BOARDROOM ALPHA FOR INVESTORS

Generate New Ideas. Meet ESG Mandates. Accelerate Analysis.

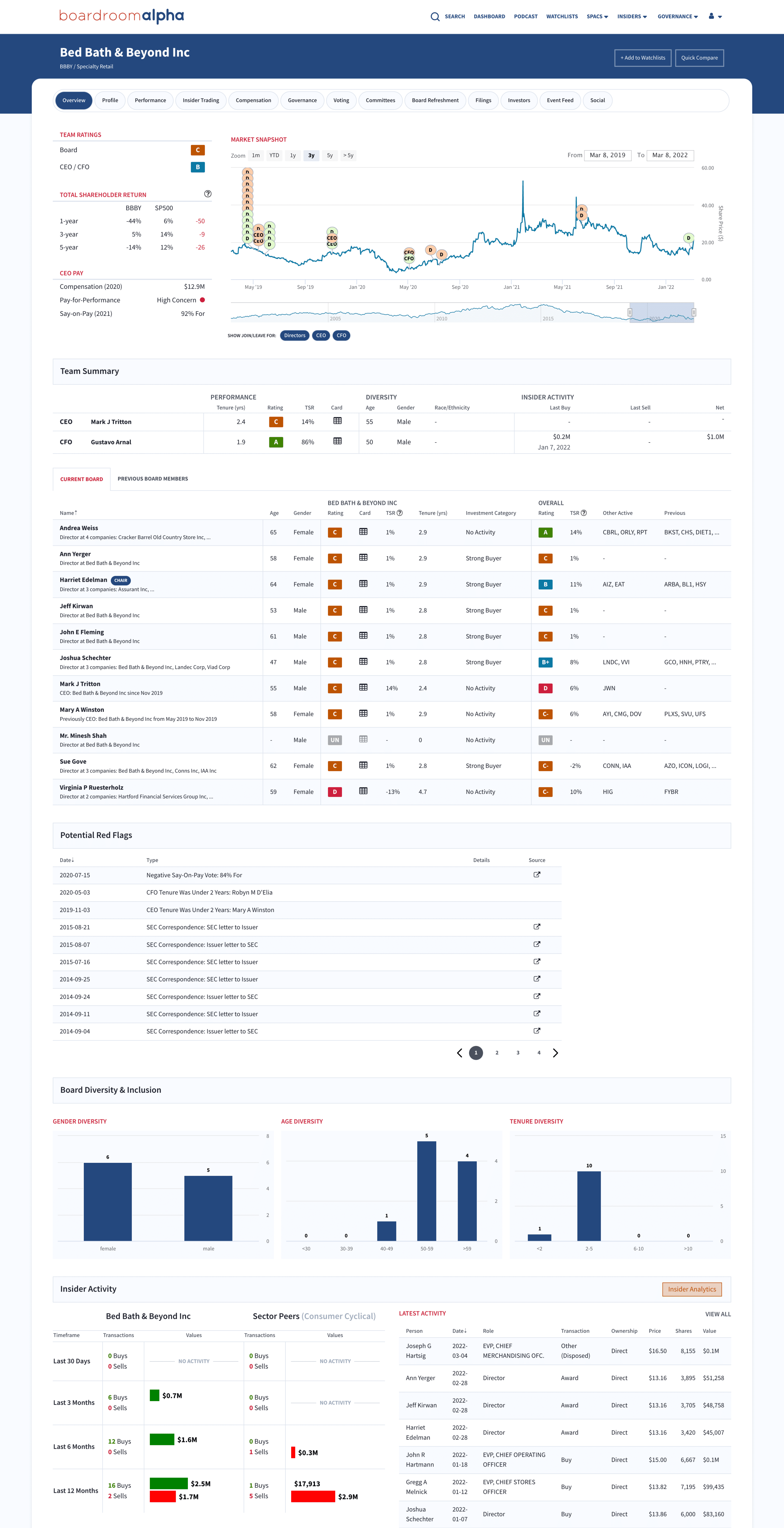

Identify Risks & Opportunities with Performance and Governance Analytics

Identify potential risks with independent, quantitatively driven assessments for every US publicly traded company.

Assess across all aspects including company performance, governance practices, shareholder voting / engagement, CEO/CFO/Director track records, and more. Potential red flags help identify key risks that may need further investigation.

