With inflation proving to be a slow-moving illness, governance and execution will be key for retail stocks.

Target confirms our worst consumer retail fears. Retailer Target (TGT) reported poor Q1 earnings and guidance, sending the shares down 25% on the day– the largest one-day decline since the Black Monday crash in 1987. EPS of $2.19 was well below consensus of $3.07 a share, reflecting supply chain and rising transportation costs. With a few exceptions, most retailers have reported a poor fiscal first quarter. Yesterday, Walmart (WMT), the world’s largest retailer, missed earnings expectations and lowered its full-year forecast. These results came after a whole host of lackluster earnings from e-commerce companies, including Amazon (AMZN) and Etsy (ETSY).

Inflation is impacting those higher on the income scale. Target’s results tell us that its not execution that’s the problem but rather that consumers are reigning in spending. Walmart already told us that customers are feeling the pinch: wages aren’t keeping pace with inflation and consumers are now paying higher prices for essentials. That said, many observers thought that Target, which caters more to the middle class customer, would be more immune. It wasn’t. Target said it saw a rapid decline in spending on discretionary categories like apparel and big ticket items such as electronics and kitchen appliances.

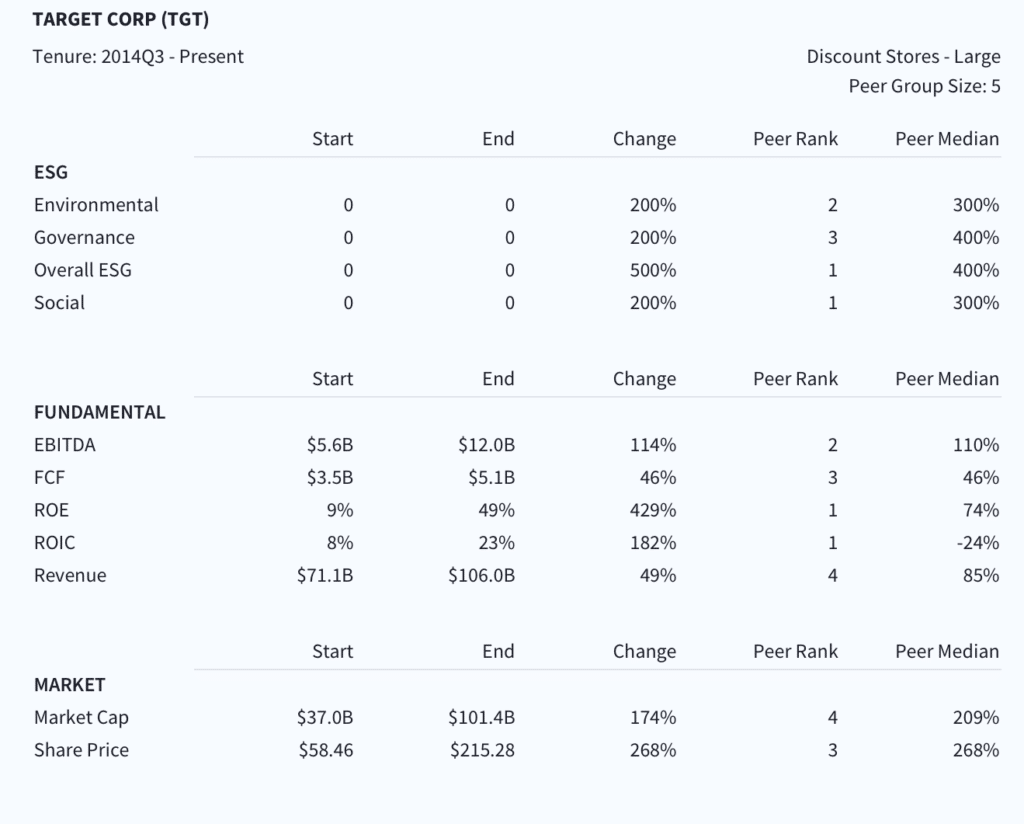

TGT has outperformed the S&P500 over the past 1, 3 and 5-year periods. Target has been a tremendous performer throughout the pandemic. TGT shares delivered TSR of +48% over the past 3 years, versus +13% for the S&P 500 over the same period.

