The industry ump has been stumped, raising questions about the future of ad measurement in a digital age

Merger arbitrage continues. This time, a failed takeover bid for Nielsen. TV ratings measurement firm Nielsen (NLSN) announced it has rejected a takeover offer from a private-equity consortium that valued the company at $25.40 a share. Elliott Management was working with Brookfield Asset Management on a leveraged buyout of the company. Nielsen, in a press release, said the offer “significantly undervalues the company and does not adequately compensate shareholders for Nielsen’s growth prospects.”

Large shareholder, WindAcre opposed the transaction. WindAcre Partnership, which holds a 10% stake in the company, opposed the transaction. WindAcre also discussed the possibility of joining the buyout group, according to Nielsen, but “determined not to join the consortium and that it would oppose the transaction as it views Nielsen’s intrinsic value to be significantly higher than values proposed by the consortium.” Today’s comments from Windacre support rejection of the takeover bid.

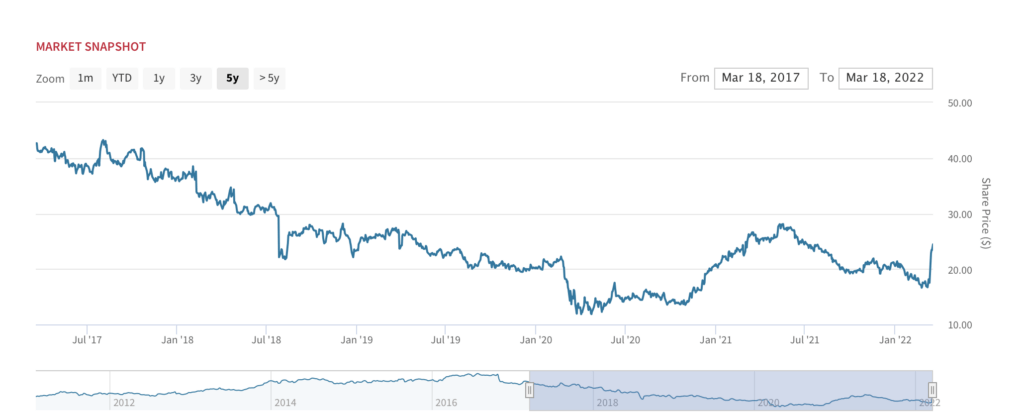

Nielsen: A dinosaur struggling to adapt in the digital age. Nielsen, which provides TV viewership data, has struggled as a public company—mainly to its inability to adapt its measurement capabilities at a time when streaming is on the rise and pay TV subscription continue to erode. There are also a lot more ways to measure TV viewing habits- including set-top boxes, Internet TV, scan-based retail data and e-commerce data. Elliott, which has been an investor in the company since 2018, has been pushing for changes for some time. In recent years, Nielsen hired a new CEO, installed several new directors, authorized a $1 billion share repurchase, and spun off its consumer data business.

Gold standard no more: lost confidence and upset customers. Simply put: NLSN’s crown as the leading ad measurement company is severely tarnished. In May 2021, NLSN revealed the company had measured viewing time incorrectly during the pandemic (undercounting viewers), due to technical hiccups. Not surprisingly, the networks that depend on Nielsen’s numbers to determine what they charge advertisers are upset—having potentially lost hundreds of millions of dollars. In September, the Media Rating Council suspended Nielsen’s accreditation for allegedly undercounting national TV viewership during the pandemic. This was a huge blow to Nielsen’s national TV measurement product, which has long been considered the industry’s gold standard. Last week, several Byron Allen-owned media companies filed a lawsuit against Nielsen on charges including fraudulent misrepresentation.

Blood in the ad measurement waters. Given NLSN’s missteps, several media companies have brazenly put out calls for new measurement tools. That said, no major client has stopped using Nielsen’s core ratings product since the suspension. “The only thing we know for sure is how dissatisfied a lot of the networks are and how serious they are about advancing measurement,” said Sean Muller, CEO of iSpot.TV (privately held), one of NLSN’s newer competitors. Comcast’s NBCUniversal has been the most public in its vitriol for Nielsen, sending out RFPs to over 50 measurement and data companies for an independent system to replace the current “outdated” approach to counting viewers. NBCUniversal also frequently touted ad measurement by iSpot.TV during the Winter Olympics. Companies like VideoAmp (privately held) and Comscore (SCOR) are also offering alternatives to fill the void created by NLSN’s fumbles.

NLSN stock: Struggling in the streaming age

Source: Boardroom Alpha

The “New Nielsen” story is progressing. Nielsen has been working on a new brand identity. Recent actions include fixing its viewer panels, which became smaller and less reliable during the pandemic; strengthening its business continuity and recovery process; improving how it communicates changes in its methods; and changing the way it incorporates broadband-only homes in ratings. The company is combining its measurement solutions into a single cross-media measurement solution, Nielsen One, which is expected to roll out by the end of this year.

Stock buyback should offer some support for the stock. Nielsen intends to begin buying back $1 billion of stock under a previously approved plan when its trading window opens.