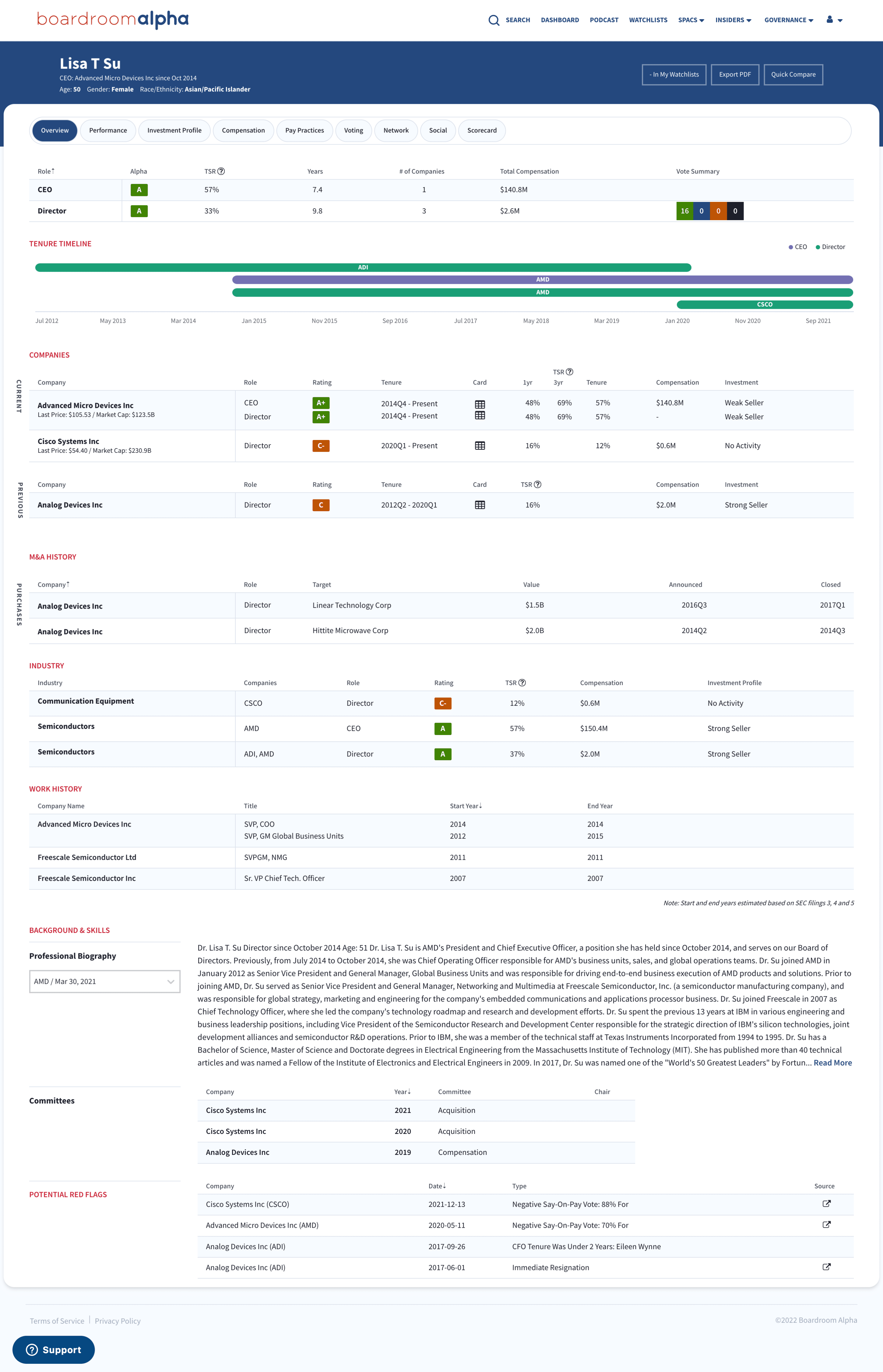

Know the Directors & Officers Behind Your Investments

Boardroom Alpha provides comprehensive scorecards on over 200,000 directors, CEOs, and CFOs at US public companies and all SPACs.

Every scorecard provides detail on their background, biography, diversity, and in-depth data and analytics on their track record as a public company executive and details on their unique attributes.

