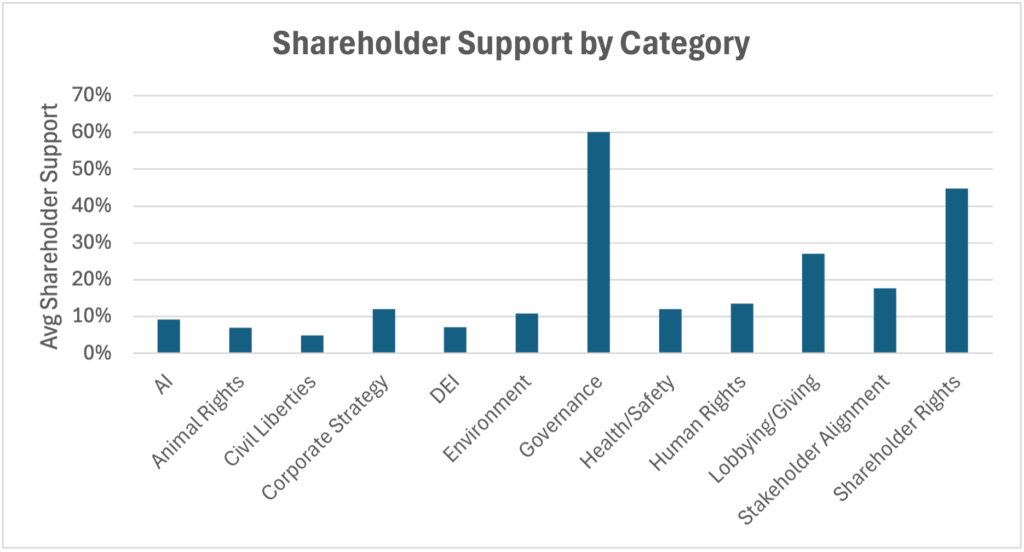

As the 2025 proxy season wraps up we wanted to take a look at how DEI / ESG / Governance proposals have fared. In our April early look article, early results suggested a tough road ahead for shareholder proposals—especially those tied to environmental, social, and governance (ESG) issues. Well, that prediction proved right as we continue to see low support across all proposal categories with the exception of those related to good governance.

Quick Links:

• Jump to Proposal Vote Result Table

• CEO Pay: The $25 Million Plus Pay Club (2025)

A Season of Low Support… Except for Good Governance

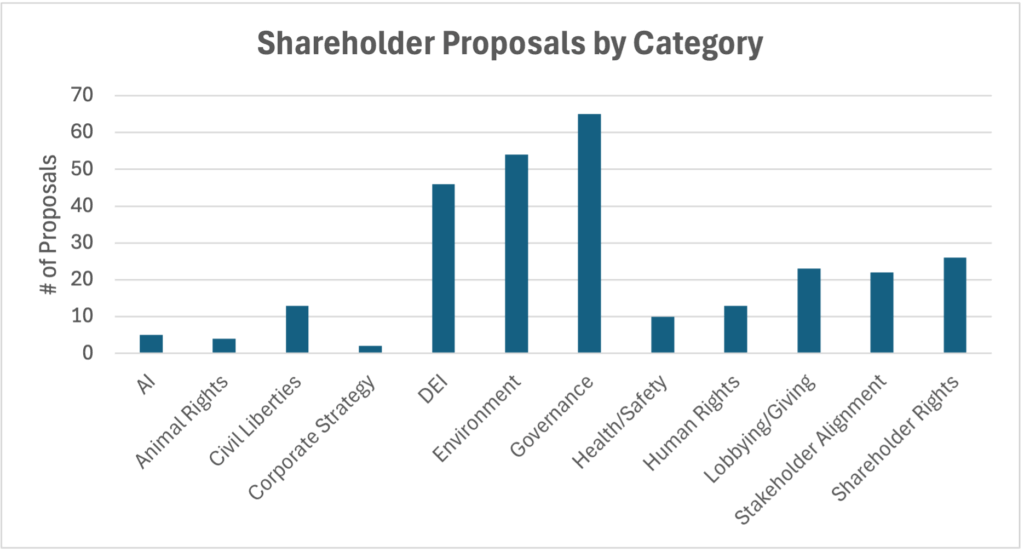

For this update we looked at just under 300 proposals from almost 200 companies. The headline from April was that of the 25+ shareholder proposals voted on in early 2025 that we looked at, almost all received less than ~10% shareholder support. The short story on this update: support remains very low across categories with the exception, again, being “good governance” related measures such as declassification. As we noted in April, we are always pleased to see declassification proposals–especially when done proactively by management. In our view, there is little reason to have a classified board. More often than not this is an entrenchment tactic as opposed to a true alignment with shareholder interests.

From the January–March meetings we had a few big players with shareholders showing little support for DEI and similar proposals, for example:

- Costco (COST): A proposal requesting a report on the risks of maintaining DEI efforts received just 2% support.

- Visa (V): Two proposals—on DEI and merchant category codes—failed to break the 1% threshold and lobbying transparency didn’t break 15%.

- Apple (AAPL): Shareholders generally showed more support here with a much-watched proposal on ethical AI data acquisition receiving 11%, while a human rights proposal relating to privacy and child protection garnered with 9% support. However, the report on charitable giving only received 2% support.

Looking at April and May votes, we see similar. Here is a snapshot of the three most targeted companies: Amazon (AMZN), Meta Platforms (META), and Berkshire Hathaway (BRK.B). All three are targeted because of there scope and scale of their activities, but also because they are prominent companies that will drive headlines and clicks for those advocating for change. Here’s a look:

- Amazon (AMZN): Amazon is always a favorite for shareholders to poke with proposals. Support averaged under 14% and only two cracked 20% support. Interestingly we saw not just one, but two proposals on AI.

- Meta Platforms (META): Similar to AMZN (and most others) overall support was low (<12%). The most support came for governance changes around META’s dual class structure — all cracked 20%, but are far from passing. Receiving almost no support was a proposal to assess the benefits of converting some amount of Meta’s treasury from cash (and similar) to Bitcoin under the premise that Bitcoin is better protected from inflation. Given Bitcoin’s current price and the generally renewed crypto craze, we’re a little surprised this didn’t garner a little more support.

- Berkshire Hathaway (BRK.B): With shareholder proposals receiving an average of less than 2% at the meeting, it is clear that the majority of Berkshire shareholders want its management to drive the bus and feel it’s being well run. It may surprise some that Berkshire was also hit with a request on AI, but this is hot, impactful topic for stakeholders and unlike DEI which is struggling under its own weight, AI will likely grow in focus over the next several years. Berkshire was also hit by several anti-DEI proposals which, similar to pro-DEI proposals, received little support.

What’s Behind the Low Support?

The drivers behind low support levels remain the same given the on-going political, cultural, and market environment. Three of the key factors are:

- Backlash to ESG: A growing segment of investors—and politicians—have taken aim at corporate ESG initiatives. Several proposals this year actually push to scale back DEI and climate-related programs, rather than expand them.

- Proliferation of Politically-Motivated Filings: Some proposals appear to come from advocacy groups more interested in making statements than winning votes. As a result, even mainstream institutional investors—traditionally open to ESG discussions—have become more cautious.

- Lack of Alignment with Financial Materiality: Proposals that are perceived as unrelated to company performance often struggle. Requests for reports on charitable giving or third-party audits can seem disconnected from shareholder value, particularly without clear financial rationale.

Given Low Support, Do These Votes Matter?

