Swirling in a sexual harassment crisis and amidst shareholder scrutiny of the Microsoft acquisition, the video game maker makes a timely Board refresh. Will the latest housecleaning be enough?

Activision Blizzard gets two new senior women executives. Videogame maker Activision Blizzard (ATVI) today announced the addition of two new senior women executives to its Board. Lulu Cheng Meservey has joined the Board, effective immediately. Cheng Meservey is currently VP of communications at Substack (privately-held). Kerry Carr will be nominated for election to the Company’s Board of Directors at Activision Blizzard’s 2022 annual meeting. Carr is currently an SVP with Bacardi (privately held) and alum of The Walt Disney Company (DIS). Hendrik J. Hartong III and Casey Wasserman will not stand for re-election at the 2022 Annual Meeting.

Board has been criticized for supporting toxic culture. Activision’s board has been criticized for supporting CEO Bobby Kotick amidst allegations of a toxic culture. The gaming giant is said to have enabled a “frat boy” work culture that has led to sexual misconduct and misogyny. Activision has faced an onslaught of discrimination and sexual harassment lawsuits and federal investigations. In March, a federal court judge approved Activision Blizzard’s $18 million settlement between the company and the Equal Employment Opportunity Commission (EEOC) over sexual misconduct and discrimination.

Several ongoing legal battles over sex bias and harassment. Today, Activision Blizzard won the dismissal of a lawsuit in California accusing the video game maker of misleading investors by downplaying the severity of alleged sexual harassment and discrimination against female employees. Another lawsuit by The California Department of Fair Employment and Housing is still pending.

ATVI’s sexual harassment crisis could thwart Microsoft deal. SOC Investment Group has criticized Activision Blizzard’s response to recent sexual harassment and discrimination lawsuits. Last November, the firm called for the resignation of senior figures including CEO Bobby Kotick, chairman of the board Brian Kelly and lead independent director Robert Morgado. “This transaction fails to properly value Activision and its future earnings potential, in significant part because it ignores the role that the sexual harassment crisis—and the Activision board’s incompetent handling of it—has played in delaying product releases and depressing the share price,” the firm argues.

Activision has been failing in the diversity department. Today’s news follows on the heels of last week’s appointment of Kristen Hines, a former executive with Accenture (ACN), as Activision Blizzard’s new chief diversity, equity and inclusion officer. Hines’ appointment was timely, as Activision had also has been found to be in violation of a California law that requires publicly traded companies with six or more people on the board to have at least three women directors. Prior to today’s announcement, the company had two women on the Board: Reveta Bowers, a independent governance and organizational consultant for various non-profits; and Dawn Ostroff, Chief Content and Advertising Officer at Spotify (SPOT).

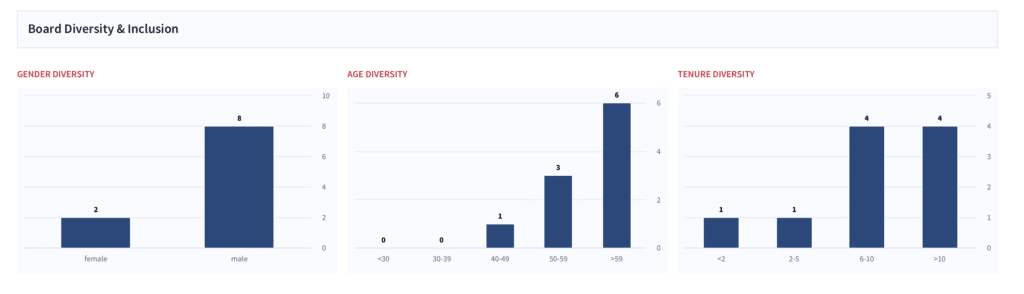

ATVI: Board Diversity & Inclusion Snapshot (before today’s announcement)

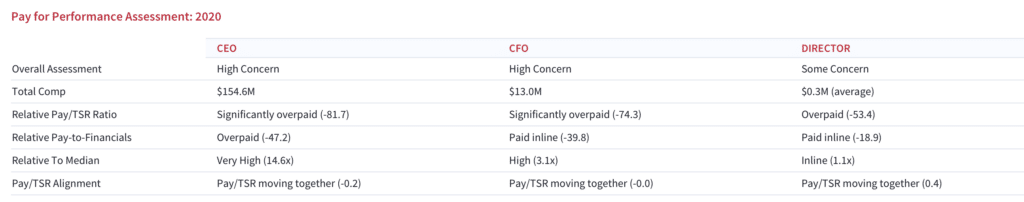

More red flags: executive compensation. In addition to the relative underperformance of ATVI shares, executive compensation is another important notable concern, with the company’s C-suite and directors overpaid relative to peers. Notably, only 55% of shareholders voted in favor in the company’s 2021 Say-on-Pay vote. Following the sexual harassment allegations, in October 2021, Kotick took a pay cut which reduced his overall annual compensation to $62,500 and did not give him any additional bonuses or equity. That said, critics viewed the reduction as an “empty public gesture” in light of the severity of the allegations facing the company.

Kotick’s golden parachute. Relating to compensation, there are obvious concerns around Kotick, who could could receive as much as $22 million in stock in July or later, if Activision’s board sees improvement in company culture. Should Kotick be fired without cause by Microsoft, he’ll get a $15 million “golden parachute,” according to the filing’s compensation proposal.

Overpaid? ATVI Pay for Performance Assessment: 2020

Cleaning house ahead of Microsoft acquisition; April 28 vote. Regulators are currently reviewing the $68.7 billion proposed acquisition by Microsoft (MSFT). Since the January announcement, the deal has come under significant scrutiny– both by the FTC and shareholders of both companies. Microsoft anticipates a close in 1H2023, subject to closing conditions and regulatory review. The FTC is currently conducting an antitrust review to determine whether the takeover would give Xbox an unfair competitive advantage. Earlier this month, members of the US Senate also wrote a letter of concern about the deal, suggesting that Microsoft’s acquisition could lead to sexual misconduct accusations being swept under the rug. An improvement of Activision’s corporate culture is critical to the success of this transaction, which would be Microsoft’s largest to date. Activision Blizzard investors will vote for or against the proposed takeover in a special meeting of stockholders on April 28.