Corporate Governance Red Flags for Companies and People

Monitor for the potential governance red flags that investors, proxy advisors, and others are watching for.

Governance risk factor coverage includes: terminations, immediate resignations, high CEO/CFO turnover, investigations from SEC and other groups, class action activity, accounting firm dismissals, SEC filing and technical violations, and more.

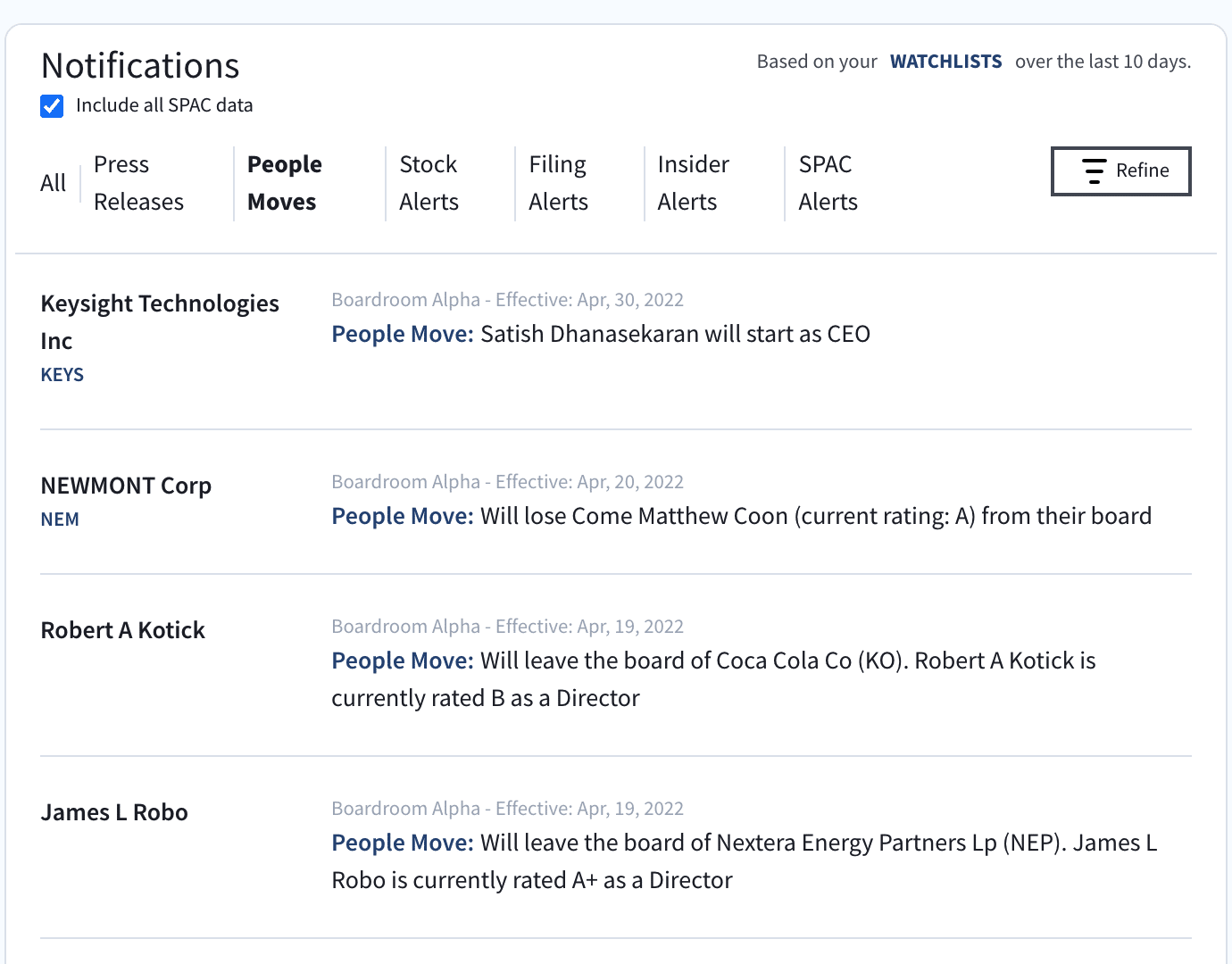

Monitor CEO, CFO, and Director Moves

Monitor CEO, CFO, and director moves as they happen. Understand on new executives will impact the company and how departures could create new risks.

