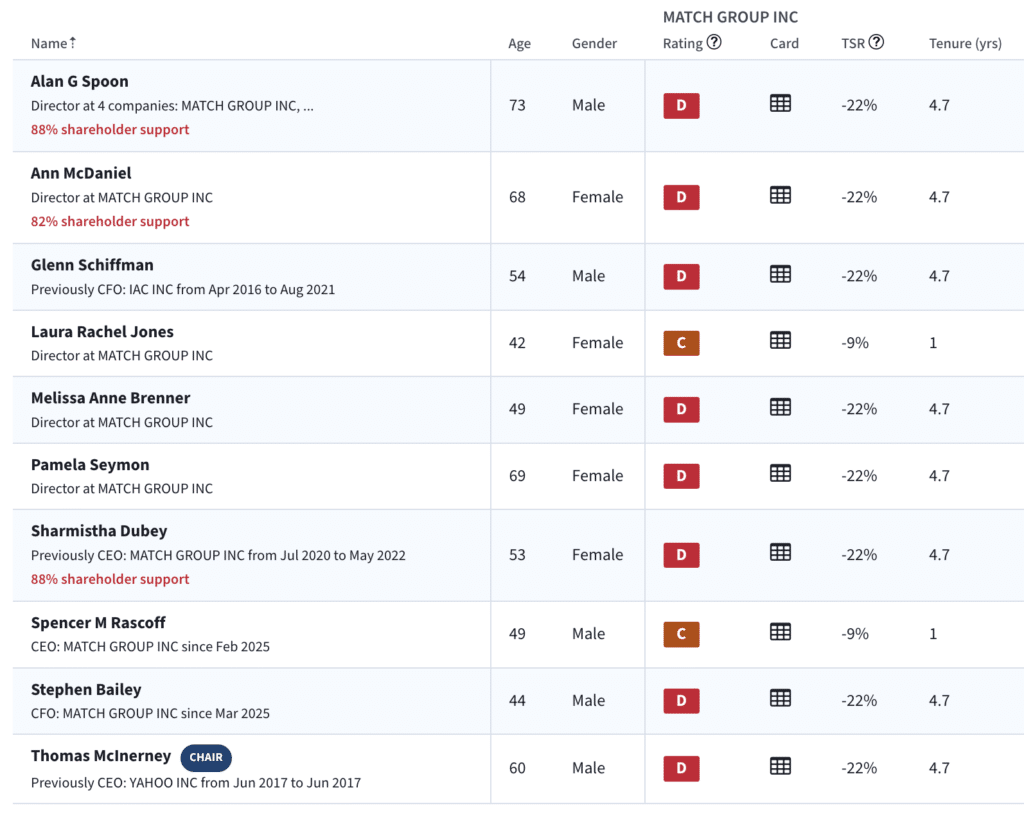

Match’s latest CEO, Spencer Rascoff first joined the board after “constructive” discussions with Elliott Management in March 2024 and was appointed CEO on February 4th. Rascoff is the third CEO since Match’s spin. While the board has been ready to try new CEO’s, it hasn’t been ready to change itself. Other than Laura Jones who joined at the same time as Rascoff and from an Elliott push, the Match board is composed entirely of directors that have been on the board since the spin. That includes former CEO Sharmistha Dubey who resigned in May 2022 after delivering a -25% TSR (total shareholder return) and, now as a board member, has seen the stock drop by almost -70%.

Since the spin-off, 80% of Match’s board has presided over significant shareholder value destruction—yet they remain in place.

Match Governance Is a Problem

- C-Suite Turnover: Match is now on its third CEO and CFO in just under 5 years since its spin.

- Insiders Profit. Shareholders Lose: Insiders have consistently made significant sums while shareholders have lost out. Examples include consistent insider selling with little to no buying and oustsized compensation for poor performing executives. For example, ex-CEO Dubey received 50% of unvested equity upon resignation and received over $23M of compensation in 2022 despite a disastrous tenure as CEO. Similarly, Dubey’s successor at CEO, Bernard Kim, saw the stock drop -54% and yet received compensation upwards of $40M. Ex-CFO Gary Swidler made over $30M as he oversaw a stock drop of -70% and most recently sold almost $8M in MTCH stock as he gets ready to leave the company as President at the start of April.