Overall, the vast majority of public company shareholders want companies to focus on their fiduciary responsibility to build successful businesses that deliver returns for shareholders through responsible governance. n many cases, unusually high support for shareholder proposals or unusually low support for directors reflects the outsized influence of proxy advisors ISS and Glass Lewis. Their recommendations—whether well-founded or not—often sway votes, with many funds following blindly.

With institutions like BlackRock and Vanguard increasingly offering pass-through voting or client-directed voting, we hope to see shifts in support dynamics over the coming years. We’re also in agreement with folks like Jamie Dimon, Bill Gurly, and Brad Gerstner that the ISS / Glass Lewis duopoly is a problem and funds, when they don’t allow client-directed voting, should take more ownership of their voting choices and have that focus tied tightly around performance and governance. Brad and Bill’s latest BG2 podcast episode hits this hard around minute 55.

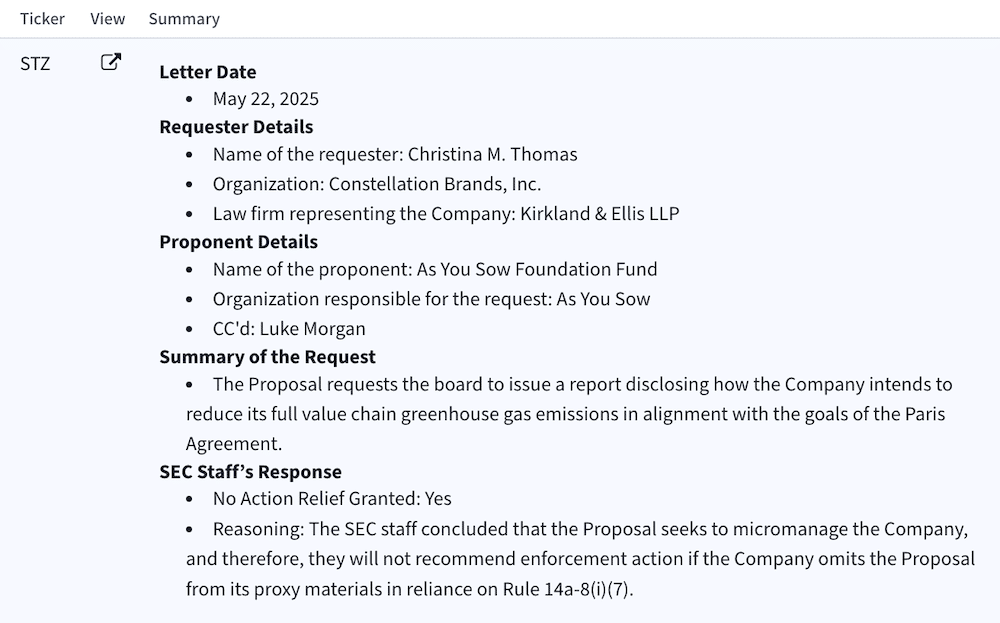

Don’t Forget: Not All Shareholder Proposals Make it to Vote (SEC No Action)

It’s important to remember that not all attempted shareholder proposals make it to a vote. When a shareholder proposal is submitted, companies can appeal to the SEC’s Division of Corporation Finance for what’s known as a “no-action” letter—essentially asking the SEC staff to confirm they won’t take enforcement action if the company leaves the proposal out of its proxy materials. If the SEC agrees, the proposal is excluded, and shareholders never get to vote on it. The company can ask to exclude it for a variety of reasons whether on technicalities or more substantial such as it being an attempt to micromanage the company’s ordinary business operations. For example, below is a summary of a no-action request involving Constellation. In this case, the SEC granted no-action relief, allowing the company to exclude a proposal submitted by As You Sow. We’ll do a review of SEC No-Action letter activity for 2025 at a later date.

Example SEC No-Action Letter Summary from Boardroom Alpha

DEI / ESG Shareholder Proposal Result Update

| Company Name | Ticker | Meeting Date | View Proxy | View Votes | Category | Proposal | Support |

|---|---|---|---|---|---|---|---|

| ACADEMY SPORTS & OUTDOORS INC | ASO | Jun 05 | Proxy | Votes | Governance | Board Declassification Amendment | > 99% |

| ADT INC | ADT | May 21 | Proxy | Votes | Governance | To approve an amendment and restatement to the Company’s amended and restated certificate of incorporation to declassify the Board | > 99% |

| ADVANCE AUTO PARTS INC | AAP | May 15 | Proxy | Votes | Stakeholder Alignment | Vote on a shareholder proposal related to additional requirements for executives to retain significant stock | 32% |

| AIR PRODUCTS & CHEMICALS INC | APD | Jan 23 | Proxy | Votes | Governance | Shareholder Proposal to Amend the Bylaws to Repeal any Amendments After September 17, 2023 | 62% |

| ALBEMARLE CORP | ALB | May 06 | Proxy | Votes | Shareholder Rights | Adopt simple majority vote | 68% |

| ALLIANT ENERGY CORP | LNT | May 16 | Proxy | Votes | Environment | Shareowner Proposal Requesting Third-Party Evaluation of Greenhouse Gas Emissions Reduction Targets | 12% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | AI | Shareholder Proposal: Assessment of Board Structure for Oversight of AI | 10% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | AI | Shareholder Proposal: Report on Data Usage Oversight in AI Offerings | 11% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Civil Liberties | Shareholder Proposal: Report on Advertising Risks | 1% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Additional Reporting on Impact of Data Centers on Climate Commitments | 20% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Alternative Emissions Reporting | 14% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Report on Packaging Materials | 13% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Governance | Shareholder Proposal: Mandatory Policy Separating CEO and Chair Roles | 17% |

| AMAZON COM INC | AMZN | May 21 | Proxy | Votes | Health/Safety | Shareholder Proposal: Report on Warehouse Working Conditions | 22% |

| AMEREN CORP | AEE | May 08 | Proxy | Votes | Environment | Shareholder Proposal Regarding Evaluation of Greenhouse Gas Reduction Targets | 8% |

| AMERICAN EXPRESS CO | AXP | Apr 29 | Proxy | Votes | Civil Liberties | Shareholder Proposal Relating to Civil Liberties in Advertising Services | 1% |

| AMERICAN EXPRESS CO | AXP | Apr 29 | Proxy | Votes | DEI | Shareholder Proposal Relating to DEI Goals in Executive Pay Incentives | 1% |

| APPLE INC | AAPL | Feb 25 | Proxy | Votes | AI | Report on Ethical AI Data Acquisition and Usage | 11% |

| APPLE INC | AAPL | Feb 25 | Proxy | Votes | DEI | Request to Cease DEI Efforts | 2% |

| APPLE INC | AAPL | Feb 25 | Proxy | Votes | Human Rights | Report on Costs and Benefits of Child Sex Abuse Material-Identifying Software & User Privacy | 9% |

| APPLE INC | AAPL | Feb 25 | Proxy | Votes | Lobbying/Giving | Report on Charitable Giving | 2% |

| ARROW ELECTRONICS INC | ARW | May 06 | Proxy | Votes | Shareholder Rights | Advisory Vote to Approve a Shareholder Proposal to Replace Supermajority Voting Provisions in the Company’s Charter and By-laws with a Simple Majority Voting Standard | 83% |

| ATMUS FILTRATION TECHNOLOGIES INC | ATMU | May 20 | Proxy | Votes | Governance | Amendment to Certificate of Incorporation to Declassify the Board of Directors and Phase-in Annual Director Elections | > 99% |

| AUTONATION INC | AN | Apr 23 | Proxy | Votes | DEI | Stockholder Proposal Regarding Diversity, Equity, and Inclusion Efforts | 15% |