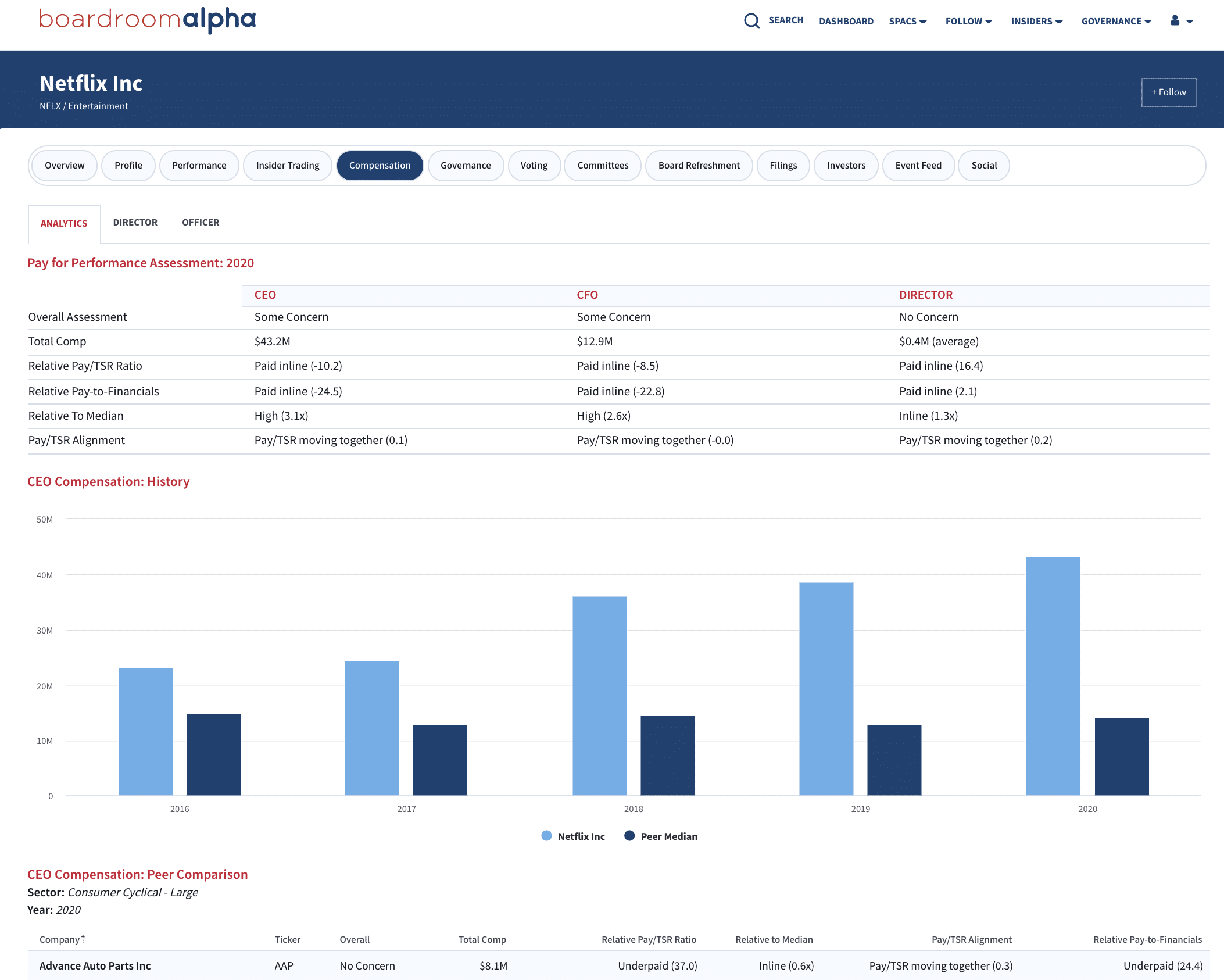

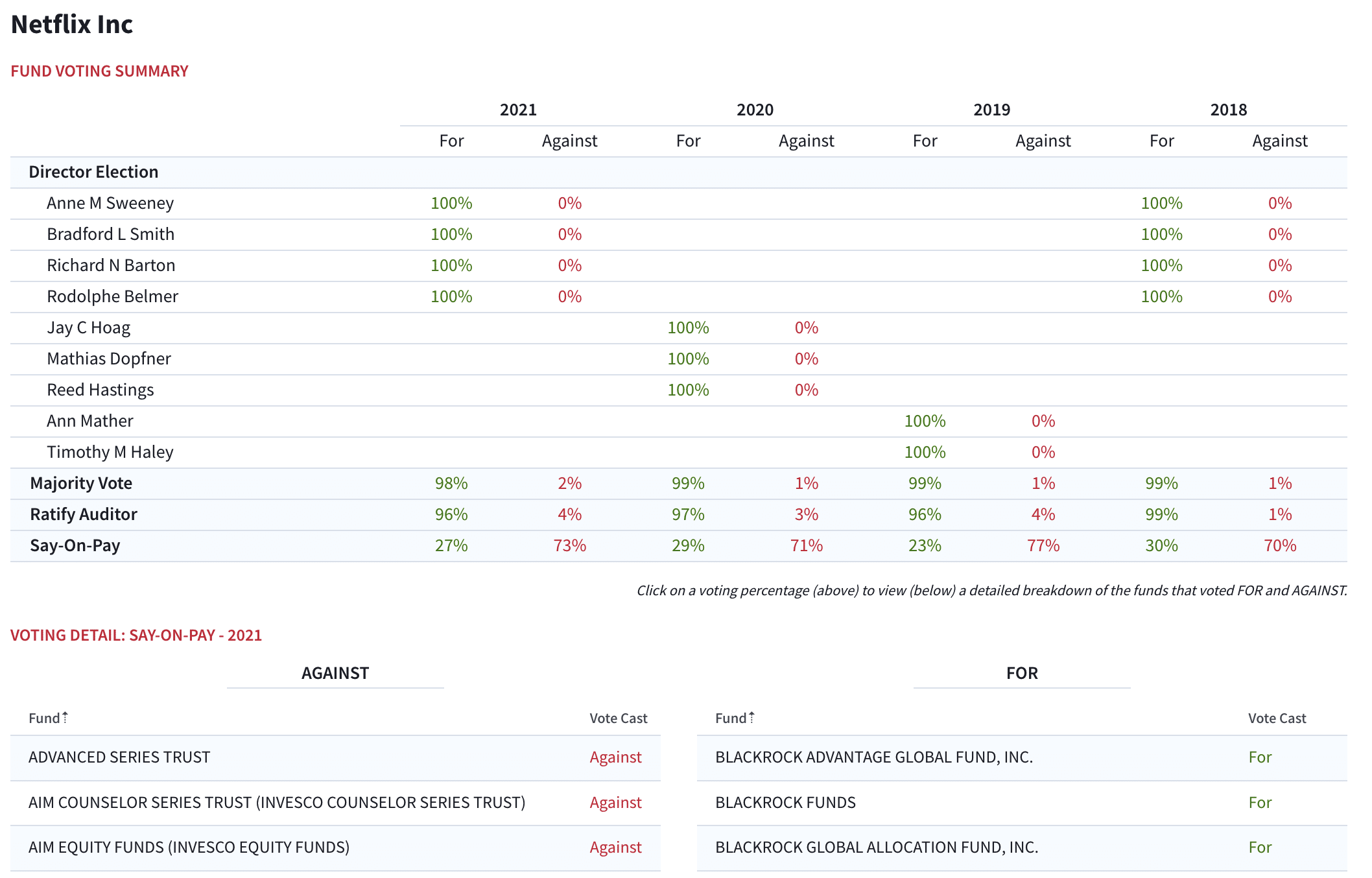

Assess Executive Compensation and Pay-for-Performance

Track and evaluate every company’s executive compensation to understand whether it is a risk or not. Watch how shareholders vote on their say-on-pay measures to identify potential shareholder discontent.

Monitor CEO, CFO, and Director Moves

Monitor CEO, CFO, and director moves as they happen. Understand on new executives will impact the company and how departures could create new risks.