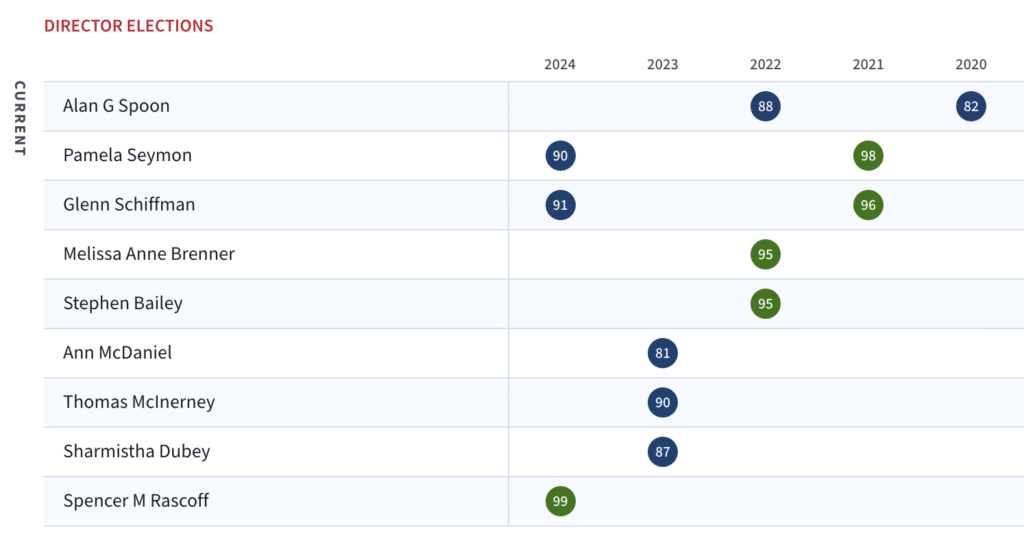

- Shareholder Discontent: Alan Spoon continues to serve on the board despite shareholders voicing a lack of support for him at his latest shareholder votes. Mr. Spoon is also the oldest board member at 73. The discontent with the board is broader though and at the 2024 shareholder meeting both Pamela Seymon and Glenn Schiffman received only about 90% support. Rascoff was the only director to receive high support which is undoubtably a reflection of Elliott’s and other shareholders’ desire for new leadership.

- Classified Board: Directors serve 3-year terms which is a an obvious hurdle for shareholders, even the powerful trio in the company now, to affect big change to the board. This year Stephen Bailey, Melissa Brenner, and Alan Spoon will all be up for election (unless Match decides to make changes to the class nominations).

Match Group’s classified board protects an entrenched, underperforming board.

- Limited Outside Public Company Experience: Limited outside public company experience among current board members, and those who possess it their track record is mixed and tied to IAC related organizations.

- Class Action Lawsuits: Match has continually faced class action lawsuits based on what shareholders believe is the withholding of key information and misleading statements that ultimately leads to big stock price drops when the information is finally made public. The latest one was filed in January 2025.

- Legal Problems from the Start: Match was forced to pay $441M to Tinder founders in December 2021 settlement agreement related to Tinder/Match merger and handling of stock compensation.

- SEC Unhappy with Reporting: In September of 2024, Match told the SEC that going forward its quarterly/annual filings will include more detailed reporting on profitability of various business segments.

Our Take

In June of 2023 Boardroom Alpha published a report on Match to its subscribers and noted many of the same performance and governance issues as we cite today. The difference today is that three (at least) powerful activists — Starboard, Elliott, and Anson — are all pushing for change and there seems to be a glimmer of hope.

The first big move was Rascoff and Jones addition to the board in March 2024. The next big move was Rascoff’s elevation to the CEO role in February. The question is what’s next? Based on track record, it’s clear that the current board is stagnant and unable to change the course of Match, so existing shareholders should welcome Anson’s fight to change board members at the next election.

Ideally, Match’s board will see the need for change itself and work with shareholders to refresh the board, governance, and hopefully chart a new course for performance. If it goes to a contested proxy, shareholders may still win, but the board will have spent shareholder dollars trying to stop changes that are obviously needed.