TGT: One of the few pandemic performers

TGT CEO Brian Cornell: Performance Scorecard

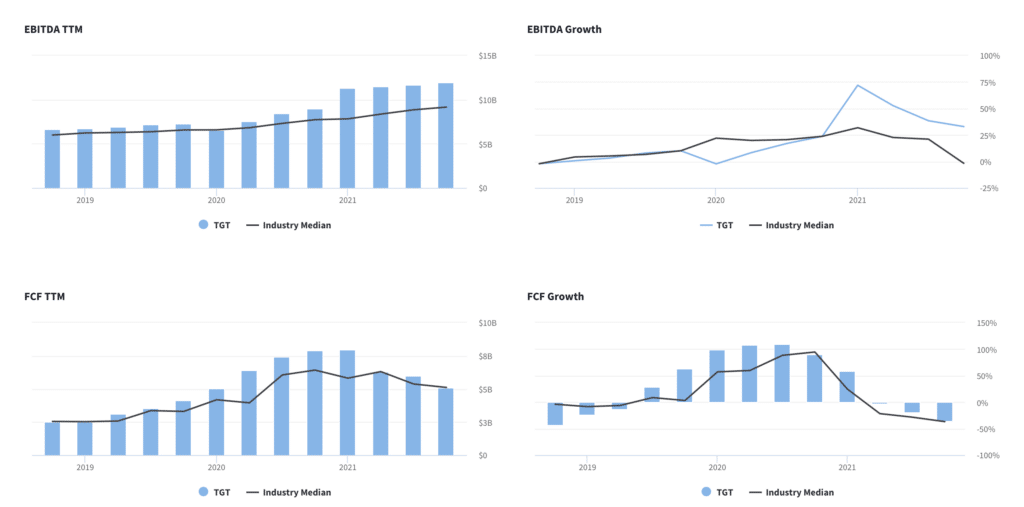

Higher costs crush forward earnings; rising inventory. Inflation and supply chain issues significantly eroded Target’s margins. In particular, freight and transportation costs exceeded already high expectations. Higher employee compensation also affected earnings, as Target recently announced a minimum wage increase of up to $24 per hour. Gross margin declined from to 25.7% from 30% as cost of sales increased 10.4% sequentially. With consumers spending less on discrectionary items, Target was forced to write down the value of excess inventory. Inventories increased by ~$5B from year-ago levels. For 2022, Target reaffirmed revenue guidance of low- to mid-single digit percentage growth. But earnings are problematic. The retailer expects FQ2 operating margin “in a wide range centered around first quarter’s operating margin rate of 5.3%.” Full-year operating margin guidance is 6%, down from a previous target of 8%. “Throughout the quarter, we faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time,” said CEO Brian Cornell.