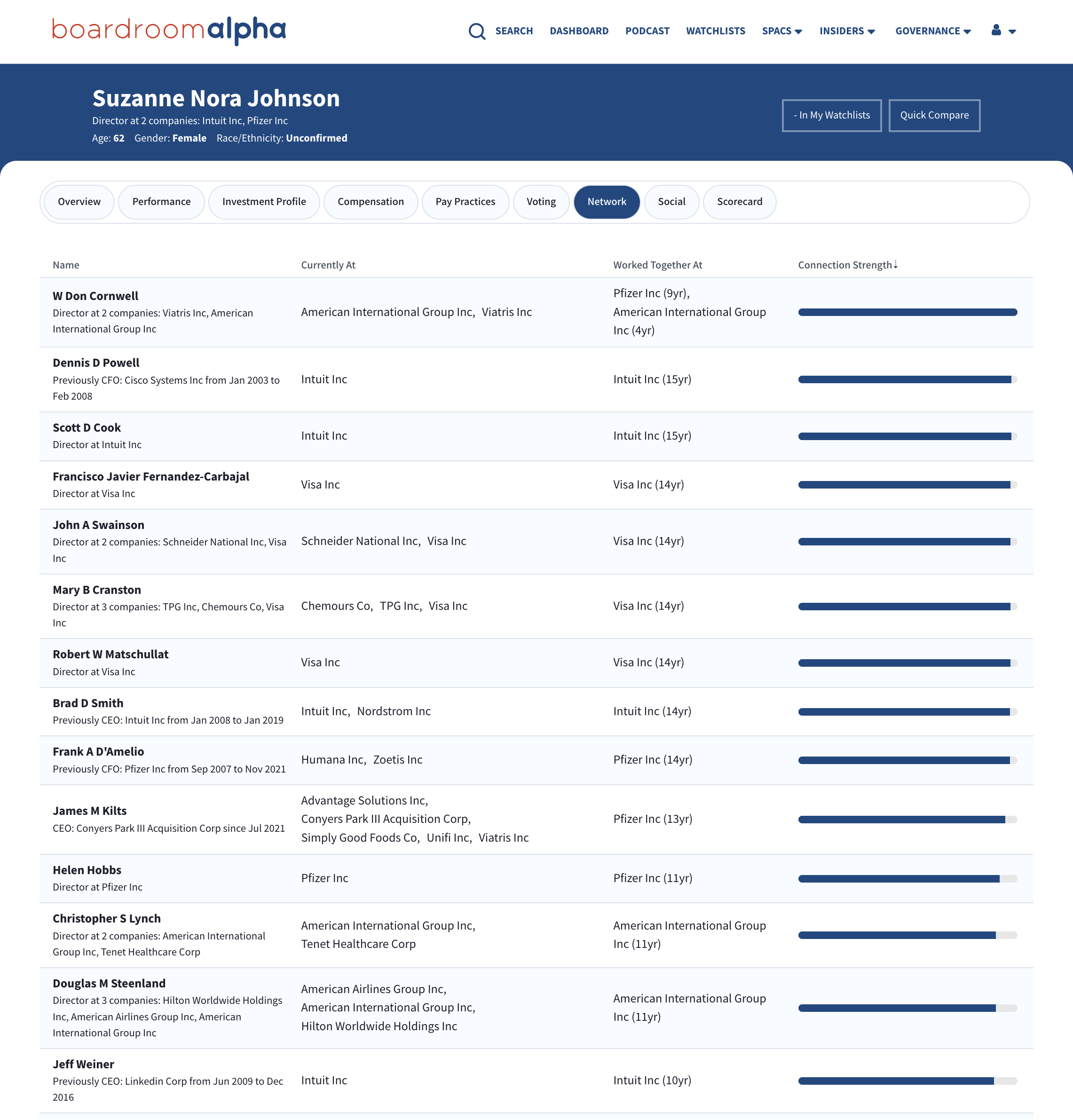

Identify Executive Relationships & Board Interlocks

For every executive see how they are connected across people and companies — including assessments for the strength of each relationship.

Quickly identify potential risks from board interlocks across companies for every officer and director.