| AUTONATION INC | AN | Apr 23 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal Regarding Political Contributions | 30% |

| BANK OF AMERICA CORP | BAC | Apr 22 | Proxy | Votes | Animal Rights | Shareholder proposal – requesting report on board oversight of risks related to animal welfare | 6% |

| BANK OF AMERICA CORP | BAC | Apr 22 | Proxy | Votes | Environment | Shareholder proposal – requesting disclosure of energy financing ratio | 16% |

| BANK OF AMERICA CORP | BAC | Apr 22 | Proxy | Votes | Environment | Shareholder proposal – requesting report on lobbying alignment with Bank of America’s climate goals | 16% |

| BANK OF AMERICA CORP | BAC | Apr 22 | Proxy | Votes | Governance | Shareholder proposal – requesting the nomination of more director candidates than board seats | 2% |

| BELLRING BRANDS INC | BRBR | Proxy | Votes | Governance | An amendment to the Company’s Certificate of Incorporation to declassify the Company’s Board of Directors | > 99% | |

| BELLRING BRANDS INC | BRBR | Proxy | Votes | Governance | A stockholder proposal to adopt a director election resignation guideline | 19% | |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | AI | Create new committee of independent directors on Artificial Intelligence (“AI”) | 4% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | DEI | Conduct an evaluation and issue a civil rights and non-discrimination report evaluating how Berkshire Hathaway’s policies and practices impact employees and prospective employees based on their race, color, religion (including religious views), sex, national origin, or political views and the risks those impacts present to Berkshire Hathaway’s business. | 1% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | DEI | Designate a Board Committee to oversee the Company’s diversity and inclusion strategy across its holding companies. | 1% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | DEI | Improve the executive compensation program to include the factor of the highest NEO’s pay ratio | 2% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | DEI | Oversee an independent racial discrimination audit analyzing Berkshire’s legal and reputational risks stemming from its subsidiaries’ race-based initiatives | 1% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | Environment | Annual disclosure of clean energy financing ratio | 3% |

| BERKSHIRE HATHAWAY INC | BRK.B | May 03 | Proxy | Votes | Environment | Annually publish a report of Berkshire Hathaway Energy’s incurred costs and associated actual benefits accrued to shareholders, to public health, and to the environment, from the subsidiary’s environmental activities that are voluntary and exceed federal/state regulatory requirements | 1% |

| BLACKROCK INC | BLK | May 15 | Proxy | Votes | Governance | Shareholder proposal requesting reform of the board election to list more candidates than the number of directors to be elected | 1% |

| BLACKROCK INC | BLK | May 15 | Proxy | Votes | Stakeholder Alignment | Shareholder proposal requesting a report on risks associated with stakeholder capitalism | 1% |

| BOEING CO | BA | Apr 24 | Proxy | Votes | DEI | Shareholder Proposal – Civil Rights Audit | 6% |

| BOEING CO | BA | Apr 24 | Proxy | Votes | DEI | Shareholder Proposal – Report on DEI and Related Risks | 3% |

| BOYD GAMING CORP | BYD | May 08 | Proxy | Votes | Health/Safety | Report on Smokefree Policy | 11% |

| BRISTOL MYERS SQUIBB CO | BMY | May 06 | Proxy | Votes | DEI | Request to Cease DEI Efforts Proposal | 2% |

| BUILDERS FIRSTSOURCE INC | BLDR | Mar 28 | Proxy | Votes | Governance | Amendment to our Certificate of Incorporation to Declassify our Board of Directors | 98% |

| CADENCE DESIGN SYSTEMS INC | CDNS | May 08 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal Regarding Political Spending | 44% |

| CAPITOL FEDERAL FINANCIAL INC | CFFN | Jan 28 | Proxy | Votes | Governance | Amendment to Charter for Board of Directors declassification | 78% |

| CARRIER GLOBAL CORP | CARR | Apr 09 | Proxy | Votes | Lobbying/Giving | Shareowner Proposal for Lobbying Transparency Report | 14% |

| CBOE GLOBAL MARKETS INC | CBOE | May 06 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal Regarding Political Spending | 56% |

| CELANESE CORP | CE | Apr 17 | Proxy | Votes | Shareholder Rights | Advisory Vote on Shareholder Proposal Requesting Simple Majority Vote Charter and By-laws Amendments, if Properly Presented | 64% |

| CENTENE CORP | CNC | May 13 | Proxy | Votes | Environment | Shareholder proposal to disclose plan to reduce total contribution to climate change | 23% |

| CENTENE CORP | CNC | May 13 | Proxy | Votes | Environment | Shareholder proposal to report on climate risk to retirement investments | 9% |

| CF INDUSTRIES HOLDINGS INC | CF | May 06 | Proxy | Votes | Stakeholder Alignment | Shareholder proposal regarding shareholder approval requirement for excessive golden parachutes | 44% |

| CHARLES RIVER LABORATORIES INTERNATIONAL INC | CRL | May 20 | Proxy | Votes | Animal Rights | Shareholder Proposal by PETA | 8% |

| CHARTER COMMUNICATIONS INC | CHTR | Oct 01 | Proxy | Votes | Lobbying/Giving | Vote on the stockholder proposal regarding political expenditures report | 19% |

| CHEMOURS CO | CC | Apr 22 | Proxy | Votes | DEI | Shareholder Proposal to Adopt a Policy to Assess Biodiversity Impacts | 6% |

| CHESAPEAKE UTILITIES CORP | CPK | May 07 | Proxy | Votes | Governance | Declassification Amendment | > 99% |

| CHEVRON CORP | CVX | Oct 01 | Proxy | Votes | Human Rights | Stockholder Proposal on Human Rights Practices | 10% |

| CHOICE HOTELS INTERNATIONAL INC | CHH | Oct 01 | Proxy | Votes | Shareholder Rights | Shareholder Proposal for Simple Majority Vote Requirement | 97% |

| CITIGROUP INC | C | Apr 29 | Proxy | Votes | Animal Rights | Stockholder proposal requesting a report disclosing the Board’s oversight regarding material risks associated with animal welfare. | 6% |

| CITIGROUP INC | C | Apr 29 | Proxy | Votes | DEI | Stockholder proposal requesting a report on the effectiveness of Citi’s policies and practices in respecting Indigenous Peoples’ rights in Citi’s existing and proposed financing. | 13% |

| CITIGROUP INC | C | Apr 29 | Proxy | Votes | Environment | Stockholder proposal requesting a report on financial statement assumptions and climate change. | 1% |

| CMS ENERGY CORP | CMS | May 02 | Proxy | Votes | Shareholder Rights | Shareholder Proposal: Support Shareholder Ability to Call for a Special Shareholder Meeting | 70% |

| COCA COLA CO | KO | Apr 30 | Proxy | Votes | Civil Liberties | Shareowner Proposal Regarding a Report on Civil Liberties in Advertising Services | 1% |

| COCA COLA CO | KO | Apr 30 | Proxy | Votes | DEI | Shareowner Proposal Regarding a Report on Brand Image Impacts | 5% |

| COCA COLA CO | KO | Apr 30 | Proxy | Votes | DEI | Shareowner Proposal Regarding DEI Goals in Executive Pay | 1% |

| COCA COLA CO | KO | Apr 30 | Proxy | Votes | Environment | Shareowner Proposal Regarding a Report on Food Waste | 12% |

| COGNIZANT TECHNOLOGY SOLUTIONS CORP | CTSH | Jun 03 | Proxy | Votes | Shareholder Rights | Shareholder Proposal Regarding Support for Special Shareholder Meeting Improvement | 9% |