Higher costs are taking a toll on profitability

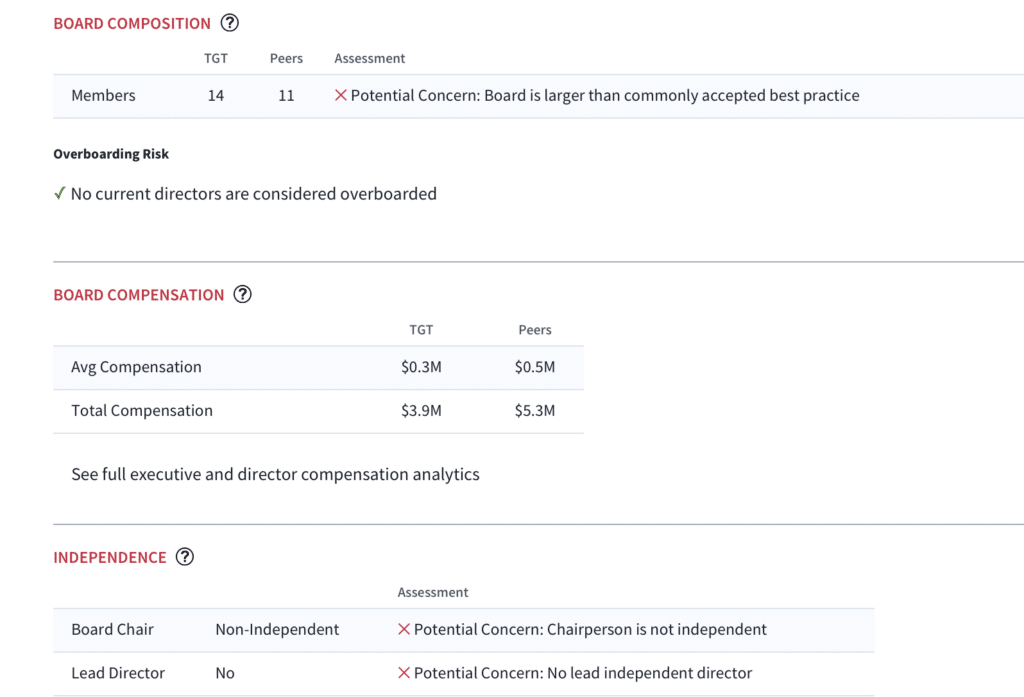

Red flags: Board size, non-independent Chair. Target’s board consists of 14 members, larger than common accepted best practice. Both board and executive compensation are within peer norms. Another governance-related red flag: Board Chair, CEO Brian Cornell, is not independent. Target also lacks an independent lead director.

TGT: Governance snapshot

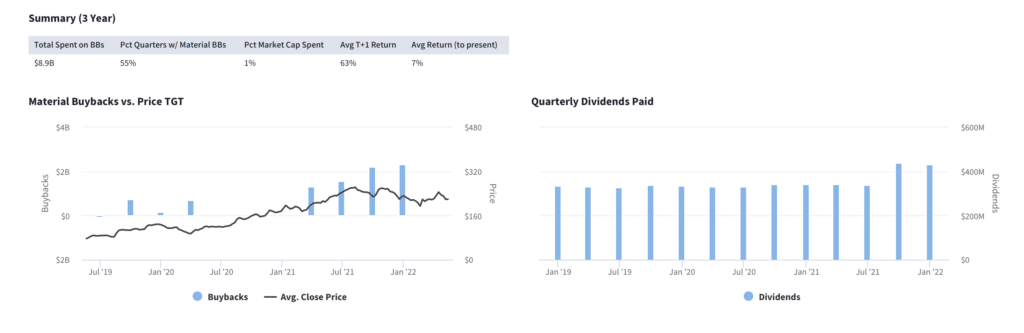

Despite significant cash decline, Target is pursuing more buybacks. Cash balance is $1.1B, down from $7.8B in the year-ago quarter.

Buyback and dividend history

Could see more downward revisions to guidance across the sector. Target and Walmart are such large and well-run companies that was surpassing to hear management so taken aback by the magnitude of inflation and freight costs and the shift in consumer category spending. Kudos to Cornell for being honest. “While we anticipated a post-stimulus slowdown…we didn’t anticipate the magnitude of that shift,” said Cornell on the earnings call. Based on forward guidance, these pressures are expected to continue for the foreseeable future. We’re increasingly worried about more downward revisions to guidance, especially if overall consumer spending weakens further and the U.S. economy moves closer to a recession.

There’s really no place to hide, but we like more inflation-resistant retailers in this environment. While TGT shares trade at a more reasonable 16x forward EPS, we still think there is potential for risk to forward estimates as Target’s costs are clearly increasing going forward and supply chain issues are expected to last through 2023. The bottom line is that discretionary spending is slowing as consumers are now paying more for food and gas. In the retail segment, we prefer Home Depot (HD) and Lowe’s (LOW), owing to more reasonable valuation as well as our view that home improvement spending is more resistant to inflationary pressures.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.