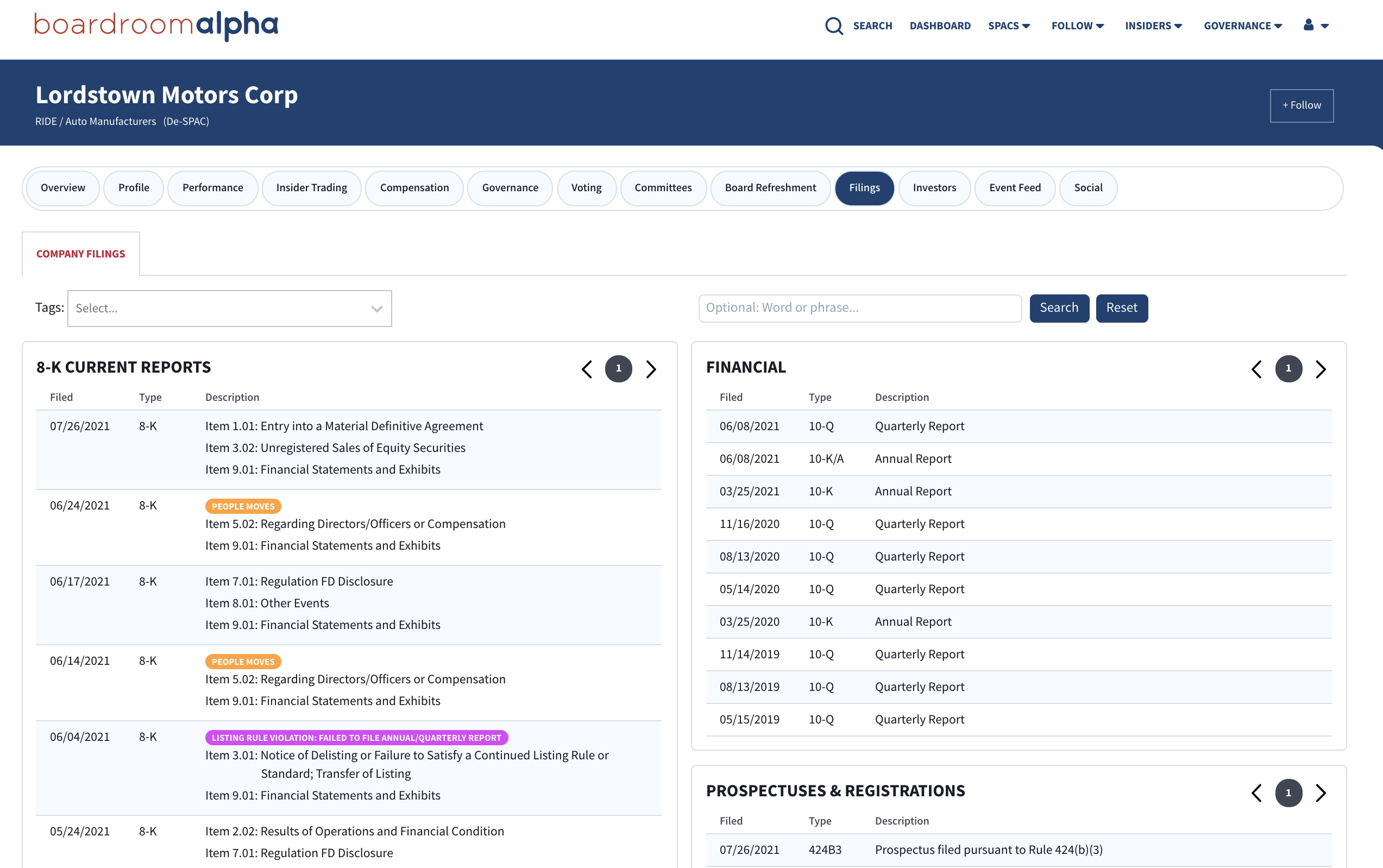

Intelligent SEC Filings Search & Tagging

Quickly search all SEC filings for a single company or across all companies. Leverage Boardroom Alpha’s machine learning classifications to quickly narrow your search to the most relevant filings.