| COLGATE PALMOLIVE CO | CL | May 09 | Proxy | Votes | Environment | Revisit Plastic Packaging Policies | 3% |

| COLGATE PALMOLIVE CO | CL | May 09 | Proxy | Votes | Governance | Support an Independent Board Chairman | 30% |

| CORE SCIENTIFIC INC | CORZ | May 23 | Proxy | Votes | Governance | To approve an amendment to the Company’s Third Amended and Restated Certificate of Incorporation to eliminate the classification of the Board of the Company, such that all directors will stand for election each year for a one-year term beginning with the Company’s 2026 Annual Meeting of Stockholders | 99% |

| COSTCO WHOLESALE CORP | COST | Jan 23 | Proxy | Votes | DEI | Shareholder proposal requesting report on the risks of maintaining DEI efforts | 2% |

| CUMMINS INC | CMI | May 13 | Proxy | Votes | Governance | Shareholder Proposal Regarding an Independent Board Chairman | 41% |

| DANA INC | DAN | Apr 24 | Proxy | Votes | Governance | Shareholder proposal to require an independent Board Chairman | 26% |

| DEERE & CO | DE | Feb 26 | Proxy | Votes | DEI | Shareholder Proposal Regarding a Civil Rights Audit | 29% |

| DEERE & CO | DE | Feb 26 | Proxy | Votes | DEI | Shareholder Proposal Regarding a Corporate Financial Sustainability Report | 1% |

| DEERE & CO | DE | Feb 26 | Proxy | Votes | DEI | Shareholder Proposal Regarding a Report on Racial and Gender Hiring Statistics | 1% |

| DEERE & CO | DE | Feb 26 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal Regarding a Report on Charitable Giving | 1% |

| DOLLAR GENERAL CORP | DG | May 29 | Proxy | Votes | Environment | Shareholder Proposal to Publish Food Waste Transparency Report | 10% |

| DOLLAR GENERAL CORP | DG | May 29 | Proxy | Votes | Health/Safety | Shareholder Proposal to Publish Report on Employee Access to Healthcare | 8% |

| DOLLAR GENERAL CORP | DG | May 29 | Proxy | Votes | Human Rights | Shareholder Proposal to Adopt Comprehensive Human Rights Policy | 23% |

| DOLLAR GENERAL CORP | DG | May 29 | Proxy | Votes | Shareholder Rights | Shareholder Proposal to Remove One-Year Holding Period | 15% |

| DOMINION ENERGY INC | D | May 07 | Proxy | Votes | Environment | Shareholder Proposal on Non-Carbon Emitting Generation Goals | 1% |

| DOMINOS PIZZA INC | DPZ | Feb 28 | Proxy | Votes | Shareholder Rights | SHAREHOLDER PROPOSAL REGARDING SHAREHOLDERS’ RIGHT TO REQUEST A SPECIAL MEETING | 36% |

| DOVER CORP | DOV | May 02 | Proxy | Votes | Governance | To consider a shareholder proposal requesting an independent board chair | 37% |

| DRAFTKINGS INC | DKNG | Oct 01 | Proxy | Votes | DEI | Shareholder proposal regarding board matrix disclosure | 4% |

| DTE ENERGY CO | DTE | May 08 | Proxy | Votes | Shareholder Rights | Shareholder Proposal on Elimination of Holding Period for Special Meetings | 5% |

| DUKE ENERGY CORP | DUK | May 01 | Proxy | Votes | Environment | Shareholder proposal regarding a net-zero audit | 2% |

| DUKE ENERGY CORP | DUK | May 01 | Proxy | Votes | Shareholder Rights | Shareholder proposal regarding support simple majority vote | 98% |

| EASTMAN CHEMICAL CO | EMN | May 01 | Proxy | Votes | Governance | Advisory Vote on Stockholder Proposal Regarding an Independent Board Chair | 30% |

| EDISON INTERNATIONAL | EIX | Apr 24 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Regarding Shareholder Approval of Certain Severance Pay Arrangements | 8% |

| ELEVANCE HEALTH INC | ELV | May 14 | Proxy | Votes | DEI | Shareholder proposal requesting report on the effectiveness of Diversity, Equity and Inclusion efforts | 14% |

| ELI LILLY & CO | LLY | May 05 | Proxy | Votes | Governance | Amendment to Eliminate Classified Board Structure | 87% |

| EMERSON ELECTRIC CO | EMR | Feb 04 | Proxy | Votes | Governance | Amendment to Declassify the Board of Directors | 98% |

| ENERGIZER HOLDINGS INC | ENR | Jan 24 | Proxy | Votes | Governance | Shareholder Proposal regarding Director Election Resignation Governance Policy | 17% |

| EPAM SYSTEMS INC | EPAM | Apr 01 | Proxy | Votes | Governance | Approval of an Amendment to the Charter to Declassify the Board | 99% |

| EVERSOURCE ENERGY | ES | May 01 | Proxy | Votes | Governance | Shareholder Proposal: Support an Independent Board Chairman | 47% |

| FIRSTENERGY CORP | FE | May 21 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal on Lobbying Activity and Policies | 8% |

| FISERV INC | FI | May 14 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Requesting Amendments to Compensation Recoupment Policy | 6% |

| FLOOR & DECOR HOLDINGS INC | FND | May 07 | Proxy | Votes | Governance | Amendment to Certificate of Incorporation – Eliminate Legacy Classified Board Provisions | > 99% |

| FLOWERS FOODS INC | FLO | May 22 | Proxy | Votes | Governance | Shareholder Proposal to Adopt a Policy for an Independent Board Chair | 29% |

| FLOWSERVE CORP | FLS | May 16 | Proxy | Votes | Shareholder Rights | Shareholder Proposal – Requesting Elimination of the One-Year Holding Period Requirement to Call a Special Shareholder Meeting | 10% |

| FOOT LOCKER INC | FL | Oct 01 | Proxy | Votes | Environment | Vote to Approve a Shareholder Proposal Regarding Greenhouse Gas Emissions | 6% |

| FORD MOTOR CO | F | May 08 | Proxy | Votes | Environment | Reporting on the Company’s Supply Chain Emissions and Net Zero Goals | 6% |

| GENERAL DYNAMICS CORP | GD | May 07 | Proxy | Votes | Human Rights | Shareholder Proposal regarding a Human Rights Impact Assessment | 5% |

| GENERAL MOTORS CO | GM | Jun 03 | Proxy | Votes | Environment | Shareholder Proposal Regarding a Report on Supply Chain GHG Emissions Reduction Strategies | 14% |

| GENUINE PARTS CO | GPC | Apr 28 | Proxy | Votes | DEI | Shareholder Proposal on Diversity Report | 18% |

| GILEAD SCIENCES INC | GILD | May 07 | Proxy | Votes | DEI | Stockholder Proposal on DEI Practices Risks Report | 1% |

| GILEAD SCIENCES INC | GILD | May 07 | Proxy | Votes | Governance | Stockholder Proposal on Independent Board Chair Policy | 36% |

| GILEAD SCIENCES INC | GILD | May 07 | Proxy | Votes | Human Rights | Stockholder Proposal on Human Rights Policy | 36% |

| GOLDMAN SACHS GROUP INC | GS | Apr 23 | Proxy | Votes | DEI | Shareholder Proposal Regarding DEI Goals in Executive Pay Incentives | 2% |

| GOLDMAN SACHS GROUP INC | GS | Apr 23 | Proxy | Votes | DEI | Shareholder Proposal Regarding Racial Discrimination Audit | 2% |