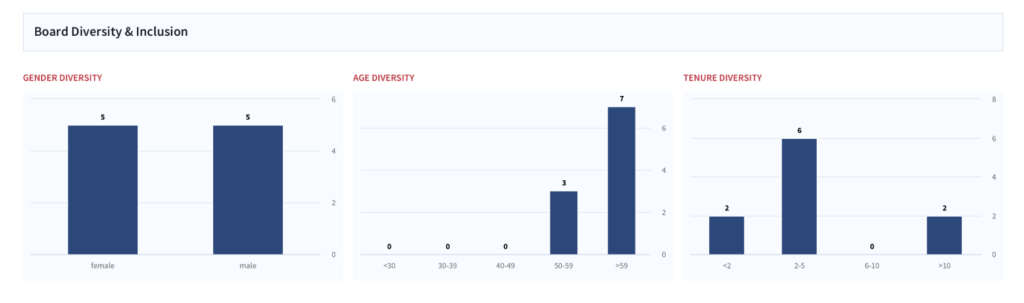

NLSN: Red flags. The most notable is overboarding risk. Director Nancy Tellem sits on the board of 5 companies. Say-on-pay vote is an area to watch, although has improved in recent years (83% for on 5/21 vote).

Source: Boardroom Alpha

NLSN: Board Diversity & Inclusion Snapshot

Source: Boardroom Alpha

Ad measurement industry may bifurcate over time. In the past, Nielsen has been able to wield its dominance and capitalize on its customers’ preference for a one-stop shop. But in an industry that relies on trust– independent and accurate measurement– and when that measurement is directly tied to lucrative advertising revenue—the loyalty pendulum can easily shift in the other direction. Many observers suggest the ad measurement industry will separate into two core systems– one to measure advertising and evaluate its impact /value; and another to assess the popularity of content and decide which shows to produce and how to distribute and schedule them. The latter is more suited to newer models like dynamic ad insertion—that is, different viewers might see different commercials even while watching the same show at the same time. Ultimately, NLSN has value in the former camp, but has yet to adapt its business model toward newer digital advertising models.

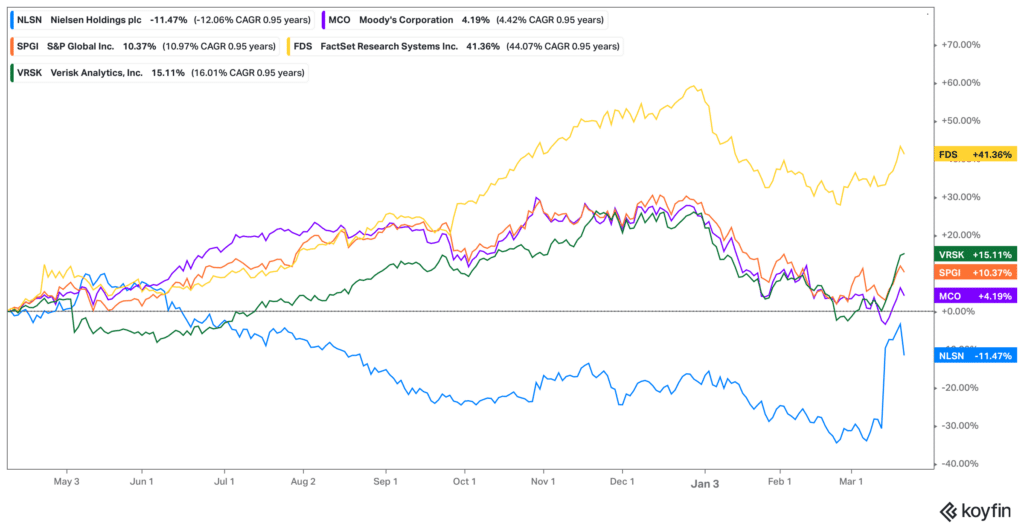

NLSN stock: value without a catalyst. For now, most of the speculation surrounding NLSN stock is around the likelihood of a higher bid. From a fundamental perspective, there’s not much of a catalyst here: this is a low single-digit grower for now. Once the industry’s umpire, Nielsen is now facing direct criticism from its customers. The company must move fast in order to address competitors, which appear to offer more granular data at a lower cost. At the same time, NLSN is managing a high debt load ($5.6B in long term debt). That said, NSLN stock is trading at a discount to peers like Moody’s (MCO), Verisk (VRSK), S&P Global (SPGI) and FactSet (FDS) on an EV/EBITDA basis. The market appears to be undervaluing NLSN’s media business and scarcity value as the leading pure-play in this space. As more momentum comes out of the stock, we’d start to look at the name as a value play closer to the $20 level.

NLSN relative to comparables

Expect merger arb trend to continue. Separately, Thoma Bravo announced today its acquisition of Anaplan, a SaaS financial planning tool, for $10.7B. We expect more and bigger acquisitions, spurred by inflation / valuation reset, and a renewed willingness of sponsors to partner with each other and other investors in “club” deals. Another deal catalyst is ESG as a lever for value creation: both in board/governance structures as well as investor interest in allocating increased capital to sustainable investments, particularly investments that support the transition to a low-carbon economy.