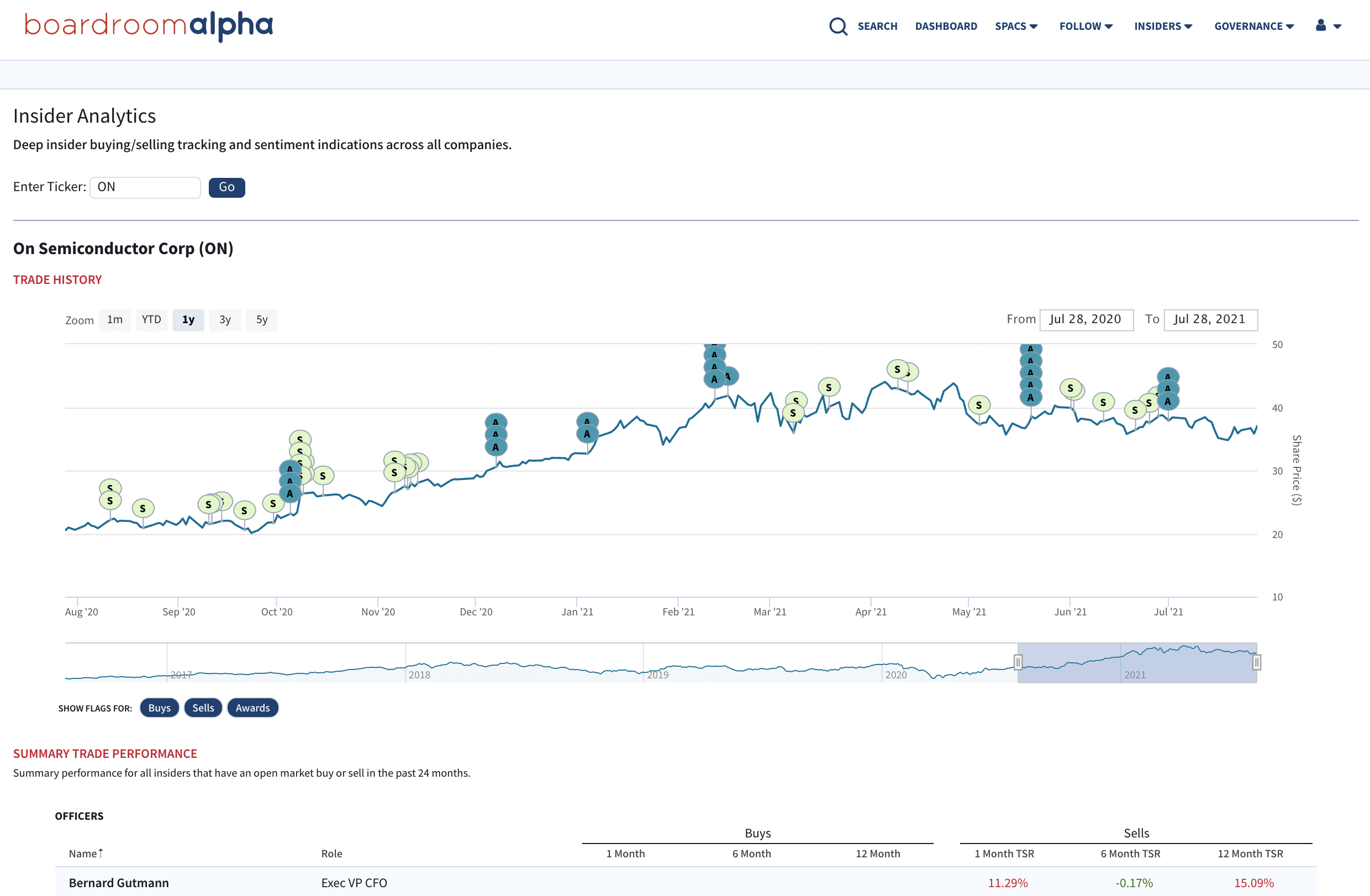

Monitor Insider Buying, Selling, and Awards

Monitor how a company’s CEO, executives, and directors are buying and selling their company’s stock. Also monitor awards relative to performance to watch for potential governance red flags.

Assess the activity on its own and relative to the company’s peers to see if their activity is out of the normal, accepted practices.

Identify Gaps in Institutional Shareholder Support

Get full visibility into how institutional shareholders are voting on key company and shareholder proposals. Discover which proposals lacked support and where potential shareholder risks are present.

Corporate Governance Database

Boardroom Alpha’s comprehensive governance provides insight into the governance of all US publicly traded companies and the executives and directors behind them. Use our robust RESTful API, take data feeds, or integrate directly into Excel.

Governance Data

- Executive Compensation data

- Director Compensation data

- Say-on-Pay voting

- Insider buying and selling (all Form 3, 4, 5) data

- Fund voting (from N-PX Filings)

- Board indendence

- Director overboarding

Governance Analytics

- Pay-for-performance

- Board interlock analysis

- Board performance analytics (TSR, ratings, and more)

- CEO performance analytics (TSR, ratings, and more)

- Diversity analytics

- Insider buying/selling analysis