| GOLDMAN SACHS GROUP INC | GS | Apr 23 | Proxy | Votes | Environment | Shareholder Proposal Regarding Disclosure of Energy Supply Financing Ratio | 15% |

| GOODYEAR TIRE & RUBBER CO | GT | Apr 14 | Proxy | Votes | Environment | Adopt policies regarding tire and road wear particle goals and timelines | 6% |

| GROUP 1 AUTOMOTIVE INC | GPI | May 13 | Proxy | Votes | Shareholder Rights | Shareholder Proposal for Simple Majority Vote | 46% |

| HCA HEALTHCARE INC | HCA | Apr 24 | Proxy | Votes | Corporate Strategy | Stockholder Proposal Regarding a Report on Acquisition Strategy | 12% |

| HCA HEALTHCARE INC | HCA | Apr 24 | Proxy | Votes | Health/Safety | Stockholder Proposal Regarding Amendment to the Patient Safety and Quality of Care Committee Charter | 10% |

| HEWLETT PACKARD ENTERPRISE CO | HPE | Apr 02 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal: Transparency in Lobbying | 22% |

| HOME DEPOT INC | HD | May 22 | Proxy | Votes | DEI | Shareholder Proposal on Biodiversity Impact Assessment | 16% |

| HOME DEPOT INC | HD | May 22 | Proxy | Votes | Environment | Shareholder Proposal on Packaging Policies for Plastics | 17% |

| HOME DEPOT INC | HD | May 22 | Proxy | Votes | Governance | Shareholder Proposal on Independent Chair | 27% |

| HONEYWELL INTERNATIONAL INC | HON | May 20 | Proxy | Votes | Governance | Independent Board Chairman Proposal | 23% |

| IDEX CORP | IEX | May 08 | Proxy | Votes | DEI | Stockholder Proposal on Hiring Practices | 14% |

| IDEXX LABORATORIES INC | IDXX | May 07 | Proxy | Votes | Governance | Shareholder Proposal Regarding Annual Election of Directors | 92% |

| INTEL CORP | INTC | May 06 | Proxy | Votes | Human Rights | Stockholder Proposal Requesting a Report on an Ethical Impact Assessment | 9% |

| INTEL CORP | INTC | May 06 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal Requesting a Report on Charitable Giving | 2% |

| INTERNATIONAL BUSINESS MACHINES CORP | IBM | Apr 29 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal to Support Transparency in Lobbying | 19% |

| INTERNATIONAL PAPER CO | IP | May 12 | Proxy | Votes | DEI | Shareowner Proposal Concerning a Report on the Company’s LGBTQIA+ Equity and Inclusion Efforts | 6% |

| IROBOT CORP | IRBT | May 16 | Proxy | Votes | Governance | Amendments to Certificate of Incorporation to Declassify the Board | 96% |

| JOHNSON & JOHNSON | JNJ | Apr 24 | Proxy | Votes | Human Rights | Shareholder Proposal – produce a human rights impact assessment | 11% |

| JOHNSON & JOHNSON | JNJ | Apr 24 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal – shareholder opportunity to vote on excessive golden parachutes | 5% |

| JPMORGAN CHASE & CO | JPM | May 20 | Proxy | Votes | Environment | Proposal 5 – Shareholders did not approve the proposal on report on social impacts of transition finance | 11% |

| JPMORGAN CHASE & CO | JPM | May 20 | Proxy | Votes | Governance | Proposal 4 – Shareholders did not approve the proposal on support for an independent board chairman | 37% |

| KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC | KNX | May 13 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal on Political Spending Transparency | 42% |

| KOHLS CORP | KSS | May 14 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal: Shareholder Vote on Executive Severance Payments | 10% |

| KRAFT HEINZ CO | KHC | May 08 | Proxy | Votes | Environment | Stockholder Proposal Regarding a Report on Recyclability Claims | 12% |

| KRAFT HEINZ CO | KHC | May 08 | Proxy | Votes | Environment | Stockholder Proposal Regarding Report on Plastic Packaging | 12% |

| KRAFT HEINZ CO | KHC | May 08 | Proxy | Votes | Governance | Stockholder Proposal to Adopt Policy on Independent Board Chair | 28% |

| L3HARRIS TECHNOLOGIES INC | LHX | Apr 18 | Proxy | Votes | Lobbying/Giving | Transparency in Lobbying | 11% |

| LANTHEUS HOLDINGS INC | LNTH | May 01 | Proxy | Votes | Governance | Approve the stockholder proposal regarding the declassification of the Company’s Board of Directors | 99% |

| LENDINGCLUB CORP | LC | Jun 03 | Proxy | Votes | Governance | Management Proposal to Amend and Restate the Company’s Eighth Amended and Restated Certificate of Incorporation (Declassification) | 99% |

| LENNAR CORP | LEN | Apr 09 | Proxy | Votes | DEI | Stockholder Proposal on LGBTQIA+ Equity and Inclusion Report | 9% |

| LENNAR CORP | LEN | Apr 09 | Proxy | Votes | Environment | Stockholder Proposal on Greenhouse Gas Emissions Disclosure | 10% |

| LENNAR CORP | LEN | Apr 09 | Proxy | Votes | Governance | Stockholder Proposal on Independent Board Chairman | 21% |

| LEVI STRAUSS & CO | LEVI | Apr 23 | Proxy | Votes | DEI | Shareholder Proposal on DEI Efforts | < 1% |

| LIBERTY ENERGY INC | LBRT | Oct 01 | Proxy | Votes | Governance | Amendment to Declassify the Board | > 99% |

| LINCOLN NATIONAL CORP | LNC | May 22 | Proxy | Votes | Governance | Non-Binding Shareholder Proposal Regarding Independent Board Chair | 38% |

| LITHIA MOTORS INC | LAD | Apr 24 | Proxy | Votes | Stakeholder Alignment | Vote on a shareholder proposal requesting shareholder approval of certain executive severance arrangements, if properly presented | 33% |

| LOCKHEED MARTIN CORP | LMT | May 09 | Proxy | Votes | Human Rights | Stockholder Proposal Requesting a Report on Alignment of Political Activities with Human Rights Policy | 10% |

| LUMEN TECHNOLOGIES INC | LUMN | May 13 | Proxy | Votes | Shareholder Rights | Shareholder Proposal for Simple Majority Voting | 92% |

| MARATHON PETROLEUM CORP | MPC | Apr 30 | Proxy | Votes | Governance | APPROVAL OF AN AMENDMENT TO THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS | 99% |

| MARATHON PETROLEUM CORP | MPC | Apr 30 | Proxy | Votes | Shareholder Rights | SHAREHOLDER PROPOSAL SEEKING A SIMPLE MAJORITY VOTE | 48% |

| MARKEL GROUP INC | MKL | May 21 | Proxy | Votes | Environment | Shareholder Proposal – Report on Company’s Greenhouse Gas Emissions | 15% |

| MARKEL GROUP INC | MKL | May 21 | Proxy | Votes | Shareholder Rights | Shareholder Proposal – Simple Majority Vote | 71% |

| MASCO CORP | MAS | Proxy | Votes | Governance | Approval of an amendment to the Company’s Certificate of Incorporation to phase-out the classification of the Board of Directors over a three-year period and provide for the annual election of directors. | > 99% | |

| MATTEL INC | MAT | Proxy | Votes | Environment | Stockholder Proposal on Climate Change | 6% | |

| MCDONALDS CORP | MCD | May 20 | Proxy | Votes | Civil Liberties | An advisory shareholder proposal requesting a report related to oversight of advertising risks | 1% |

