Boardroom Alpha provides in-depth analytics and tracking of all public company executives and officers. Below is a rundown of the CEO moves and CFO moves made at notable companies this past week. Get a demo today to see how you can receive real-time alerts and in-depth analytics.

Weekly CEO & CFO Move Wrap

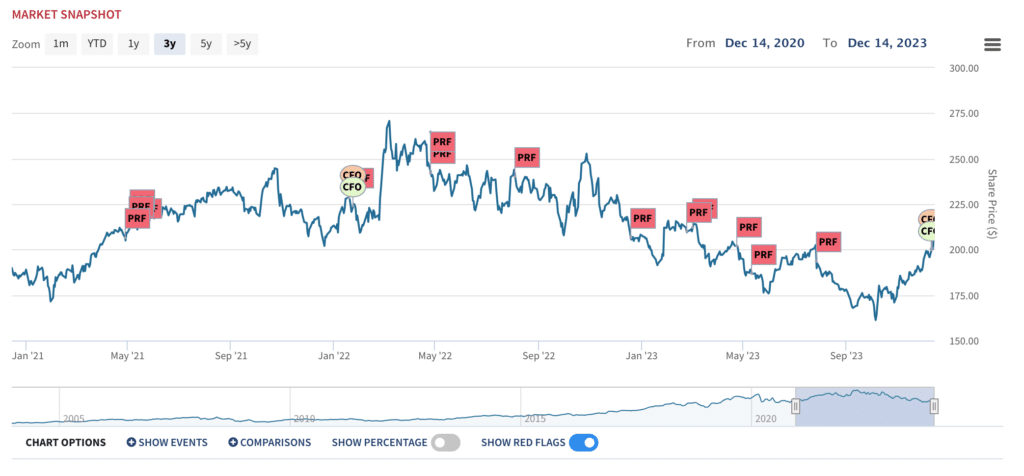

Michelle Turner steps aside as L3Harris (NYSE: LHX) CFO as Ken Bedingfield steps in. Ms. Turner came in after LHX’s most recent recovery from a stock price dip during the pandemic, but has seen the stock drop ~4% over her nearly 2 years there (-2.3% annualized). Since hitting an all-time high in March of 2022, LHX has been on a relatively steady decline. However, LHX surged in the past month to over $200 and investors will be wondering whether the new executive team (CEO Kubasik is only 2.5 years on the job) can make the turnaround stick. In part, investors will be bolstered by the recent cooperation agreement with D.E. Shaw that put Kirk Hachigian and William Swanson on the board effective as of the start of December.

CEO Moves

VERADIGM INC (MDRX)

Leaving: CEO – Richard J Poulton ( 1.6 yrs ; -31.7% TSR)

Replaced by (interim): Shih Yin Ho

Dr. Ho, age 53, is a seasoned digital health, software, and pharmaceutical services entrepreneur, executive, and advisor, having spent over 20 years developing products and companies in health information infrastructure, data analytics, and decision support for life sciences. Dr. Ho has served as President of Glimpse LLC (“Glimpse”), an independent software and strategy consulting firm for pharmac…read full bio

CFO Moves

L3HARRIS TECHNOLOGIES INC (LHX)

Leaving: CFO – Michelle L. Turner ( 1.9 yrs ; -2.3% TSR)

Replaced by: Kenneth L Bedingfield

Mr. Bedingfield, 51, joins L3Harris from Epirus, Inc. a privately held technology company developing software-defined counter-electronics effects and power management solutions for defense and commercial applications, where he most recently served as Chief Executive Officer since 2022 and as President, Chief Operating Officer and Chief Financial Officer from 2020 to 2022. He served as Corporate Vi…read full bio

SOLO BRANDS INC (DTC)

Leaving: CFO – Somer Webb ( 1.6 yrs ; -16.4% TSR)

Replaced by (interim): Andrea K Tarbox

Ms. Tarbox serves on the board of directors of Solo Brands and chairs the audit committee. Ms. Tarbox brings extensive experience in the CFO role. Her 20 years of service in various CFO roles include 12 years at KapStone Paper and Packaging, Inc. (formerly NYSE: KS) where she helped lead KapStone’s successful sale to WestRock Company (NYSE: WRK) in 2018. …read full bio

SYMBOTIC INC (SYM)

Leaving: CFO – Thomas C Ernst Jr ( 1.5 yrs ; 174.1% TSR)

Replaced by: Carol J Hibbard

Ms. Hibbard, age 56, joins the Company from The Boeing Company, a major aerospace firm, where she served as Senior Vice President and Controller since April 2021. Previously, Ms. Hibbard held various strategic and financial roles with The Boeing Company, including Vice President and Chief Financial Officer of Boeing Defense, Space & Security (“BDS”) from May 2017 thr…read full bio