| MCDONALDS CORP | MCD | May 20 | Proxy | Votes | DEI | An advisory shareholder proposal to revisit diversity, equity, and inclusion in executive compensation | 1% |

| MCDONALDS CORP | MCD | May 20 | Proxy | Votes | Environment | An advisory shareholder proposal requesting disclosure on climate transition plans | 10% |

| MERCK & CO INC | MRK | May 27 | Proxy | Votes | Civil Liberties | Shareholder proposal regarding a report on civil liberties in advertising services | 2% |

| MERCK & CO INC | MRK | May 27 | Proxy | Votes | DEI | Shareholder proposal to revisit DEI goals in executive pay incentives | 1% |

| MERCK & CO INC | MRK | May 27 | Proxy | Votes | Governance | Shareholder proposal regarding a tax transparency report | 23% |

| MERCK & CO INC | MRK | May 27 | Proxy | Votes | Human Rights | Shareholder proposal regarding a human rights impact assessment | 15% |

| MERITAGE HOMES CORP | MTH | May 22 | Proxy | Votes | Governance | Amendment to Declassify the Board of Directors | > 99% |

| MERITAGE HOMES CORP | MTH | May 22 | Proxy | Votes | Lobbying/Giving | Stockholder Proposal for Transparency in Political Spending | 58% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | AI | Shareholder Proposal Regarding Report on AI Data Usage Oversight | 10% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Civil Liberties | Shareholder Proposal Regarding Report on Data Collection and Advertising Practices | 11% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Corporate Strategy | Shareholder Proposal Regarding Bitcoin Treasury Assessment | < 1% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Environment | Shareholder Proposal Regarding GHG Emissions Reduction Actions | 3% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Human Rights | Shareholder Proposal Regarding Report on Child Safety Impacts and Actual Harm Reduction to Children | 13% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Human Rights | Shareholder Proposal Regarding Report on Hate Targeting Marginalized Communities | 15% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Human Rights | Shareholder Proposal Regarding Report on Risks of Deepfakes in Online Child Exploitation | 6% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Regarding Disclosure of Voting Results Based on Class of Shares | 21% |

| META PLATFORMS INC | META | May 28 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Regarding Dual Class Capital Structure | 26% |

| MONDELEZ INTERNATIONAL INC | MDLZ | May 21 | Proxy | Votes | Civil Liberties | Shareholder Proposal: Assessment of Supplier & Partner Code of Conduct | 10% |

| MONDELEZ INTERNATIONAL INC | MDLZ | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Climate Lobbying Report | 11% |

| MONDELEZ INTERNATIONAL INC | MDLZ | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Report on Flexible Plastic Packaging | 13% |

| MONDELEZ INTERNATIONAL INC | MDLZ | May 21 | Proxy | Votes | Environment | Shareholder Proposal: Report on Recycled Content Claims | 11% |

| MONDELEZ INTERNATIONAL INC | MDLZ | May 21 | Proxy | Votes | Human Rights | Shareholder Proposal: Third-Party Report on Human Rights Policy | 13% |

| MORGAN STANLEY | MS | Proxy | Votes | Environment | Shareholder Proposal Requesting Annual Disclosure of the Company’s Energy Supply Ratio | 13% | |

| NATIONAL HEALTH INVESTORS INC | NHI | May 21 | Proxy | Votes | Governance | Amendment to the Company’s Articles of Incorporation to declassify the Board of Directors | 94% |

| NETFLIX INC | NFLX | Jun 05 | Proxy | Votes | DEI | Amend the Code of Ethics to enhance policies on non-discrimination, anti-harassment, and whistleblower protection | 6% |

| NETFLIX INC | NFLX | Jun 05 | Proxy | Votes | Environment | Issue a Climate Transition Plan | 10% |

| NETFLIX INC | NFLX | Jun 05 | Proxy | Votes | Lobbying/Giving | Report on Charitable Giving | < 1% |

| NEWELL BRANDS INC | NWL | May 08 | Proxy | Votes | Stakeholder Alignment | Stockholder Proposal to Approve Additional Stock Retention Requirements for Executives | 32% |

| NORTHROP GRUMMAN CORP | NOC | May 21 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal on Clawback Policy | 7% |

| NVR INC | NVR | May 06 | Proxy | Votes | Shareholder Rights | Shareholders did not approve a shareholder proposal to provide shareholders with the right to call a special meeting | 30% |

| NXU INC | NXUR | Feb 11 | Proxy | Votes | Governance | To amend the Certificate of Incorporation to classify the board of directors of Nxu | 99% |

| OLD DOMINION FREIGHT LINE INC | ODFL | May 21 | Proxy | Votes | Environment | Disclose how Old Dominion intends to reduce its Scope 1 and 2 greenhouse gas emissions in alignment with interim and long-term climate targets aligned with the Paris Agreement. | 15% |

| OMNICOM GROUP INC | OMC | May 06 | Proxy | Votes | Governance | Shareholder Proposal Regarding Independent Board Chairman | 28% |

| O REILLY AUTOMOTIVE INC | ORLY | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal: Support Improved Clawback Policy for Unearned Executive Pay | 6% | |

| OTIS WORLDWIDE CORP | OTIS | May 15 | Proxy | Votes | Lobbying/Giving | Reporting on Political Contributions and Expenditures | 40% |

| PENUMBRA INC | PEN | May 28 | Proxy | Votes | Governance | Approval of an amendment to the Company’s Restated Certificate of Incorporation to phase in the declassification of the Company’s Board of Directors | > 99% |

| PEPSICO INC | PEP | May 07 | Proxy | Votes | DEI | Shareholder Proposal on Biodiversity and Nature Loss | 17% |

| PEPSICO INC | PEP | May 07 | Proxy | Votes | DEI | Shareholder Proposal on Racial Equity Audit | 17% |

| PEPSICO INC | PEP | May 07 | Proxy | Votes | Environment | Shareholder Proposal on Sustainable Packaging Policies for Plastics | 15% |

| PEPSICO INC | PEP | May 07 | Proxy | Votes | Health/Safety | Shareholder Proposal on Non-Sugar Sweetener Risks | 11% |

| PFIZER INC | PFE | Apr 24 | Proxy | Votes | DEI | Issue A Report Evaluating The Risks Related To Religious Discrimination Against Employees | 2% |

| PHILLIPS 66 | PSX | May 21 | Proxy | Votes | Governance | Management proposal to approve the declassification of the Board of Directors | 97% |

| PHILLIPS 66 | PSX | May 21 | Proxy | Votes | Governance | Non-binding Shareholder proposal requiring annual director resignations | 33% |

| PINNACLE WEST CAPITAL CORP | PNW | May 21 | Proxy | Votes | Shareholder Rights | Shareholder Proposal: Support Special Shareholder Meeting Improvement | 3% |

| PLANET FITNESS INC | PLNT | May 06 | Proxy | Votes | DEI | Stockholder proposal regarding EEO-1 report disclosure policy | 35% |

| POST HOLDINGS INC | POST | Jan 30 | Proxy | Votes | Governance | Adoption of Director Election Resignation Guideline | 14% |

| POWER INTEGRATIONS INC | POWI | May 15 | Proxy | Votes | Governance | Advisory Proposal on Chairman and CEO Separation | 45% |

| PPG INDUSTRIES INC | PPG | Apr 17 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal on Executive Officer Severance | 6% |

| PPL CORP | PPL | May 16 | Proxy | Votes | Environment | Shareowner Proposal for Independent Evaluation of Greenhouse Gas Reduction Targets | 7% |

| PRUDENTIAL FINANCIAL INC | PRU | May 13 | Proxy | Votes | Governance | Shareholder Proposal Regarding Independent Board Chairman | 35% |

| PULTEGROUP INC | PHM | Apr 30 | Proxy | Votes | Environment | Shareholder Proposal on Adoption of Paris-Aligned Emission Reduction Goals | 24% |

| PULTEGROUP INC | PHM | Apr 30 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal on Amendment to Clawback Policy on Unearned Incentive Pay | 5% |

| REGIONS FINANCIAL CORP | RF | Apr 16 | Proxy | Votes | Shareholder Rights | Shareholder Proposal Relating to Simple Majority Vote | 93% |

| RESTAURANT BRANDS INTERNATIONAL INC | QSR | Jun 03 | Proxy | Votes | Environment | Consider a shareholder proposal regarding food waste | 11% |

| RESTAURANT BRANDS INTERNATIONAL INC | QSR | Jun 03 | Proxy | Votes | Governance | Consider a shareholder proposal regarding defining director independence | 9% |

| RESTAURANT BRANDS INTERNATIONAL INC | QSR | Jun 03 | Proxy | Votes | Health/Safety | Consider a shareholder proposal regarding antibiotics policy | 11% |

| Restaurant Brands International Limited Partnership | RSTRF | Jun 03 | Proxy | Votes | Environment | Consider a shareholder proposal regarding food waste | 11% |

| Restaurant Brands International Limited Partnership | RSTRF | Jun 03 | Proxy | Votes | Governance | Consider a shareholder proposal regarding defining director independence | 9% |

| Restaurant Brands International Limited Partnership | RSTRF | Jun 03 | Proxy | Votes | Health/Safety | Consider a shareholder proposal regarding antibiotics policy | 11% |

| REVVITY INC | RVTY | Apr 22 | Proxy | Votes | Shareholder Rights | Shareholder proposal regarding ability to call special shareholder meeting | 65% |

| RTX CORP | RTX | May 01 | Proxy | Votes | Lobbying/Giving | Shareowner Proposal for Lobbying Transparency Report | 13% |

| RYAN SPECIALTY HOLDINGS INC | RYAN | Oct 01 | Proxy | Votes | Governance | Approval of an amendment to the Certificate to declassify the Board and phase-in annual director elections | > 99% |

| SALLY BEAUTY HOLDINGS INC | SBH | Jan 24 | Proxy | Votes | Governance | Vote on a Stockholder Proposal to Adopt a New Director Election Resignation Guideline | 39% |

| SCHWAB CHARLES CORP | SCHW | May 22 | Proxy | Votes | Governance | Stockholder Proposal Requesting Declassification of the Board to Elect Each Director Annually | 84% |

| SERVICENOW INC | NOW | Oct 01 | Proxy | Votes | Shareholder Rights | Shareholder Proposal Regarding Right to Cure Nomination Defects | 3% |

| SERVICENOW INC | NOW | Oct 01 | Proxy | Votes | Shareholder Rights | Shareholder Proposal to Remove One-Year Holding Period Requirement | 8% |

| SITEONE LANDSCAPE SUPPLY INC | SITE | Proxy | Votes | Governance | Amendment to the Charter to Declassify the Board of Directors | > 99% | |

| SKYWEST INC | SKYW | May 06 | Proxy | Votes | Civil Liberties | Adopt and disclose a Non-Interference Policy upholding the rights to freedom of association and collective bargaining in its operations | 29% |

| SKYWORKS SOLUTIONS INC | SWKS | Proxy | Votes | Environment | Stockholder Proposal Regarding Disclosure of Scope 3 Greenhouse Gas Emissions | 22% | |

| SLEEP NUMBER CORP | SNBR | Jan 01 | Proxy | Votes | Governance | Approve Amendments to the Company’s Articles and Bylaws to Declassify the Board | 99% |

| SMITH A O CORP | AOS | Apr 08 | Proxy | Votes | DEI | Stockholder Proposal on Hiring Practices | 4% |

| SONOCO PRODUCTS CO | SON | Apr 16 | Proxy | Votes | Lobbying/Giving | Advisory (Non-binding) Shareholder Proposal Regarding Transparency in Political Spending | 36% |

| SOUTHERN CO | SO | May 21 | Proxy | Votes | DEI | Stockholder Proposal: Report on Workforce Civil Liberties | 1% |

| SOUTHWEST AIRLINES CO | LUV | May 14 | Proxy | Votes | Stakeholder Alignment | An advisory (non-binding) vote on a shareholder proposal to amend clawback policy for unearned executive pay | 34% |

| S&P GLOBAL INC | SPGI | May 07 | Proxy | Votes | Stakeholder Alignment | Shareholder proposal to to amend the Company’s clawback policy for unearned executive pay | 11% |

| SPIRIT AEROSYSTEMS HOLDINGS INC | SPR | May 23 | Proxy | Votes | Lobbying/Giving | Stockholder proposal titled “Transparency in Political Spending” | 51% |

| SPROUTS FARMERS MARKET INC | SFM | Proxy | Votes | Governance | Amendment of the Company’s certificate of incorporation to declassify the Company’s Board of Directors | > 99% | |

| STARBUCKS CORP | SBUX | Mar 12 | Proxy | Votes | Animal Rights | Shareholder Proposal Requesting Disclosure on Cage-Free Egg Commitments in China and Japan | 8% |

| STARBUCKS CORP | SBUX | Mar 12 | Proxy | Votes | Civil Liberties | Shareholder Proposal Requesting a Report on Human Rights Risks Related to Labor Organizing | 1% |

| STARBUCKS CORP | SBUX | Mar 12 | Proxy | Votes | DEI | Shareholder Proposal Requesting an Annual Report on Discrimination Risks Related to Charitable Giving | 1% |

| STARBUCKS CORP | SBUX | Mar 12 | Proxy | Votes | Environment | Shareholder Proposal Requesting an Annual Emissions Congruency Report | 1% |

| STARBUCKS CORP | SBUX | Mar 12 | Proxy | Votes | Governance | Shareholder Proposal Regarding Independent Board Chair Requirements | 15% |

| STATE STREET CORP | STT | May 14 | Proxy | Votes | Environment | Shareholder Proposal Requesting a Report Disclosing Whether and How the Company Addresses Transition of Workers and Fairness to Communities in its Transition Finance Strategy | 12% |

| STATE STREET CORP | STT | May 14 | Proxy | Votes | Governance | Shareholder Proposal Requesting the Adoption of a Policy and Amendment to the By-Laws Requiring the Chair of the Board to be an Independent Member of the Board in the next CEO transition | 26% |

| STEEL DYNAMICS INC | STLD | Apr 25 | Proxy | Votes | Shareholder Rights | Shareholder proposal for special shareholder meeting improvement | 11% |

| SYNOPSYS INC | SNPS | Apr 10 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal on Golden Parachutes | 38% |

| TENET HEALTHCARE CORP | THC | May 22 | Proxy | Votes | Health/Safety | Shareholder Proposal on Maternal Health Outcomes | 5% |

| TERADYNE INC | TER | May 12 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal for Report on Political Contributions and Expenditures | 51% |

| TERADYNE INC | TER | May 12 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal for Report on Political Contributions and Expenditures | 51% |

| TEXAS ROADHOUSE INC | TXRH | May 15 | Proxy | Votes | DEI | Advisory Vote on Shareholder Proposal Regarding the Adoption of a Policy Requiring the Disclosure of the Company’s Consolidated EEO-1 Report | 28% |

| THERMO FISHER SCIENTIFIC INC | TMO | May 21 | Proxy | Votes | Shareholder Rights | Shareholder Proposal to Remove Holding Period Requirement | 8% |

| TIMKEN CO | TKR | May 02 | Proxy | Votes | Environment | Shareholder Proposal on Greenhouse Gas Emissions Reduction Targets | 9% |

| TIMKEN CO | TKR | May 02 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal on Recoupment of Incentive Pay Policy | 8% |

| TRAVELERS COMPANIES INC | TRV | May 21 | Proxy | Votes | Environment | Shareholder Proposal Relating to a Report on Climate-Related Pricing and Coverage Decisions | 12% |

| TYLER TECHNOLOGIES INC | TYL | May 06 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal Regarding Political Spending | 26% |

| TYSON FOODS INC | TSN | Jan 01 | Proxy | Votes | Governance | Shareholder proposal requesting that the Company disaggregate shareholder voting results | 13% |

| UGI CORP | UGI | Jan 31 | Proxy | Votes | Governance | Shareholder Proposal Regarding Director Election Resignation Governance Guideline | 21% |

| UNION PACIFIC CORP | UNP | May 08 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Requesting an Amended Clawback Policy | 7% |

| UNITEDHEALTH GROUP INC | UNH | Jun 02 | Proxy | Votes | Stakeholder Alignment | Shareholder proposal requesting a shareholder vote regarding excessive golden parachutes | 13% |

| UNITED PARCEL SERVICE INC | UPS | May 08 | Proxy | Votes | Environment | Shareowner Proposal Requesting Report on Risks from Carbon-Reduction Commitments | 6% |

| US BANCORP | USB | Apr 15 | Proxy | Votes | DEI | A shareholder proposal regarding a report on board oversight of risks relating to discrimination | 2% |

| VERALTO CORP | VLTO | May 14 | Proxy | Votes | Governance | To approve amendments to the Company’s Amended and Restated Certificate of Incorporation to phase out the classification of the Board | > 99% |

| VERISK ANALYTICS INC | VRSK | May 20 | Proxy | Votes | Shareholder Rights | Ability for shareholders to call for a special shareholder meeting | 43% |

| VERIZON COMMUNICATIONS INC | VZ | May 22 | Proxy | Votes | Civil Liberties | Shareholder Proposal Regarding Discrimination in Advertising Services | 2% |

| VERIZON COMMUNICATIONS INC | VZ | May 22 | Proxy | Votes | Environment | Shareholder Proposal Regarding a Lead-Sheathed Cable Report | 14% |

| VERIZON COMMUNICATIONS INC | VZ | May 22 | Proxy | Votes | Environment | Shareholder Proposal Regarding Climate Lobbying Alignment | 15% |

| VERTEX PHARMACEUTICALS INC | VRTX | May 14 | Proxy | Votes | Stakeholder Alignment | Shareholder Proposal Regarding Excessive Golden Parachutes | 37% |

| VISA INC | V | Jan 28 | Proxy | Votes | Civil Liberties | Shareholder proposal requesting a report on policy on merchant category codes | 1% |

| VISA INC | V | Jan 28 | Proxy | Votes | DEI | Shareholder proposal on gender-based compensation gaps and associated risks | 1% |

| VISA INC | V | Jan 28 | Proxy | Votes | Governance | Shareholder proposal requesting adoption of a new director election resignation governance guideline | 17% |

| VISA INC | V | Jan 28 | Proxy | Votes | Lobbying/Giving | Shareholder proposal on transparency in lobbying | 14% |

| WALGREENS BOOTS ALLIANCE INC | WBA | Jan 30 | Proxy | Votes | Environment | Stockholder Proposal on Cigarette Waste Report | 7% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | Civil Liberties | Shareholder Proposal for Evaluation of Respect for Civil Liberties in Advertising | < 1% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | DEI | Shareholder Proposal for Racial Equity Audit | 7% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | DEI | Shareholder Proposal for Report on Delays in Revising DEI Initiatives | < 1% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | Environment | Shareholder Proposal for Report on Reduction of Plastic Packaging | 6% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | Environment | Shareholder Proposal to Revisit Plastics Packaging Policies | 1% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | other | Shareholder Proposal for Review of Health and Safety Governance | 7% |

| WALMART INC | WMT | Jun 05 | Proxy | Votes | other | Shareholder Proposal for Third-Party Assessment of Company Policies | 4% |

| WALT DISNEY CO | DIS | Mar 20 | Proxy | Votes | Civil Liberties | Shareholder proposal requesting a report on risks related to selection of ad buyers and sellers | 1% |

| WALT DISNEY CO | DIS | Mar 20 | Proxy | Votes | DEI | Shareholder proposal requesting consideration of participation in the Human Rights Campaign’s Corporate Equality Index | 1% |

| WALT DISNEY CO | DIS | Mar 20 | Proxy | Votes | Environment | Shareholder proposal requesting a report on climate risks to retirement plan beneficiaries | 7% |

| WARRIOR MET COAL INC | HCC | Apr 23 | Proxy | Votes | Civil Liberties | Stockholder Proposal Relating to Assessment of the Company’s Respect for the Human Rights of Freedom of Association and Collective Bargaining | 3% |

| WELLS FARGO & COMPANY | WFC | Apr 29 | Proxy | Votes | DEI | Shareholder Proposal – Annual Report on Prevention of Workplace Harassment and Discrimination | 15% |

| WELLS FARGO & COMPANY | WFC | Apr 29 | Proxy | Votes | DEI | Shareholder Proposal – Report on Respecting Indigenous Peoples’ Rights | 12% |

| WELLS FARGO & COMPANY | WFC | Apr 29 | Proxy | Votes | Environment | Shareholder Proposal – Energy Supply Ratio | 18% |

| WELLS FARGO & COMPANY | WFC | Apr 29 | Proxy | Votes | Lobbying/Giving | Shareholder Proposal – Annual Report on Congruency of Political Spending and Corporate Values | 11% |

| WENDY’S CO | WEN | May 21 | Proxy | Votes | DEI | Stockholder Proposal Regarding Worker-Driven Social Responsibility | 7% |

| WENDY’S CO | WEN | May 21 | Proxy | Votes | Environment | Stockholder Proposal Regarding Single-Use Plastics | 9% |

| WESCO INTERNATIONAL INC | WCC | May 22 | Proxy | Votes | Shareholder Rights | Shareholder Proposal to Give Shareholders the Ability to Call for a Special Shareholder Meeting | 39% |

| WINGSTOP INC | WING | May 22 | Proxy | Votes | Governance | Approval of an amendment to the Company’s Certificate of Incorporation to declassify the Board | > 99% |

| WOLVERINE WORLD WIDE INC | WWW | May 01 | Proxy | Votes | Environment | Shareholder Proposal Regarding Greenhouse Gas Emissions Disclosures and Targets | 16% |

| XYLEM INC | XYL | May 13 | Proxy | Votes | Shareholder Rights | Amend the appropriate company governing documents to give the owners of a combined 10% of our outstanding common stock the power to call a special shareholder meeting | 46% |

| YUM BRANDS INC | YUM | May 15 | Proxy | Votes | DEI | Shareholder Proposal on Faith-Based Employee Resource Groups | 1% |

| YUM BRANDS INC | YUM | May 15 | Proxy | Votes | Health/Safety | Shareholder Proposal on Antimicrobials Policy | 12% |

| YUM BRANDS INC | YUM | May 15 | Proxy | Votes | Health/Safety | Shareholder Proposal on Workplace Safety Policies | 19% |

| ZOETIS INC | ZTS | May 21 | Proxy | Votes | Shareholder Rights | Shareholder Proposal to Remove One-Year Holding Period Requirement | 14% |